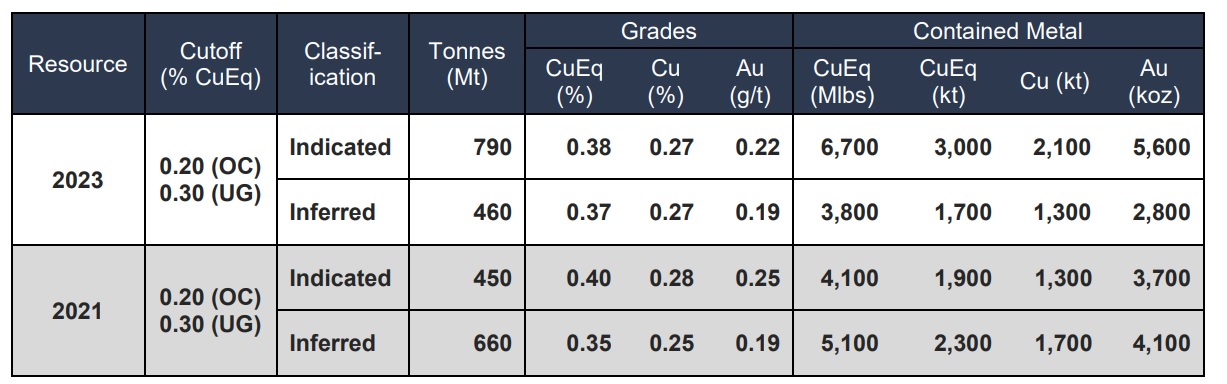

Xanadu Mines (XAM.AX, XAM.TO) and its partner Zijin Mining have released an updated resource calculation for the flagship Kharmagtai copper project in Mongolia. The updated resource now contains almost 800 million tonnes in the indicated resource category at an average grade of 0.27% copper and 0.22 g/t gold for a total copper content of approximately 4.6 billion pounds and 5.6 million ounces of gold. ON top of that, there’s a 460 million tonne inferred resource with an average grade of 0.27% copper and 0.19 g/t gold for approximately 3 billion pounds of copper and 2.8 million ounces of gold. On a combined basis, the project now contains approximately 7.5 billion pounds of copper and 8.4 million ounces of gold. A substantial increase compared to the 6.6 billion pounds and 7.9 million ounces as defined in the 2021 resource calculation.

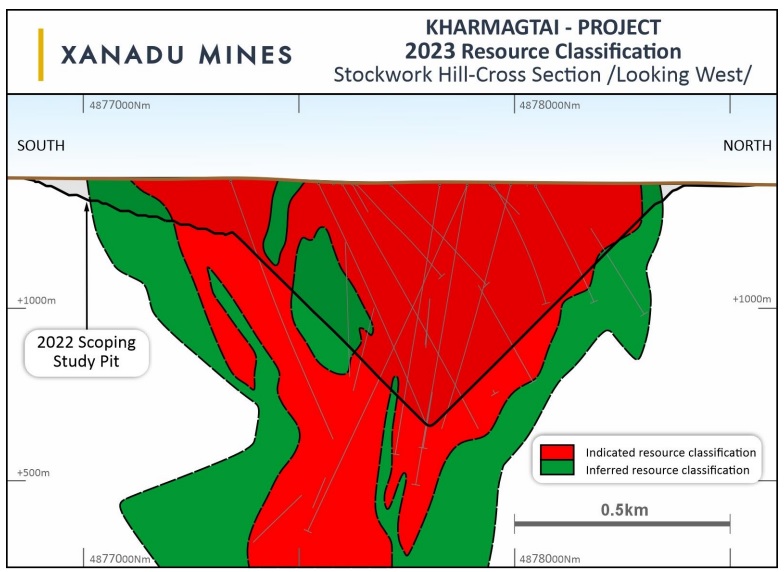

Equally important is the increased confidence in the resource as the total tonnage that ended up in the indicated resource category almost doubled. That’s important as the company is working towards a pre-feasibility study which will contain a mineable ore reserve. The improvement versus the 2021 resource was achieved by drilling less than 60,000 meters in 162 diamond drill holes. This means a total of 311,000 meters has now been drilled at Kharmagtai.

As a reminder, Zijin will spend approximately A$64M to acquire 50% of the entity which owns a 76.5% stake in the project. In excess of A$50M of the amount will be directly spent on the project. Once the pre-feasibility study will be completed (expected in the third quarter of this year), Zijin will become the operator of the project where after Xanadu has three options: it can either continue the 50/50 joint venture and contribute its share of the capex, it can sell its 50% to Zijin for US$50M or it can go halfsies by selling 25% of the JV to Zijin for US$25M plus a loan carry for Xanadu’s costs until commercial production. The latter sounds like the most intriguing option for Xanadu at this point.

While the grade is low, the anticipated low strip ratio of 1:1 should enable the project to move forward. A 2022 scoping study outlined an after-tax NPV8% of US$630M based on a 30 year mine life with a yearly production rate of 65-110 million pounds of copper and 50-110,000 ounces of gold per year with the higher end of the range to be achieved after an expansion of the plant in year 5. Thanks to the substantial gold credit, the all-in sustaining cost is anticipated to be just $1.02/pound. The 2022 scoping study used a copper price of $4/pound and a gold price of $1700/oz.

Disclosure: The author has no position in Xanadu Mines. Please read the disclaimer.