Introduction

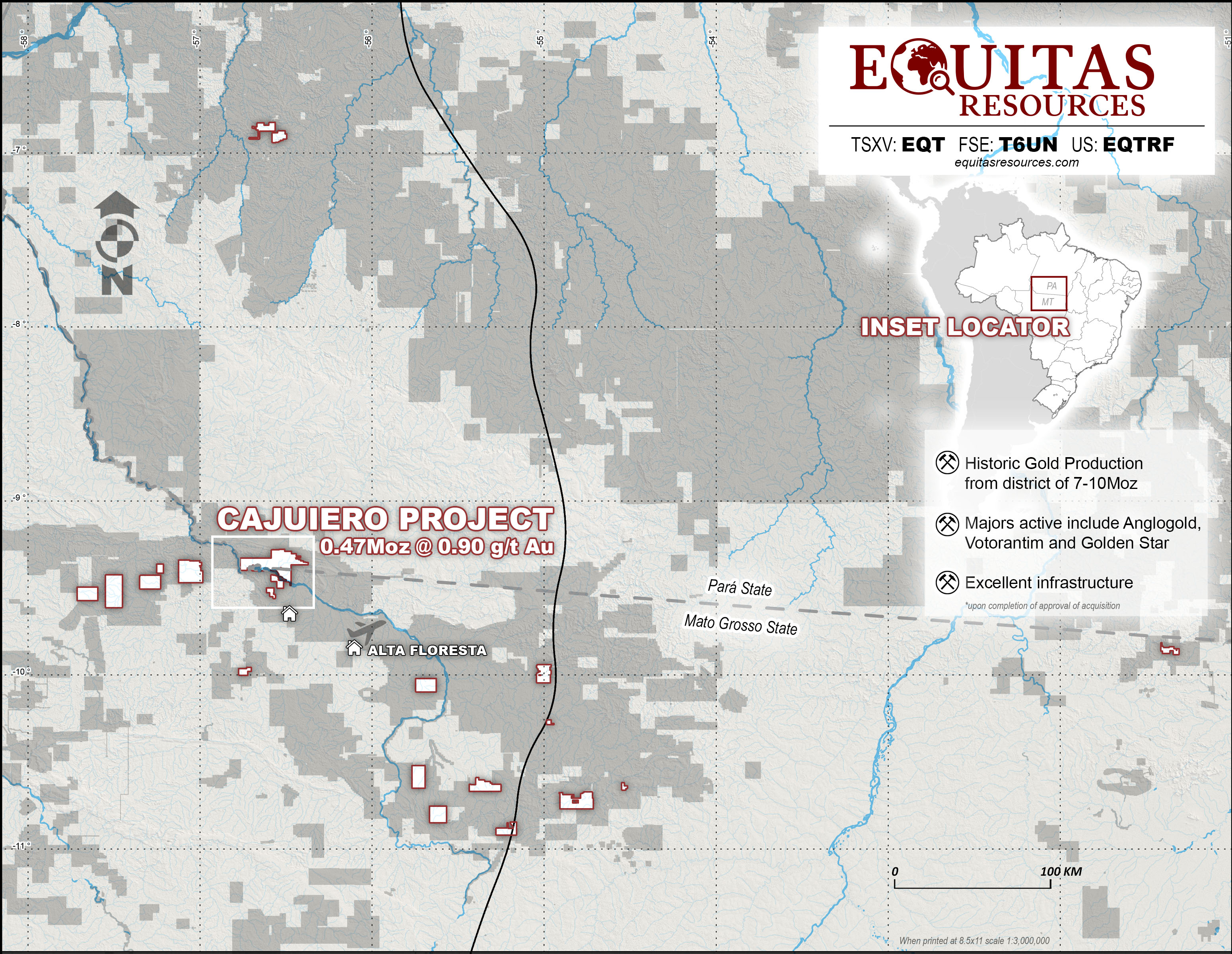

We have been keeping an eye on Equitas Resources (EQT.V) ever since it announced its game-changing acquisition of the Cajueiro gold project in Brazil. Whereas Equitas was previously focusing on exploring the Garland nickel project in Canada, it suddenly became a near-term producer overnight after having acquired a Brazilian gold project.

The production rate at Cajueiro should increase exponentially in the next few months and quarters, and in this report we will discuss the merits of the company’s development plans into more detail. The current market capitalization based on almost 230 million shares (including the C$1M placement with Cartesian) is approximately C$18M, based on yesterday’s closing price of C$0.075.

Analyzing the Cartesian deal: not cheap, but probably the best source of cash

Despite the improving gold price, it still isn’t easy for smaller companies to raise a substantial amount of cash on the market, so several juniors still have to look for alternatives, as did Equitas. The company signed a binding agreement with Cartesian which would allow Equitas to access a US$5M line of credit and whereby Cartesian will invest US$1M in the company by purchasing approximately 20 million shares at C$0.07 per share (with an 18 month lockup period, which is a positive feature as it guarantees Equitas Cartesian won’t dump the shares on the open market).

The US$5M line of credit actually is a secured gold prepayment agreement, whereby Equitas will have to deliver 2,100 ounces of gold to Cartesian for every US$1M it has drawn down from the credit line. Should Equitas need more than 1 year to repay the withdrawn amount, this increases to 2,300 ounces. As you notice, it’s in the company’s best interest to repay this credit line as fast as possible because if it would draw down US$4M from the line of credit, it could save approximately $1M worth of gold deliveries ( 4 X 200 ounces X $1250/oz).

Long story short, this deal is excellent to immediately hit the ground running by adding a gravity plant and a CIL plant to the Cajueiro project which should allow Equitas to produce in excess of 10,000 ounces of gold per year (see later), but it’s not a cheap deal (keeping in mind Cartesian will retain a 0.5% NSR on Cajueiro after the gold prepayment deal ends). That being said, if the Cartesian financing is a one-off deal, it’s definitely better than issuing 100 million new shares to raise the same amount of cash.

A combination of production and exploration at Cajueiro will provide a lot of flexibility

It’s pretty nice to get your hands on 100% of a gold project with a NI43-101 compliant resource estimate which contains almost 420,000 ounces of gold for a total consideration of less than C$10M, but it’s even nicer to know the exploration potential at Cajueiro is quite phenomenal.

The previous owners have only been able to do a limited amount of regional exploration or extension drilling at the known gold zones, but now the project is part of a publicly listed vehicle, it was much easier to raise some cash to kick-start the exploration program (which will be funded by the increasing gold production – see later).

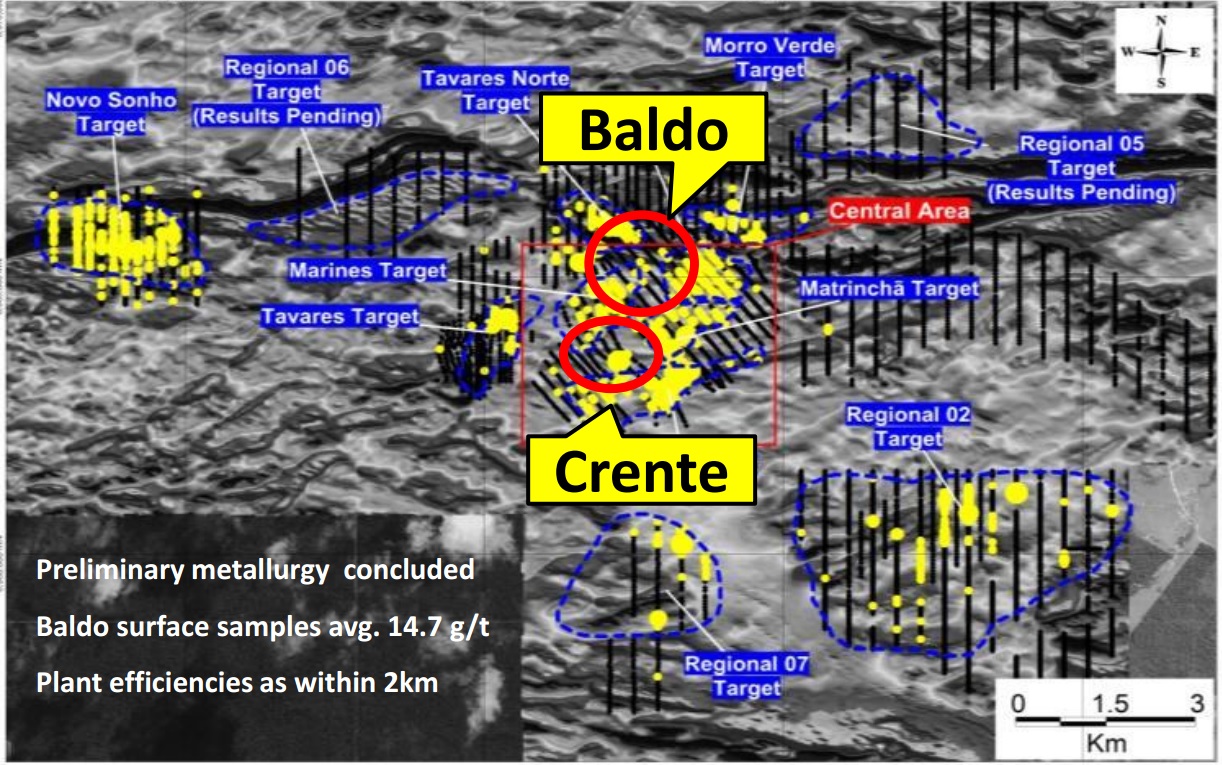

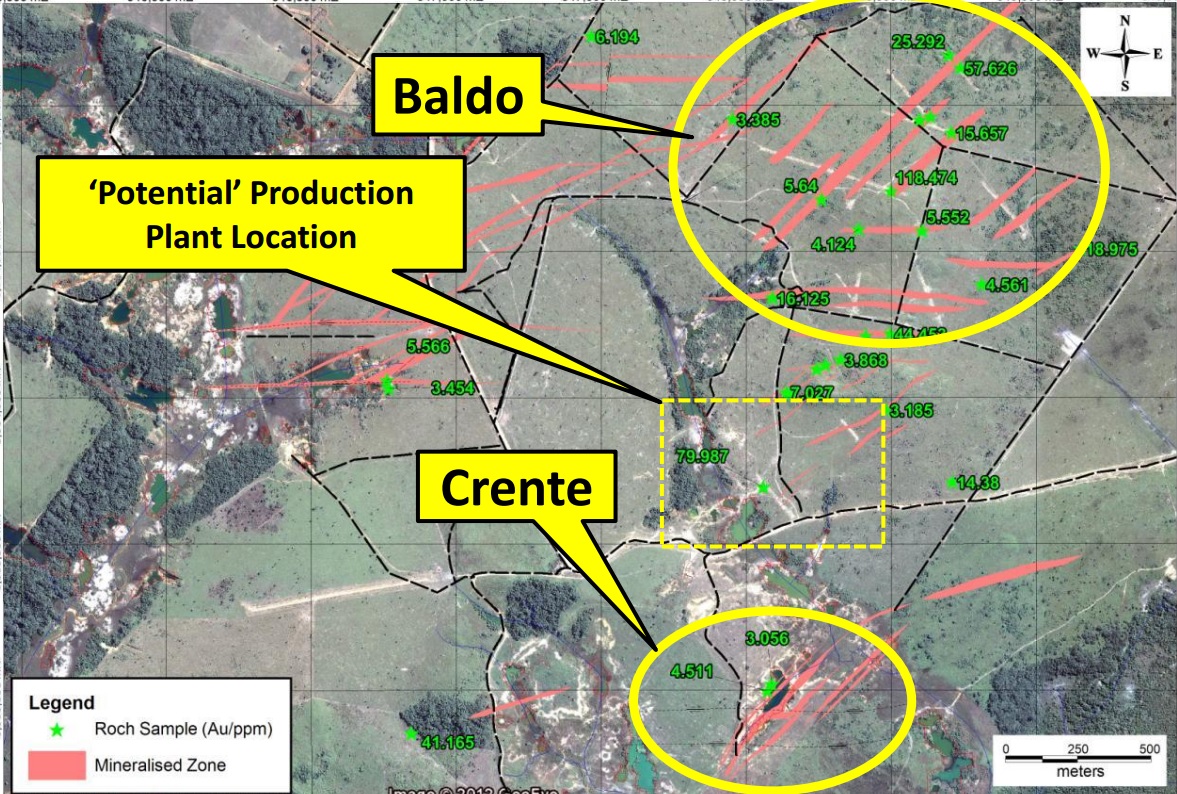

Equitas Resources hasn’t wasted a lot of time and it definitely didn’t want to wait for the operating cash flow to kick in before knowing what it really was getting into, and it earmarked a part of the proceeds of a C$1.5M capital raise to immediately start with a drill program on the project’s Baldo zone. Baldo is a relatively small zone at its 39,053 hectares of the Cajueiro project, with a small resource estimate of 30,000 ounces of gold (at an average grade of in excess of 3 g/t which is really nice for an open pit resource!), but the company’s geologists are so convinced about the location and structure of the mineralized trend where Baldo is located (and, granted, looking at the maps there’s a very obvious southwest-northeast trend) they immediately wanted to start a drill program.

The exact locations where Equitas will drill had already been outlined with a sampling program which yielded interesting results (and definitely interesting enough to warrant a drill program to follow up on the assay results). Equitas designed a 20 hole drill program for a total of 1,600 meters. As you correctly notice, the average depth of the holes will be just 80 meters, so Equitas will barely be scratching the surface of the Baldo-zone. But for now, it’s all what matters for Equitas as its targeting the oxide and transition zones whilst leaving the sulphide zones underneath for later.

Drilling at Baldo has started a few weeks ago, and we would expect the drill results to start rolling in by the end of next month, but we’re also looking forward to see the results of a 700 meter trenching program (also at Baldo) to find out what Equitas is really sitting on.

The production scenario seems to be quite straightforward

The nice thing about Brazil and the recent turmoil on the gold markets is that it has become quite cheap to explore. Equitas is definitely benefiting from this as the expected all-in cost for its Baldo drill program is expected to be less than $150 per meter (and less than $100 based on just drilling), so punching the 20 holes should cost the company no more than $300,000. And that could be well-spent money because in our previous calculations we were expecting Equitas to add approximately 100,000 ounces of gold in a best case scenario. But even if Equitas would be able to add just 50,000 ounces (half of what we are expecting), the discovery cost per ‘new’ ounce would be six dollars. That’s right, $6/oz! And that’s very likely what Equitas will try to continue to do; completing smaller drill programs to add as much value to the property as possible by spending as little as possible.

Of course, you always need cash to spend on exploration and whereas most exploration companies continuously need to tap the equity markets to fund these programs, Equitas Resources is in the enviable position it will be able to use its own operating cash flow to finance the drilling and trenching programs.

Indeed, a part of its land package is included in a zone where mining is permitted, and the previous owners have been producing minimal amounts of gold as part of an alluvial gold mining program. We wouldn’t say this was ‘amateur hour’, but again, with the backing of a public company (and the incoming cash from Cartesian) the project could now be fast-tracked towards a meaningful production rate.

In a first step, Equitas Resources will add a gravity plant to the mine site. This plant will have a capacity of approximately 200-250 tonnes per day, and based on an average recovery rate of 60% of the gold in the ore, we would expect the average yearly production of the gravity plant to be approximately 3-4,000 ounces of gold. That’s not a lot, but as this gold would be recovered though the gravity method, the production cost per ounce of gold will be pretty low. In Equitas’ words; the production from the gravity plant will put the company at a self-sustaining level.

As said, the gravity plant is just the first step as Equitas is also planning to install a CIL plant (‘Carbon in Leach’) with a capacity of 4-500 tonnes per day, which could bring the total annual production rate to 12-15,000 ounces of gold (depending on the average head grade) and based on an average recovery rate of +90% of the gold. The previously processed ore from the gravity plant could also then be put through the CIL.

Equitas quoted in their corporate presentation that the CIL’s gold production will create net cash flow in which they can grow organically. With the cash flow created, Equitas plans to duplicate the low risk steps of constructing a gravity plant then tying in a CIL plant in other zones of the Cajueiro project. While continuing to expand its resources through drilling, trenching and sampling in between the zones.

Equitas doesn’t have an official feasibility study for its production scenario’s and thus isn’t allowed to publish production and cost guidances which makes it more difficult for the normal investor to really understand what the impact of these production scenario’s will be. We made some back of the envelope calculations, and we would expect the all-in sustaining cost per ounce of gold to be $600/oz (or less) once the CIL plant is up and running as well. Assuming an average received price of $1200/oz, Equitas’ operating margin will be approximately $600/oz, resulting in a net pre-tax cash flow of at least US$5M per year (before making the payments to Cartesian).

Conclusion

Of course, you should keep in mind these are just our back of the envelope calculations based on the few details we currently know, compared to existing gravity and CIL operations around the world. Equitas has a very good chance of being free cash flow positive by Q1 2017, and it will be great to be able to spend several millions of dollars on exploration without having to raise those funds by issuing new shares.

The deal with Cartesian isn’t cheap, but it was the fastest way to get access to some cash to get both the gravity plant and CIL plant up and running. Once these two plants will start to produce gold, we would like to see Equitas starting to repay the Cartesian line of credit and to not draw down any additional cash.

Go to Equitas’ website

The author has no position in Equitas Resources. Equitas is not a sponsor of this website, but Zimtu Capital is. Please read the disclaimer