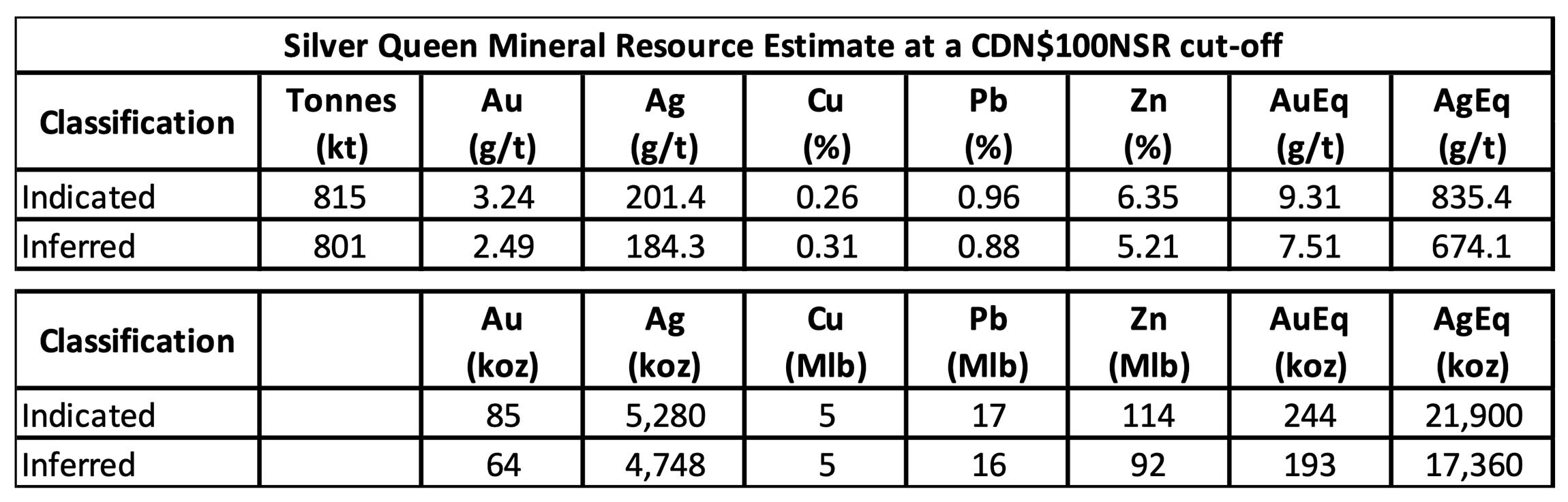

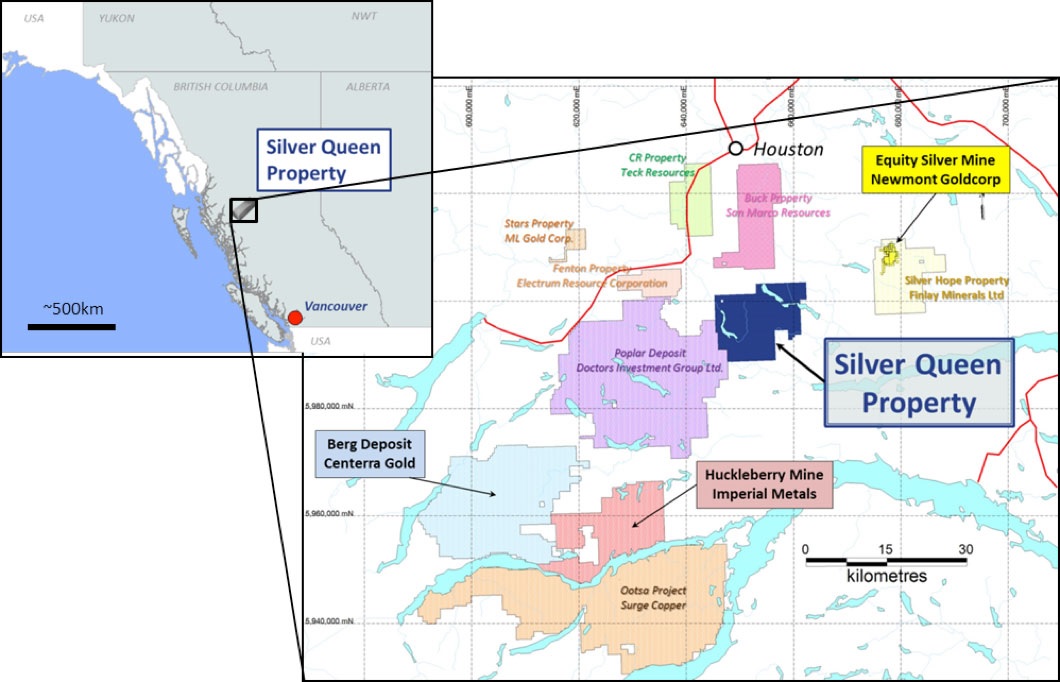

Equity Metals (EQTY.V) was able to take advantage of the renewed interest in silver exploration stories in 2020 and immediately completed a Phase I and Phase II drill program on its polymetallic Silver Queen project where silver appears to be the dominant metal. As labs were seriously backed up in 2020 due to the rather unexpected increase in exploration efforts in North America in combination with some COVID-related staffing issues, assay results are still slowly trickling in.

Although Equity Metals still has to report on a bunch of holes (which we expect to see in the next few weeks), the company has begun a third phase drill program at Silver Queen. We sat down with VP Exploration Rob Macdonald to discuss the recent assay results and how these fit into the big picture at Silver Queen. The existing resource is a good starting point for exploration activities at Silver Queen, and the next few holes will likely provide a better idea of the expansion potential beyond the current resource.

A Q&A with Robert Macdonald, VP Exploration

The drill program

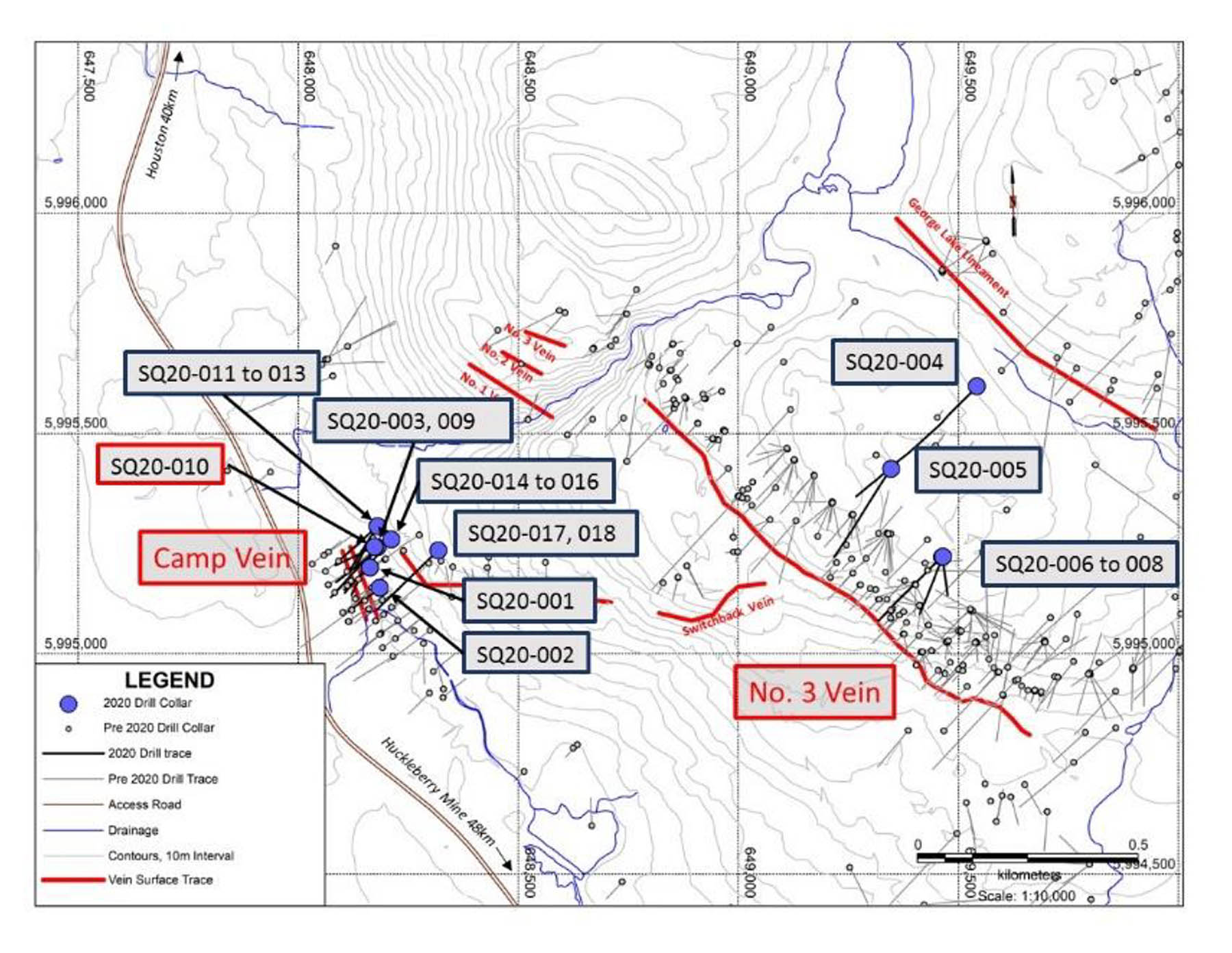

I think we can say the assay results of the holes so far are very encouraging and every single hole you drilled has hit mineralization. Zooming in on the No 3 Vein (where you have a clear path defined towards resource expansion), could you elaborate on how meaningful the results of holes 6, 7 and 8 are?

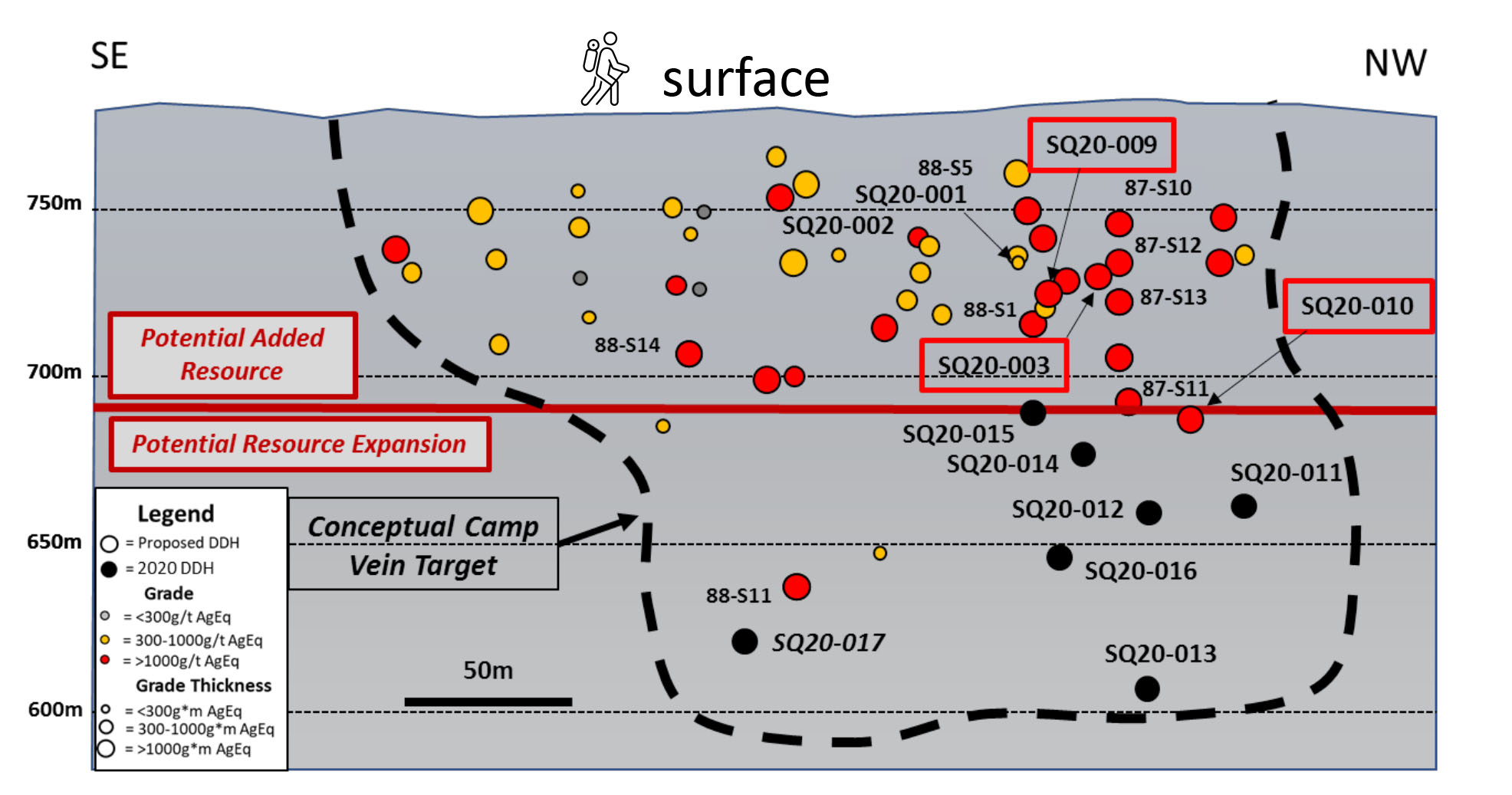

When we first assumed control of the Silver Queen project, we knew of the exceptional grades that had been previously identified in historic drilling at both the Camp and No. 3 Veins; however, we had no first-hand knowledge as to the styles of the mineralization or the distribution of grade within individual veins, nor the extent and potential grade of the sometimes broad alteration/mineralization halos around the high-grade veins, which could be important factors in ultimately determining the value of the project.

It was important to test some of the known mineralization within the resource blocks which we were able to do with holes 6-8. The two deeper holes -07 and -08, which tested the lower extents of the modelled mineralization, successfully intersect sufficient thicknesses of robust mineralization leaving us encouraged as to the continued exploration potential deeper down the vein system.

And how should we interpret the higher-grade but narrower zones within a wider interval? The real paydirt will be the narrower higher grade areas while the mineralized ‘halo’ around these very high-grade intervals will keep the cost of mining dilution down?

Yes, the higher grade helps carry the broader mineralized intervals and can make the wider interval worth mining and that can be the difference between utilizing lower-cost ‘mechanical’ mining methods vs higher-cost narrow mining methods. The higher-grade intervals attract attention in News Releases and Presentations for this reason.

Note that our drilling on the No. 3 vein identified mineralized alteration haloes around the veins of up to 16 metres wide. Some of these zones may not be mineable, but when incorporated into a mine plan, will help reduce dilution around targeted intervals and can upgrade the overall mine-plan.

It took a while as the labs are backed up, but the assay results are rolling in nicely now. Which holes from the Phase II program are we still waiting for at this point?

Yes, the labs have been very slow, but are starting to get back into a more normal pace. We have released assays from the first phase of exploration on the project, which was completed in September 2020. Highlights of that drilling include bonanza-grade mineralization in drill hole SQ20-010 which intersected a 0.3 metre interval grading 56,115g/t Ag within a broader 4.4 metre interval averaging 4,632g/t Ag and 0.2g/t Au, 0.4% Pb and 1.2% Zn in the Camp Vein target.

Armed with the early results from the Phase I program, we initiated a second drill phase targeting down dip and along strike of the Bonanza-grade mineralization in the Camp Vein. Assays from this second phase are just starting to come in, and we expect to be in a position to make a public release in the coming two to three weeks.

Looking at the drill location of the holes we are waiting for, these all seem to be situated in the area you have earmarked for resource expansion on the Camp Vein. While the holes you have already completed confirmed the historical intervals and interpretation of the mineralized structure, would you say the real testing of your exploration theory will be in the holes that haven’t been released yet?

Yes, most of the previous drilling in the Camp Vein tested the veins to less than 80m depth. We have now confirmed the shallow mineralization and have tested the veins to over 150 metres depth in two separate areas. More drilling is required to fill in some spaces within our drill pattern, which we will complete later this year.

Going back to the original exploration target of Camp Vein where you outlined a conceptual target area of 500 by 300 meters for a tonnage of about 0.5 million tonnes. Do you expect to be able to further finetune your exploration target based on the results from holes 11-17 testing the vein at depth?

Yes, we wanted to test the potential down-dip extensions of the bonanza-grade mineralization intersected in hole SQ20-010. We tested a potential plunge of this zone in an area further along strike and at depth to the southeast, with hole SQ20-017. Interestingly our deep test with hole SQ20-017 also intersected the No. 5 Vein in the upper part of hole SQ20-17, and we managed to test this vein again with a second short hole, SQ20-18. All in all, we tested three different target concepts with the Phase II program and are eagerly awaiting the assay results.

You have now completed your Phase I and II drill programs, completing about 5,000 meters of drilling. How satisfied were you with how this drill program progressed (other than the lab backups)? We can imagine it wasn’t easy to figure everything out during these COVID times and things may have been a bit slower or more expensive than you had expected it to be?

We are very satisfied with our progress to date. We have confirmed the grade and continuity of mineralization in both the Camp and No. 3 vein systems and have started the process of extending the each of these mineralized zones. We look to build on this in the coming year and are well positioned for continued success on the project moving foreword. The Camp and crew have been working effectively and efficiently under less-than-ideal conditions, and they are to be commended.

While waiting for the assay results of the remaining 8 holes, you will already start a Phase III drill program right away. Could you perhaps elaborate a little bit on the what Phase III will try to accomplish?

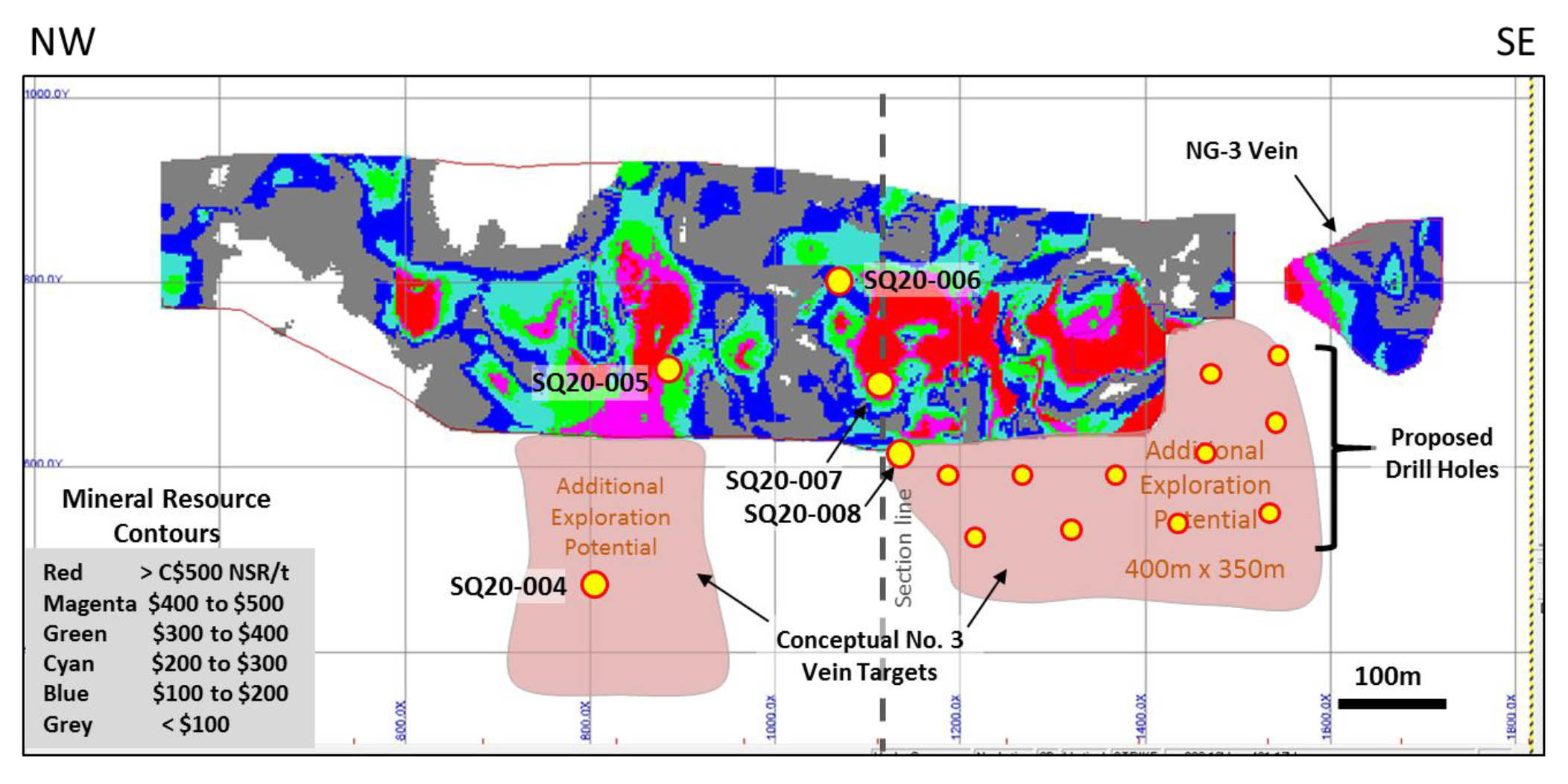

The Phase III program will test a 350m x 400m area that forms the potential southeast and down-dip extensions of the No. 3 Vein. Historical drilling in this area returned high-grade gold values and strongly elevated copper values in several drill holes and may reflect a closer proximity to higher temperature, gold-enriched mineralization related to the adjacent Itsit porphyry system. Drilling will also test potential extensions of the NG-3 vein system to determine both the orientation of this vein and its relationship to the No. 3 Vein system.

Having completed 5,000 meters of drilling in Phase I and II and adding about 4,000 meters in Phase III will result in a combined 9,000 meters of drilling. Would you expect to be in a position to release an updated resource estimate on the No 3 Vein after completing Phase III drilling, or is it still too early for that?

I think at this point, it is still too early to tell. What I can say is that we are looking closely at the results from the completed drilling on the No. 3 Vein, and particularly the Camp Vein, to assess how we may ‘stitch’ together the zones of mineralization. Demonstrating continuity between the mineralized intervals is the first step in putting together resource estimates for the different vein systems.

I would also like to point out that mineral systems such as at Silver Queen usually develop metal zoning such that certain portions of the veins are enriched with silver and other portions are enriched with gold or base metals. As we test the numerous veins to depth and along strike, we hope to be able to predict where future drill holes will have the best chance to adding significant resources.

We rarely talk about this, but Equity Metals still has diamond exposure through its partial ownership of two diamond projects. Are any exploration plans being developed? Are you looking to do anything with these assets (monetizing, farm-out,…)?

I am glad you asked. We have just initiated a ‘tow-mag’ survey (magnetometer survey pulled by snowmobile) at a 50m line spacing on two of our claims located to the north of the leases that make up the main tenures of the property. This work will meet our exploration and assessment requirements on these claims for the coming three years and set the stage for some follow-up surveying if new targets are identified. Diamond prices have recovered somewhat since we assumed management of the Company and there is more exploration activity going on in the district. Things may be heating up. We will just have to see.

Corporate

As of the end of November, Equity Metals had a working capital position of around C$1.2M but you were able to top up the treasury by raising C$2.37M by issuing just over 13.1M flow-through shares at C$0.18. This should be sufficient to fully fund the Phase III exploration plans but you’ll likely still have an additional C$0.7-0.8M in flow-through money you will have to spend on exploration activities before the end of this calendar year, is that correct? May we assume a Phase IV drill program perhaps during or after the summer is pretty much a guarantee?

We plan to be busy going into the Summer with a small reconnaissance surface program in the early Summer to evaluate and upgrade some additional geophysical and regional geochemical targets that have been identified in our compilation work through the Fall and Winter. We are also planning a Phase IV drilling program to follow up with additional drilling at the Camp Vein target initially, and potentially on the No. 3 Vein, depending on upcoming drill results.

We noticed the subsequent events of your financial statements also confirm about 3.5M warrants and options were exercised for total proceeds of almost C$400,000. As your share price remains pretty strong around C$0.25, may we assume you continuously see warrants being exercised?

Yes, I hope so. It has been a while since warrant exercise was a reliable financing method for not only Equity but many companies on the venture exchange.

With about 36 million warrants at C$0.10 and C$0.12 from previous placements as well as the almost 6.6M warrants with a strike price of C$0.25 issued in the flow-through placement, you probably won’t have to tap the equity markets this year unless of course, you want to accelerate your exploration programs to pick up the pace at Silver Queen this year, taking advantage of the financing window that’s clearly open for junior exploration companies these days?

Our hope is that continued exploration on the project will generate sufficient news flow to support the stock price and to allow the exercise of the warrants which in turn will allow at least partial funding for upcoming exploration on the property.

Conclusion

The next few weeks will be very interesting for Equity Metals as the company will be releasing additional drill results from the recent Silver Queen drill program. The results that still have to be released were targeting deeper zones of the known vein structure as Equity Metals’s shallow drill program has now confirmed the expectations of the new team (which took the reigns just a few months before the COVID pandemic started).

According to VP Exploration Robert Macdonald it may still be too early for a resource update after the Phase III drill program, but at the very least we will already get a good indication of the potential of the camp vein (where the company is hoping to boost the tonnage from 0.2 to 0.5 million tonnes at an average silver-equivalent grade of around 1,000 g/t). The real size of the Silver Queen project will however be determined by the No3 Vein just a few hundred meters east of the Camp Vein. The Phase III drill program which will start soon will be targeting that No3 Vein and by the end of this year, we should have a pretty good idea of the potential of both the Camp Vein as well as the No3 Vein.

Disclosure: The author has a long position in Equity Metals Corp but has recently sold shares to exercise warrants. Equity Metals Corp. is a sponsor of the website. Please read the disclaimer.