Not entirely unexpected, Excelsior Mining’s (MIN.TO) share price has performed very well since our initial report in April, going as high as C$1.48 which is 85% higher than the C$0.80 when we published our first report. This increase was caused by a smooth permitting process as well as a substantial increase of the copper price, which is now trading above $3/lb.

This move wasn’t unexpected as we previously mentioned we had the impression the market was waiting for Excelsior to secure all operating permits, which has been a relatively smooth process so far.

Since it almost touched the C$1.50 level, the share price has come off again to just C$1.09 right now, for a market capitalization of C$182.7M (US$143M). As the final permit from the EPA seems to be right around the corner, Excelsior Mining could be due for a re-rating once all permits will be secured.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

Almost all permits have been received by now

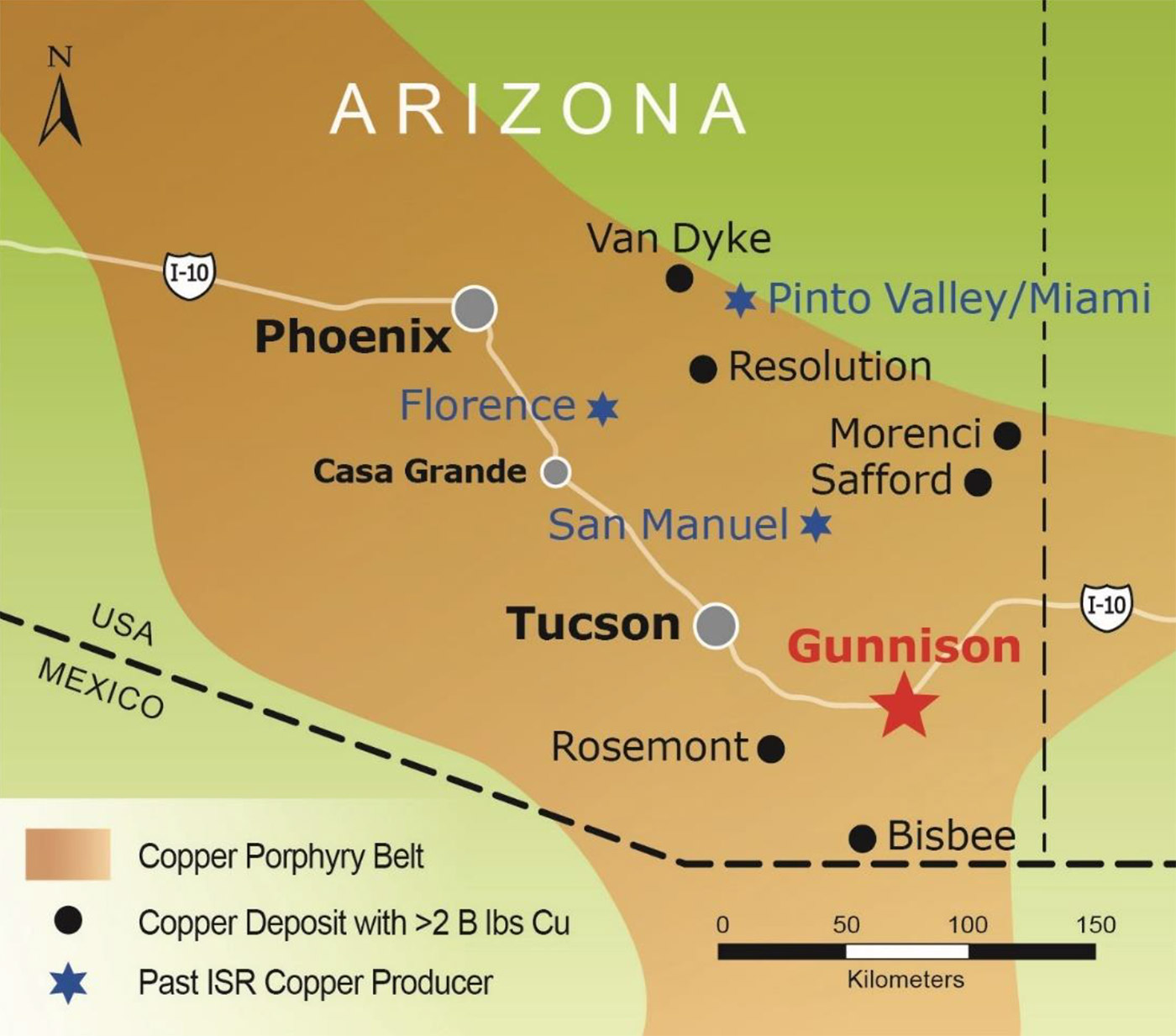

As mentioned before, Excelsior is now in the final straight line to receive all necessary permits for the Gunnison copper project in Arizona. The company was awarded the Aquifer Protection Permit from the Arizona state agency in the third quarter, and the final permit needed for the Gunnison project to start producing copper is the Underground Injection Control permit, to be issued by the Environmental Protection Agency (‘EPA’), is now within reach as well.

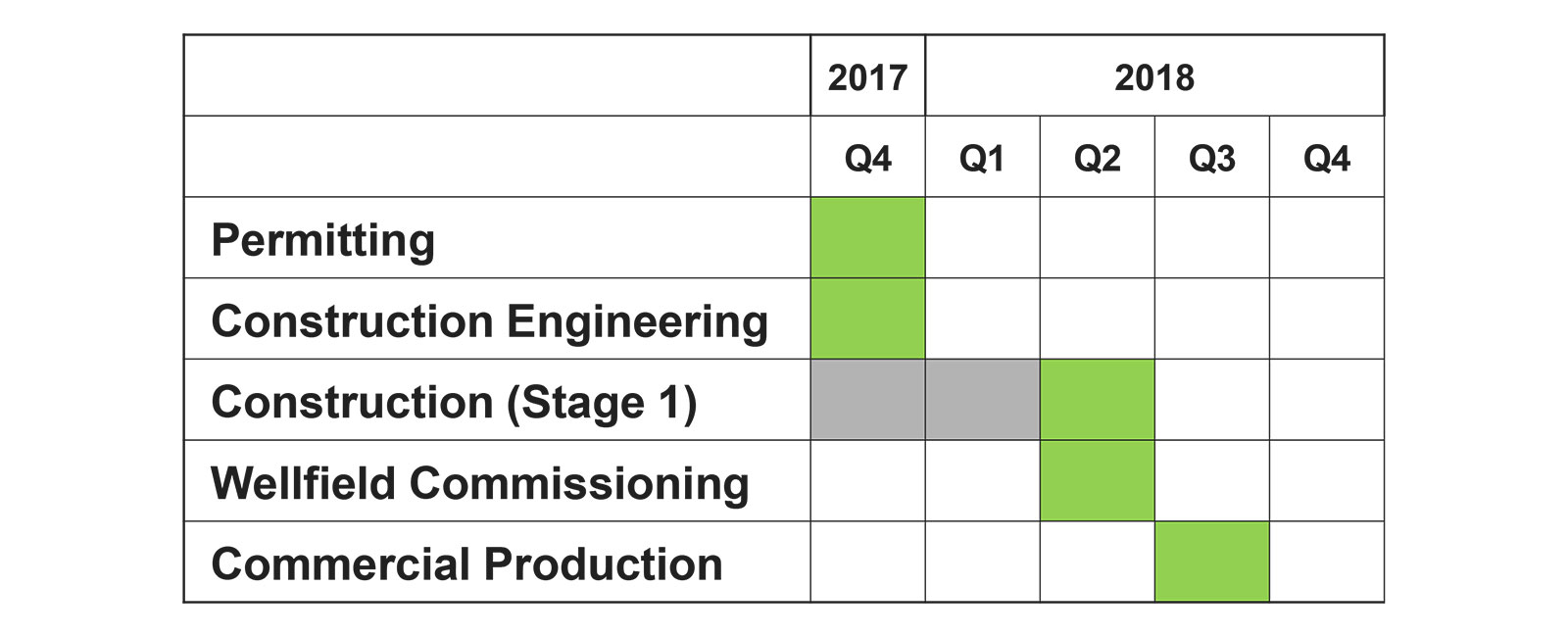

The EPA has issued a draft operating permit for the project which remained open for comments during a 30 day period, which has now been extended to January 8th (as can be seen on the EPA website). This indicates the company’s original timeline (see the next image) is slightly outdated as the final permit will now only be issued in the first quarter of 2018 rather than before the end of this year.

Despite the slight permitting delay, our thesis remains intact as Excelsior Mining is very likely already pursuing its financing package – as it already filed a short form prospectus earlier this month.

Even the worst possible financing mix indicates a much higher NAV/share

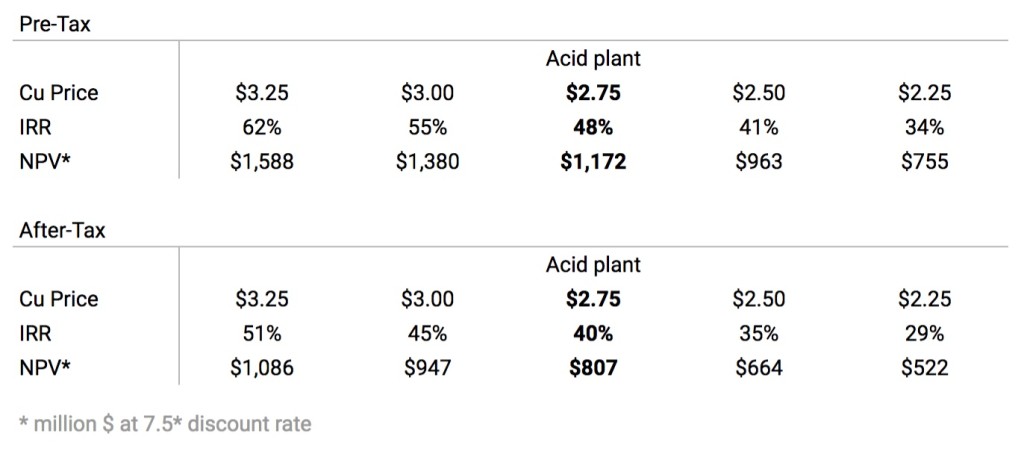

You might remember the sensitivity table provided in the feasibility study:

Indeed, using a copper price of US$3 per pound (a 4.4% discount compared to the spot price) the after-tax NPV7.5% of the project (including the construction of the acid plant, which we think still is the most likely scenario) is US$947M, or approximately C$1.2B. With an IRR of 45% at $3 copper, Excelsior Mining really shouldn’t have any issues to fund the initial capex of $47M as well as the additional $117M to increase the production rate to 75 million pounds per year (before reaching the final production stage of 125 million pounds of copper per year).

The first phase of the project will require just US$47M (+ working capital), so let’s assume Excelsior will need to raise US$60M (C$75M). Even if it would raise the entire C$75M in equity at C$1 per share, the share count would increase to just 243M shares. If we would round this up to 250 million shares, the NPV/share will be approximately C$5.05 (as you need to add the US$47M back to the NPV calculation as well).

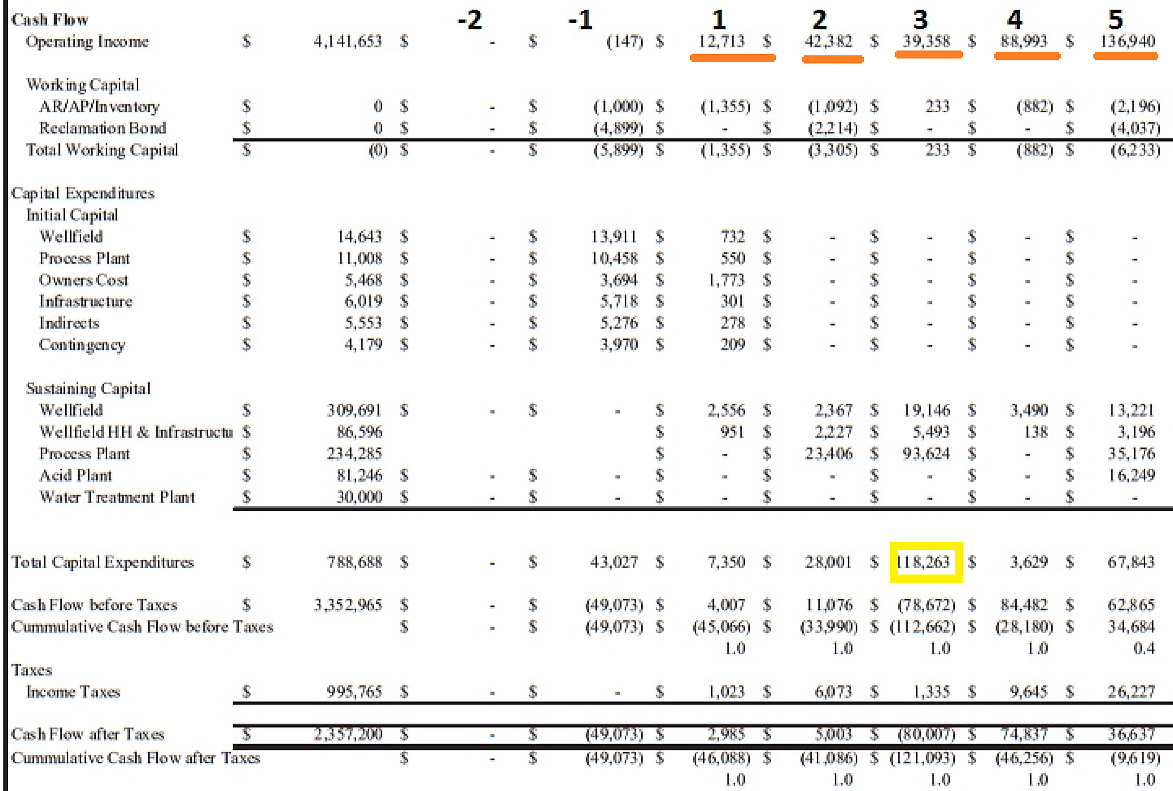

The second phase of the Gunnison project should be up and running in the fourth year of operations. This means the company will have to spend the $117M in Y3. A part of this will be funded by the cash flow generated in the Phase I 25 mlbspa operation.

According to Excelsior’s model, the pre-capex cash flow generated at Gunnison will be US$95M. After deducting the US$35M in sustaining capex in Y1 and 2 and the $117M in Y3, this results in a total additional cash need of US$57M. As the mine will be in production by then, we would actually expect Excelsior to be in a position to fund the entire $57M with debt. After all, the Y4 free cash flow is expected to be around $80-85M (obviously after taking the sustaining capex into consideration).

So long story short, we wouldn’t be surprised to see Excelsior Mining ending up with just 250 million shares outstanding (or even less) as it will be able to fund the vast majority of Phase II and Phase III through internally generated free cash flow, making it more attractive to finance these expansions by using debt.

Conclusion

According to the company’s own feasibility study and assuming the share count will increase to 250 million shares, the NAV/share will be around C$5. Whilst additional dilution cannot be excluded, it doesn’t seem to be likely given the expected cash flows from the initial 25M pounds per year operation. And even if the share count would increase to 300 million shares (which seems unlikely), the NAV/share would still remain north of C$4.

We are counting down the days for Excelsior to receive its EPA permit. Once this final box will have been ticked, Excelsior Mining will be in the final straight line to be cash flowing.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

Disclosure: Excelsior Mining is a sponsoring company. We have a long position. Please read the disclaimer