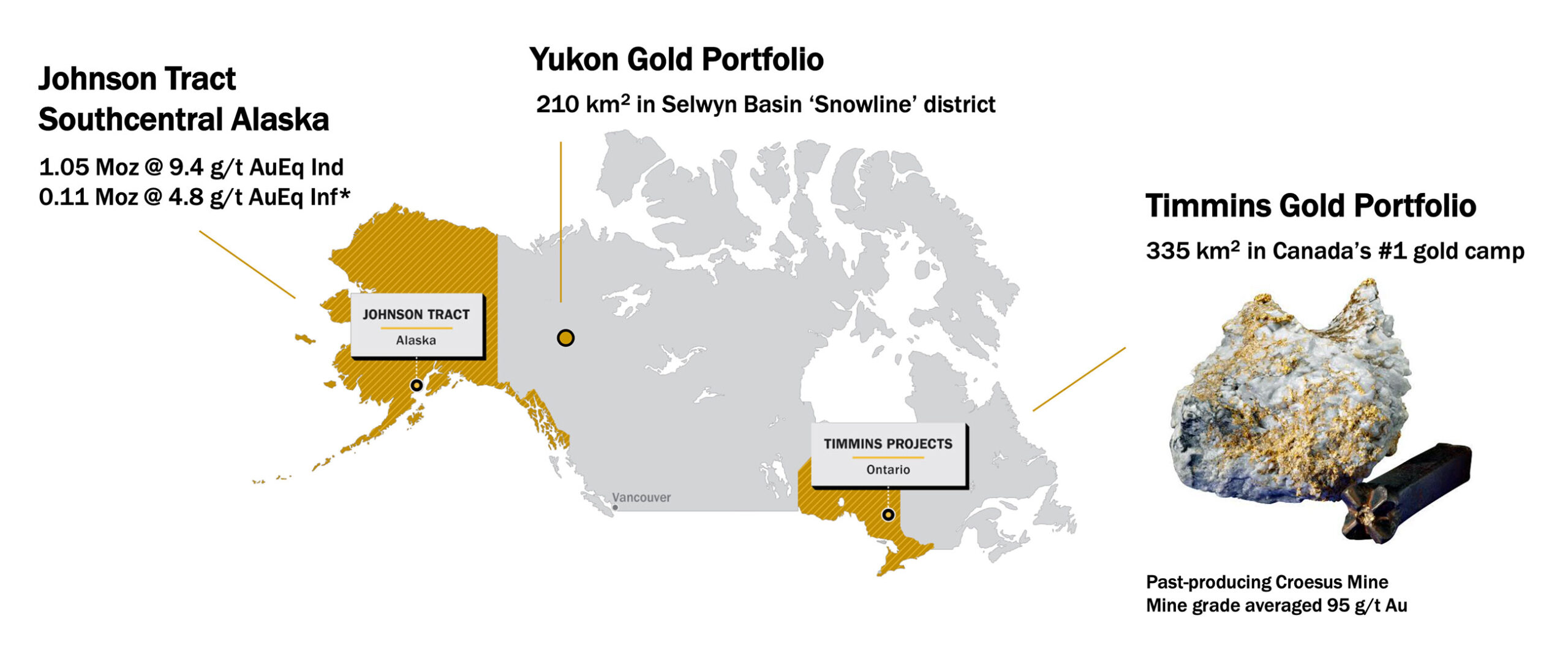

Although (some) low grade projects definitely have their merits, high grade is still king. HighGold Mining (HIGH.V) owns the high-grade underground Johnson Tract gold project in Alaska but didn’t get any love for its other exploration projects. That’s a pity, but it also creates a vicious circle: exactly because investors mainly care about the flagship project, the company is gently pushed towards spending the cash exactly on that project. This means the other projects don’t really have a chance to be developed.

Then a company has two options. It either sells the projects (preferably for shares and with strong work commitments) or it finds a more creative way around it. HighGold Mining opted to spin out its Yukon and Ontario exploration assets in a new company called Onyx Gold. Onyx will issue shares to HighGold Mining which will pass along the majority of those shares to its own shareholders so every HighGold Mining shareholder will have direct exposure to the Onyx story. Onyx also plans to complete a placement to raise cash which will enable it to hit the ground running.

The Johnson Tract project

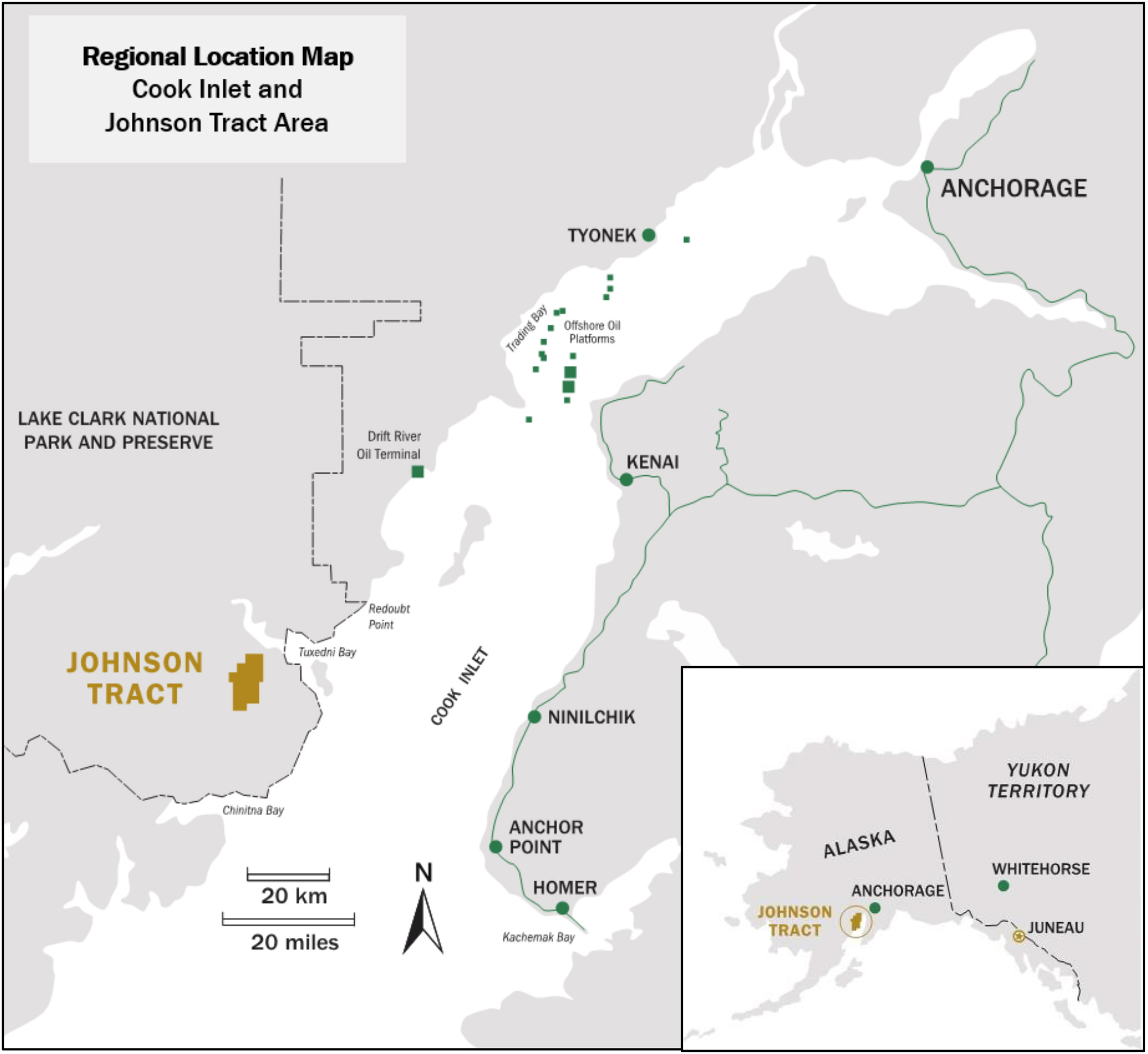

HighGold will be ‘left behind’ with its flagship asset, the Johnson Tract underground project in Alaska. The approximately 8,000 hectare project is located approximately 200 kilometers southwest of Anchorage and is located on private land within the Lake Clark National Park. So while the project is surrounded by the National Park, there should be no major impact on the permitting trajectory. Additionally, the land package is owned by Cook Inlet Region Inc. which is an Alaskan Native corporation. The corporation is entitled to transportation and port easements through park lands for the purpose of mineral extraction so the location of the project in relation to the National Park should not be an issue at all.

Mineralization was already discovered in the Eighties by Anaconda Minerals which outlined what’s currently known as the Johnson Tract deposit. Subsequent to the discovery, now more than 40 years ago, there was an era of pretty continuous exploration over a 13 year period until all activities ceased in the mid-90s, right after Westmin Resources was looking at a scenario to ship the high-grade ore directly to a mill in British Columbia.

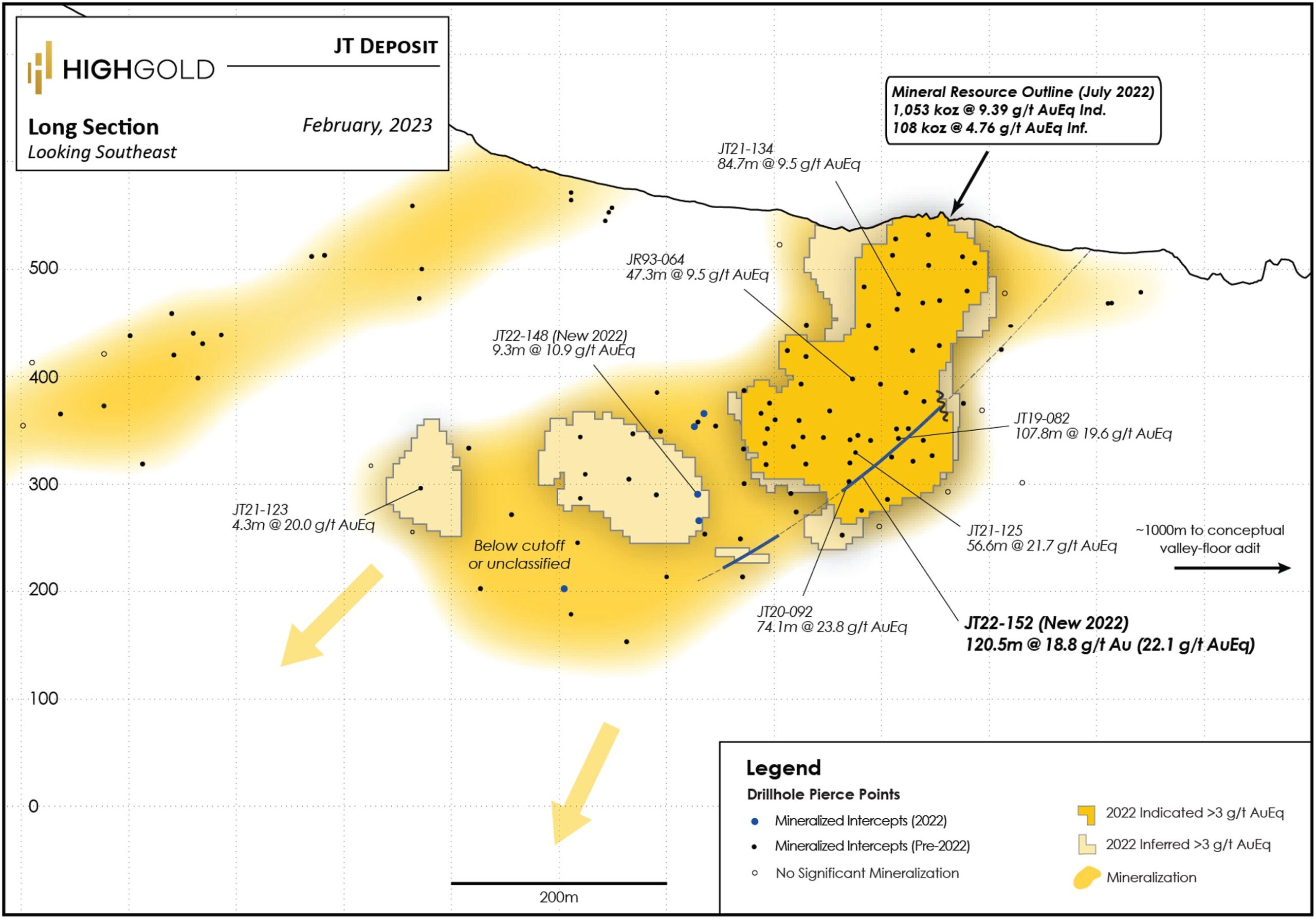

The project was subsequently picked up by Constantine Metals (recently acquired by American Pacific Mining) and spun out of Constantine in what became HighGold Mining. HighGold completed approximately 19,000 meters of drilling before the cutoff date of the most recent resource estimate (which was published in July 2022 – the cutoff date of the drilling was October 2021) which means the results of the 2022 drill program are not yet included in this resource.

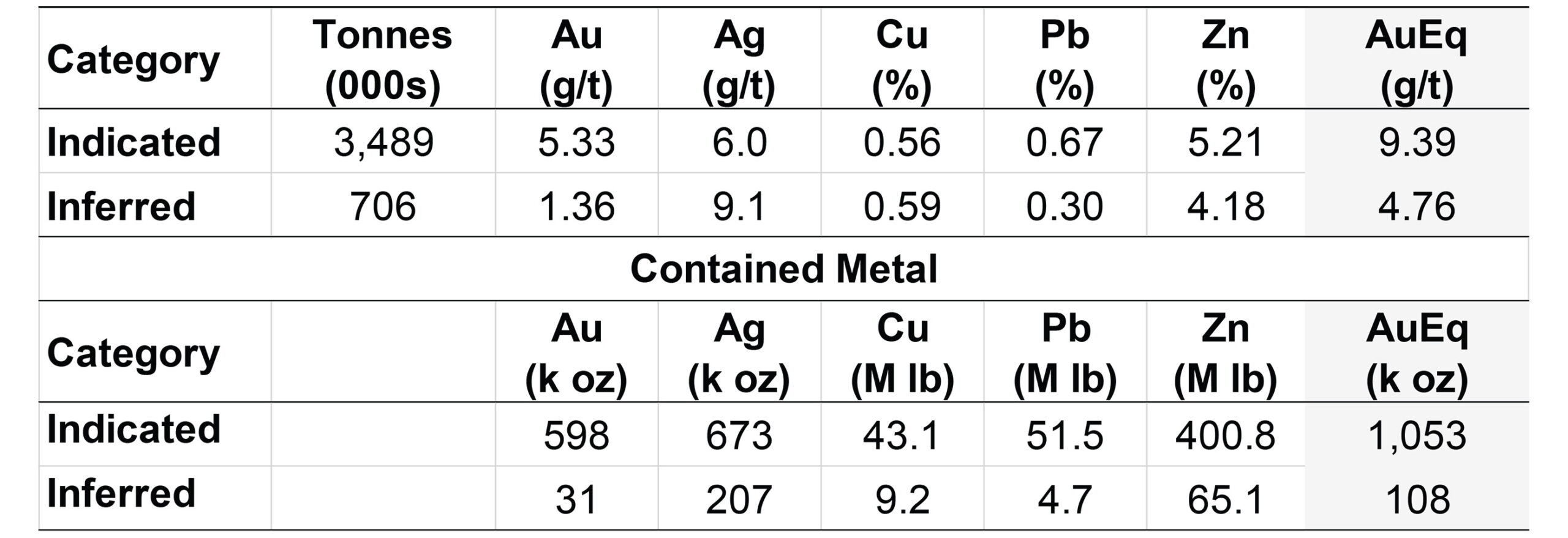

The Johnson Tract deposit is well-defined: about 90% of the overall resource is contained in the indicated resource category with just a very minimal amount of tonnes in the lower-ranked inferred resource category. The indicated resource category contains 3.5 million tonnes at an average grade of 9.39 g/t gold equivalent, subdivided in 5.33 g/t gold, 6 g/t silver, 0.56% copper and 5.88% ZnPb and contains 1.05 million ounces gold-equivalent including 598,000 ounces of pure gold.

The inferred resource is smaller and lower grade but perhaps this could be upgraded in the future considering the mineralization remains open at depth and along strike.

The resource calculations highlights a few important features: the average horizontal width of the resource is approximately 40 meters which is about 10 times wider than the average underground deposits in the Americas. Additionally, the geometry couldn’t be any better when considering an underground mining scenario: the thickness and width is unprecedented and this means the company could gain access to the resource from the valley floor to mine the highest grade zone first and apply a bottom-up mining scenario. An additional bonus would be the potential to explore the deeper areas of Johnson Tract while drilling from the 1,500 meter long exploration ramp rather than drilling from surface.

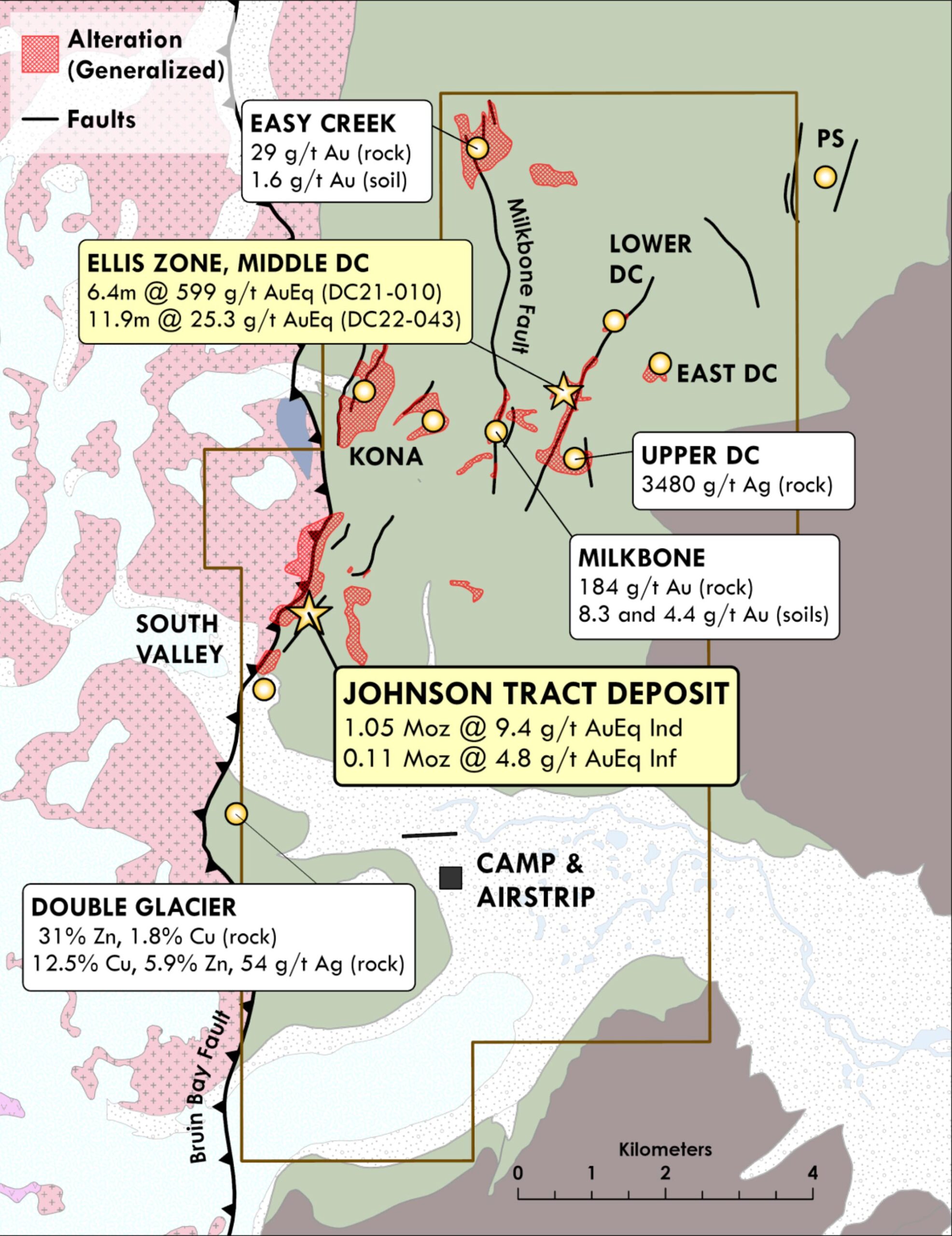

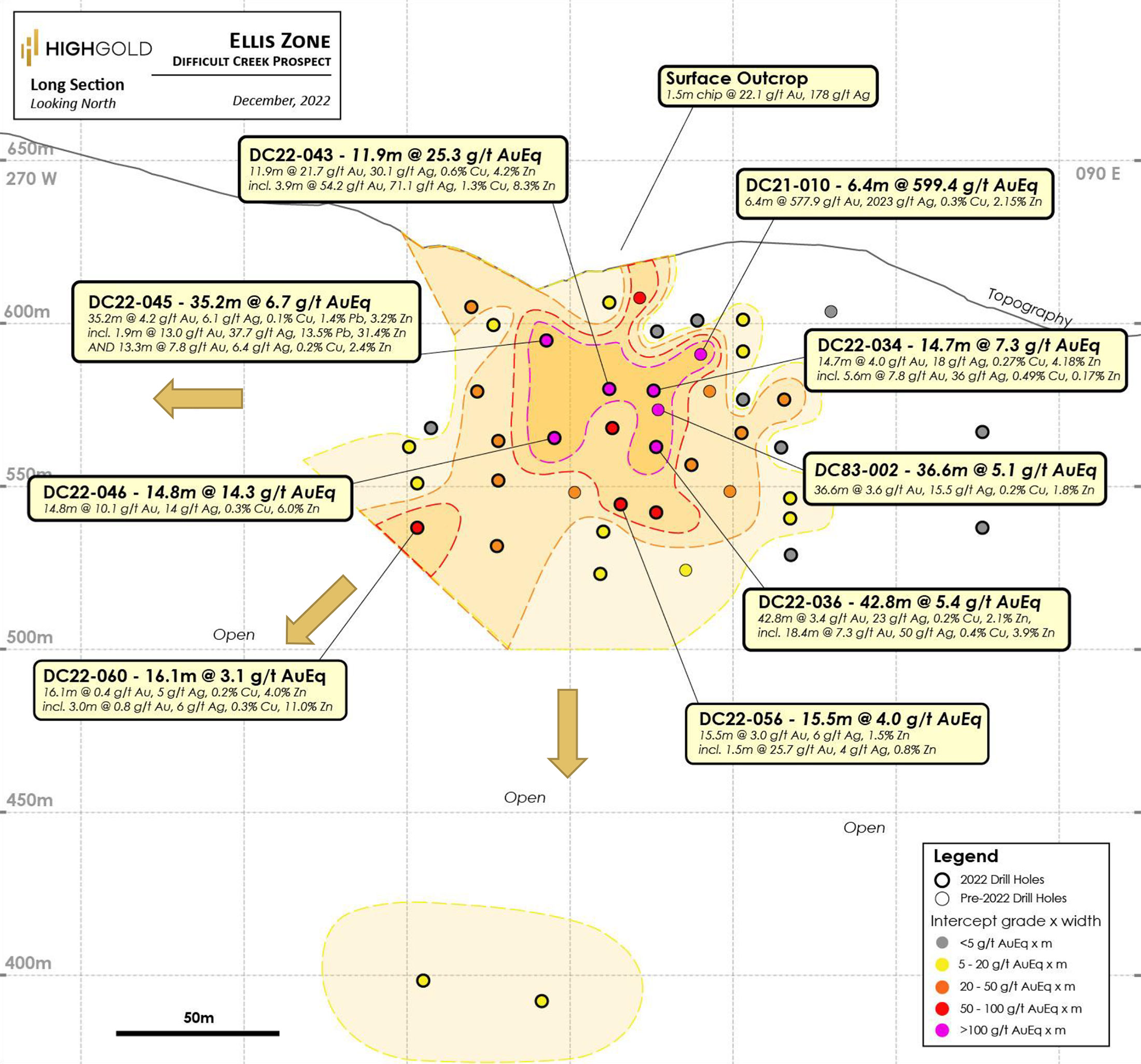

And although most of the attention was focused on the Johnson Tract deposit as that of course was the most advanced zone on the land package, let’s not forget HighGold has plenty of other fish in the sea and has just started its regional exploration programs. The newly discovered Ellis Zone for instance, yielded high grade results in holes drilled in both 2021 and 2022 and will likely be at the forefront for additional exploration to build up resources outside of the Johnson Tract zone.

From here on, the entire focus of the company will be on the Johnson Tract project and the regional exploration in the district. All other assets (the gold exploration assets in Canada’s Yukon Territory and Ontario province) will be spun out into Onyx Gold.

Sitting down with CEO Darwin Green

What is the main reason to spin out your Yukon and Ontario asset portfolio?

First of all, it oobviously unlocks value for existing HIGH Shareholders and allows us to focus 100% of our efforts on advancing Johnson Tract.

This spin-off also better aligns investors with their investor profile: they will get shares of two companies with different risk profiles and in different stages along the development curve. There is HighGold with an asset where value is backstopped by ounces in the ground and a trajectory that suggests eventual development while Onyx provides exposure to early-stage discovery drilling and thus is a more discovery-driven company.

By spinning out Onyx, we will have a better ability to finance exploration on all projects which is really hard to do when all projects are under one roof. Otherwise this could result in projects being under explored which unfortunately was the case at HighGold the past few years.

And finally, by opting for spinning out the Yukon and Ontario assets into Onyx, we will be able to minimize the dilution of HighGold (and thus the JT Project): we don’t have to dilute an established asset to fund higher risk early stage exploration. By creating two separate companies, Onyx can get out there and develop its asset portfolio independently from HighGold.

As you didn’t get any value for the assets while they were in Highgold you are obviously hoping the spinco will help. Can you give two compelling reasons why shareholders should not sell but keep the shares of the spinco?

In our opinion, Onyx has one of the best Snowline/Valley look alike targets in the new Reduced Intrusion Related Gold (RIRG) gold district emerging in east Selwyn Basin – multi-km scale high-tenor gold in soil anomaly that is drill ready and it will be drilled this summer – that’s why Onyx is completing a raise coinciding with the spinoff transaction.

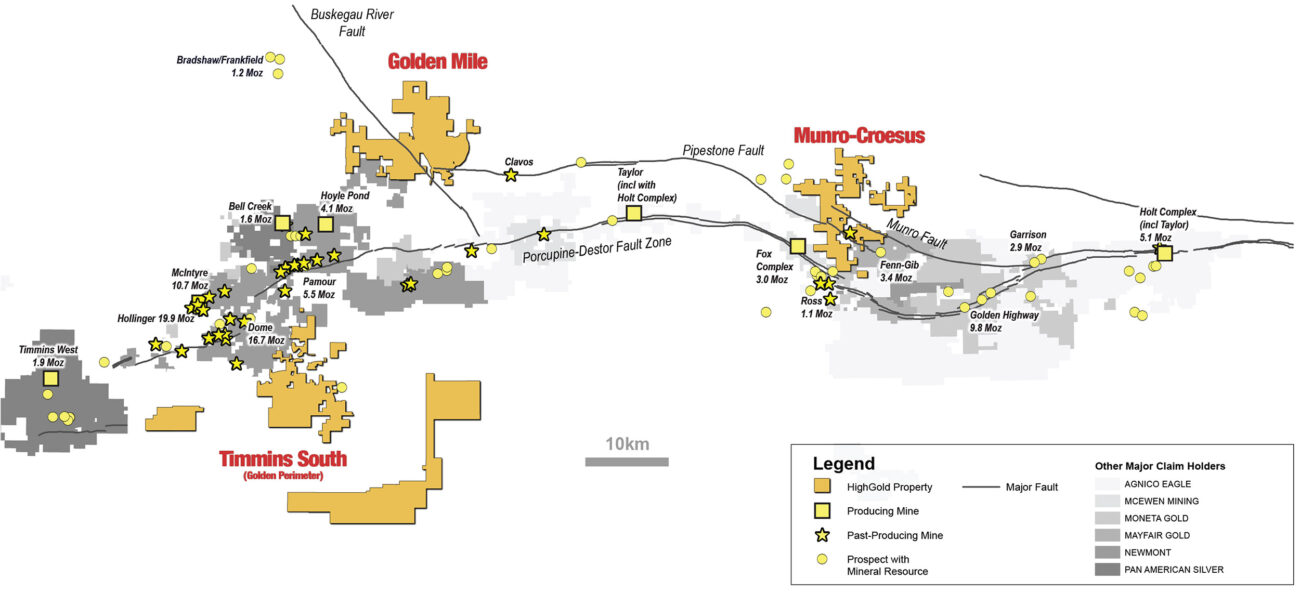

We also have one of the largest land positions held by a junior in the Timmins Gold camp. Timmins is Canada’s most productive and mature gold district. Our claims are well located in areas of excellent geological real estate and we will be drilling a new bulk tonnage type discovery this fall following the drill program in Yukon

Will you install a new management at Onyx?

We intend to share some staff between the two companies but will also include some new blood as I will continue to focus on Johnson Tract. For now, I will act as interim CEO for Onyx while we start to look for a permanent replacement. We are in no rush as it is more important to hire the right person.

Additionally, Onyx will be run out of our office which will reduce the G&A expenses for both companies.

At Johnson Tract, the unique selling point is obviously the high grade and decent and consistent width of the mineralization, would you agree?

Yes, absolutely. And don’t forget the exploration upside as we will continue to explore the greater JT District.

Some investors argue that as the majority of the resources at JT are already in the indicated category, the total size of the mineralized area is already pretty well known. What would be your reply to that statement?

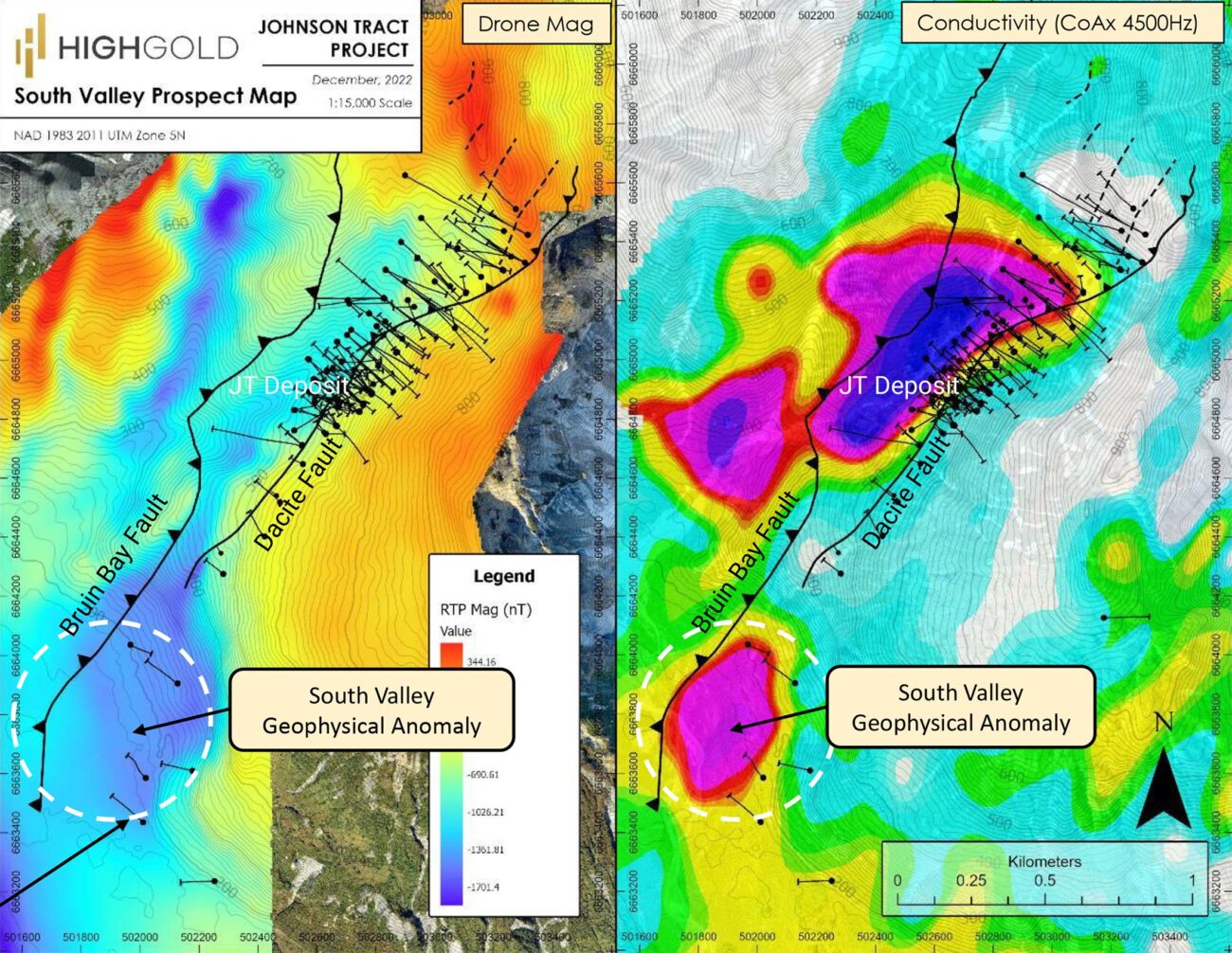

We are just getting started. We have a new discovery at the Ellis Zone (Difficult Creek) which is 4km from JT. JT itself is open but getting a bit more challenging to drill from surface. We also have a geophysical look alike 1km to the south that will be drilled this year. So while the main expansion opportunity at the JT deposit is pivoting to future drilling from underground, there are plenty of regional targets we need to follow up on.

Has Johnson Tract reached the critical mass to start thinking about economic studies? How would you deal with the relatively remote location?

Compared to Timmins it is remote, but compared to most other projects in Alaska, the Golden Triangle or the Yukon it is actually very accessible. It is comparable to the operating Greens Creek (Hecla Mining (HL)) and Kensington (Coeur Mining (CDE)) mines in terms of being accessible by water and a relatively short distance away from communities with a work force. We also have access to an airstrip which can accommodate small fixed wing aircraft coming in from for instance Anchorage (which is just 30 minutes away).

Any comments on when you think you’ll be ready to work on a PEA?

With >90% of our resource in the indicated category, high-quality metallurgical data in hand, and a growing engineering and environmental database we are certainly in a position to initiate a PEA or even PFS. However, it makes little sense to do so while we are still in the resource expansion and discovery stage. We intend to establish an initial resource at the Ellis Zone pending completion of our 2023 drill program, after which we may consider launching on an economic study. In the meantime, we continue to work on reducing technical risk and refining our understanding of things like Geotech, hydrogeology and other variables that will be critical inputs to a future mine model. The work done to date indicates almost the entire Indicated Resource is amenable to low-cost Long Hole Open Stope (LHOS) type mining.

It is a strong signal to see you are able to pull off a no-warrant financing at only a small discount to the share price. Are the participants long-time supporters of highgold? Any new names?

We see a combination of new names and long term shareholders.

Are participants in the placement still entitled to shares in the Onyx spin-off or has the record date passed?

Yes. The record date will be after the Shareholder vote which will be held late May. We anticipate Onyx will be up and trading by mid June and participants in the current financing will be entitled to receive the Onyx shares as part of its going-public transaction.

Could you briefly touch on the use of proceeds of the 7 million financing?

All funds are dedicated to Johnson Tract (+ G&A). Onyx will fund its own way with a separate go public financing.

We are planning a 2-rig drill program at JT this season hat will include about half of the meterage at the new Ellis Zone – in a drive to establish an initial resource there – as well as targets on the south edge of the main JT Deposit, where we are looking to expand the existing +1Moz AuEq resource, as well as an exciting new geophysical look-alike target to JT at South Valley. The balance of the budget will be on engineering and environmental study work in support of permitting plans and plans for the eventual development of an UG Exploration Ramp to support UG drilling.

In addition to the above we will have a regional surface program conducting mapping and smaplign to the north and south whtin the belt

Let’s dig a bit deeper into your exploration plans for this year. Can you expand a bit on them and what you are trying to achieve?

We will have a dual focus this year: we want to grow the resource base and further de-risk the project.

Our exploration will be dedicated to expand the newly discovered Ellis Zone and establish an initial resource there while we will also be looking to expand the JT deposit to the South. And finally, the geophysical target in the South Valley looks pretty appealing to us as there are quite a few similarities with the ‘main’ JT deposit.

We will also be very active on the de-risking front. We expect to permit an expanded airstrip and road to future portal site and we will support CIRI in their efforts to establish a road to tidewater and port easement (as you mentioned in the project overview). We will also advance environmental and engineering studies to support a permit application for the underground exploration ramp that would provide a tremendous platform for UG exploration drilling. We would of course make sure the exploration ramp will be ‘production-sized’ which will help us to keep the potential construction cost of a mine down the road very reasonable.

What is the current drill cost per meter in your neck of the woods?

We currently expect to pay US$550 – $650/meter on an all-in basis. This includes the cost of assaying, the helicopter based support and maintaining the camp.

Any parting thoughts?

I think it couldn’t be a better time to have a position in HighGold as the stock is trading at a huge discount to our past 3 financings (with an average price north of C$1.60). We also have strong endorsements from our institutional investor base while a senior gold producer is one of our largest shareholders. And the current shareholders get a free spin out with exposure to a walk up drill target in the center of what is arguably Canada’s most significant new gold discovery (Snowline) in the past two years.

Conclusion

HighGold’s share price was trading close to C$3 during the renewed interest in the gold space in the summer of 2020, and it reached a high of C$1.8 in the fall of 2021 when drill results confirmed the continuity of the high-grade gold results. Unfortunately the share price followed the general trend in the precious metals exploration sector: down. At the current levels, it makes very little sense to raise money to continue the activities at Johnson Tract while trying not to neglect the Canadian properties. That’s why spinning off those assets in a new entity is a good idea as Onyx Gold can solely focus on advancing the earlier stage exploration projects in Ontario and the Yukon Territory.

At the current market capitalization of just C$50M (before the impact of the C$7M capital raise on the HighGold level), the risk/reward ratio offered by HighGold Mining is appealing.

Disclosure: The author has a long position in HighGold Mining. HighGold Mining is a not sponsor of the website at this time.