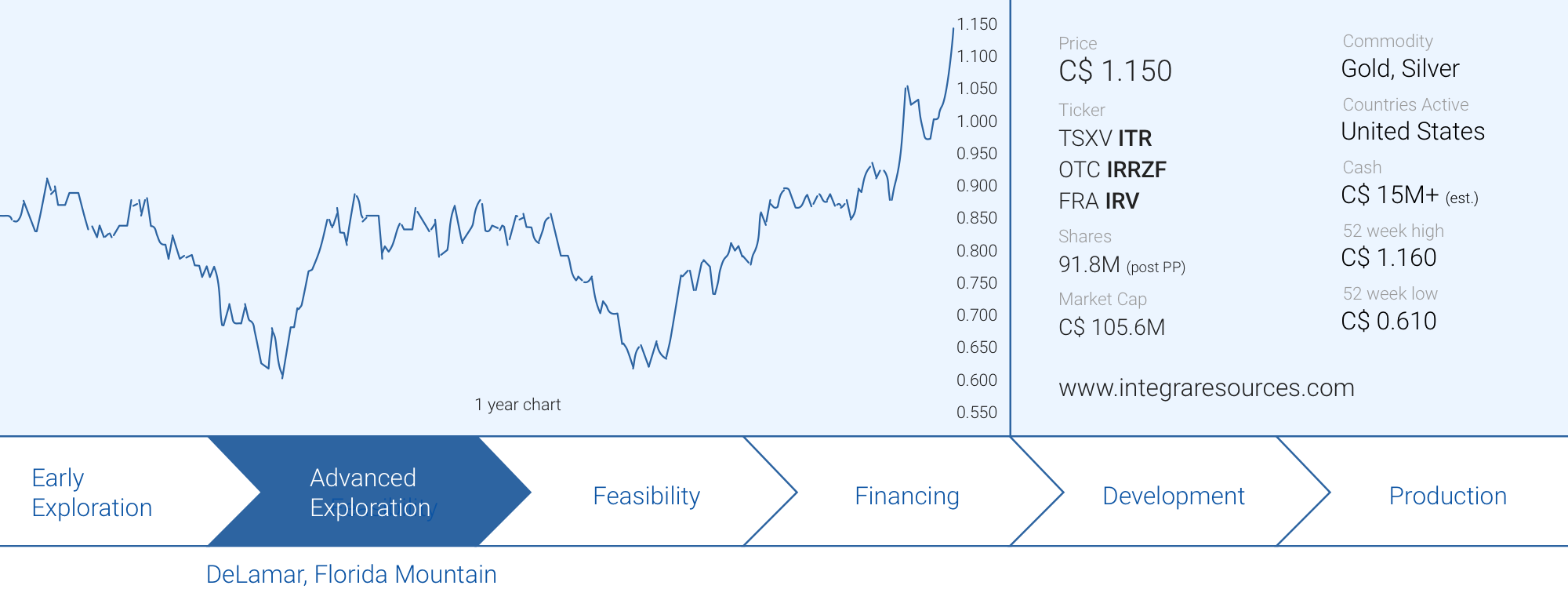

It’s almost unheard of in the mining sector, but sometimes companies really do what they promise to do. Integra Resources (ITR.V) appears to be one of such companies as it continues to tick the boxes along the way of the development curve of its flagship DeLamar project in Idaho. Less than 18 months after publishing an initial inferred resource on both DeLamar and Florida Mountain, Integra already reported a substantially larger and – more importantly – upgraded resource which now contains almost 4.2 million ounces gold-equivalent based on today’s Silver:Gold ratio of around 88 (and 4.4 million gold-equivalent ounces using Integra’s ratio).

Along the way, Integra Resources also completed additional metallurgical test work and with those results in hand, ITR is in the final straight line towards the finish line and the company expects to have a Preliminary Economic Assessment out in the first few weeks of September.

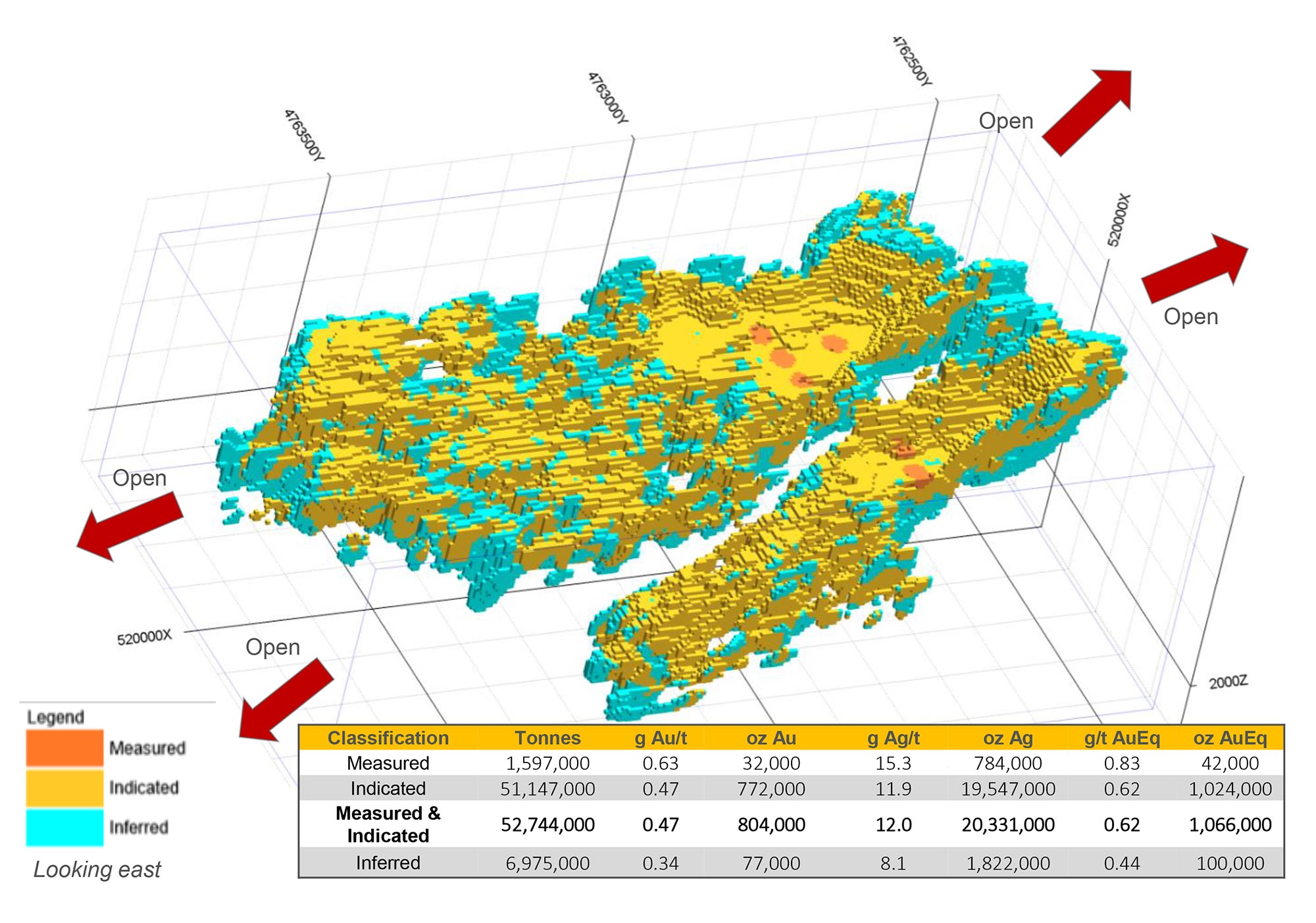

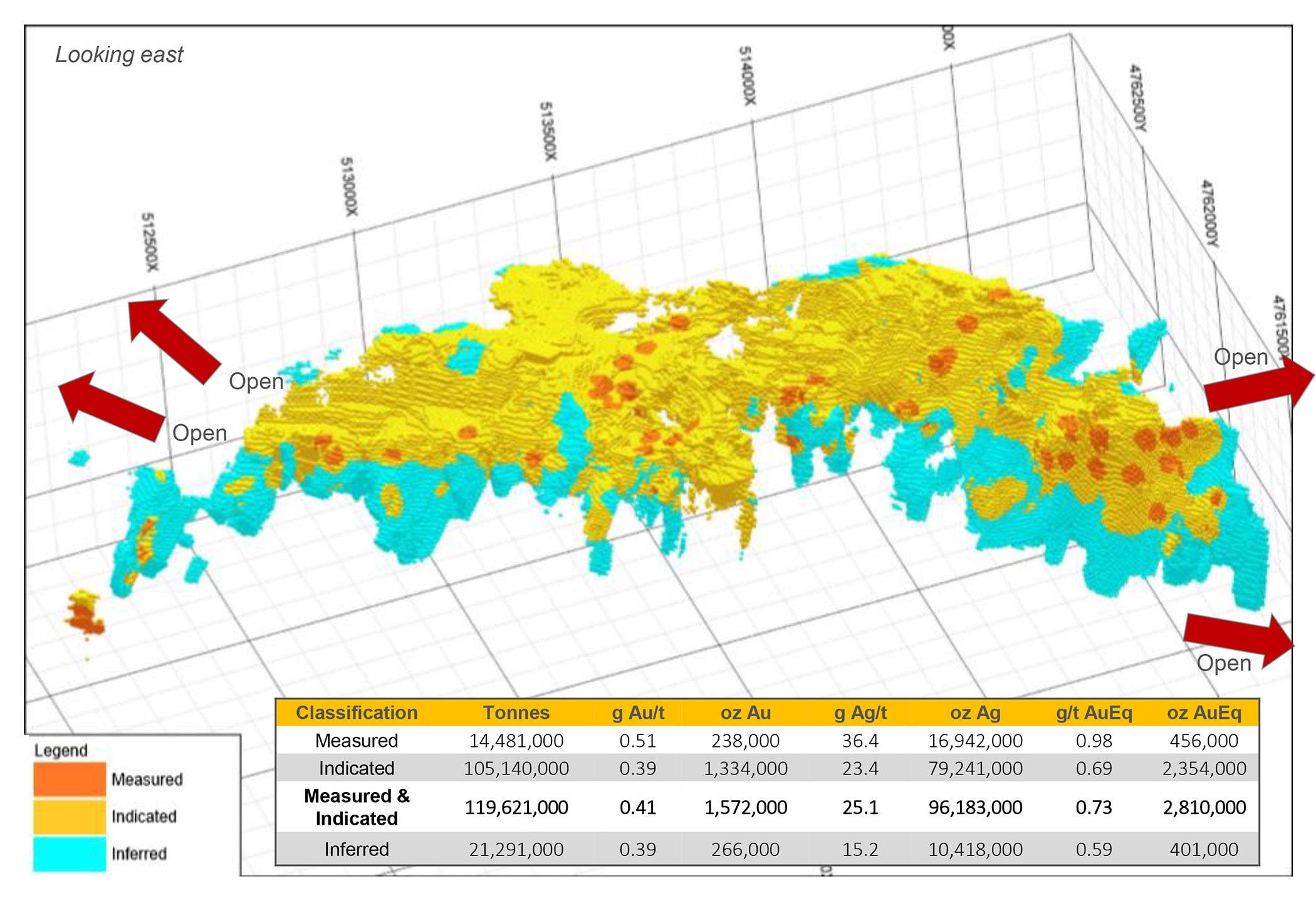

The recent resource update

Integrareleased an updated resource estimate on its 100% owned DeLamar project (subject to a final C$4.5M cash payment to Kinross which is due in the fourth quarter of this year). The total resources increased by just over 20% on a gold-equivalent basis, but what’s more important is that roughly 90% of the ounces are now part of a measured and indicated resource category. That’s almost unheard of for a company that hasn’t even completed a PEA yet, and it indicates the upcoming PEA (expected in September) will be very robust as the mine life will be based on the more reliable Measured and Indicated resources rather than using an all-inferred resource.

The average grade of 0.43 g/t gold and 21 g/t silver in the measured and indicated resource is also very decent, as this represents a gross rock value of US$28 per tonne. The net recoverable and payable rock value will depend on the recovery rates (which will be lower for the heap leach operations compared to milling the sulphides in a smaller scale mill scenario to start.

Of the 4.4 million gold-equivalent ounces (based on a silver:gold ratio of 77.7 to 1 ratio), 2.7 million ounces are ‘pure’ gold while the remainder consists of 129 million ounces of silver. Using the current spot prices ($1530 – $17.6) the gold-equivalent resource would be around 4.2 million ounces, of which approximately 1.9 million ounces are classified as oxide and transitional (in the measured, indicated and inferred categories combined), which means they should be amenable to heap leaching. Considering the recovery rate for the silver during the leaching process is substantially lower than for the gold (40% versus 85%), we estimate approximately 60-65% of the 1.9 million gold-equivalent ounces will be recoverable using the updated recovery rates (see later).

This paves the way for an initial heap leach operation that would be larger than we originally anticipated. We had expected Integra to design a mine plan which included a heap leach operation for the first 3-4 years of the DeLamar mine life as A) this would be less capital intensive and B) the revenue from the heap leach operations would help to fund the equity portion of a modest sized sulphide milling operation to start. But with 1.9 million ounces that could be processed via a heap leach process, Integra has now created optionality: the heap leach phase could continue much longer than originally thought and this could be an interesting feature should the gold price unexpectedly nosedive again. An important element to maintain operational flexibility.

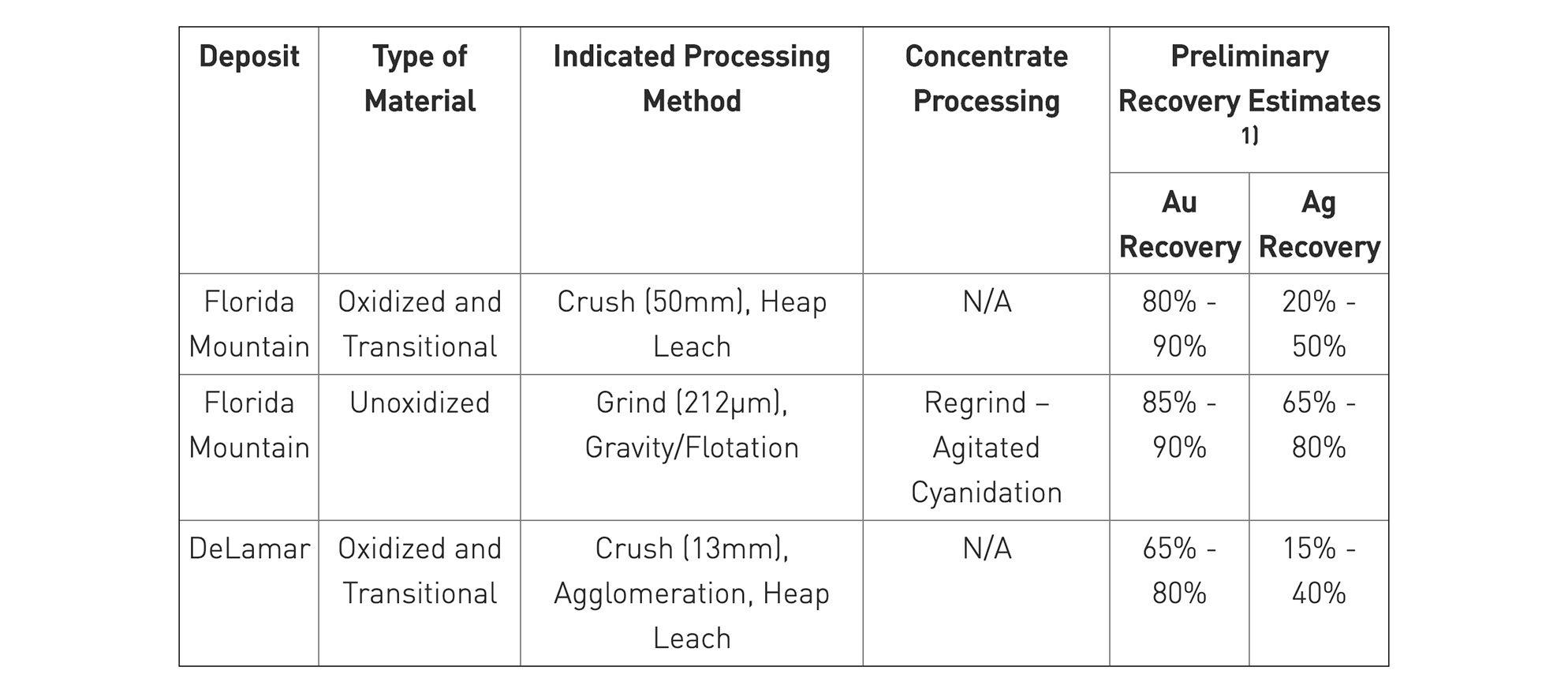

The metallurgical test work

Poor recovery results have already torpedoed plenty of mining projects, and although both the DeLamar and Florida Mountain deposits were previously mined (allowing Integra to data-mine (pun intended) for historical recovery results), the company realized it needed to do additional test work to ensure its upcoming PEA would be reliable and robust.

As Integra Gold had been mulling over a heap leach scenario followed by a milling phase to process the sulphide rock, we were also very interested in checking out the recovery rates for a heap leach operation (Kinross Gold originally did leach some of the rock on a trial basis as a test but this was a short-lived attempt so there isn’t a lot of reliable data available). The original column leach tests indicated an average recovery rate of 81% for the gold and 40% for the silver from Florida Mountain and these results have now been updated in an August update, providing more detailed recovery rates for the different types of mineralization at DeLamar and Florida Mountain.

The updated results confirm the Florida Mountain deposit appears to be the best choice for a heap leach operation with gold recoveries between 80-90% and silver recoveries between 20% and 50%. While the DeLamar oxide and transitional zones could also be processed through a heap leach strategy, the average recovery rates are substantially lower at 65-80% for gold and 15-40% for silver. That’s a wide range and perhaps a bit lower than the range for Florida Mountain, but Integra Resources has been guiding for the higher end of these recovery rates (so almost 80% for the gold and almost 40% for the silver, which brings the recovery rates in line with the Florida Mountain results. Should Integra indeed be able to make this happen, prioritizing the Florida Mountain rock over the DeLamar rock for the heap leach phase would become irrelevant.

The results that were announced also include the anticipated recovery results for a milling scenario based on the Florida Mountain rocks: using a very common gravity & flotation based flow sheet, the test work indicates between 85% and 90% of the gold could be recovered while roughly 65-80% of the silver contained in the rocks could be recovered as well.

The updated recovery rates at Florida Mountain confirm the potential to focus the heap leach operation around this deposit considering Florida Mountain is gold-heavy, and the heap leach recovery rates are currently about a third higher than the recovery rates associated with leaching the DeLamar rocks (remember, Integra is guiding for the higher end of the DeLamar recovery rates). This doesn’t mean the entire Florida Mountain deposit should be leached, as back in the ‘80s and ‘90s the Florida Mountain rock was used to blend with the DeLamar ore to reduce the average clay content that was encountered at DeLamar. But it’s clear the leaching phase should focus on the Florida Mountain zones.

Another advantage of the updated Florida Mountain leach test work is the relatively low cyanide consumption, which has been estimated at 170 grams of NaCN per tonne of rock. The low consumption rate will have a positive impact on the economics of the project and we expect to see a low processing cost for the heap leach operation when Integra Resources publishes the results of its Preliminary Economic Assessment next month.

Considering the average mill recovery rates were 91% for gold and 77% for silver in the Kinross-days, it makes sense to throw the silver-heavy paydirt in the mill as the silver recoveries are almost twice as high compared to the leaching process. So while we are unsure if it’s even feasible to construct a leach pad and process just the Florida Mountain rock, from a purely theoretical point of view, Integra’s heap leach scenario should predominantly focus on the Florida Mountain zones but should Integra indeed be able to confirm the DeLamar recovery rates will end up at the upper end of the guidance, then both deposits could be mined and processed simultaneously whereby Integra could decide to mine and process the gold-heavier Florida Mountain or silver-heavier DeLamar depending on the prices of both metals.

The recent metallurgical update did not contain updated recovery rates for the sulphide zones at DeLamar but given the long production history during Kinross’ ownership of the project we don’t anticipate any issues there. Just as a reminder; Kinross obtained high recovery rates for the gold and almost 80% for the silver during its 15-year operating life. A good start, but we have the impression Integra is predominantly focusing on the heap leach scenario right now. Which makes a lot of sense as the ROI of a leach operation should be much higher than for the sulphide scenario thanks to an expected low capex and opex.

Filling up the treasury

Integra was once again able to pull off a financing with a minimal discount and no warrant. Originally announcing a C$8M placement at C$0.86, the placement had to be upsized to C$12M and Integra still had to turn people down when it closed a C$12.46M placement. After paying the appropriate finders fees, a net amount of around C$12.2M will be added to Integra’s cash position.

This immediately removes one important factor from the equation. By raising the money proactively (and perhaps surprisingly) before the PEA will be published, Integra avoids a scenario whereby the market knows it would need to finance and drive the share price down in anticipation. Integra was vulnerable to those potential speculative ‘attacks’ as it has to settle the C$4.5M promissory note to Kinross by November 3rd. Raising the C$12M+ now is a solid move to prevent any speculation from short-sighted investors.

What to expect from the upcoming PEA?

Company representatives confirmed the PEA remains on track for publication in September, and we hope the initial results will be published before the Beaver Creek and Denver Gold Show conferences that month.

As it’s too difficult to even make an attempt to run some back of the envelope numbers (it really depends on Integra’s decision how much of the unoxidized rock it wants to mill and when exactly in the mine life it will switch from a heap leach operation to a milling operation – or perhaps it could have both options simultaneously, et cetera). There are so many variables and the official PEA is so close to the finish line we will just wait for the official numbers to be published.

This doesn’t mean we can’t share some of our focus points for the upcoming PEA. These are some of the elements we will keep close tabs on:

- How much of the 4.4 million gold-equivalent ounces will effectively end up in the mine plan?

- How high will the LOM strip ratio be and how will it evolve throughout the mine life?

- Will Integra’s consultants be successful in optimizing the first few years of the mine life by combining low strip ratios while processing gold-dominant zones to maximize the efficiency of the leaching process, while keeping the silver-rich zones untouched for the milling phase?

- What metal prices will be used as base case prices, and how will the NPV evolve using a lower gold and silver price? We would be interested in seeing a scenario with $1100/1200 gold and $15 silver as well.

Conclusion

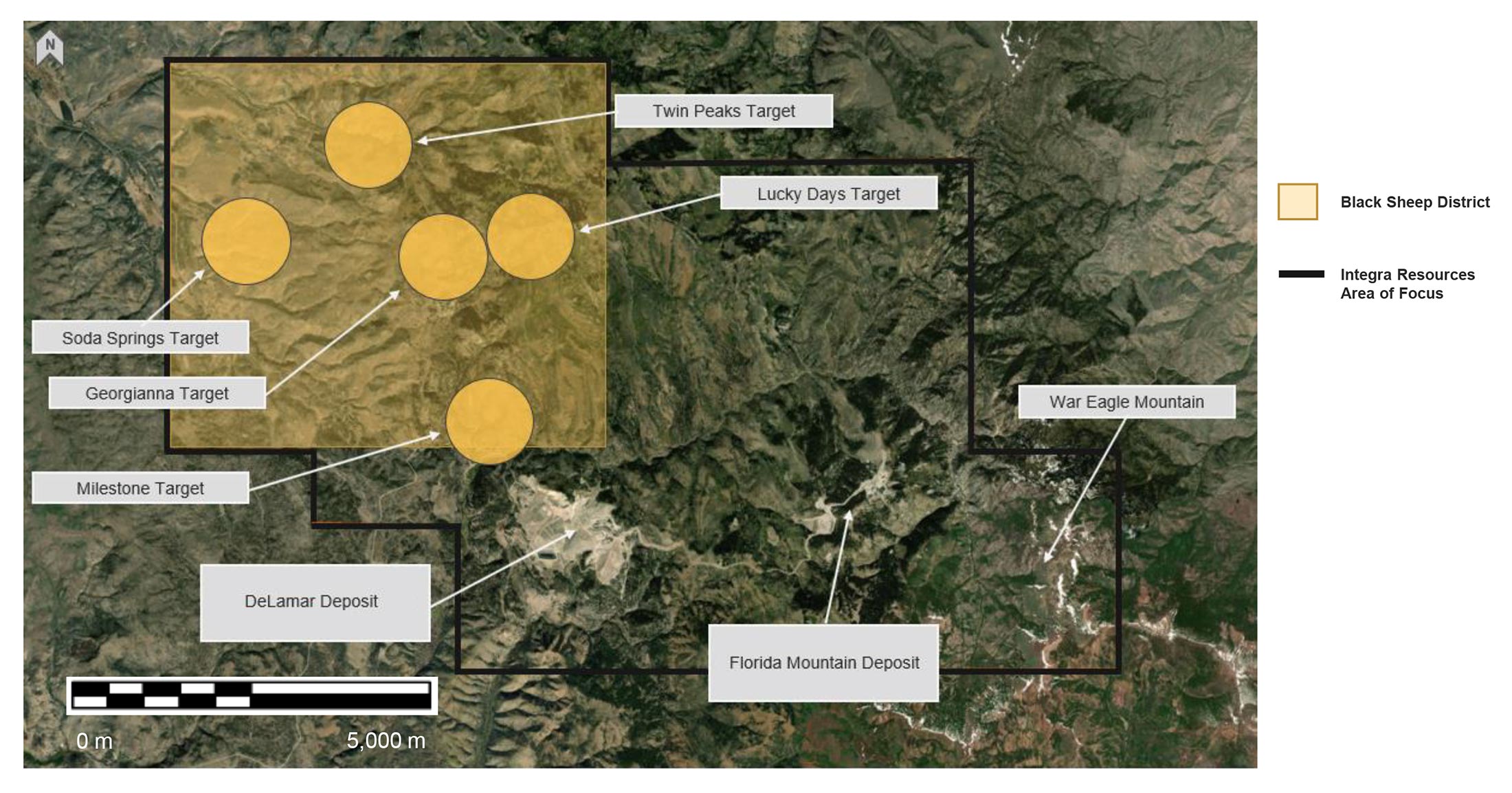

Integra Resources has been ticking almost all the boxes and the upcoming PEA is the final one to tick in this stage of the company’s life. Just to give you an idea how aggressively Integra has been advancing this project: In the past two years, the Company has released two resource updates, drilled more than 30,000 meters, completed extensive metallurgical testing and doubled its land package with highly prospective, district targets. Integra is now gearing up for a Preliminary Economic Assessment, which should be completed in September, right in time for the ‘conference season’ with the Denver Gold Show and Beaver Creek conferences in September, and the European conferences in München and Zürich.

While we will only know for sure how many ounces will end up in the mine plan and how viable the mine is once the PEA will be published but let’s also keep in mind there still is plenty of exploration potential at DeLamar as Integra has barely scratched the surface. Both the upcoming PEA and resource estimates are based on just the DeLamar and Florida Mountain deposits and do not take the exploration potential on the multiple targets around these areas into account. Additionally, step-out drilling from the current resource areas could easily and quickly add tonnage as Integra would basically just have to follow the vein orientation and IP chargeability in the North/South direction at Florida Mountain, and continue to step out towards the northwest at DeLamar. We expect the company to publish an additional resource update in 2020, and are quite confident this next resource will contain in excess of 5 million ounces gold-equivalent.

The upcoming PEA should be good and we are convinced the current $1500 gold price and $17 silver price will demonstrate strong economics with a high Net Present Value and a strong Internal Rate of Return, making the project sufficiently appealing for any mid-tier or senior producer to increase its exposure to a gold/silver project in a Tier-1 mining jurisdiction.

Disclosure: Integra Resources is a sponsoring company. The author has a long position in Integra Resources