A very wise man once said that you need to buy stocks (and assets) when blood is running in the streets, and this adage might very well be true. Enter the scene, Jericho Oil (JCO.V), which is taking advantage of the current low oil price environment to scoop up (producing) oil assets from companies in distress. This is the perfect time to start building an oil company by acquiring profitable assets on the cheap. In this report, we will explain Jericho’s business model and strategy, as well as why we think this company has an excellent chance to build the current small-scale production out towards becoming a mid-tier producer.

Jericho’s business model

It’s actually pretty simple, Jericho Oil intends to use its available human and financial resources to acquire oil assets from other companies that have to dispose of them due to (financial) difficulties. Indeed, larger companies like Pengrowth Energy (PGF.TO, PGH), Chesapeake Energy (CHK), and so many other mid-tier and senior oil producers have had to sell assets to raise a sufficient amount of cash to repair their balance sheets, or at least keep them in a decent shape. And this situation is no different in Oklahoma and the Mid-Continent, where Jericho operates.

That’s where Jericho Oil will play an important role. Its executives realized that this is the time to build an oil company from scratch by taking advantage of the current low price environment to grab up assets that become available on the market at a very decent price, compared to the crazy prices oil assets were sold for when oil was trading at $100 per barrel.

Jericho Oil should actually be seen as some sort of ‘oil bank’. It acquires assets in Oklahoma and intends to sit on them whilst keeping the production going. This results in two big advantages to the company. First of all, due to the low production cost of these wells, Jericho Oil is making money at the field level. The company has really been trying hard to keep its costs under control, and as the company continues to pick up assets with a breakeven position at approximately $20 per barrel, the operating cash flow at $40 oil would be sufficient to cover all the overhead expenses as well (and as the company’s production rate will increase, this ‘all-in breakeven point’ will obviously decrease).

And secondly, thanks to the very low decline rate of these oil assets, the company doesn’t need to invest a huge amount of capital to keep the oil production at a relatively stable level. In fact, the company doesn’t intend to spend too much capital expenditures (the bare minimum) at all as long as the oil price is trading below $45 per barrel. Due to the very low capital intensity of these wells to keep the production stable level, Jericho is able to just sit on the assets and wait for a higher oil price before investing in the existing operations to expand the production rate and increase the resources and reserves.

And Jericho isn’t doing this alone. It is conducting all acquisitions in a 50-50 joint venture with the private equity partner (which basically is the investment vehicle of a wealthy American family). Not only does this reduce the risk as all projects are now being vetted by two separate parties, it also allows the company to spread the risk over several assets. If Jericho Oil would have had to acquire all projects on a 100 percent basis, it would not have been able to acquire several different assets but would have had to stick with just one or two of the acquisitions which would have increased the risk due to asset concentration.

The 2015 acquisitions

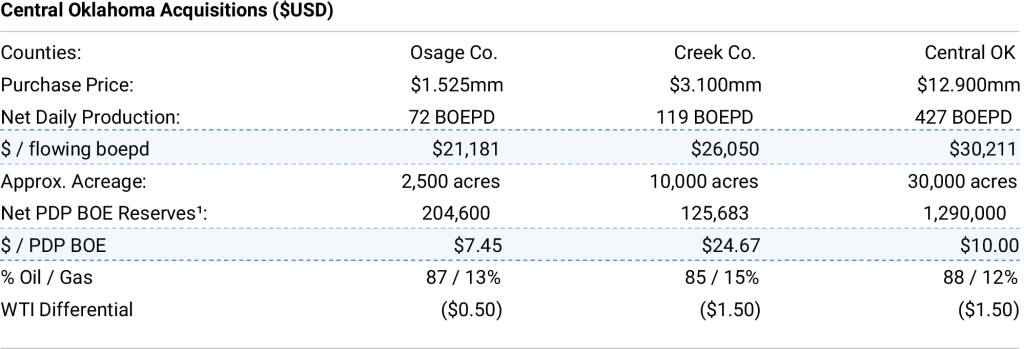

The company has closed three acquisitions for a total consideration of US$17.5M in cash (on a 100% basis). Jericho has acquired a 50% interest in two assets with a total production rate of approximately 200 barrels of oil per day (95 barrels /day attributable to Jericho) as well as a 25% stake in the larger acquisition in central Oklahoma. The only reason why the company has not acquired a 50% ownership in that project as well, is due to financial constraints. The total price tag of the central Oklahoma acquisition was almost US$13 million, and that would have required Jericho oil to fork over approximately C$8 million.

And this is once again why it is important to work together with trusted parties. As Jericho Oil is always working with the same private family to buy these assets, that private family has allowed Jericho some more time to come up with the cash to fund the acquisition of the remaining 25% and the company expects to finalize this acquisition before the summer.

Once Jericho closes the acquisition of the remaining 25% in central Oklahoma, its attributable production rate will increase by in excess of 100 barrels of oil per day, putting the company on track to have a total production rate of approximately 350 barrels per day. On top of that, with these three acquisitions, Jericho Oil added no less than 42,500 acres to the total land position and in excess of 1.5 million barrels of oil in the PDP reserves, of which 50% will be attributable to the company.

As you can see in the previous image, the prices to acquire these properties were not excessive at all. Jericho paid between US$21,000 and US$30,000 per flowing barrel, and between $7.5-25 per barrel of oil in the proven development producing reserves. That’s pretty cheap, considering Mid-Con Energy Partners (MCEP) was acquiring similar projects at an acquisition cost of in excess of $110,000 per flowing barrel just two years ago!

On top of that, the total price paid per acre was ranging from just $300 per acre to $600 per acre, which is well below the average prices paid for acreage during the energy boom of a few years ago. And this is an important thing you need to keep in mind, the larger the land position, the more attractive Jericho Oil will be to any potential suitor. Does this mean the company is buying acreage just for the sake of buying it? No, not at all, as JCO continues to focus on picking up producing properties rather than land. That’s why we said Jericho Oil should be seen as an ‘oil bank’ rather than a ‘land bank’.

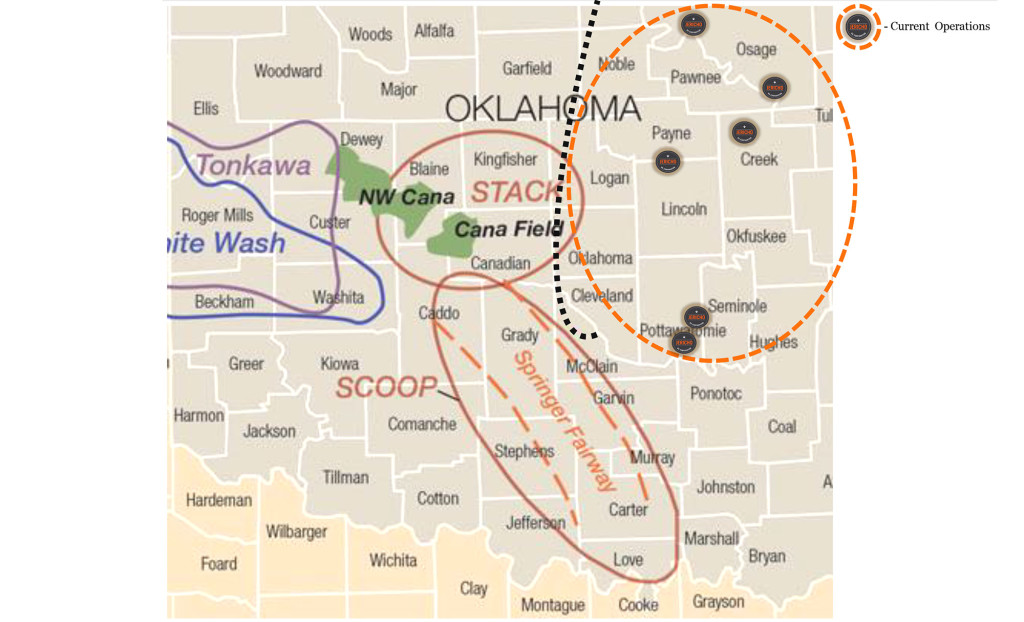

Why in Oklahoma?

Well, first of all, the United States obviously is very safe country to work in if you are an oil producer. The regulations and legal framework are very detailed and this gives the companies a certain sense of safety which you for instance would not have if you would be operating an oil project in the African jungle. These regions are very familiar with oil and gas production, and the lives of a lot of people depend on it, so the risk to rattle the locals is extremely low.

Another important reason why the company is picking up these wells, is that even though the initial decline rate of oil wells in Oklahoma is extremely high, it really levels off after a certain period of time, resulting in an average decline rate of a single-digit percentage right now. That’s important to know, because this means Jericho Oil can keep its capital expenditures extremely limited as practically no important investments are needed to keep the oil production at the current level.

There are also more properties available in Oklahoma, because the economics of a new well are not as good as other regions in the United States. The basins Jericho is targeting are positioned relatively high on the cost curve, resulting in the reduced desire to drill more wells by companies that are already in the region. As drilling wells in other regions of the USA have better economics, operators prefer to tap into those resources rather than spending more cash in the Mid-Continent.

But that’s exactly what Jericho Oil does not want to do. It does not want to join this ‘flight to safety’, as this pushes the asset prices of the more economical wells to higher levels, reducing the potential returns of any investment. Does this mean Jericho needs a higher oil price sooner rather than later in order to stay in business?

Not at all. The drilling economics are completely unrelated to the operating economics and once a well has been drilled and once the first steep decline has been incurred, these wells are very consistent and reliable producers, resulting in a very low decline rate and a very low operating cost. So even though it would not make sense to drill new wells right now because the economics would not work out (due to the high initial decline rate), as the operating cost is just $20 per barrel, Jericho’s project’s still have an operating margin of $15-20 per barrel right now, so the company can just sit tight and wait for the oil price to increase before going out there and drill any new wells.

If the production costs are just $20/barrel, why did the previous operators go bankrupt?

Okay, Jericho is currently producing oil at an operating cost of $20 per barrel, but how is it possible the company is able to pick up assets on the cheap if the production cost is still much lower than the current oil price?

Well, it all comes down to the drilling economics, and the capital allocation of the previous owners of the assets. Back in the days when oil was trading at $80-$100 per barrel, it did make sense to drill the expensive wells as the oil price was high enough to support an economic case. So even though all those operators had to borrow quite a substantial amount of cash to be able to drill these wells to keep the production rates at an elevated level, despite the high decline rates in the first few months of the production like on your well, it still made sense to drilled wells and hope for the best.

Unfortunately, reality caught up with them really fast and really hard, and the substantial debt positions of these companies required them to spend a substantial amount of cash on the annual interest expenses to service this debt. This resulted in some sort of vicious circle, whereby suddenly a company’s total operating cash flow had to be used to cover the interest expenses, resulting in an inadequate capital position to drill more wells to keep the production at a stable level. This resulted in much lower production rates and an even lower operating cash flow that is no longer sufficient to cover these interest expenses, nor repaying the principal amount of the debt.

As a lot of banks have revised the credit lines they extended oil and gas producers, several of them suddenly faced a huge liquidity and solvency crisis as they simply did not have a sufficient amount of cash nor the ability to generate new cash to repay these credit lines, causing the credit providers to seize the assets and putting them up for sale to recoup at least a part of the original investment.

Conclusion

And this puts Jericho oil in an excellent position to capitalize on the current state of the oil market. As it is doing everything in a 50-50 joint venture with its partner, a private family in the USA, it is able to reduce its risk factor by having exposure to several oil producing platforms instead of being concentrated on just a few of them. As the decline rates of the oil production are extremely low and as the operating cost is just $20 per barrel, Jericho’s debt free balance sheet allows the company to wait for a higher oil price before moving in and drilling its own wells to boost the production rate.

At the current oil price, there will be many more oil producers that will be unable to cover the interest expenses at the repayment of the principal amounts of that as soon as their hedges are rolling off later this year. So we do expect Jericho to pick up some more assets either through a negotiated deal or out of a bankruptcy procedure. In fact, the worst thing that could happen to Jericho Oil right now, is a higher oil price before it has locked in all the assets it wants to own.

Disclosure: Jericho Oil is a sponsoring company, we hold a long position. Please read the disclaimer