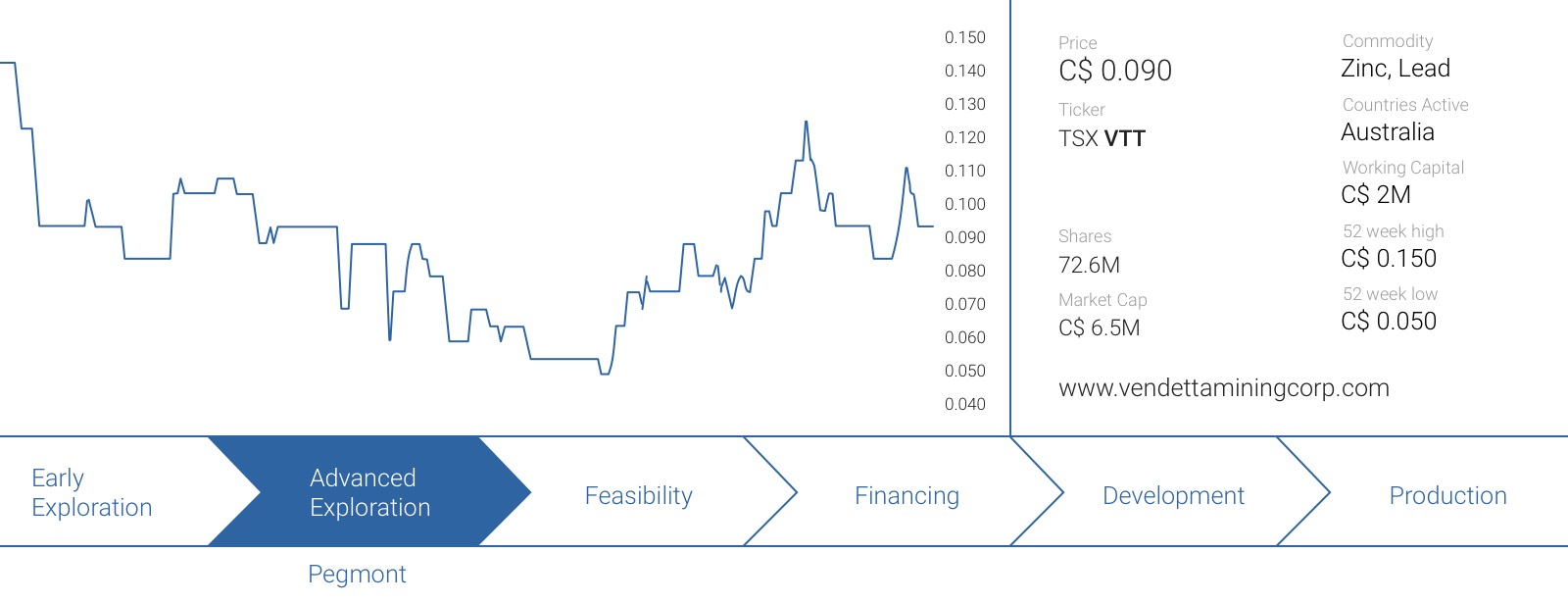

A fresh look at an old project might yield new insights, and that’s exactly what’s currently happening at the Pegmont Lead-Zinc project in Australia. The project was first discovered in the 1970s, but the code is being cracked just now. Canadian junior Vendetta Mining (VTT.V), which had a market capitalization of just C$1.1M during PDAC, has made a major breakthrough at correctly interpreting the mineralization of Pegmont, right in time to benefit from higher zinc and lead prices.

In this report we will briefly discuss the current situation on the zinc market and report back on a Q&A session with Vendetta CEO Michael Williams. The company has started its 2016 drill program last month and we aim to release a more comprehensive report later this summer, around the time the first drill results are completed.

The zinc market is finally contracting

One of the main reasons why we originally talked to Vendetta Mining was the fact we were looking for new zinc stories. We know, several ‘gurus’ have been predicting a zinc supply shortage for the past 5 years, but it’s really appears to be happening now. The world zinc supply has been decreasing quite steadily as several large mines closed (and others will close soon), but this wasn’t immediately visible in the zinc price as the supply surpluses of the past decade boosted the inventory of the metal to extremely high levels.

The market has been taking care of those inventory levels in the past 24 months and as you can see on the previous image (courtesy of kitcometals.com), the zinc inventory levels have been decreasing at a steady pace, only briefly interrupted by Glencore dumping zinc on the market to raise cash (in the second half of last year) and by brief moments of backwardation (February, June).

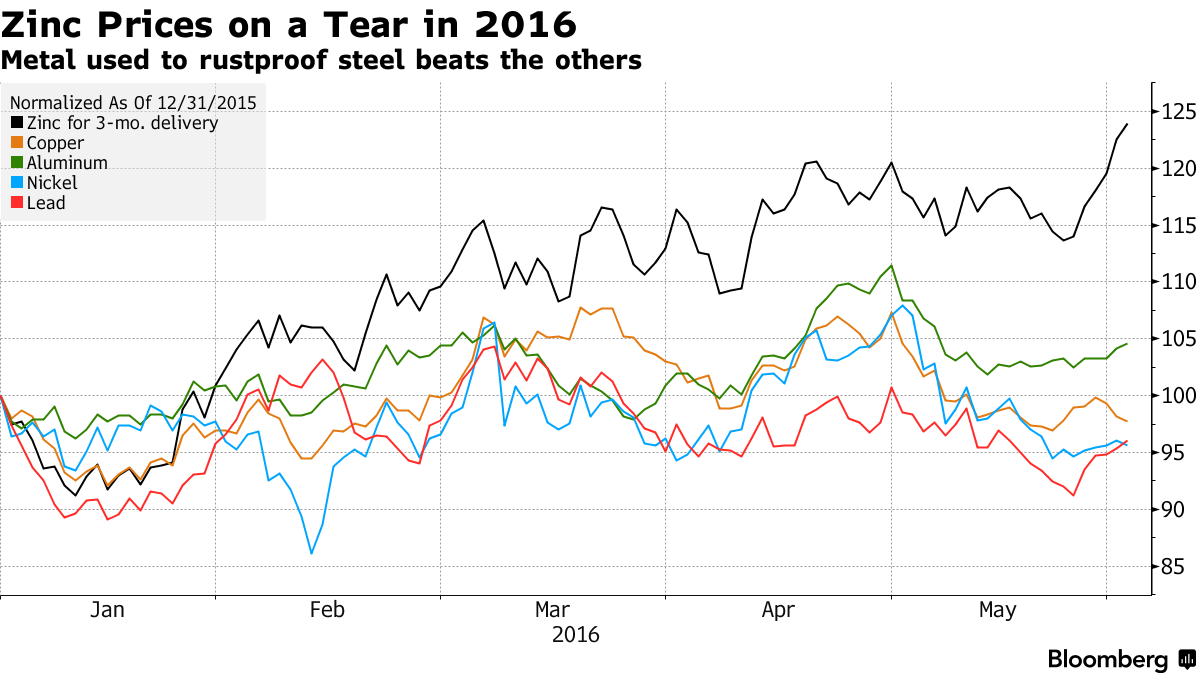

The market has been quite slow to adapt to this new situation, but don’t forget zinc is the best performing base metal on a YTD basis, and the next chart provided by Bloomberg says more than a thousand words:

In another report, Macquarie expects the total supply of zinc concentrate to fall by 8% this year, and this seems to be confirmed in the TC/RC charges at the refineries which have reached multi-year lows, indicating the zinc smelters are offering very generous terms to the suppliers of zinc concentrate. Macquarie is quite bullish on Zinc and called it its ‘favorite industrial metal’ as it expects the supply deficit to continue until 2020, reducing the total inventory of refined zinc to almost zero. Even Goldman Sachs is bullish, and expects a supply deficit of approximately 800 million pounds of zinc in FY 2017.

It took (much) longer than we expected, but the perfect storm on the zinc market is gaining momentum, and the Pegmont Lead-Zinc project might be one of the projects that could satisfy the need of the zinc smelters.

A Q&A with Michael Williams, CEO of Vendetta Mining

You had to increase the total size of your capital raise twice after seeing quite a bit of interest from the investment community. Perhaps more important is the fact Solitario Exploration & Royalty (SLR.TO , XPL) is now one of your largest shareholders. How important is this for you?

We felt the investment from Solitario and the continued support from Resource Capital Funds (which already was a large shareholder) validates our strategy and the work we have done to date. We also share the same view surrounding lead and zinc prices given the foreseeable supply issues you mentioned before.

How long will you be able to fund your activities with the C$2.5M you just raised?

The financing will fund us into 2017, with the majority of the cash going into the ground. Our goal is to release an updated NI 43-101 Mineral Resource Statement which will incorporate 6,500 m of drilling previously completed in our last campaign and the work being conducted this year. We will also complete some more metallurgical test work this year as we’re moving ahead to complete a PEA by the end of 2017.

Let’s perhaps have a closer look at Pegmont. You currently have a sulphide resource, but the total size isn’t large enough to build a viable mine. Can you elaborate on your exploration plans for this year and what your exploration target is for the next resource update?

The 5 million tonnes historic resource was confined to the upper zones of the deposit (what we refer to as zones 1-4,) and took no account of the known mineralization outside of these boundaries where considerable drilling had taken place but not with sufficient drill density to incorporate additional resources.

As a consequence, we hope to add a significant amount of additional tonnes through in-fill drilling. We also are focusing on the near surface sulphide mineralization located on the newly discovered Burke Hinge Zone.

Our goal is to produce a Preliminary Economic Assessment in 2017, demonstrating that Pegmont is viable.

Pegmont appears to be more lead-rich system although our understanding is there is potential to increase the zinc content as part of the Company’s plans. Could you discuss why Pegmont can be a project that can take full advantage of the oft-reported impending zinc deficits and strong zinc prices in the coming years?

Good question and one that is reflected with the historic resource numbers dominated by the upper part of the deposit which is indeed more lead rich. However, recent drilling down-dip in Zone 5 confirmed that the zinc grade is increasing, which is consistent with the Broken-Hill style deposit model (see the next image) and suggests that as you vector toward the original source of mineralization both overall grade and the zinc-to-lead ratio tend to increase.

There are several processing plants within trucking distance from Pegmont. How important is it to, for instance, have the Cannington mill operated by South32 (ASX:S32) so close by?

One of the key reasons we decided to option Pegmont was the infrastructure. We are blessed with access to road, rail, and power. We are also located within 25 km’s of two existing processing plants. Having infrastructure in place and a number of prominent mines closing or on a declining grade curve gives credence to our strategy that Pegmont can become a valuable new source of mineralization in the district as a standalone operation, should sufficient tonnage warrant or potentially a source of feed for existing operations.

Assuming you would be able to process the Pegmont ore with a milling lease agreement with one of the nearby mill operators, it could be quite cheap to bring the Pegmont project into production considering the ore is quite close to surface, is this correct?

The bulk of the historical resource as well as the newly defined Burke Hinge zone (26 m from surface) are on grandfathered mining leases. This would certainly allow a more expedited development and having ore close to surface will impact the potential economics.

Our goal is to delineate enough ore to sustain a standalone operation. We would also look at the possibility of using a local mill facility as it would mitigate the capital expenditure costs. Once we complete the Preliminary Economic Assessment we will have a better understanding of which direction we will pursue.

Can you elaborate a bit on the permitting process for Pegmont? How long would it take from filing a feasibility study to be fully permitted for construction and production?

Pegmont’ s permitting is certainly manageable. As mentioned, a considerable portion of the upper part of the deposit is on grandfathered mining leases. We would be required to go through the standard regulatory process on the remaining ore body but we do not anticipate any major hurdles.

From a regional perspective, the large $1.3BDugald River deposit of MMG that is also situated in the Mount Isa mining district of Queensland took roughly 18 months to go through the permitting process.

This included permitting the large tailing facility and roads. I think this speaks to the mining history of the region, the collaboration that has existed for years with the local land owners and aboriginal groups and a supportive Government and further emphasises why we consider of project to be perfectly situated.

What do you expect from the zinc and lead markets in the near-term and mid-term future? Are you happy with the current zinc price? What’s your take on the market?

Most analysts who follow zinc and lead are forecasting significant deficits over the next 24 -48 months. I am confident that we will see higher lead/zinc prices but I can never predict the timing of such a move. The falling Treatment and Refining charges at the smelter level are the proverbial canaries in the coal mine. The declining charges are a harbinger of better times ahead for the miners; on a mid-term basis I expect zinc/lead to continue to outperform all base metals with prices spiking into the $1.50 range. I would then expect higher cost production to come on stream and push prices down but with an end result that should see higher long term sustainable zinc/lead prices of around $1.15 – $1.20.

Conclusion

Vendetta raised in excess of C$2M (more than it was aiming for), and the company is determined to spend the vast majority of the cash in the ground as that’s the best (and only) way to create more value for its shareholders. We are expecting to see the first assay results before the end of July and are looking forward to see Vendetta Mining making a major move towards a 15 million tonnes resource estimate which could then be used as a stepping stone for a mine plan.

With the zinc price zeroing in on $1/lbs and the weak Australian Dollar, Vendetta is in an excellent position to capture the benefits of the perfect storm developing within the zinc market.

The author holds a long position in Vendetta Mining. Vendetta Mining is a sponsor of the website. Please read the disclaimer