Commerce Resources (CCE.V) is currently raising cash using a short form prospectus. The proceeds of this capital raise will be used to restart the pilot plant and to fine-tune the company’s flowsheet before completing a pre-feasibility study on the Ashram REE project in Québec. We discussed these developments with Chris Grove, Commerce’s president.

Ashram

You are still advancing the Ashram REE project in Québec, could you perhaps provide an overview of what you have done so far in the past 12 months, and what you’re planning to do in the next 12 months?

Sure! In the very near future (say, mid-August), we expect to start a new drill program which will be right in time for the site visit we are planning to host later this month. We are expecting the Quebec Minister of Mines, Luc Blanchette and Robert Sauve, the Chairman of the Societe du Plan Nord to visit Ashram in late August.

We are currently raising cash to predominantly fund the pilot plant and metallurgical test work, and these steps should allow us to fine-tune our flow sheet that will be used in the PFS. We still need to finishing one remaining step, the magnetics, where after we will be producing the samples that have been requested by majors, and on top of that, we will look to upgrade our “free” fluorite (which hasn’t been taken into account when we calculated the economics of Ashram) by-product to acid grade fluorspar.

We will also continue to be active with community meetings, presentations at trade shows and environmental data collection on site.

As you notice, we will continue to advance the Ashram project after having completed the groundwork in the past few quarters and year. We have actually completed a very nice review of our activities at Ashram in a two pager (which you can read here). We continued to collect data for the baseline environmental work but also pretty much completed the condemnation drilling to determine where the site infrastructure should be built.

2. Upper Fir Tantalum / Niobium Project, Blue River, BC

On the metallurgical front, you have been working to update your flow sheet. Can you provide more background about what you have been able to improve, and how this will impact the overall value of the project?

We have de-risked the flowsheet considerably through substantial test work on the pilot plant level. The piloting of the leach actually reduced the amount of reagents needed (reducing the operating expenses), and simplified the entire flow sheet. The flotation work allowed us to reduce the amount of reagents used by up to 80%, making the process much more robust.

The bottom-line here is that we obtained our highest grade mineral concentrates to date at the highest total recovery to date – both far surpassing the PEA values. This was all done was lower reagent dosages and a simpler process compared to just a year earlier, which bodes well for future updates of the PEA at Ashram.

We still have the WHIMS (Wet High Intensity Magnetics) to operate on the pilot scale size, with some development work to do prior. There is considerable potential here to continue to improve recoveries and grade, but of course, the proof will be in the pudding!

We also disclosed our intention to market a fluorspar by-product. A major point here is that this does not cost us anything to produce to met-spar grade as it could be considered a waste product of the REE processing process. I don’t think any other Rare Earth junior can say this about its potential by-products.

You have also announced you’re looking into generating your own (green) power at Ashram by building wind turbines. Would you be able to sell your potential excess power on the grid, or would you store it in large on-site batteries? What would be the potential economic impact on green power versus diesel-powered generators? Will you qualify for government grants, intended to stimulate the renewable energy sector?

Yes, that’s correct. We are looking at just one 2MW turbine in partnership with TUGLIQ.

It would provide power for Ashram only as we are not connected to the grid. Initial indications are that a turbine will be cost efficient and reduce our overall power costs materially. And yes, we have already received a first government grant and we will continue to qualify for additional grants.

This is all made possible as Raglan (Glencore’s nickel deposit 650 kilometers to the north of the Ashram) has demonstrated the technology is applicable to our situation as well.

Back in October, you announced improved recovery rates at Ashram, which will boost the economics. Will you update the PEA with these recovery rates as well as incorporating the fluorspar by-product? How big could the impact of both factors be on your production cost per kilogram of REE concentrate?

Yes, all this will be incorporated into a PFS (we prefer to release a full pre-feasibility study rather than just updating the PEA which wouldn’t make sense for us). As you can understand, we cannot state any numbers on its impact on the production expenses, however, we definitely expect it to be material. Any increase in recovery is a major benefit to the project.

Glencore

You have announced a binding MOU with NorFalco, a subdivision of Glencore. It’s remarkable to see a major commodity powerhouse teaming up with a company in the PEA-stage. Could you elaborate a bit more on the relationship with Glencore?

The relationship with Glencore is very positive and it came about in a very organic manner; we requested a meeting with them because of their nickel/ lead smelting operation in Belledune, New Brunswick, which was an ideal potential location for our downstream hydro-met facility. On top of that, we thought there might be some synergy advantages along the way as Glencore’s facility produces sulfuric acid as a by-product which is something we will need for our processes.

Although this MOU focuses on securing long-term sulphuric acid supply, it sets a foundation for ongoing discussions on other fronts.

Does the MOU extend beyond the potential purchase of the sulphuric acid? Does Glencore trade in REE’s? How important are the recent fluorspar results for your relationship with Glencore?

We will certainly look for additional synergies between us and Glencore. REE’s are not a core commodity for them, but they have expressed an interest in them and it will be interesting to see how this may play out.

There has been interest expressed as well in other commodities that we could possibly produce, and from our other assets including our Blue River tantalum project. Fluorspar is certainly one of the 90 commodities that Glencore trades in, and so it might be logical that our fluorite is of interest to them.

Corporate

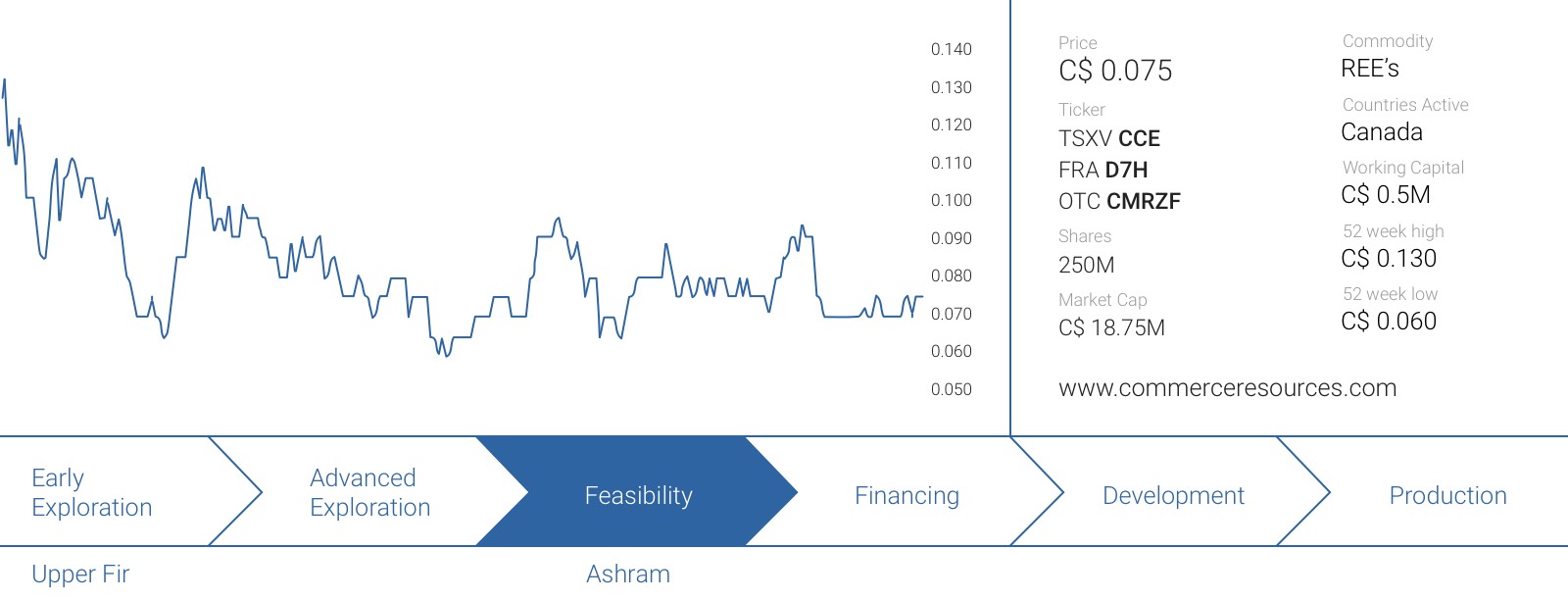

You are currently raising cash through a prospectus offering with each unit priced at C$0.075 (consisting of one common share and a full warrant with a strike price of C$0.10), and have closed a first tranche of C$1.17M. Your original intention was to raise C$1-3M. The minimum objective has now been reached, but do you think you will be able to raise the entire C$3M in this financing round?

I hope so. We are optimistic about the 2nd tranche of this short form offering, and we are just in the process of aggregating orders now.

What will the proceeds of the current market be used for?

The primary use of proceeds is to complete the pilot plant and to produce the samples that have been requested. We did add several new requests for samples in the last month at the REE conference in Denver.

What’s your opinion of the current situation on the REE market? Can we expect the sentiment to change soon? Commerce has extensive contacts in Asia, how are the potential buyers of REE concentrate (re)acting?

I do expect the sentiment to change and in general my outlook is that the REE market is actually very strong – demand has continued to grow year upon year since 2009, even though prices have fallen since 2011.

This is the confusing thing about the REE market – that the overall demand and usage has grown and continues to grow, which is not obvious at all while the falling prices are very obvious to everyone, and because of this the actual market seems less robust than it actually is. The REE’s are very much one of the key commodities that are essential for anything that is “clean and green” as is, of course lithium, which has had huge price appreciation from this usage in these new tech products. This drive to effect positive change on global warming is one of the main issues of the global zeitgeist right now. The intent of the current climate accord following the COP21, with the number of signatories – 195 countries as of last count – is clear and the basic tools to accomplish any change will require lithium and REE’s.

In terms of something that might have an effect on REE’s is the very significant increase in expansionist tendencies by China in the South China Sea. Arguably, a weaker economy in China is a major concern for the ruling party and so the President needs to be seen as a strong man, to offset the reality that there is this weakness implicit there – a simple case of “the best defense is a good offense”. The numbers and the severity of these incidents have increased exponentially and this has created great unease with any other country in the area – Japan, the Philippines, Taiwan – and of course all of these countries have treaties that require the United States to come to their aid in the case of military action.

To compare what happened in the fall of 2010 – the Senkaku fishing boat incident – to any number of recent incidents including the arbitrary imposition of a “No Fly Zone” by China, and then the resulting “accident” of Taiwan firing a missile towards China, I think it is clear that something could happen that would have a significant effect on trade relations in general. However, even without a specific incident such as China cutting off supplies of the REE’s to Japan, I can tell you that the Japanese are much more anxious about finding a more stable source for the REE’s. No question about that.

Of course something else to consider is that the largest market for the REE’s is still China by far – they consume approximately 60% of the entire production, and this makes sense (if you have ever been to China) because there is no country that needs more relief in terms of air pollution, no country that needs more electric transportation than China, and in this regard, in the minds of the Chinese a fair question is, does China have enough feed stock for what they consider to be the “future”?

Is the future in China the next five years, or is it the next ten 5 year plans? That is a very fair question and I can tell from the month or so we spent in China in 2012 – before the installation of President Xi (November 2012) – we met the majority of the REE majors, and we met the largest several times, and the takeaway was that there was this concern over the abundance, or lack thereof, REE feed stock for their future. I would argue that this concern has been put on the back burner by the very reform minded President Xi, but it has arguably not gone away. And as our Ashram project seems to be on the lower end of the cost curve, the project will be viable, even at the current low REE prices.

The author has no position in Commerce Resources. Commerce Resources is not a sponsor of this website, but Zimtu Capital is. Please read the disclaimer