Here at Caesars Report we haven’t been participating in the lithium-hype as most companies seemed to be very fairly valued, as Orocobre’s (ASX:ORE) market capitalization reached A$1B, and Canadian companies were falling over themselves to find a lithium property (just any asset was good enough) to benefit from the lithium boom.

But then we came across Millennial Lithium (ML.V) which is reinventing itself as a lithium explorer. Earlier this year the company optioned the Lincoln lithium property in Nevada, but our interest was really triggered when Millennial announced the acquisition of an Argentinean Lithium project, located within the ‘Lithium triangle’. This report will predominantly focus on the Argentinean project, as we think this will be the asset that will create the most shareholder value, as salares-based projects usually have a low operating cost and a low capital intensity, making the development of such projects more appealing than hard rock lithium mines.

An overview of the Lithium market

In order to understand the value proposition of Millennial Lithium, we think it makes sense to spend a few paragraphs on a general overview of the lithium market as we realize this commodity isn’t as main-stream as gold or copper.

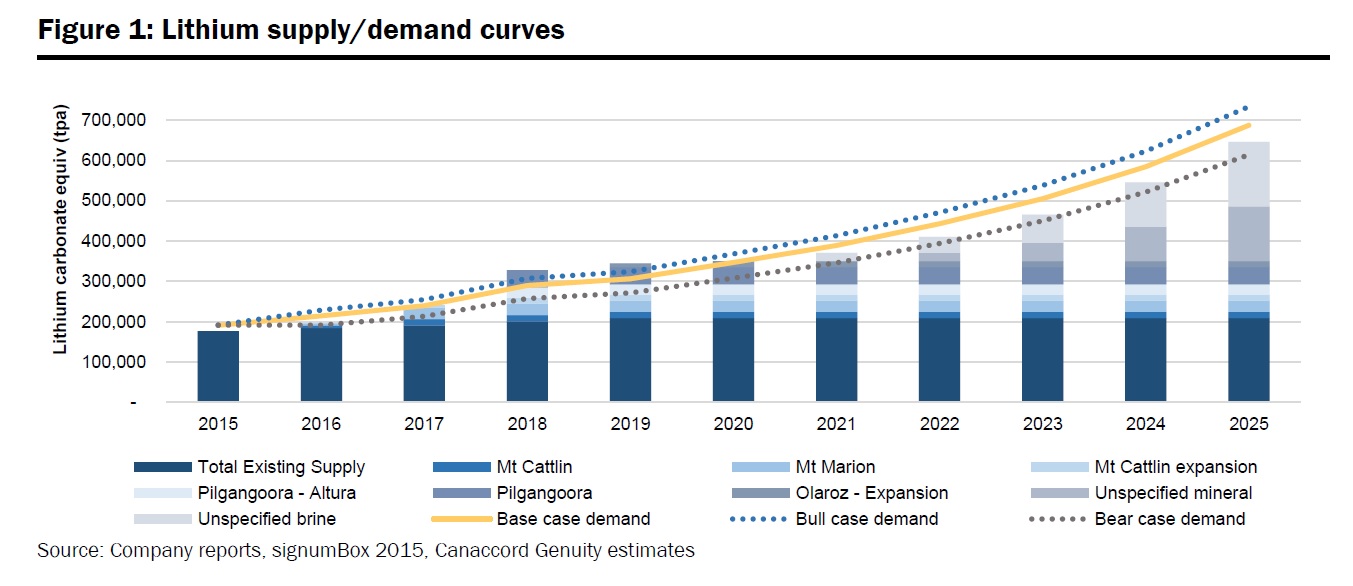

As of right now, the total lithium demand and supply were more or less in an equilibrium as the total production of 200,000 tonnes of Lithium Carbonate Equivalent (‘LCE’, you need just over 5 tonnes of LCE for one tonne of ‘pure’ lithium) is being absorbed by the market. The fact there is no oversupply already is a good start, but the situation on the markets was (and still is) really tight as the news of a supply deficit in 2015 (which would continue into 2016) sent the lithium price soaring. Whereas LCE was trading at less than $6,000/t in 2014 and the majority of 2015, end-buyers started to panic at the beginning of this year, and the LCE contract prices increased to $8,000+ per tonne whilst Orocobre confirmed it will receive an average price of $10,000/t in the current quarter.

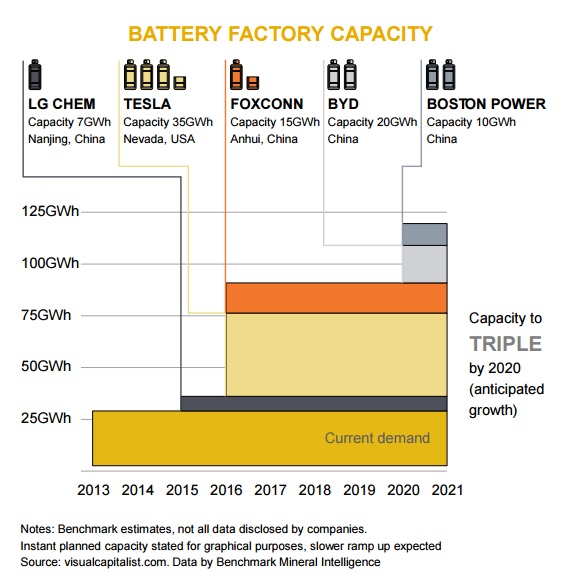

Canaccord is expecting a 14% CAGR (!) in the lithium demand for the remainder of this decade. This would mean the demand for lithium will increase by – on average – 30,000 tonnes per year, and the total world demand by the end of this decade would then be almost twice as high as the total demand in 2015. That sounds pretty aggressive to us, but if you look at the start-up of the different battery factories planned in the next few years, it’s not unthinkable considering the plants operated by LG Chem, Tesla Motors, Foxconn, BYD and Boston Power will increase the battery capacity by 87 GWh. And if you know 1 GWH requires approximately 1000 tonnes of lithium per year, the demand will increase by 90,000 tonnes per year just by these factories focusing on electric vehicles alone.

If we would now be a little bit more conservative than Canaccord and use a 8% CAGR for the next five years, the annual demand would increase to in excess of 295,000 tonnes per year. That’s almost 100,000 tonnes of LCE per year on top of the current demand which basically means the world needs to get at least one Olaroz project (owned by Orocobre) into production. Sure, Albemarle (ALB), FMC (FMC) and Orocobre are already investigating the possibility to increase their production rates, but this will only be sufficient to cover the demand increase in the next few years.

Using the same CAGR, the world will need an additional 25,000 tonnes of LCE in 2021 and 52,000 tonnes of LCE compared to 2020, and that’s exactly where Millennial Lithium comes into play. We aren’t counting on the company being in production before the end of the quarter, but it should be possible to be ready for a construction decision by the end of this decade, to fill the need for an additional lithium supply early next decade.

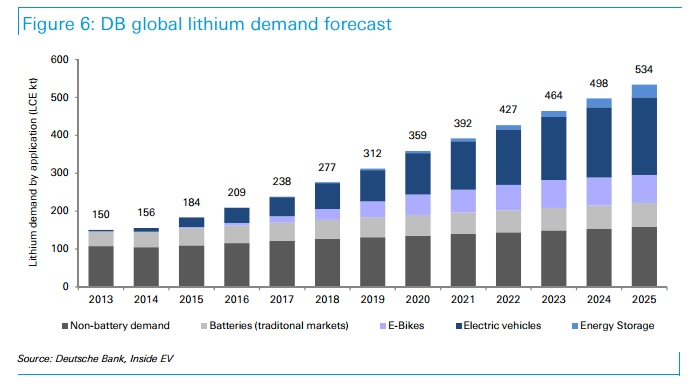

And just so you’d know, Canaccord is expecting a total LCE demand of 687,000 tonnes in 2015, whilst Deutsche Bank is expecting the total demand to increase to 534,000 tonnes. If we would use the most conservative scenario of both financial institutions, the Deutsche Bank estimate of 534,000 tonnes means the world will need to find an additional 350,000 tonnes of LCE per year. And that’s 20 (!) times the size of Orocobre’s Olaroz project.

Millennial’s project is located in an established salar-region

The location of the company’s Lithium project was not disclosed in the initial press release, as the company was still trying to tie up the surrounding land positions to increase the footprint of the project. Now the NI43 technical report has been filed, all details have been made public as well.

And Millennial didn’t disappoint as the location indeed does seem to be top-notch and the Pastos Grandes project is located within walking distance from other promising projects owned by Lithium Americas (LAC.T), Orocobre and Lithium X Energy (LIX.V).

Millennial’s management team didn’t acquire just any project, as it’s located in one of the most promising lithium districts in the world, as the salares in a 200 kilometer radius around the Pastor Grande project contain millions of tonnes of Lithium Carbonate Equivalent. On top of that, Orocobre’s producing Olaroz project is located 120 kilometers north of the Pastos Grandes, and the simple fact Orocobre is zeroing in on its nameplate production capacity of 17,500 tonnes of LCE per year shows these types of salares have the right characteristics to be developed into producing low-cost lithium mines.

The total acquisition price to acquire 100% of the project is actually very reasonable, as Millennial Lithium will be required to make cash payments totalling US$2.2M, spending $1.6M on exploration and issuing shares valued at US$1M to the vendors within the first twelve months after receiving Exchange approval of the definitive agreement. On top of that, there’s an existing 1.5% NSR on the property, which could be repurchased by Millennial Lithium by making a lump sum payment of US$3M.

The NI43-101 technical report contains a lot of useful information, confirming the merits of the project

The total size of the initial licenses was just over 1,200 hectares, but the company has submitted an application to the government of Salta to add in excess of 4,000 hectares to this land position. This would result in a dominant land package of in excess of 50 square kilometers on a salar where there’s practically no competition.

The Pastos Grandes salar is located approximately 154 kilometers west of Salta, the capital of the province. The existing infrastructure seems to be quite decent as Highway 129 takes you all the way to a little village called Santa Rosa de los Pastos Grandes where after a 13 kilometer dirt road takes you to the property. All in all, the total travel time from Salta seems to be approximately 3 hours which means the project is quite accessible considering Salta has an international airport with daily flights to Buenos Aires, Sao Paulo and Lima.

The property was previously explored by Eramine, a subsidiary of Paris-listed Eramet, in a joint venture with Bolloré, a US$10B+ holding company controlled by the Bolloré family. Eramet and Bolloré then decided to focus on another lithium property in Argentina but – and this could save the company a lot of money – we expect Eramine to hand over the historical exploration data to Millennial Lithium within the next few weeks, which will allow Millennial Lithium to design a more efficient exploration program.

We shouldn’t ignore the potential potash by-product credit

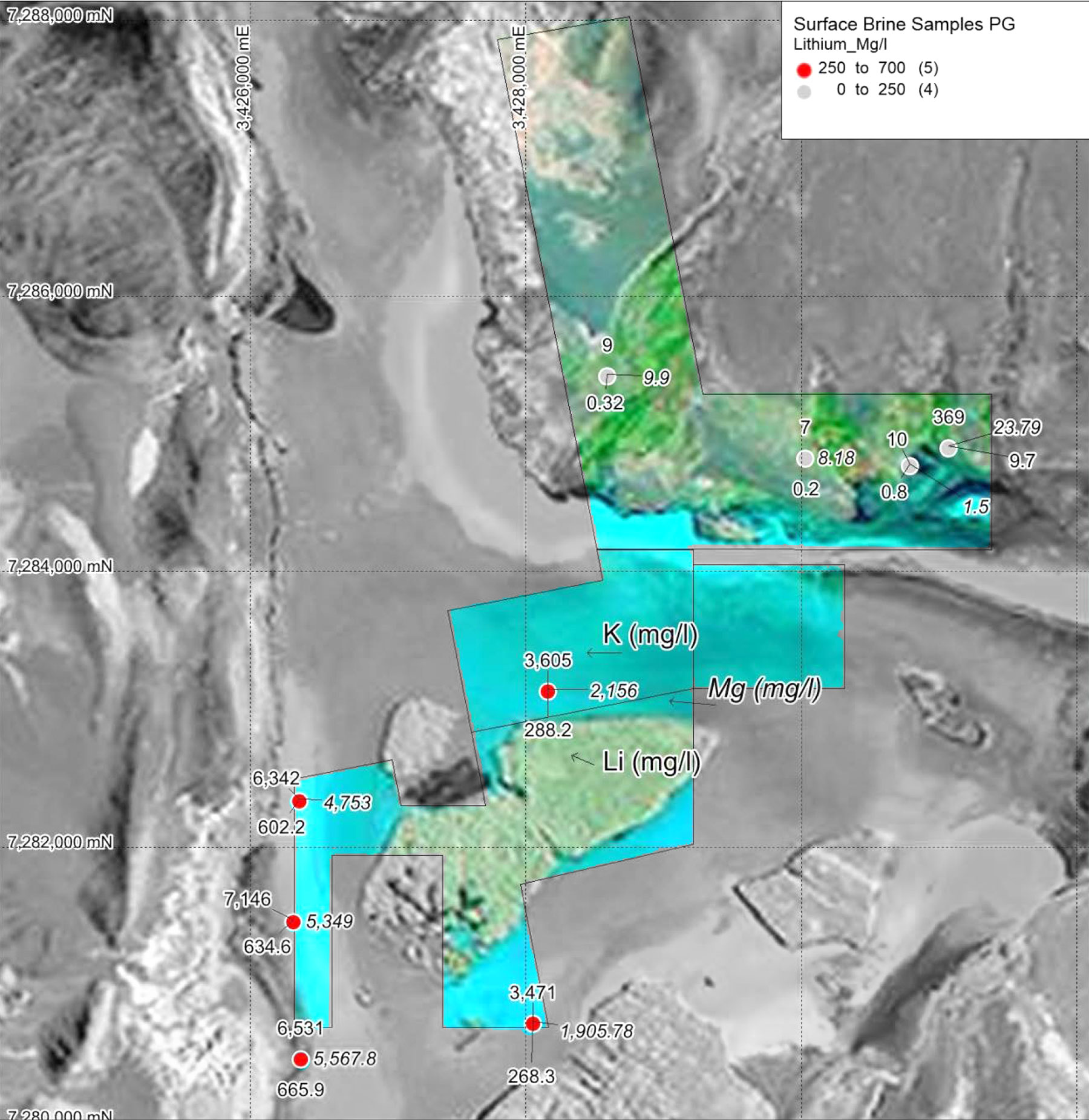

The average lithium grade at the Pastos Grandes project is pretty consistent at 330-560 milligram per liter, with peak values of up to 3,0000 mg/liter which is super high grade for a lithium project up there. This is indeed a little bit lower than the nearby deposits (the Olaroz deposit has an average grade of 690 mg/t in the measured and indicated resource category whilst the Hombre Muerto-based project owned by Galaxy Resources (ASX:GXY) and FMC Corp (FMC) has an average grade of 753 mg/l), but this shouldn’t really be a problem.

Keep in mind this is not a hard rock operation, but a brine operation, and the lithium is basically recovered by letting the water evaporate in dedicated evaporation ponds. So a lower lithium grade means that more water will have to evaporate the same amount of lithium but as an evaporation process isn’t labor intensive nor capital intensive, an average grade of approximately 500 mg/t wouldn’t be a deal-breaker at all.

In fact, Nivaldo Rojas, a mining engineer and former country manager for BHP Billiton (BHP), says the only ‘negative’ consequence of the lower grade would be the fact Millennial Lithium’s evaporation ponds will have to be a little bit larger to allow an optimal evaporation rate. On top of that, the total amount of drilling on the property is still very limited, and not a single hole has drilled deeper than 125 meters from surface.

Why is this important? Well, in the Argentinean salares you generally encounter more dense brines at depth as the denser mineralization tends to ‘sink’ to lower depths. And as these denser zones usually contain higher lithium grades, it’s not unthinkable (and in fact very realistic) to expect higher lithium grades when Millennial Lithium drills a few deeper holes.

The magnesium:lithium grade of the Pastos Grandes project also remains relatively low at 5.35-7.87 which is in line with the magnesium:lithium ratio of the Atacama region in Chile, but better than the Rincon and Uyuni zones where the ratio is definitely higher at almost 9 and 16. A low Mg:Li ratio improves the processing efficiencies of the brines, so with an average ratio of, say, 6, it should be fairly easy to process the Pastos Grandes ore, which is quite similar to the Atacama-style brines in Chile.

But there’s something else we’d like to highlight here, and that’s the potassium:lithium ratio. According to the technical report, a conventional circuit should be able to recover up to four times as much commercial-grade potash than LCE. So if Millennial Lithium would design an operation aiming to produce 20,000 tonnes of LCE per year, it would be able to sell 80,000 tonnes of potash as well. Even if you’d apply the current distressed prices for potash ($200-225/t), the by-product revenue could easily come in as high as $15-20M, reducing the net production cost per tonne of LCE by $700-900.

Considering the ‘pure’ production cost of lithium carbonate recovered from Argentinean salares is approximately $2,000-2,250/t, you immediately understand the importance of trying to recover a saleable potash product as this could reduce the net production costs to less than $2,000/t.

Appointing Iain Scarr as VP Exploration and Development is a solid move

In the final week of July, Millennial Lithium also announced it has appointed Iain Scarr as Vice-President of Exploration and Development. We consider this to be a great step forward, as Scarr has decades of experience in lithium projects and lithium-related projects. In fact, he was responsible for the Definitive Feasibility Study on the Sal de Vida project owned by Galaxy Resources (ASX:GXY), which is located less than 100 km south of Millennial’s Pastos Grandes project.

This means that with the appointment of Scarr, Millennial Lithium now has someone who has extensive expertise about both the region and lithium brines. We would expect Scarr to play a pivotal role in the future of the company, as it’s not unlikely Millennial will be able to build a team around him.

Conclusion

Anyone who wants to have exposure to the booming lithium market should invest in the companies with the best odds to effectively become a producer, preferably producing the lithium at a low average cost to ensure the viability of the project at sub-$10,000 price levels. We aren’t too keen on the hard rock lithium assets and think the lithium projects where the lithium could be recovered from brines through simple evaporation techniques are very likely the best way to go.

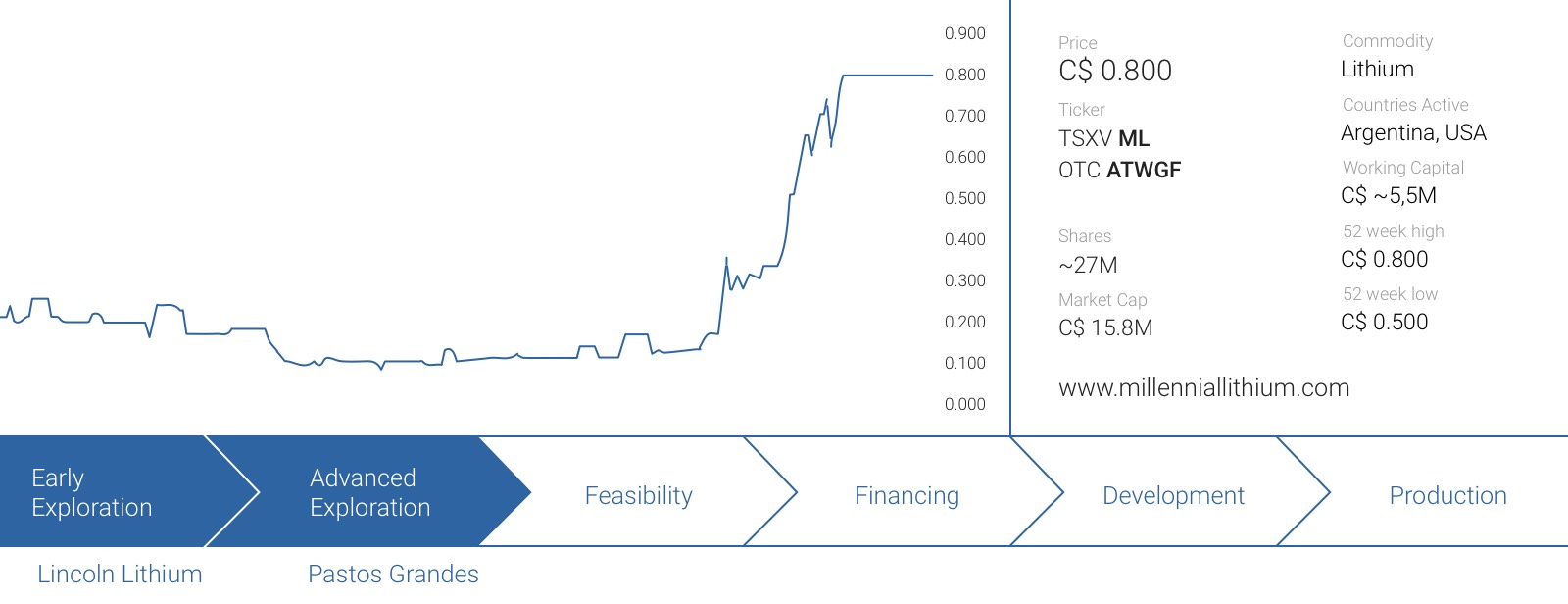

Millennial Lithium is one of the newest kids on the block, but it does look like this company is much more promising than the average Lithium-hopeful out there. The company also has a lithium project in Nevada, but we think the newly-acquired Argentinean project will be the sole creator of additional shareholder value. The company will resume trading again today after a 5 week trading halt and it’s anyone’s guess what the share price will be at the end of this week. But if it’s any help, Neo Lithium (NLC.V) currently has an enterprise value of approximately C$80M, which would equate to C$3.5 per share for Millennial Lithium. Of course, there’s no guarantee both companies will be given the same valuation by Mr. Market, but the pre-halt pro-forma market capitalization of less than C$20M seems to be way too cheap.

The author has a long position in Millennial Lithium. Millennial Lithium is a sponsor of the website. Please read the disclaimer