Nevada Copper (NCU.TO) has confirmed its cornerstone shareholder, Pala Investments, will inject an additional US$5M into Nevada Copper. The cash infusion will be structured as a convertible debenture, with an annual interest rate of 12% and a conversion price of C$0.90 per share (which would result in NCU issuing approximately 7-7.5 million shares, depending on the USD/CAD exchange rate). Pala will also receive a C$200,000 arrangement fee and 2.5 million warrants at C$0.97.

Red Kite has also agreed to amend the terms of its loan agreement with Nevada Copper, which should give the company some more room to breathe. The further involvement of Pala Investments doesn’t surprise us at all, considering we already pointed out in an article last august Pala would have access to a lot of cash after selling its stake in London-listed Sierra Rutile to Iluka Resources (ASX:ILU).

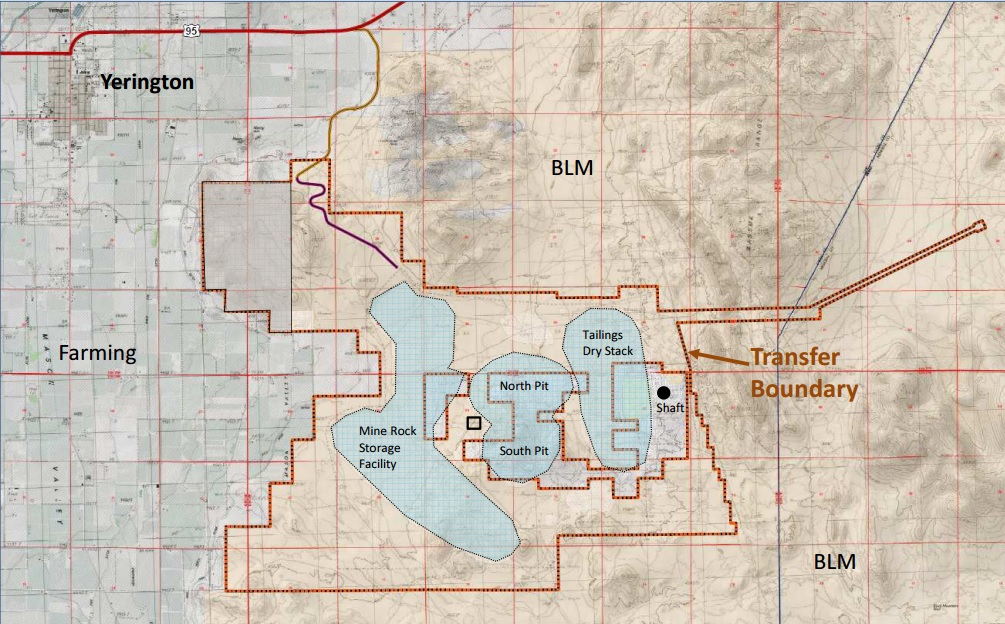

Unfortunately NCU is one of the very few copper companies that have been left behind since the copper price started to move, and the existing debt on the balance sheet might be the main culprit here. The company will now continue to drill the North deposit which should result in an updated resource estimate which will then subsequently be used for a new mine plan. This new mine plan will be based on updated technical studies wherein Nevada Copper will aim to determine the economics of the underground mine on a standalone basis.

Go to Nevada Copper’s website

The author has a long position in Nevada Copper. Please read the disclaimer