Birimian (ASX:BGS) announced it has executed a binding letter of intent with Shandong Mingrui Group whereby the latter has committed to purchase the Bougouni Lithium project in Mali for an A$107.5M cash payment.

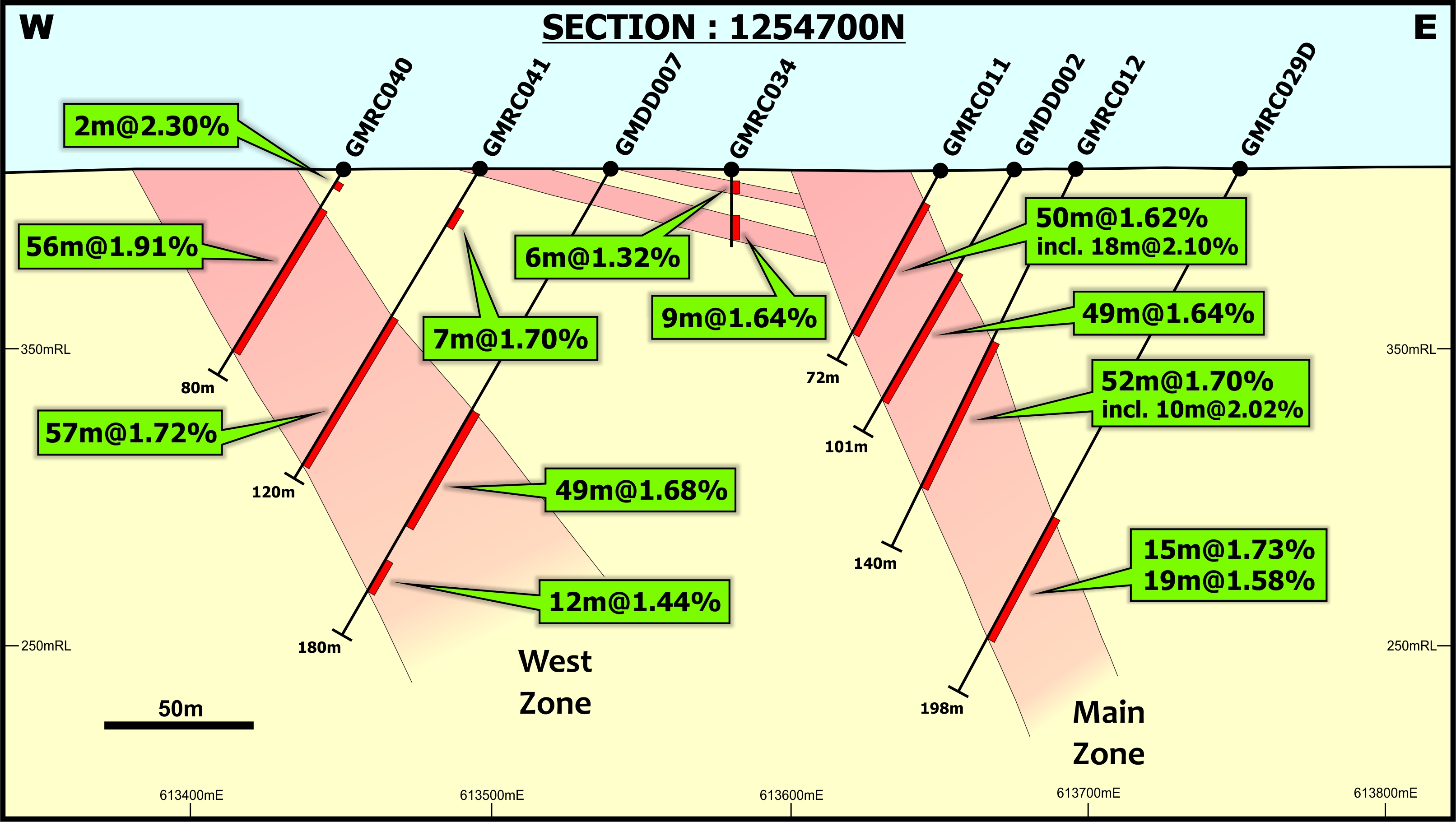

The project currently contains 15.5 million tonnes at 1.48% Li2O, for a total of 229,000 tonnes of Li2O. An ongoing 10,000 meter drill program will just continue, and will be completed by the end of this year which would allow Birimian to update its resource estimate later this quarter, and to complete a reserve estimate and pre-feasibility study in the second quarter of the calendar year.

Considering Birimian’s market capitalization is just A$60M, an offer of A$107.5M is very appealing although it remains unclear whether the ‘plus any applicable taxes’ would also take a profit tax in Australia into consideration. That’s very likely not the case, and the main question will be how much (net) cash will end up in Birimian’s treasury, and that’s the reason why the company’s market capitalization is still 40% lower than the offer.

The property has a book value of just below A$5M, and Birimian has accumulated losses of almost A$19M, so we would expect an after-tax cash result of A$70-75M. This is a back of the envelope estimate, and we would be very interested in learning the effective taxation rate on the potential sale.

Go to Birimian’s website

The author has no position in Birimian. Please read the disclaimer