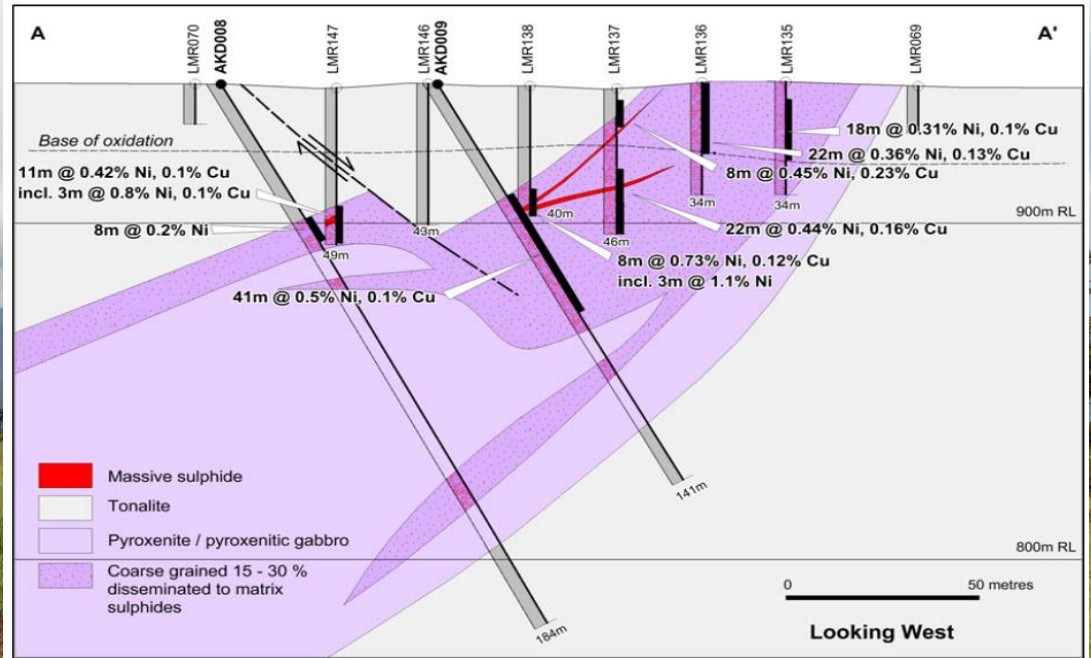

Blencowe Resources (BRES.L) has entered into an agreement to acquire the Akelikongo nickel project in Uganda. That project was previously in a joint venture between Rio Tinto (RIO) and ASX-listed Sipa Resources (SRI.AX) and has seen a cumulative spending of approximately US$15M. Those exploration expenditures included approximately 19,000 meters of drilling on three separate lenses. Some of the drill results are quite interesting given their proximity to surface. With for instance 41 meters containing 0.5% nickel (starting at 34 meters from surface) and 22 meters containing 0.36% nickel and 0.13% copper starting at surface, the project definitely has its merits.

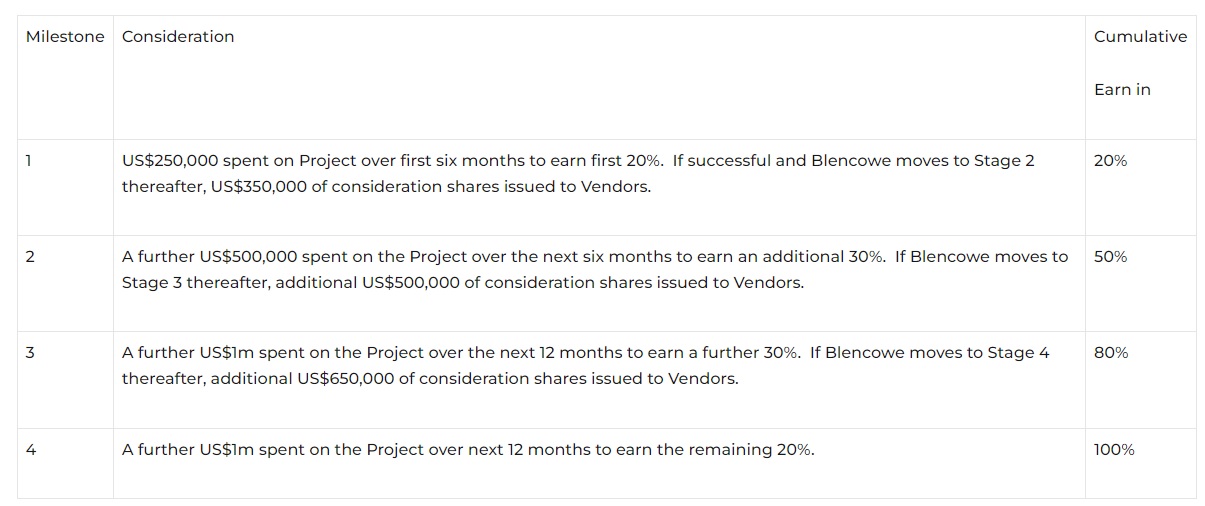

To acquire full ownership of the project, Blencowe has to spend US$2.75M on exploration and issue US$1.5M worth of shares to the vendor, which will retain a 1.5% NSR when Blencowe completes its earn-in agreement.

The 2022 exploration program at Akelikongo will consist of electromagnetic surveys in the first half of this year to further define the drill targets and to trace the known mineralization along strike and down plunge. As Blencowe needs to spend US$250,000 on exploration within the first six months of the agreement, this appears to be a good approach to complete the required commitments while figuring out where to drill. A drill program will likely start in the second half of the year and will contribute towards spending US$0.5M in exploration to boost the stake in the project to 50% from the initial 20%.

Disclosure: The author has no position in Blencowe Resources. Please read our disclaimer.