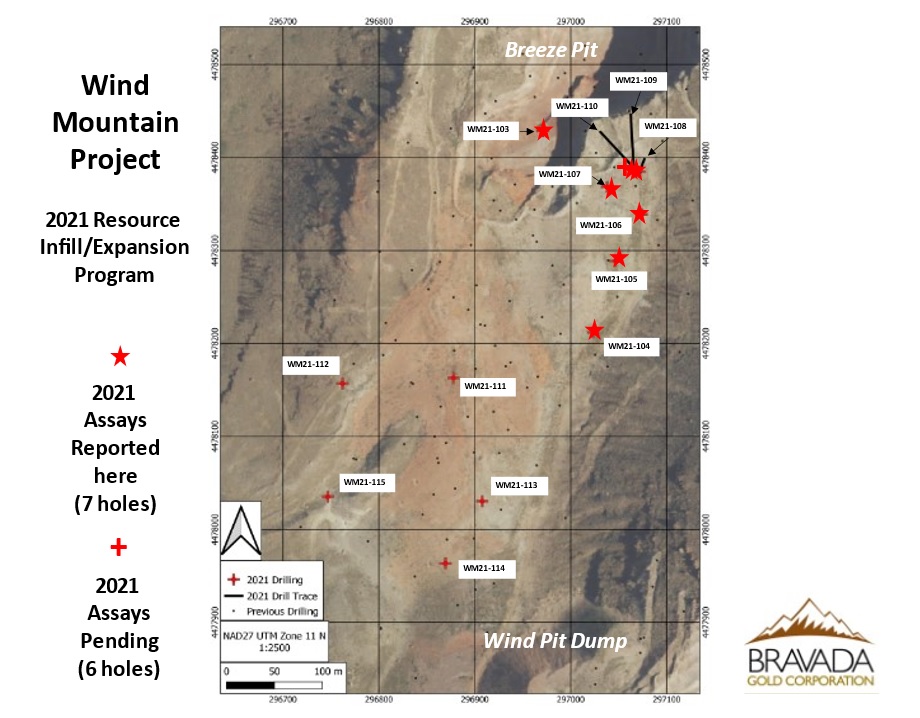

Bravada Gold (BVA.V) has released the assay results from 7 of the 13 holes it has drilled on the Wind Mountain project. Four holes were drilled in another attempt o find the feeder zone, the remaining 13 holes were designed as infill and resource expansion holes on and around the known oxide gold (and silver) resource at Wind Mountain. As the feeder target drilling didn’t yield the desired results (yet, we hope), it makes more sense to just fully focus on the oxide resource and update the PEA.

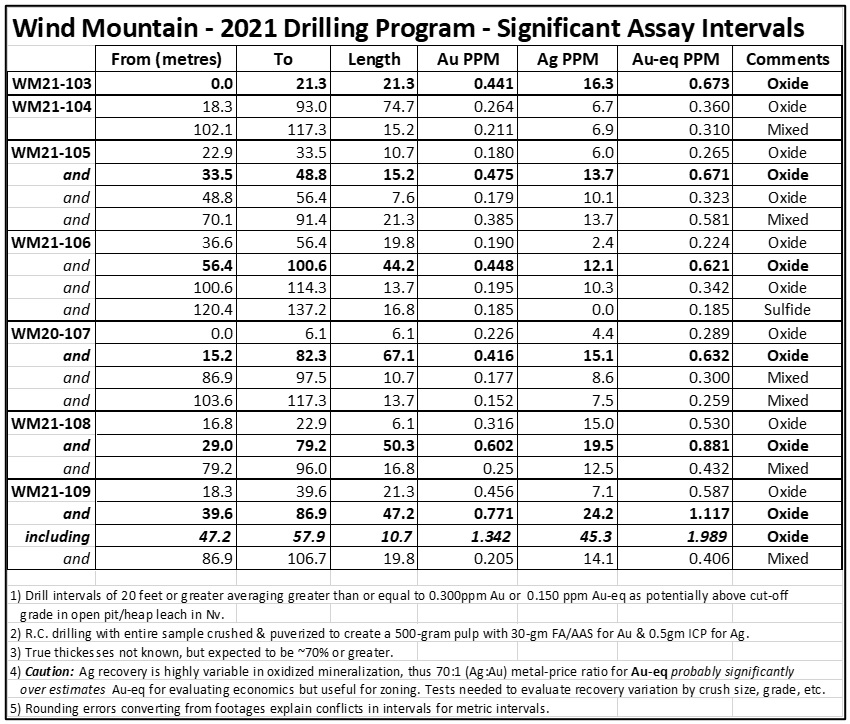

Keep in mind Wind Mountain’s oxide resource is low grade. The reported drill results of 21.3 meters containing 0.44 g/t gold and 44.2 meters of 0.448 g/t gold are quite decent (given the average resource grade of 0.34 g/t in the indicated resource category using a cutoff grade of 0.155 g/t, but there are also some nice higher grade intervals: the 50 meters of 0.6 g/t is good, the 47.2 meters of 0.77 g/t gold is very good (especially as these holes seem to be adding tonnage to the known resource). We don’t care too much about the silver values (and also aren’t too keen on using the gold-equivalent ratio – we also respect Bravada for clearly mentioning the AuEq grade is likely overstating the real grade) as Wind Mountain will likely be a heap leach project with poor silver recovery rates. For now we’ll mainly look at the pure gold grades and will consider the silver that will potentially be recovered the icing on the cake.

Drilling requires cash, and Bravada Gold is currently in the process of raising C$700,000 by issuing 10 million units priced at C$0.07. Each unit consists of one share and a full warrant valid for two years with an exercise price of C$0.12 (should those warrants be exercised, Bravada Gold will receive an additional C$1.2M in proceeds.

We expect the vast majority of the proceeds to be spent on the Wind Mountain oxide zone where Bravada plans to update the resource and the PEA as the 2012 resource likely understated the amount of ounces, while the PEA will have to take modern day input costs into consideration.

Disclosure: The author has a long position in Bravada Gold and may participate in the current placement. Bravada Gold is a sponsor of the website. Please read our disclaimer.