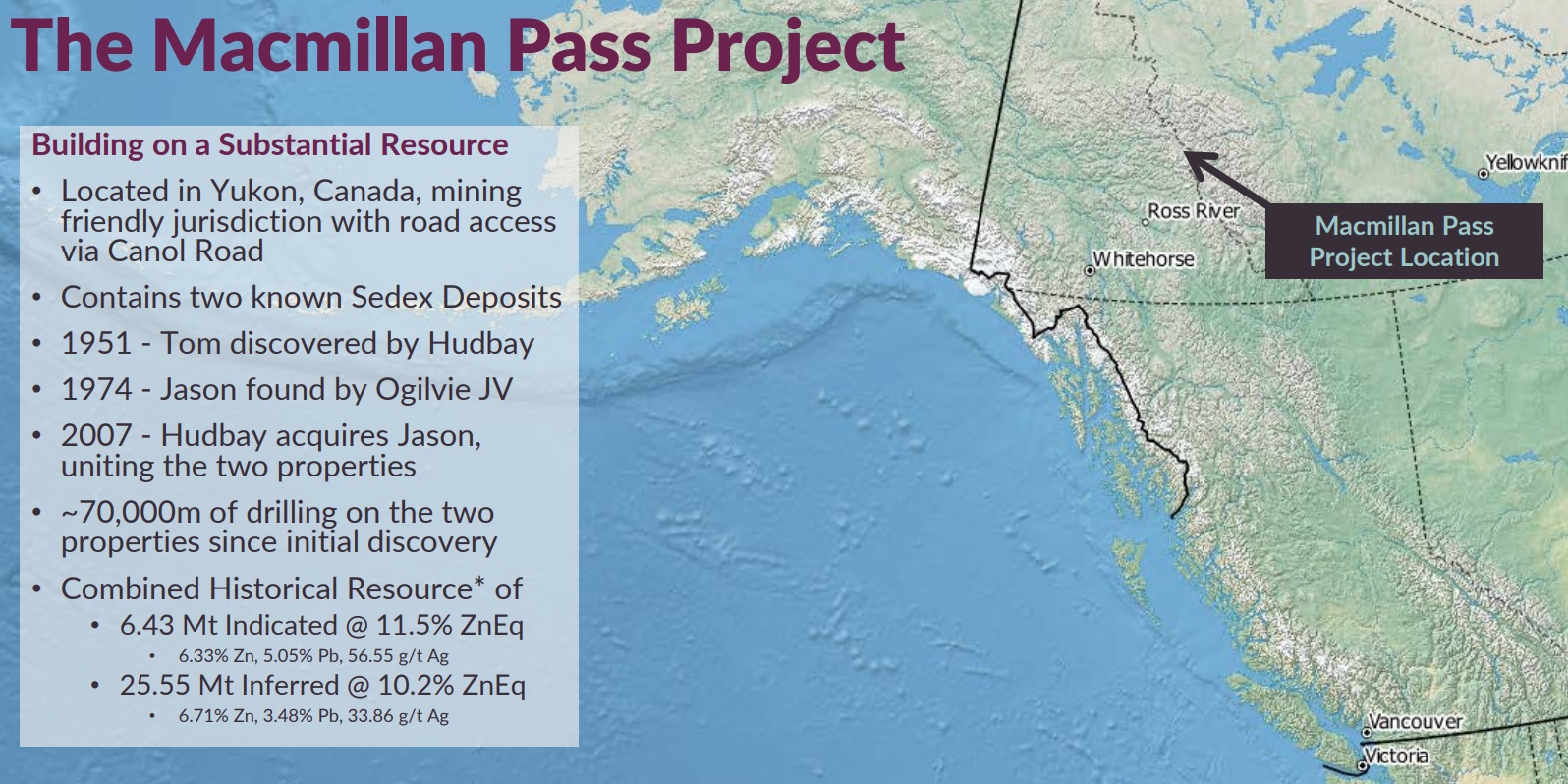

Fireweed Zinc (FWZ.V) is the newest company on the zinc front with a promising project as it has been able to execute an option agreement on the property with HudBay Minerals (HBM, HBM.TO) allowing it to acquire a 100% interest in the Tom and Jason deposits, up in the Yukon.

The deposits have been subject to approximately 70,000 meters of drilling whilst the Tom deposit has also been explored from underground with the completion of almost 6,000 meters of underground core drilling and in excess of 3,400 meters of underground development.

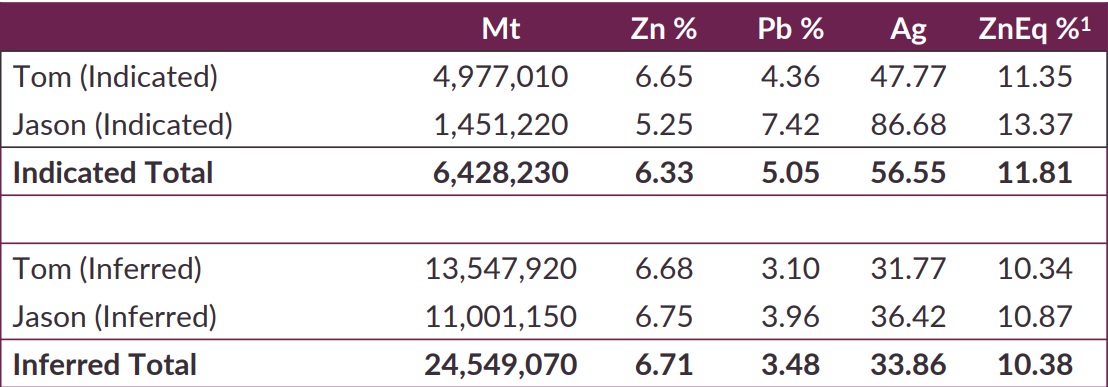

The combination of both deposits hosts a historical resource estimate of 6.4 million tonnes in the indicated category (6.33% Zinc, 5.05% Lead and 56.5 g/t silver), as well as an additional 24.5M tonnes in the inferred resource category (at 6.71% zinc, 3.48% lead and 33.86 g/t silver), and Fireweed’s first priority will be to convert and update these historical resources to current standards.

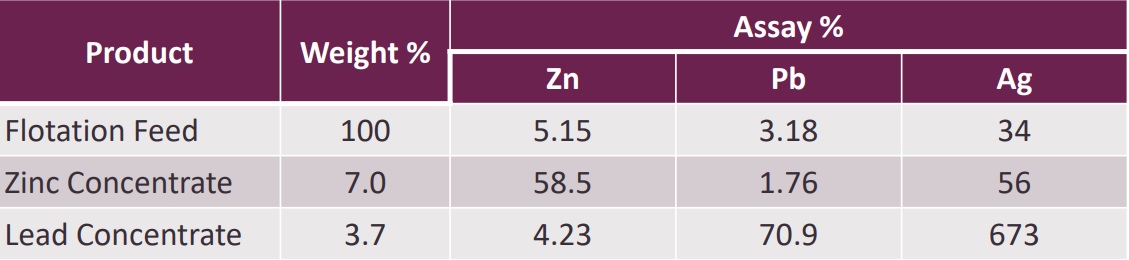

The previous owner also completed some metallurgical test work resulting in a positive outcome as 83% of the lead could be recovered in a lead concentrate with an average grade of just over 70% lead, whilst the recovery rate for the zinc is 79%, resulting in a zinc concentrate with an average grade of 58.5%, which is well in excess of the smelters requirements.

The earn-in agreement is pretty straightforward; it’s a 2 year option (which could already be exercised after 12 months), requiring Fireweed to pay HudBay C$1M in cash (C$0.25M has already been paid by now) and to spend C$1M in exploration expenditures. Upon exercising the option, Fireweed will have to issue HudBay a 15% position in Fireweed stock, whilst HBM will also retain a 3% NSR (which could be repurchased for C$5.25M).

The earn-in deal seems to be very advantageous for Fireweed Zinc, and with an existing resource estimate containing 4.5 billion pounds of zinc as well as 2.6 billion pounds of lead, Fireweed is able to hit the ground running. With a current market capitalization of C$15M with approximately C$3.5M in the treasury after a successful IPO, FWZ is actually quite cheap and it looks like the market still needs to be convinced the remote location of the project won’t be a major hurdle.

Go to Fireweed’s website

The author has a long position in Fireweed Zinc. Please read the disclaimer