GR Silver Mining (GRSL.V) announced a C$6M bought deal before the market opened on Thursday but almost immediately had to upsize the bought deal to initially C$7M and subsequently C$8M after First Majestic Silver (FR.TO, AG) notified the company it wanted to participate in the offering as well. Last Friday, GRSL increased the bought deal to 30 million units but underwriters will have the option to exercise the greenshoe option for an additional 3.9M units.

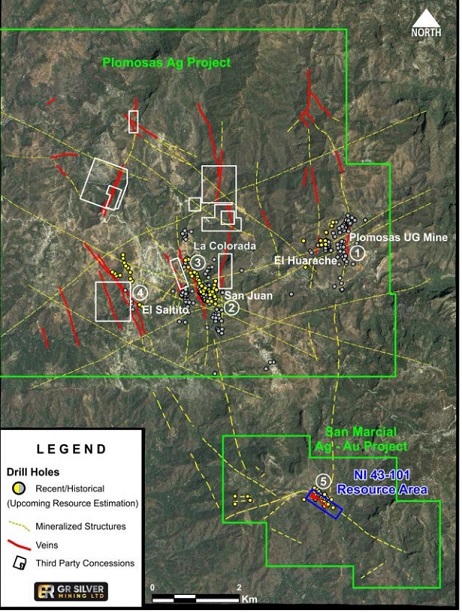

Each unit is priced at C$0.27 and consists of one share as well as ½ warrant with each full warrant allowing the warrant holder to acquire an additional share of GR Silver Mining at C$0.40 within twelve months after closing. Assuming the over-allotment option will be exercised, GRSL will raise C$9.15M of which almost C$0.6M will be paid to the bookrunners as fee. Long story short, GR Silver Mining will probably see C$8.5M in cash hitting its treasury which will put the company in an excellent spot to expand its 2020 exploration program in anticipation of a series of resource updates that could hopefully see GR Silver ending 2021 with a total silver-equivalent resource north of 100 million ounces. Only time will tell but the recent high-grade drill results at Las Plomosas are indeed quite promising.

Disclosure: The author has a long position in GR Silver Mining.