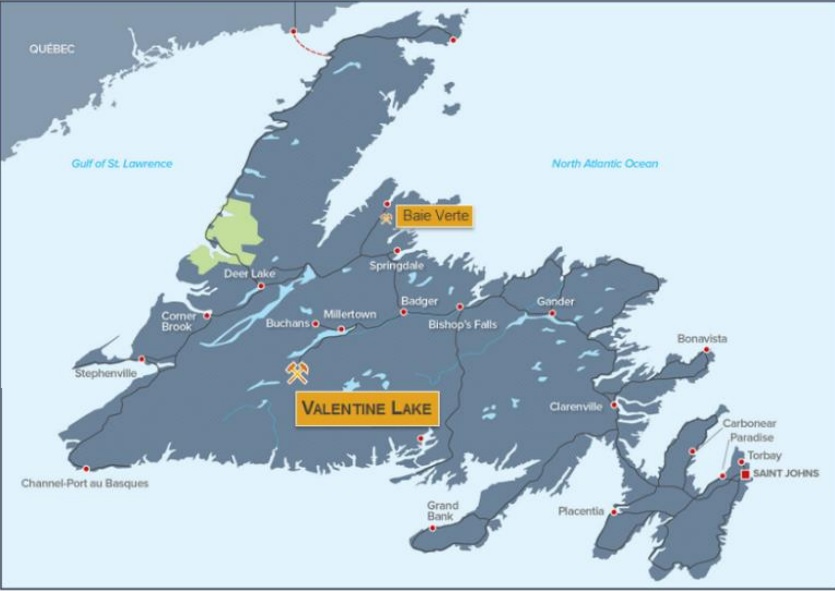

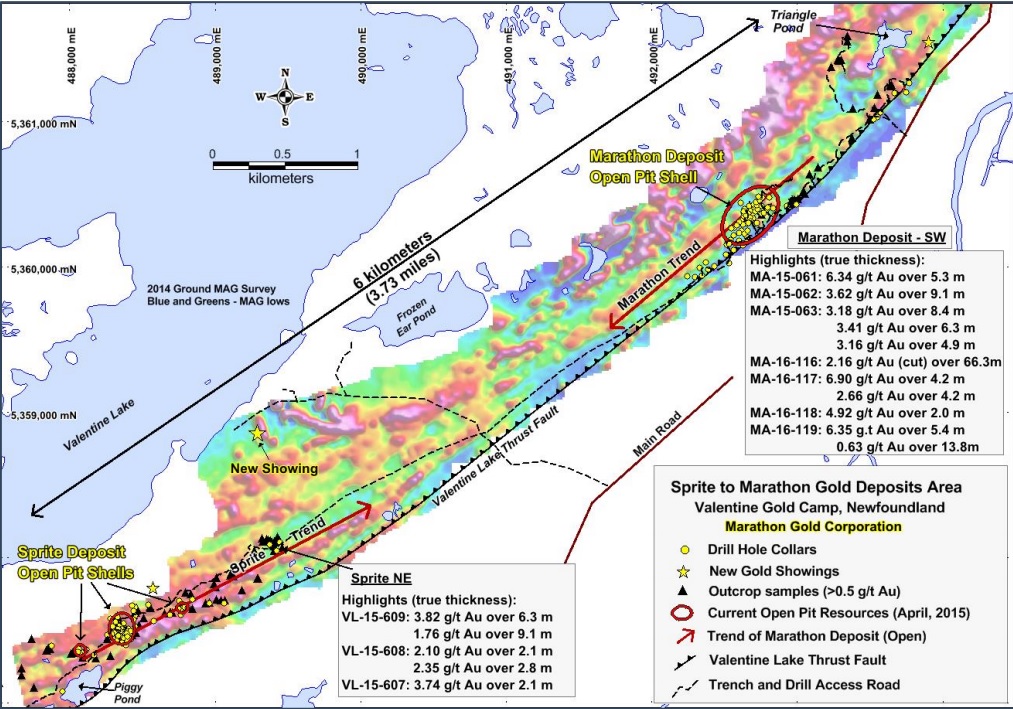

Marathon Gold (MOZ.TO) continues to release positive exploration results from the ongoing drill program at its Marathon deposit in the Valentine Gold Camp. The company has tested the zone located approximately 70 meters down-dip from where the previous drilling has been taking place, and Marathon has now confirmed the continuity of the Marathon corridor.

This mineralized corridor has a width of 50-100 meters and has been traced down to a depth of 250 meters, and with intervals of 17.6 meters of 3.24 g/t gold and 13.3 meters of 2.05 g/t gold (both intervals were announced on a ‘true width’ basis), have now extended the total strike length of the alteration and the mineralized corridor to 1.7 kilometers. That’s very positive, as it confirms the expansion potential of the currently known mineralization, but Marathon Gold will continue to prioritize drilling at and around the planned open pit to fine-tune and update its geological models.

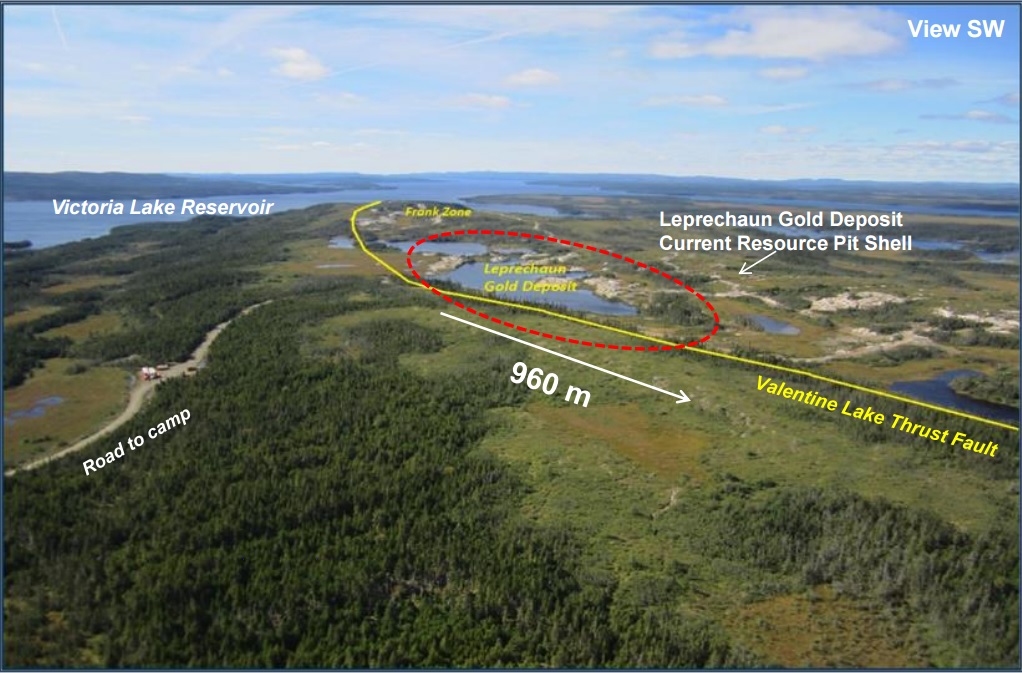

Marathon Gold is a very interesting company to keep your eye on, as not only is the footprint of the mineralization continuously increasing, the metallurgical test work is indicating an average recovery rate in the high 90’s, using a combination of gravity separation and CIL flotation at the Marathon Deposit, and this recovery rate is comparable to the recovery rates of the Leprechaun deposit (where Marathon Gold continues to test the potential to recover the gold through a heap leach operation).

At the end of October, Marathon Gold has completed a C$8M bought deal, by issuing 8.88 million flow-through shares at a price of C$0.90 per flow-through share. This will top up the company’s treasury as we expect the majority Marathon Gold’s working capital position of C$3.7M (dated June 30th) has been used by now to advance the project.

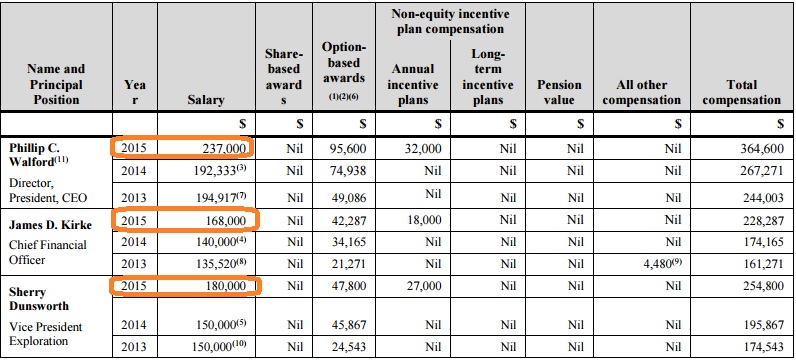

There’s one side-note though. Despite the fact the company’s share price fell by 50% to 15 cents during 2015, Marathon’s management thought it deserved a payrise. Whereas the CEO, CFO and the VP Exploration forfeited a part of their salary during 2014 (a commendable thing to do!), everything went back to normal in 2015 even though it probably was one of the toughest years on the commodity markets. With a base salary of almost C$20,000 per month, CEO Walford has a very generous compensation package for an exploration company without any revenues, and we hope his pay cheque didn’t increase further in 2016, but we will only know when the company files its Management Information Circular in the second quarter of 2017.

Go to Marathon’s website

The author has a small long position in Marathon Gold, and plans to buy more at or below C$0.65. Please read the disclaimer