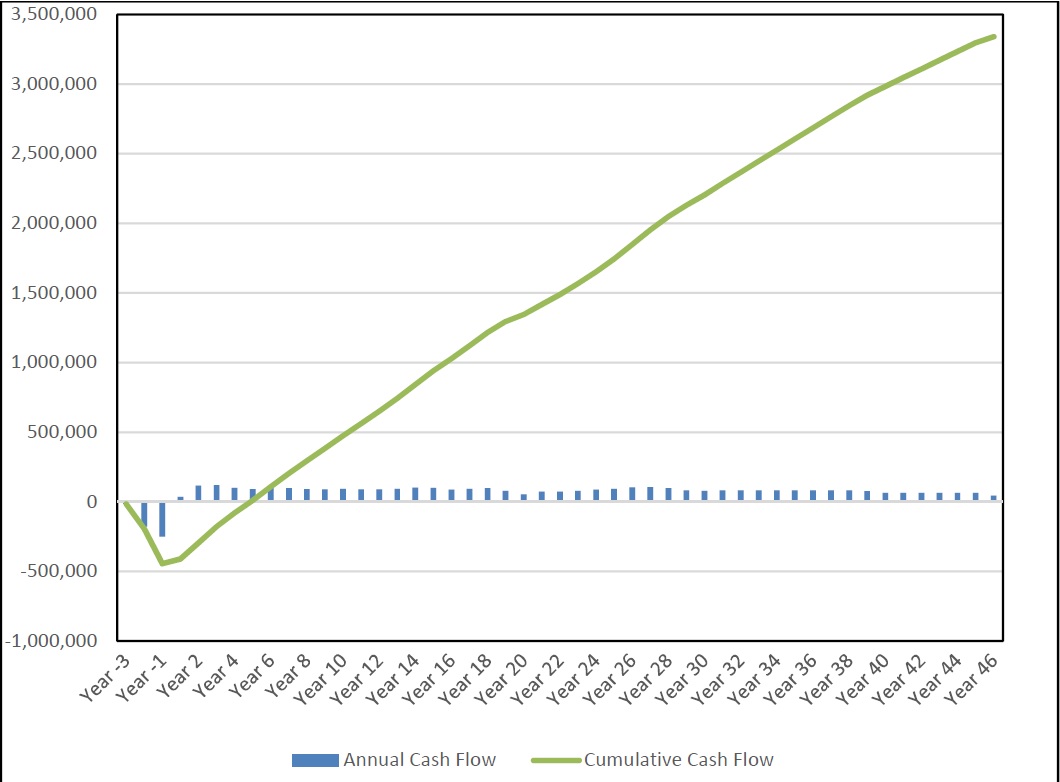

Potash Ridge (PRK.TO) has released an updated pre-feasibility study on its Blawn Mountain SOP project. According to the new study, the current reserves of 153 million tonnes will support a 46 year mine life, producing an average of 255,000 tonnes per year during the first ten years of the mine life.

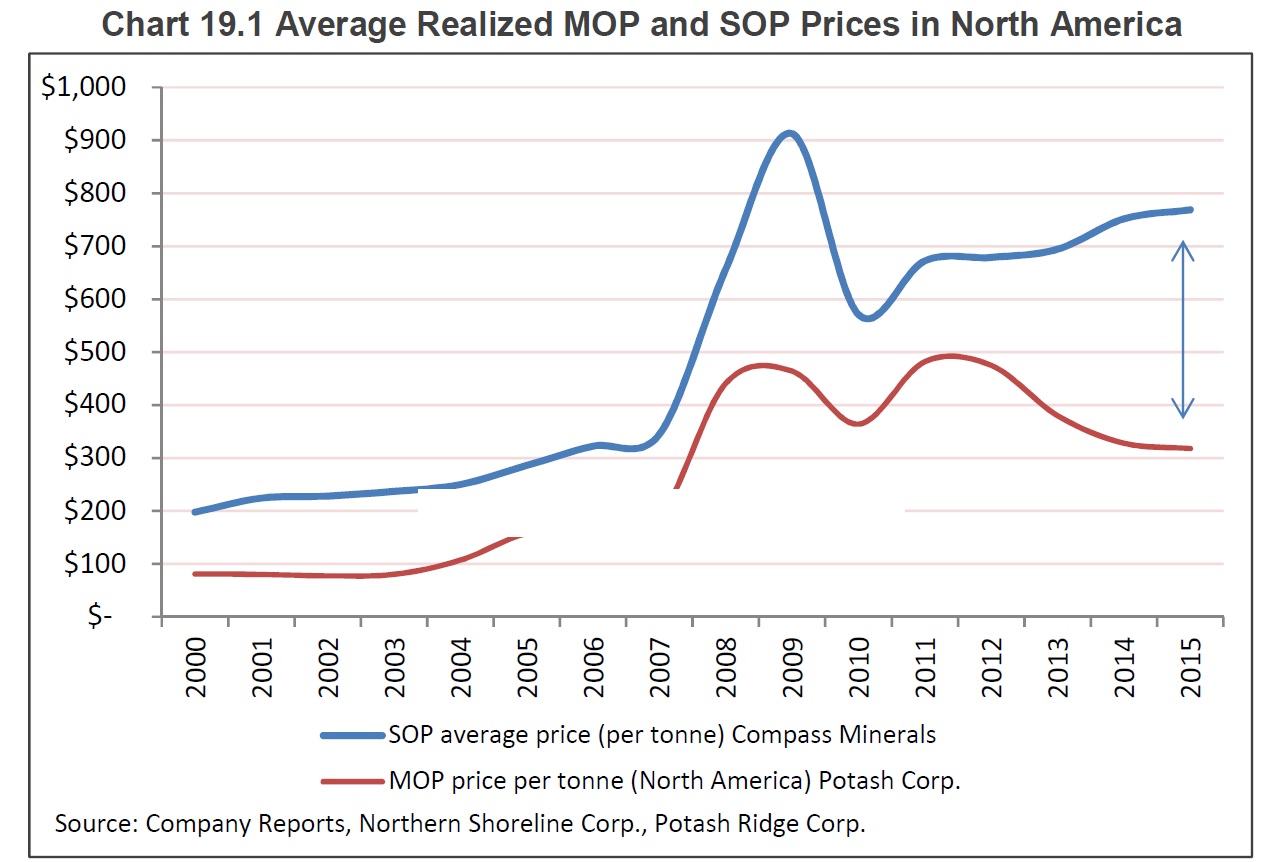

The PFS also confirms the low-cost nature of the project, as the SOP is expected to be produced at a cost of just $172/t after taking the by-product credit from selling the sulphuric acid as well as the $40/t transportation cost into consideration. As the initial capex is estimated at US$458M, the after-tax IRR comes in at 20.1% using a $675/t SOP price. The IRR might seem low, but you should keep in mind the project has a relatively long ramp-up period, which has a negative impact on the NPV and IRR.

The average after-tax cash flow is estimated at US$107M per year during the first ten years of the mine life, confirming the robust cash flow potential of the project, vis-à-vis PRK’s current market capitalization of approximately C$32M. The after-tax NPV10% is estimated at US$482M (C$630M), and we would like to emphasize this is a very robust result, given the high discount rate (we would think a discount rate of 6-8% for a US-based project is reasonable).

The technical report has already been filed, and you can expect an in-depth review from us in the near future.

Go to Potash Ridge’s website

The author has a long position in Potash Ridge Corp. Potash Ridge is a sponsor of the website. Please read the disclaimer