Six months. That’s how long Kenorland Minerals (KLD.V) had to wait for assay results from its 2021 drill program at both Regnault (part of the Frotet project) and Healy in Alaska. It was well worth the wait for the Regnault drill results as the R2 West target is shaping up to be very promising while the company discovered several additional vein structures which could add tonnes to a future resource estimate.

The 2021 drill program at Regnault was a success

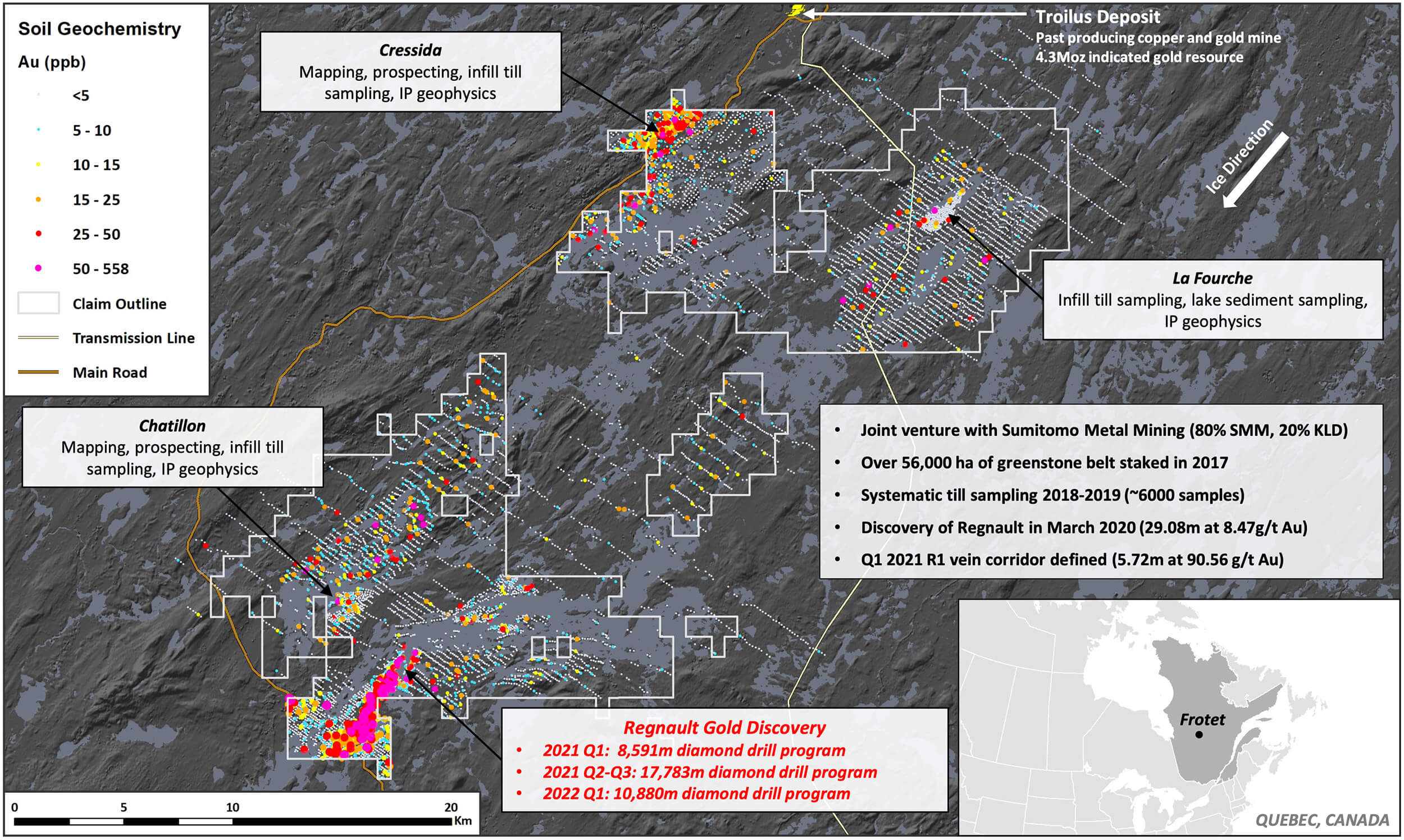

It was only in the final week of March Kenorland Minerals was able to report on the final assay results from its summer-fall drill program at the Regnault discovery which is part of the Frotet gold project in Québec, Canada. As you may remember, Japan’s Sumitomo Metal Mining owns 80% of the project after completing its earn-in agreement while Kenorland retains a 20% stake and is the operator.

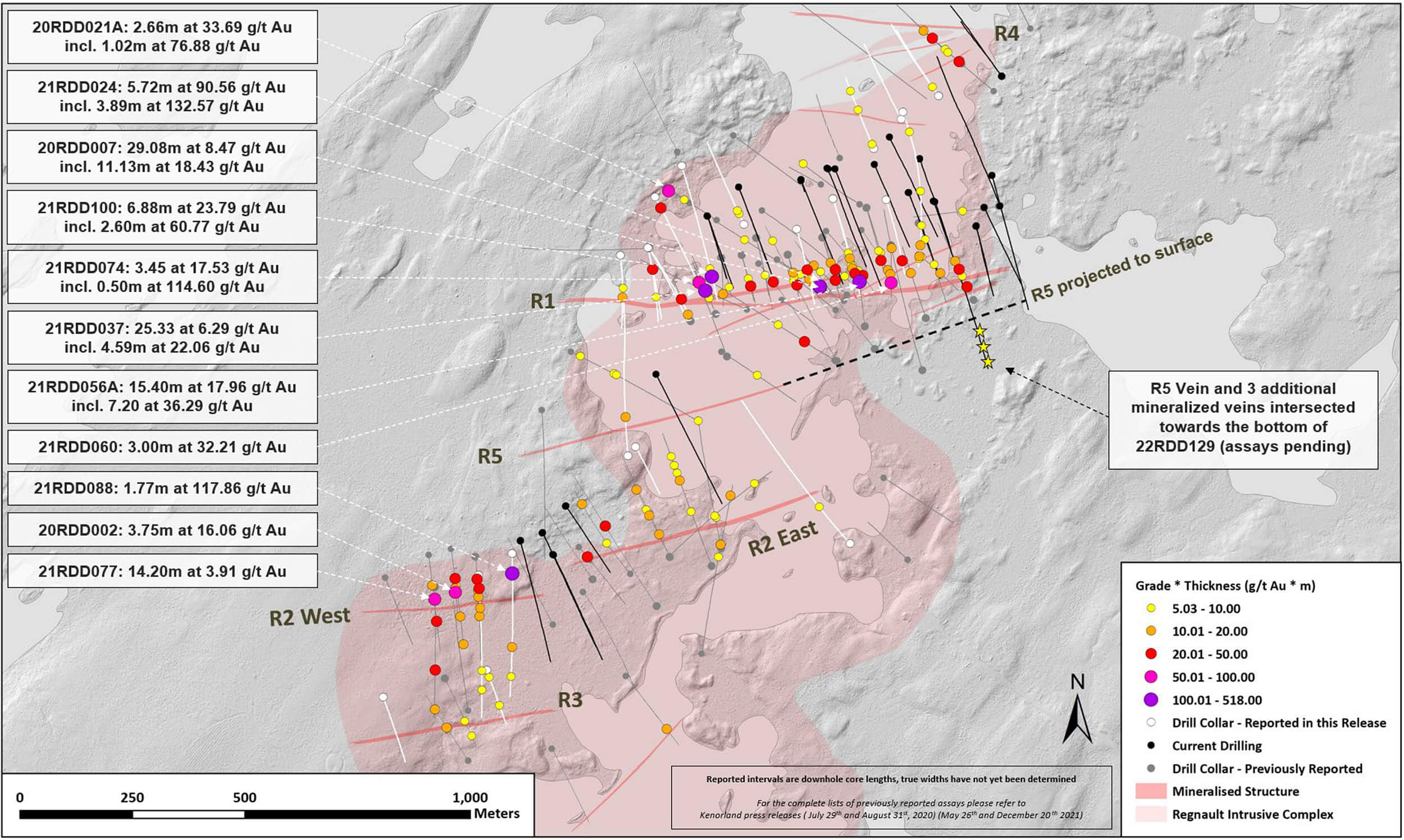

Kenorland had already reported the first batch of its Regnault holes at the end of last year and has now published the final results from 25 holes for a total of just under 8,000 meters. The summer-fall drill program at Regnault was rather sizeable with almost 18,000 meters of diamond drilling completed focusing on systematically testing the R1, R2 East and R2 West mineralized structures.

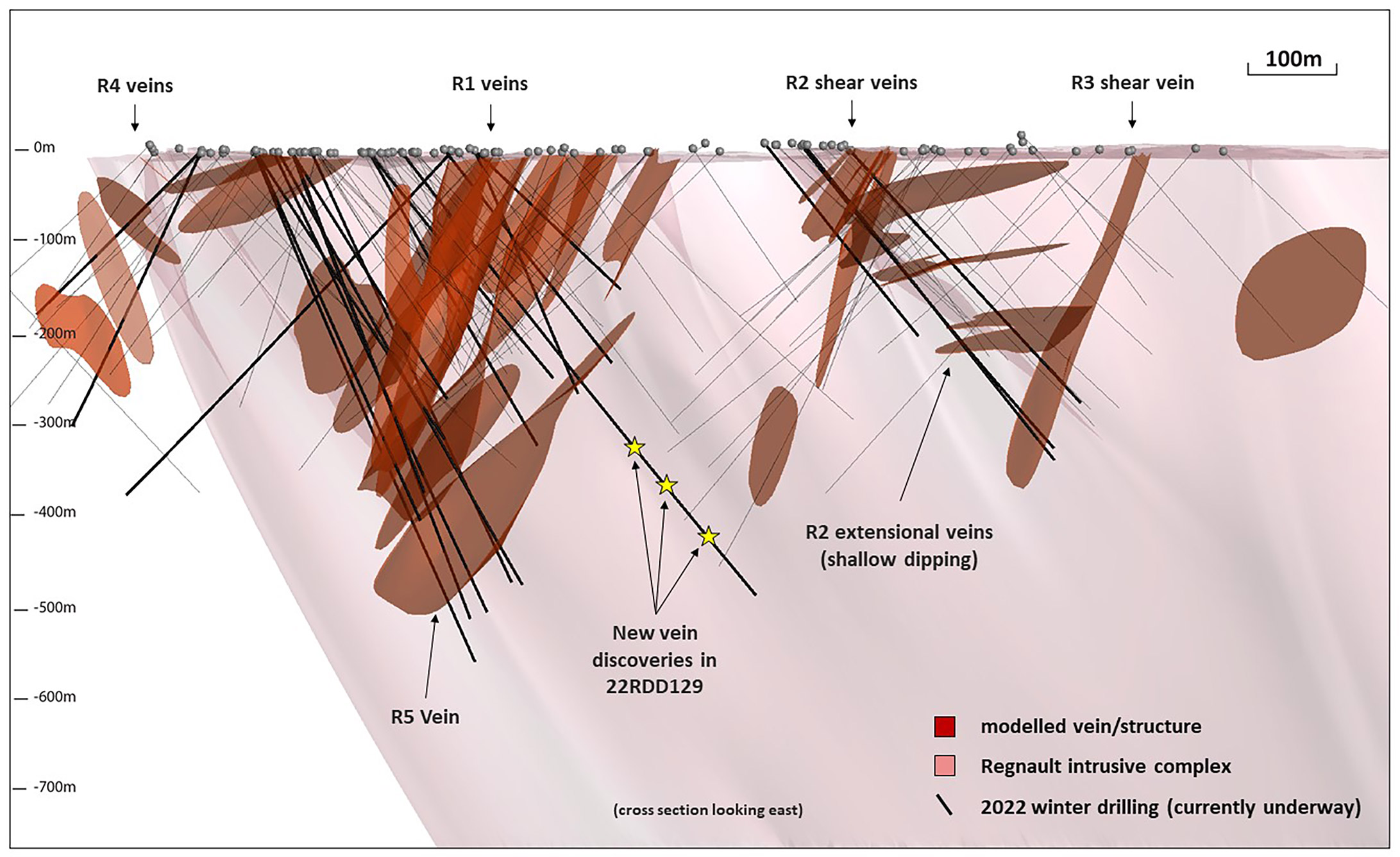

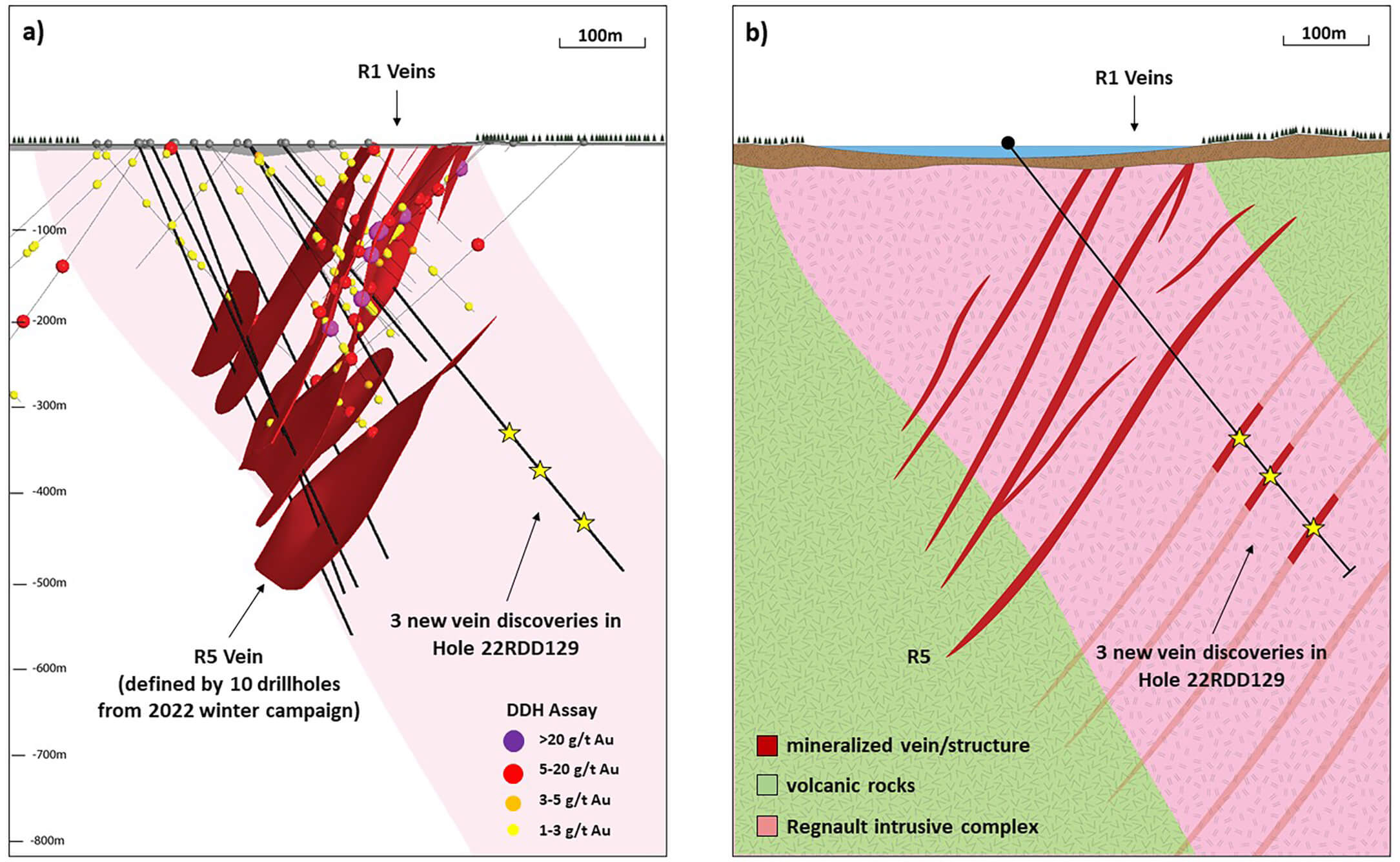

Some of the reported results are very intriguing. At R1 for instance, new holes encountered 2.5 meters of 11.15 g/t (including 0.30 meters of 84.6 g/t gold) and almost 7 meters containing 23.79 g/t gold. The results from this drill program have now expanded the strike length of the R1 zone to about 750 meters while the mineralization has been chased to a depth of 450 meters. That’s how it currently stands, but the R1 vein system remains open along strike and at depth.

That’s obviously excellent but the new drill results from the R2 West zone are even more exciting as the company appears to be rapidly building tonnage and ounces there.

The width of the intervals at R2 is relatively narrow (not unlike at R1 so this isn’t new information) but some of the intervals are best described as ultra high grade. Hole 21-088 for instance returned 1.77 meters containing almost 118 g/t gold while hole 85 returned 0.61 meters of 48 g/t gold. The R2 zone has now reached a longer strike length than R1 as the company has now been able to trace the mineralization over a strike length of 950 meters and to a depth of up to 350 meters.

Kenorland has already completed its winter drill program at Regnault before it had even received all assay results from last year’s summer-fall drill program. This winter drill program was exploring for additional mineralized structures at depth and this resulted in the discovery of the R5 structure. R5 is located parallel to and directly south of the R1 veins. The joint venture partners punched ten holes in the R5 structure which remains open in all directions and has now been traced over a strike length of approximately 350 meters.

On top of the confirmation of the R5 discovery, hole 22DDH129 was drilled to a depth of in excess of 600 meters and encountered three separate veins with an average width of 1-5 meters (which is pretty similar to the widths encountered on the other vein targets).

The holes from the winter drill program are now at the lab waiting to be analyzed. Fortunately this shouldn’t take longer than about two to three months so we should see the assay results before this year’s PDAC conference in June. In excess of 45,000 meters of drilling have now been completed at Regnault and the company’s understanding and interpretation of the structural controls is improving with each hole.

While Kenorland only retains a 20% stake in Frotet, keep in mind its net contribution to maintain that 20% stake is just a fraction of that percentage. As Kenorland is the operator of the joint venture, it earns a 10% operator fee and on top of that, it can reclaim a tax benefit from the province of Québec for mineral exploration.

Just to provide an example: if both joint venture partners propose a C$10M exploration program, Kenorland would have to contribute C$2M (20%). That’s the theory. It will receive a 10% operator fee (C$1M) as well as a tax credit of 38% on the remaining C$1M it actually does have to spend so to maintain its 20% stake in a C$10M exploration program won’t cost the company C$2M, but just under C$700,000. So yes, while Kenorland will retain ‘just’ 20% of the project, it is ‘carried’ for most of the expenses thanks to the operator fee and the tax credit in Québec.

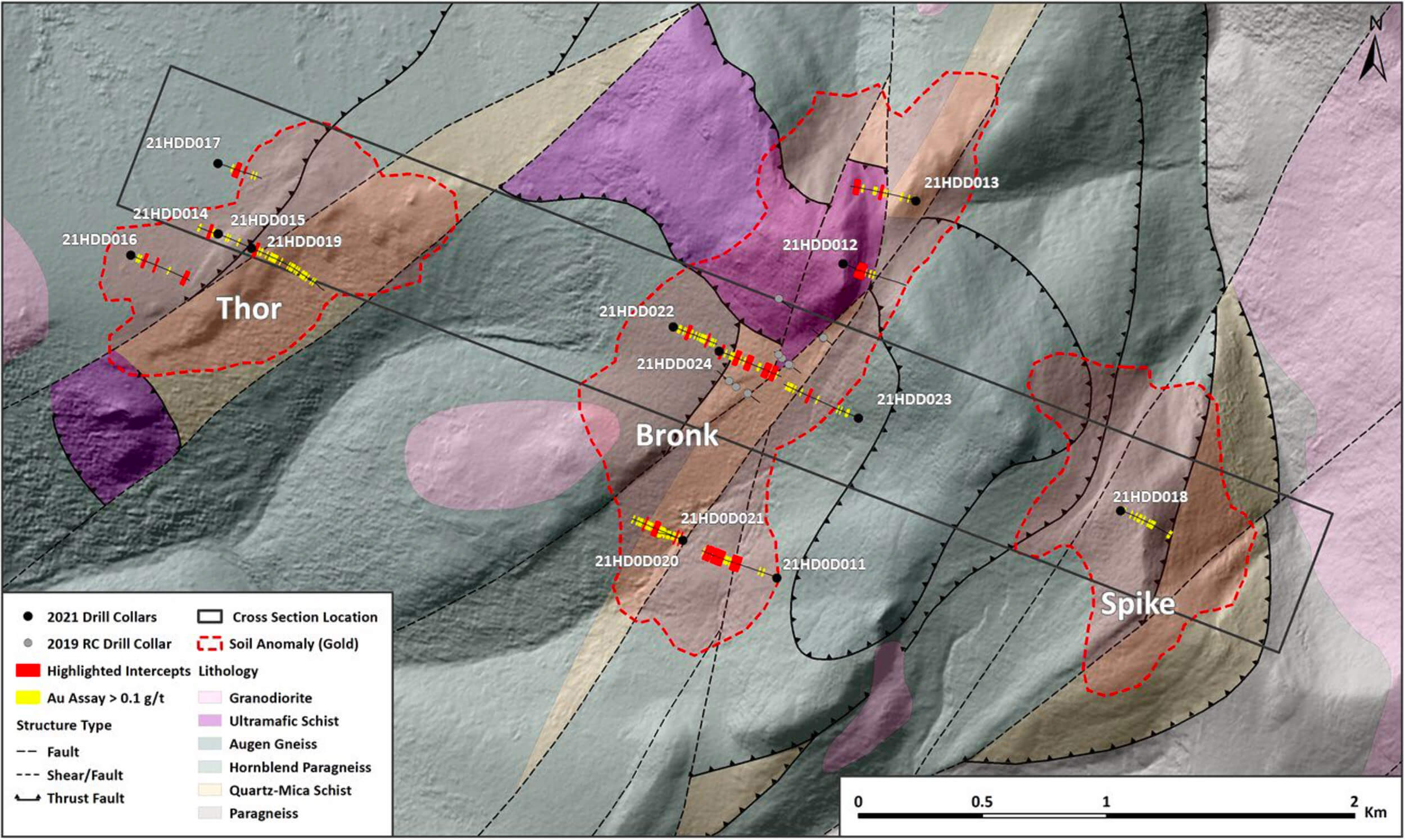

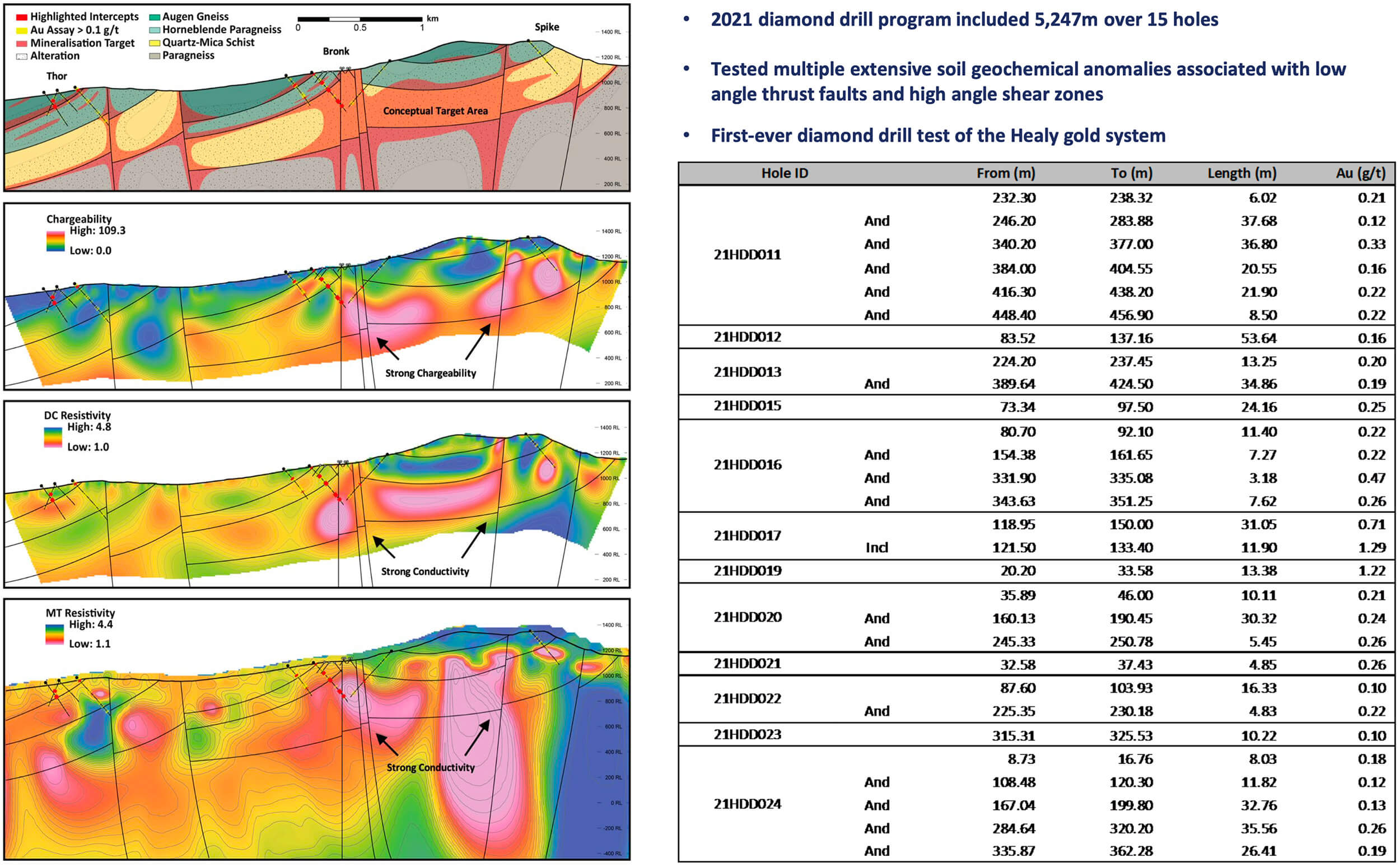

Kenorland released drill results from the Healy project in Alaska

While it’s easy to be enthused about the assay results from the Regnault discovery on the Frotet project, we were underwhelmed with the assay results from the Healy gold project in Alaska. We were looking forward to seeing those results as a first pass drill program had identified widespread but low-grade gold mineralization. 14 holes were drilled for a total of just over 5,200 meters.

That was confirmed in the 2021 drill program as almost all holes contained gold mineralization, but none of the holes contained grades that were high enough to be deemed economical.

There were some decent intervals (length-wise) but with 37 meters at 0.33 g/t gold and almost 54 meters carrying 0.16 g/t gold you obviously won’t be developing a gold mine in Alaska anytime soon and the drill results should be seen as ‘anomalous values’ but nothing more than that.

It makes Kenorland’s life easier though. The choice to drill out the Regnault discovery at C$300/meter versus drilling at Healy which costs about C$800/meter is an easy one. For the same amount of dollars, Kenorland can complete almost three times as many meters at Regnault where it has already zoomed in on high-grade gold-bearing veins.

Kenorland has spent the C$4M in exploration that was required for the company to earn a 70% stake in the project from Newmont (NEM, NEM.TO) and both companies are now moving ahead with a 70/30 joint venture. While it’s still early days and more anomalies have to be drill-tested, we don’t expect the joint venture in its current shape to continue. A third, cash-rich partner will likely (have to) be brought in to advance the project as we don’t expect Newmont to push this forward while Kenorland gets more bang for its buck in Québec.

Rather than doubling down on Healy we would expect Kenorland to shift its Alaskan focus to Tanacross in the upcoming exploration season(s).

Drilling has started at Chicobi

Although we don’t expect Kenorland to drill Healy again this year, the company will remain active on several fronts. Kenorland and Sumitomo don’t just have a joint venture at Frotet, both companies are also working together on the Chicobi gold project, also in Québec. As part of the earn-in agreement, Sumitomo can earn a 51% interest by spending C$4.9M on exploration expenditures. It can then increase its stake to 70% by spending an additional C$10M within the first 36 months after establishing the initial 51% stake in Chicobi.

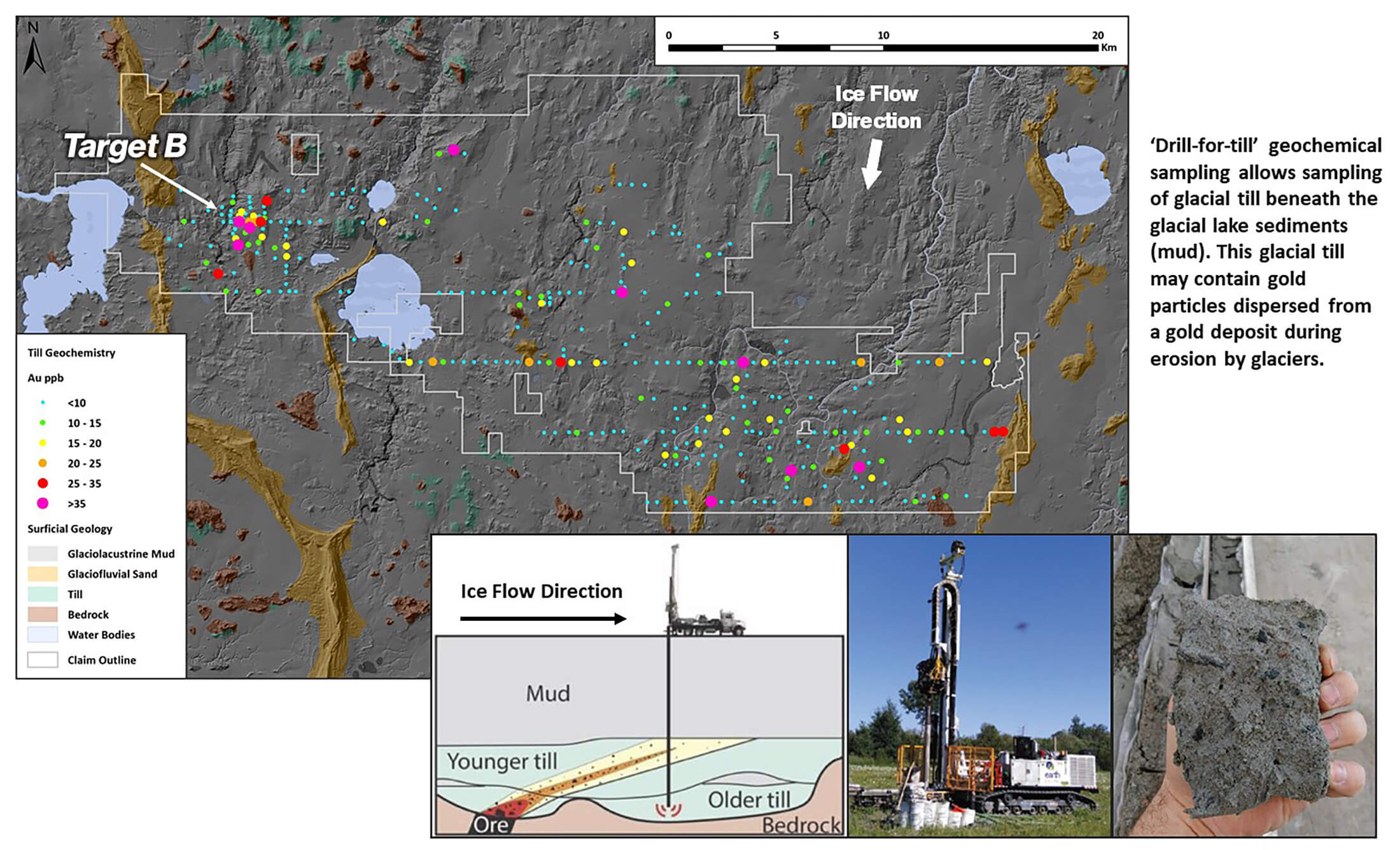

This maiden diamond drill program will consist of 2,000 meters in just four holes as the companies are aiming to follow up on a very large till anomaly of 1,500 meters by 3,000 meters. Drilling has started last week and will likely be completed in mid-April. Assay results can be expected by the end of the second quarter. We should be realistic as this is a maiden drill program on a greenfields exploration project and perhaps we should look at the drill program as a ‘data gathering mission’ before deciding on the next steps for the project.

Conclusion

Kenorland is making good progress at Regnault and a back-of-the-envelope calculation indicates the joint venture partners may have reached the initial ‘magic’ number of 1 million ounces of gold (of which 20% would be attributable to Kenorland). While we are still waiting for the assay results from the winter drill program to be published, Sumitomo and Kenorland will likely already decide on the new drill budget in the next few days or weeks as the partners obviously want to keep on drilling to add tonnes and ounces to the mineralized zones at Regnault.

Of course, Regnault is only one of the high-priority zones on the Frotet project and we expect to see the Cressida and Chatillon zones getting some attention as well this year. The main focus will obviously still be on Regnault where Kenorland and Sumitomo seem to be scratching the surface of the vein systems. The summer-fall drill program in 2021 has successfully expanded the known vein systems at R1 and R2 while the winter drill program has identified the presence of new vein systems and we are looking forward to seeing the assay results from these new discoveries.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.