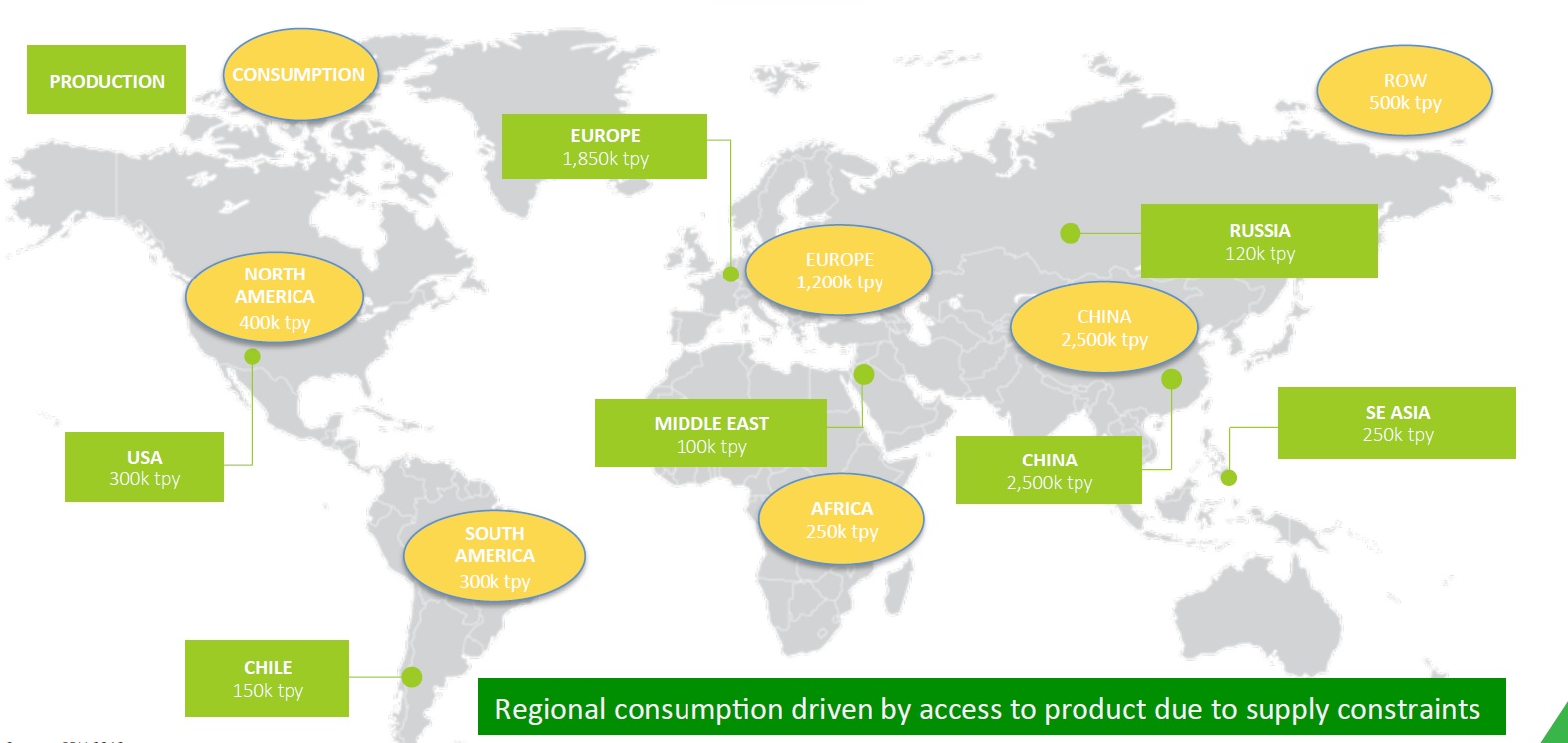

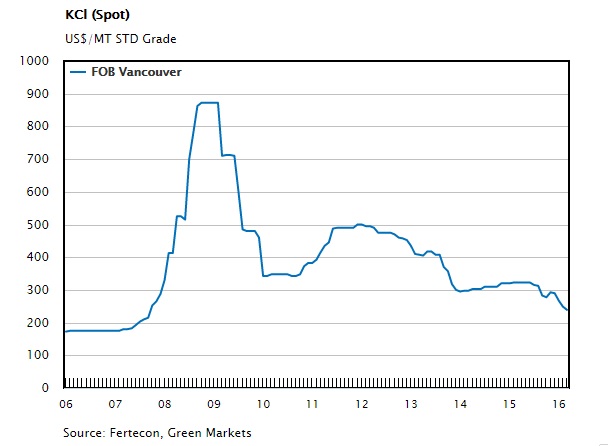

We definitely do like fertilizer companies, but let it be clear that not all fertilizer companies have been created equal. The world market is being flooded with MOP (Muriate of Potash, which is usually called ‘potash’) which has pushed the MOP price down from $850/t in 2009 to just $200/t right now. This means most of the potash producers are being hurt pretty badly as the margins have crumbled, but we wanted to point you in the direction of another fertilizer company that might actually benefit from the lower potash price. Potash Ridge (PRK.TO) is gearing up to get its SOP (Sulphate of Potash) plant in Québec up and running and not only does this project look pretty robust on a standalone basis, the economics look better with a lower MOP price and on top of that a large SOP-project in Utah provides you with optionality.

In this article we will predominantly focus on the planned Valleyfield plant in Québec as that’s where the company will create value for the shareholders in the short term. We are currently also preparing a more in-depth review of this company and will provide you with a full report within the next few weeks, but we wanted to share our first impressions with you.

Potash Ridge has completed an economic study at Valleyfield, and SNC-Lavalin expects the Valleyfield plant to be able to produce 40,000 tonnes of SOP per year which is a very respectable result, considering the initial capital expenditure for the plant is estimated to be less than C$50M. As Potash Ridge now has a market capitalization of approximately C$50M, you might think the company is almost fairly valued considering the after-tax NPV10% is C$67M.

But here’s the thing. That case was built on a sales price of C$1000/t for the SOP and an acquisition cost of C$500/t for the MOP. As it would cost the company approximately C$100/t to process the MOP into SOP, the operating margin was approximately C$400/t (or 40% of the sales price). Not bad, but if you would insert the current MOP price of C$325/t, the operating margin increases to C$550/t (even if the conversion cost would be a little bit higher), for a 40% boost of the operating margin. If you would now also factor the higher SOP price in (which is closing in on the C$1,100 mark), the operating margin will come in at around C$650/t which will reduce the payback period and increase the IRR to a much higher level. Based on an output of 40,000 tonnes per year, updating the SNC study with the current data would increase the annual cash flow by C$26M per year, so we have very little doubt the ‘real’ NPV of the project will be in excess of C$100M, and very likely closer to C$200M if you would use a lower discount rate of 7-8%.

As said, we are currently working on an in-depth report on Potash Ridge which will include an overview of the company’s large SOP project in Utah as well. We expect to release this report shortly.

Go to Potash Ridge’s website

The author has a long position in Potash Ridge. Potash Ridge will very likely become a sponsor of the website. Please read the disclaimer