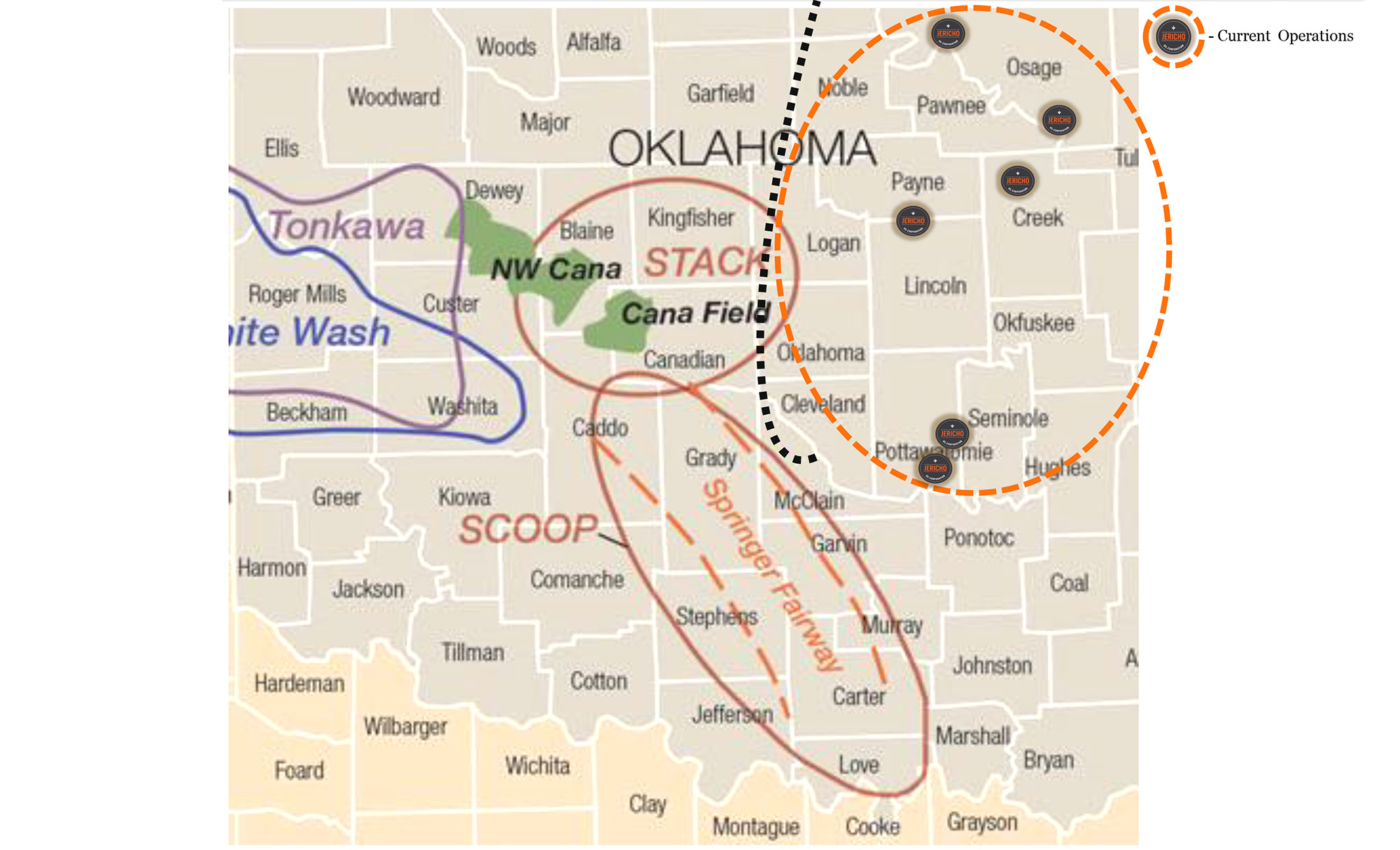

Jericho Oil (JCO.V) has acquired Oklahoma-based assets from Enervest in what seems to be a relatively cheap acquisition. Jericho’s 50% owned subsidiary, Eagle Road Oil, has purchased a 91% average working interest of 62 wellbores and 31,200 acres of land from Enervest. As the average production rate in the first quarter was approximately 225 barrels (112 attributable to Jericho Oil), the US$3.95M acquisition cost means the partners are paying just $18,000 per flowing barrel of oil which is relatively low for an asset with an average liquids/gas ratio of 77%-23%.

The $3.95M will be paid using the funds from the credit facility provided by East West Bancorp (EWBC), and this acquisition also means Jericho could probably count on an increased borrowing base, should it ever need to draw down more funds. As the credit facility required Jericho Oil to hedge a part of its oil and gas output, the additional production will mean the percentage of the consolidated production that has exposure to the spot price is increasing again as well.

After drawing down cash for working capital purposes, the hedging program and the new acquisition, Jericho’s subsidiary still has an undrawn amount of $4.63M on its line of credit.

Go to Jericho’s website

The author has a long position in Jericho Oil. Jericho Oil is a sponsor of the website. Please read the disclaimer