Although we have just recently published a report on Generation Mining (GENM.C) wherein we discussed the company’s progress and shared our own calculations ahead of the Preliminary Economic Assessment which will now be published early next year, the company surprised us again with yet another resource update.

Generation published last week the updated resource estimates on the Geordie and Sally zones, which could act as two satellite deposits to the main Marathon zone. And this update could have important implications for our economic scenario.

The new resources look good

The Geordie deposit

The updated Geordie resource is based on almost 10,000 meters of core drilling in 61 holes, drilled by previous owners of the project. Generation Mining’s consultant, P&E Mining has re-analyzed the assays and created new block models using more relevant metal prices.

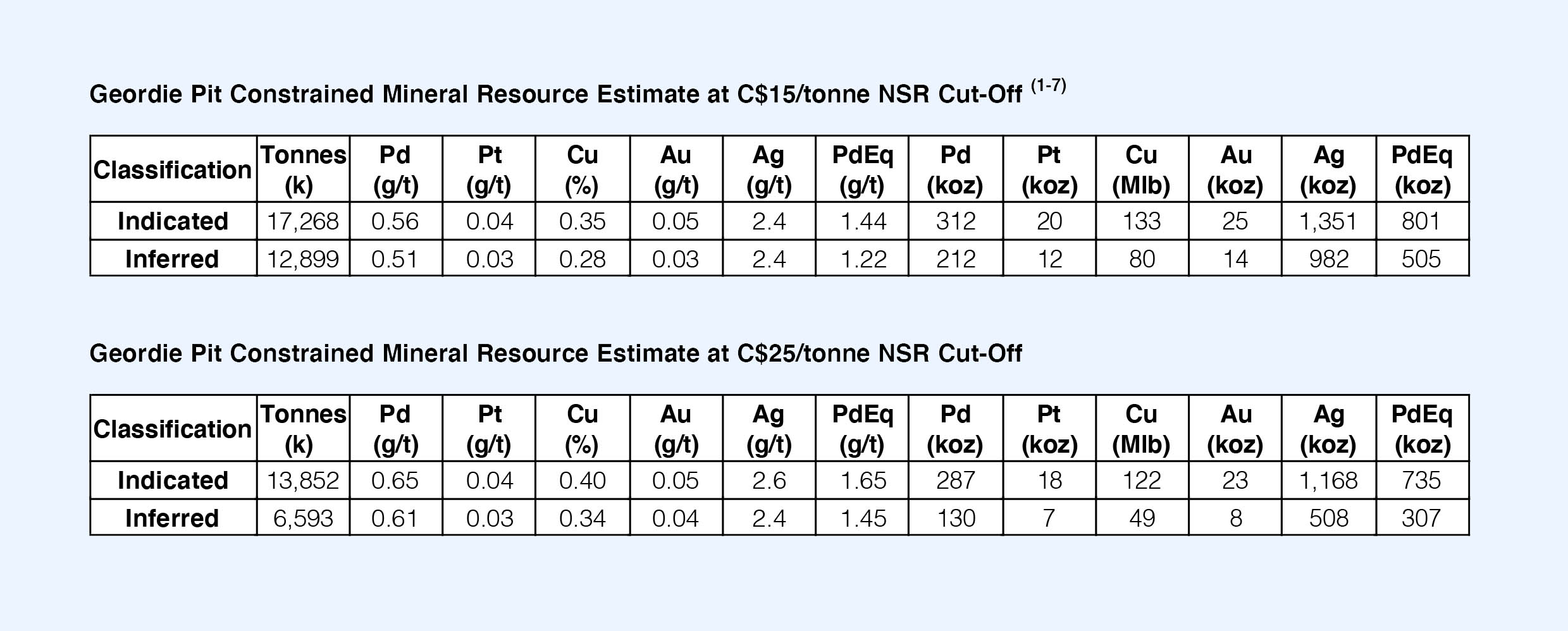

Just as in the resource update for the main zone, Generation Mining has provided two scenarios, one with a cutoff grade based on a rock value of C$15/t, and one with a rock value of C$25/t. While we acknowledge the C$15/t scenario would actually work based on the current spot price of the PGMs, we still like to opt for the higher cutoff grade, just to err on the side of caution. But to be fair and complete, you can find both resources here below.

Seeing a resource of roughly 20 million tonnes at an average grade of around 1.55-1.6 g/t PdEq is excellent, but it’s even more surprising to see roughly 2/3rd of this resource is already in the indicated resource category, indicating a higher level of confidence in the resource.

The Sally Deposit

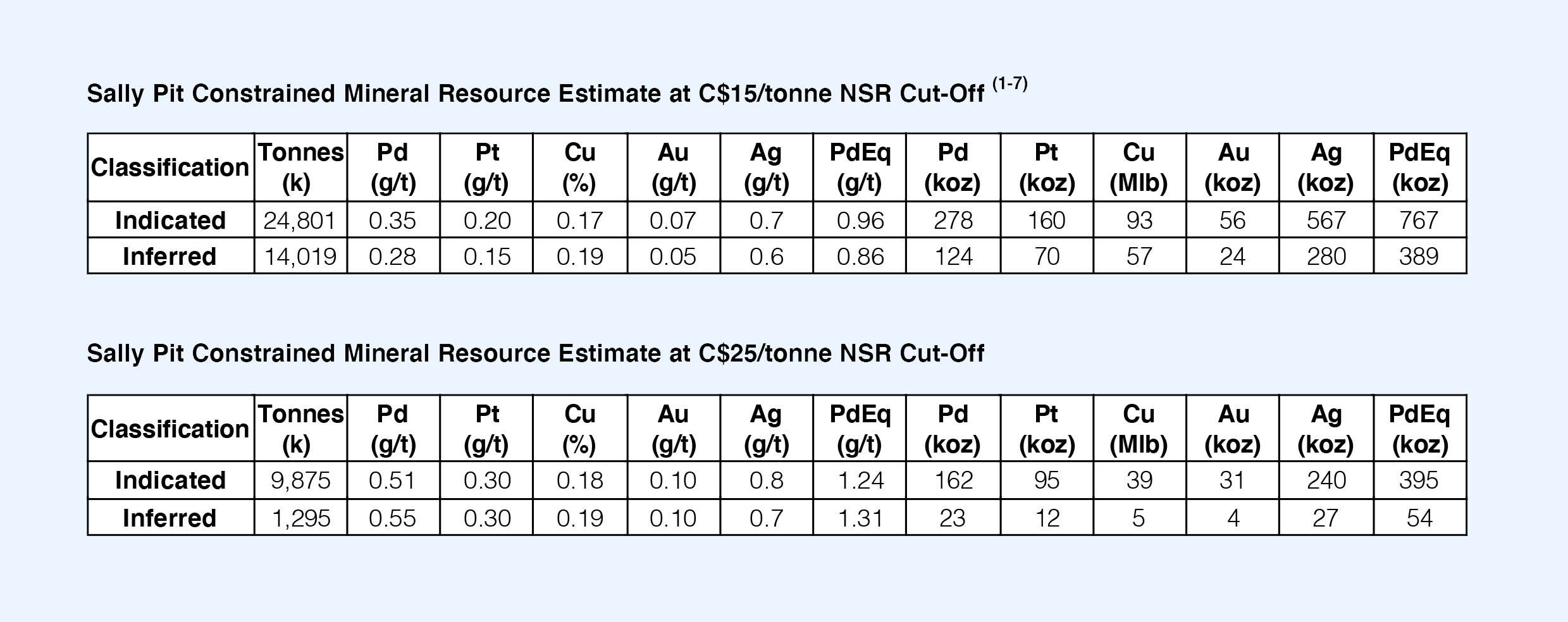

The resource on the Sally Deposit was also based on the re-interpretation of historic drill results. In fact, the Sally zone has been thoroughly drilled with 82 holes for a total of 16,953 meters (and not over 216,000 meters as the Generation Mining press release erroneously mentioned – probably a typo) and an additional 1,871 meters of trenching has been completed as well. Plenty of data for Generation Mining’s consultants to update the block model.

And the result is fine. Grade-wise it’s perhaps not as impressive as the Geordie resource, but still a very decent resource using the C$25/t cutoff. It’s interesting to see approximately 70% of the tonnes get lost going from the C$15/t cutoff to the C$25/t cutoff scenario which seems to indicate a lot of the existing tonnes had a recoverable rock value between C$15-25/t. The smaller resource of 11 million tonnes is still fine although the average grade remains relatively low (compared to both the main zone and the Geordie resource using the C$25/t cutoff.

The implications for our economic model

The implications cannot be underestimated. In our base-case scenario, we used a 16-year mine life at a processing rate of 6 million tonnes per year, which means 96 million of the 116 million tonnes in the resource estimate using a cutoff grade based on C$25/t were included in our calculation.

When using the Geordie and Sally resources at a C$25 cutoff, the 20.5 million tonnes at Geordie and 11 million tonnes at Sally would indicate Generation Mining could add an additional 5 years to the mine life if it mills both deposits (based on the current resource estimate. Considering Sally remains open in all directions, the potential to add even more tonnes appears to be quite realistic).

Keep in mind we don’t expect an immediate impact on the economics nor on the NPV that will be published as part of the upcoming Preliminary Economic Assessment. Geordie and Sally will be positioned as satellite deposits and although the average grade appears to be economic, Generation Mining has to ‘play it smart’ and will solely focus on the main zone to ensure a relatively smooth permitting process (which would be derailed in case two additional satellite deposits would be added to the overall project.)

The drill program continues to intersect the mineralized zones

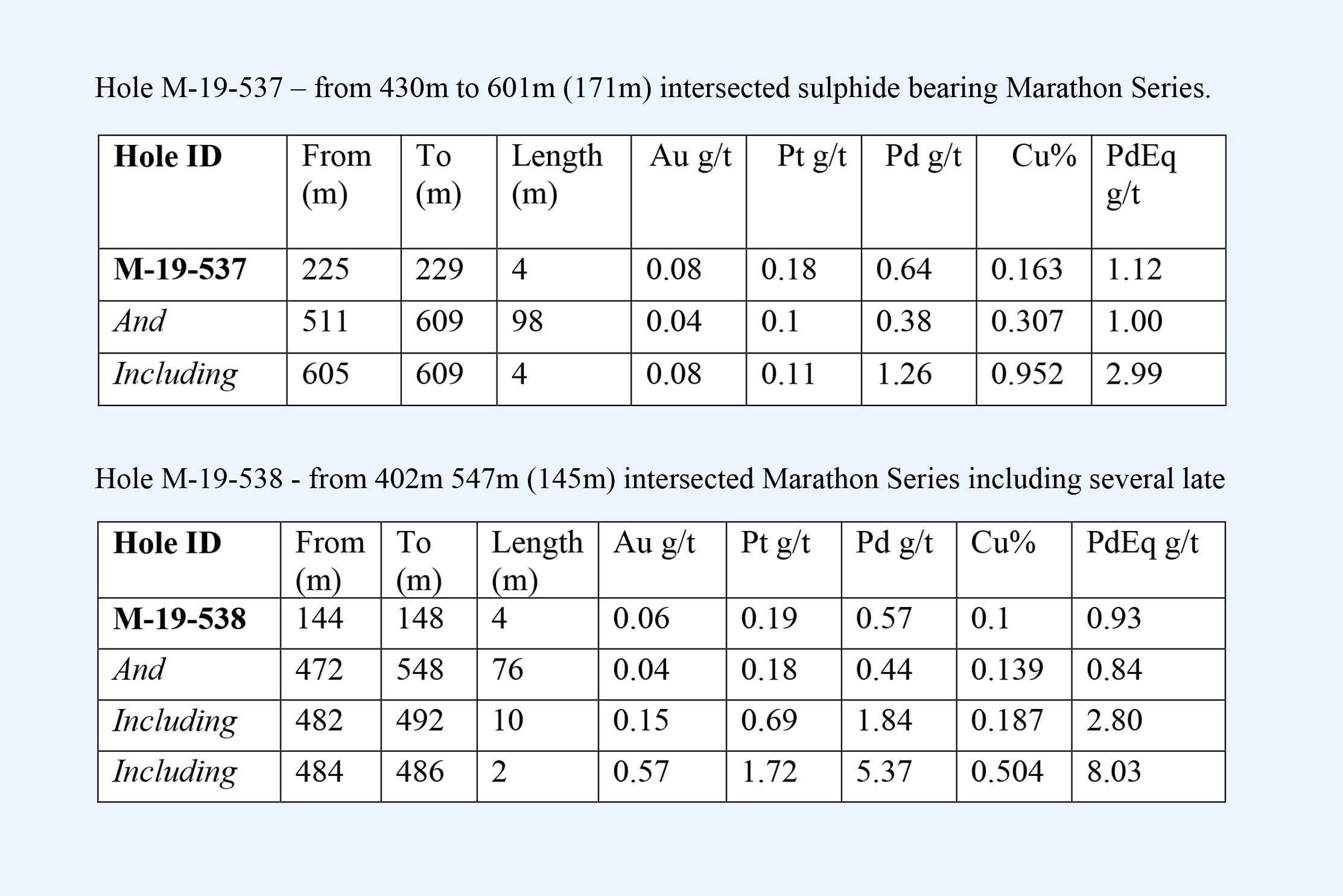

Generation Mining also provided a brief update on its ongoing drill program on the Marathon PGM deposit, and the four holes that were drilled just west of the main zone contained interesting information.

Two holes were drilled as part of a 350-meter step-out program and both intersected mineralization as they were designed to follow up on the feeder conduit which was drill-tested before, but abandoned due to poor ground conditions. The two holes did intersect PGM mineralization as you can see below and although none of the grades are too exciting given the either relatively narrow interval or vertical depth where they were encountered (98 meters at 1 g/t is great, but not at a depth of 511 meters down-hole) but it is positive to see how wide-spread the mineralization is and

Two additional step-out holes were drilled almost 1.5 kilometers west of the marathon deposit to test for massive sulphides within the feeder conduit of the Marathon Deposit. These two holes did intersect the right rocks, but the grade wasn’t there.

The rocks encountered in all four holes confirm the exploration theory and could now try to chase the grade to add more tonnes to the existing resources.

Conclusion

The main takeaway from the Generation Mining update is that this confirms there’s plenty of exploration-based upside potential on the Marathon PGM project. And although the two satellite deposits won’t be included in the upcoming PEA (nor the feasibility study which is also expected to be completed in 2020) it confirms the Marathon PGM project has the potential to have a multi-decade mine life. We used just 96 of the 116 million tonnes in our DCF calculation but should the Palladium price remain this strong, the entire lower-grade resource on the main zone of almost 180 million tonnes could result in a mine life of almost 30 years, while the Geordie and Sally deposits would add an additional 11 years to that.

Of course, that’s just wishful thinking for now. Let’s first wait to see how Generation Mining’s first PEA looks (we will be particularly interested in the IRR and NPV), as we hope and expect the company will be trying to front-load the higher grade zones to boost the economics.

In any case, Generation Mining will have to find the middle path between showing a long mine life (to boost its buyout potential by a larger player) and showing superior economics (to make it easier to secure funding) should Generation Mining be in a position where it would (at least have to pretend to) build a mine after a positive feasibility study.

The current share price must be terribly frustrating for the Generation Mining management as they are doing everything right. The deal has closed, the resource drilling is underway and updated resource estimates have exceeded expectations. With a PEA and feasibility study expected in 2020, the market should start paying attention to Generation.

Disclosure: The author holds a long position in Generation Mining. Generation Mining is a sponsor of the website.