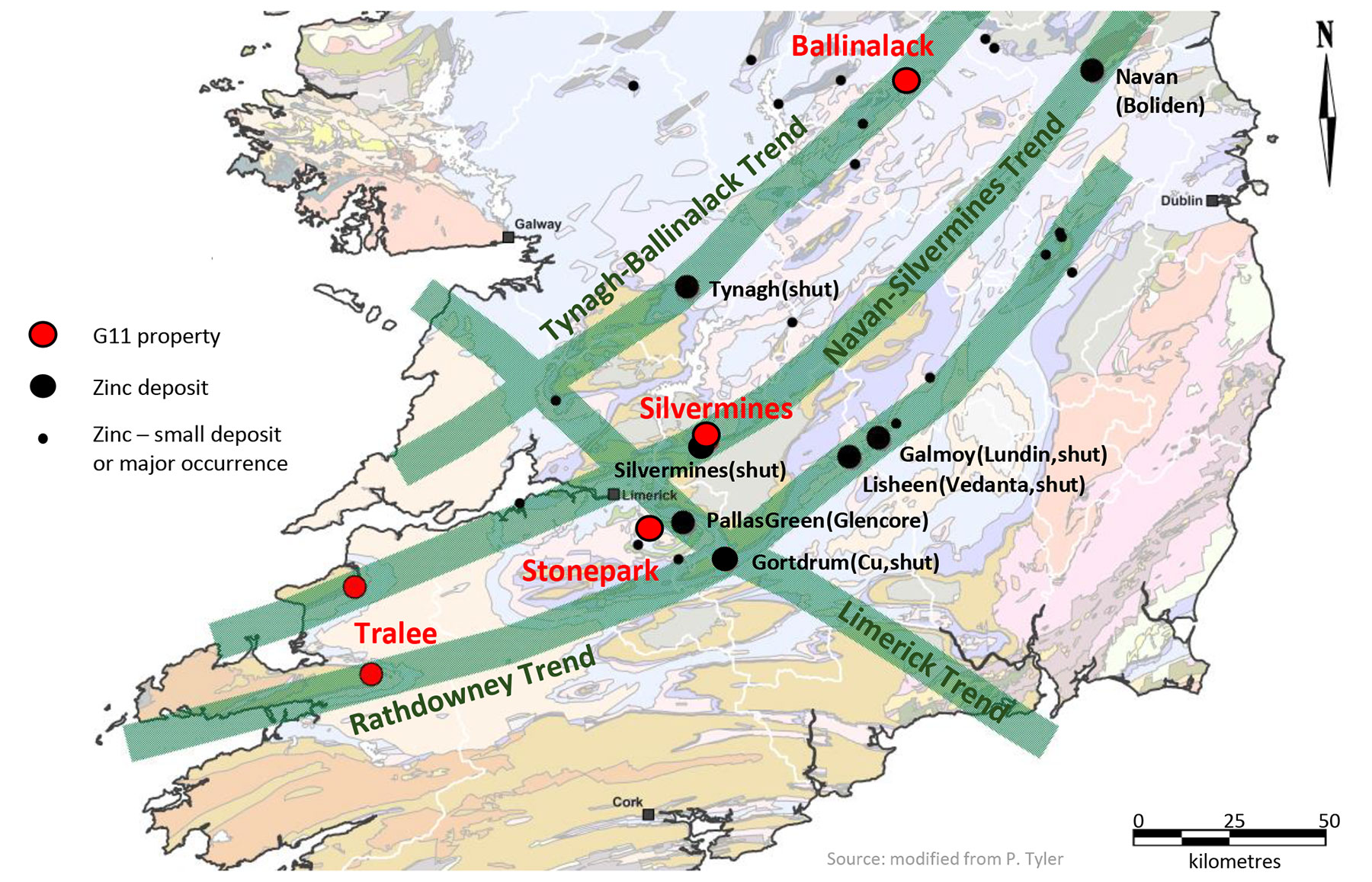

A little while ago, we flew to Ireland to kick the tires of Group Eleven Resources (ZNG.V), a relatively new zinc exploration company focusing on advanced stage projects in Ireland. Except for the zinc aficionado’s, very few people outside of Europe realize Ireland actually was one of the epicenters of the zinc production in the world. Irish concentrates were highly sought after due to the excellent characteristics of the concentrate, allowing the offtake parties to blend it with inferior concentrate to create a new homogenous product.

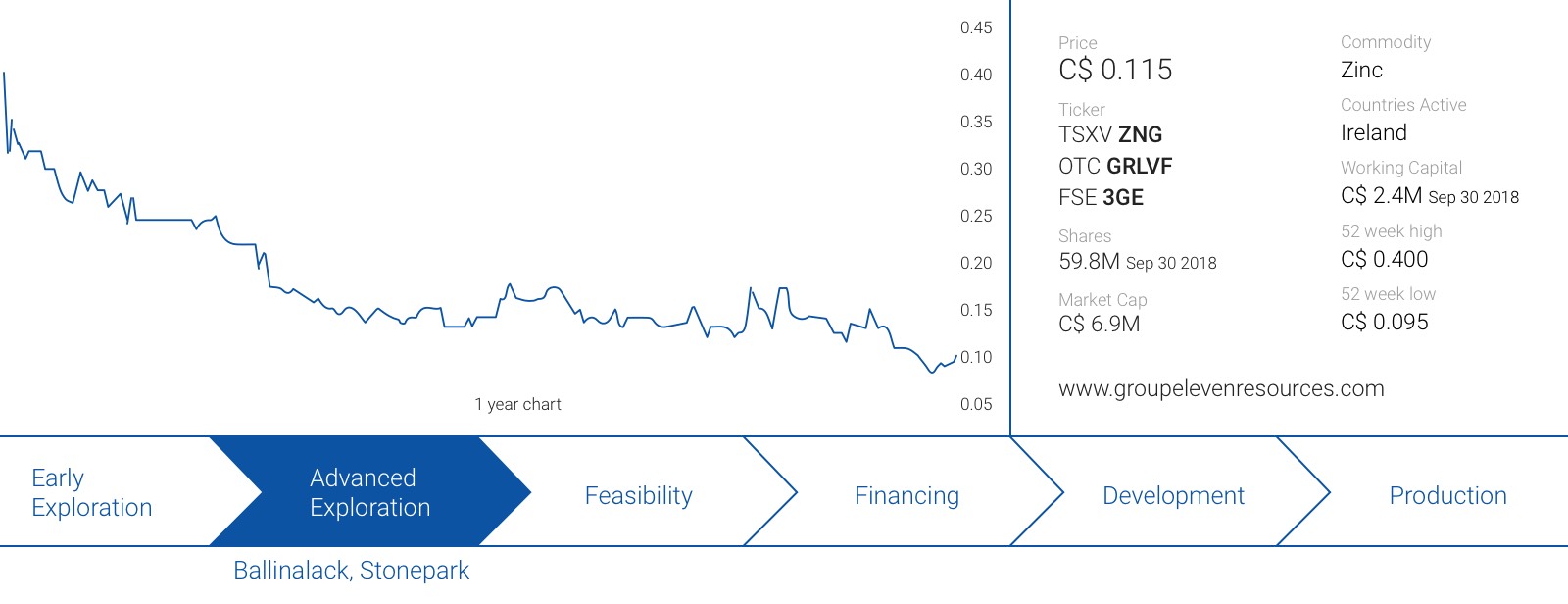

Group Eleven acquired the advanced stage assets during the recent downturn and despite a strong IPO at a decent valuation, the share price almost immediately started to slide. At the current share price of C$0.115, the market capitalization of the company is just C$6.9M, for an enterprise value of C$4.5M after deducting the cash.

The case for zinc

Whereas three or four years ago nobody seemed to care about zinc, the base metal enjoyed a lot of attention in the past 12-18 months as the fear for a zinc shortage sent the price soaring to in excess of $1.60/pound. The zinc price has recently come off its highs and is currently trading at $1.20 per pound which still is a pretty good price from a historical point of view.

In fact, the current zinc price is more than just ‘good’. It’s an excellent price, and we would actually argue it would make sense to use an even lower price for an economic model. So we aren’t using $1.50 zinc as a base case scenario, and would rather prefer to use a price between $1-1.20 to determine whether or not a mining project makes sense.

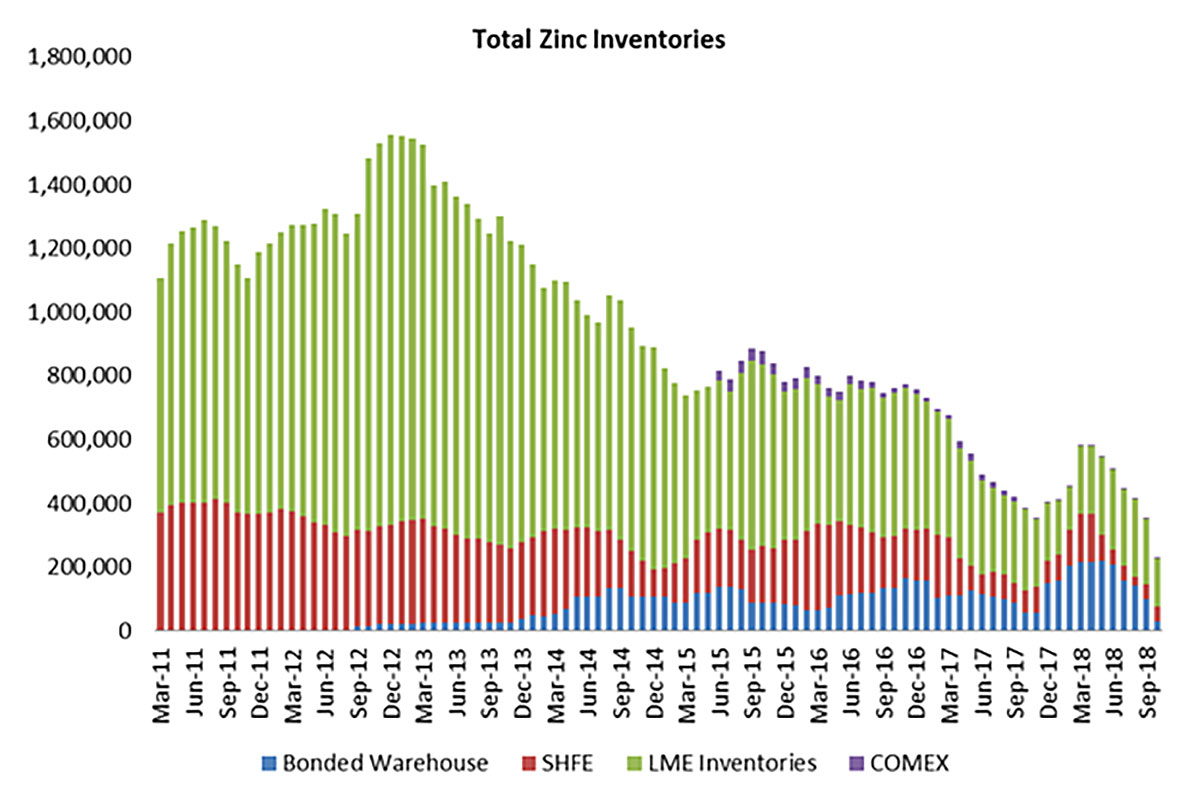

There’s plenty of market commentary out there on zinc as a commodity, so we will just show you this image, provided by Canaccord Genuity and Bloomberg:

And when you zoom in to see the developments in the last 5 years, the inventory levels seem to be falling off a cliff.

The zinc inventory levels are still declining and as the demand for zinc is still outpacing the available supply, the fundamentals remain intact.

Although Ireland is mainly associated with green landscapes, Guinness beer and Ryanair, it effectively is one of the hotspots for zinc mining. Two large mines have recently been shut down, and the Irish government is aggressively trying to encourage additional investment in detecting and building new mining projects. The ‘Tellus’ airborne geophysical survey for example, is being flown by the Geological Survey of Ireland and is trying to pick up the signatures of new large zinc deposits in Ireland.

Back in 2014, the Irish mines produced in excess of 700 million pounds of zinc (according to the US Geological Survey), down from approximately 760 million pounds of zinc in 2012, which made it the 10th largest producer of zinc in the world.

Ireland’s ability to become one of the top zinc producers in the world was based on three exceptional qualities inherent to the Irish zinc projects. First of all, thanks to the existing infrastructure, there’s a low threshold to build and operate a mine. The current rule of thumb is to find 10 million tonnes at an average grade of 10% zinc-lead (we will call this rule of thumb the ‘10@10 rule’ from here on) which makes it easier to find and develop projects.

Secondly, the quality of the Irish concentrates is absolutely excellent. The zinc grade in the concentrate is usually pretty high, and the concentrates have a very low concentration of nasty elements. This makes it a highly sought-after type of concentrate as offtake parties could easily blend this with another zinc concentrate with inferior qualities.

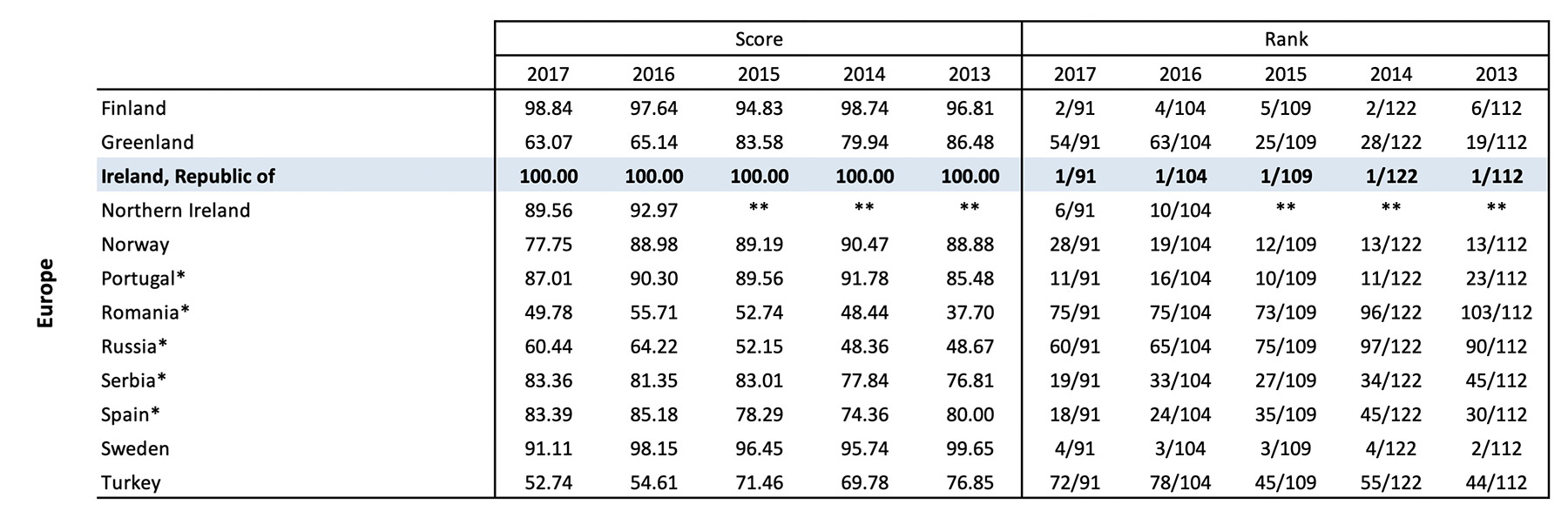

And finally, Ireland remains one of the top jurisdictions for the mining sector. In its 2017 annual survey, the Fraser Institute ranked Ireland 4th on the ‘investment attractiveness index’ and 1st in the ‘policy perception index’ which judges the existing legal framework. Ireland didn’t just finish first, it did so with a perfect score of 100/100 for the fifth year in a row…

Visiting Ballinalack and Stonepark

The company has put together an excellent land package in Ireland, consisting of several projects and we have visited the Ballinalack and Stonepark projects. Group Eleven Resources has a new exploration approach at both projects and a confirmation of its exploration theory might shine an entirely new light on the Irish zinc sector.

Ballinalack (60% interest)

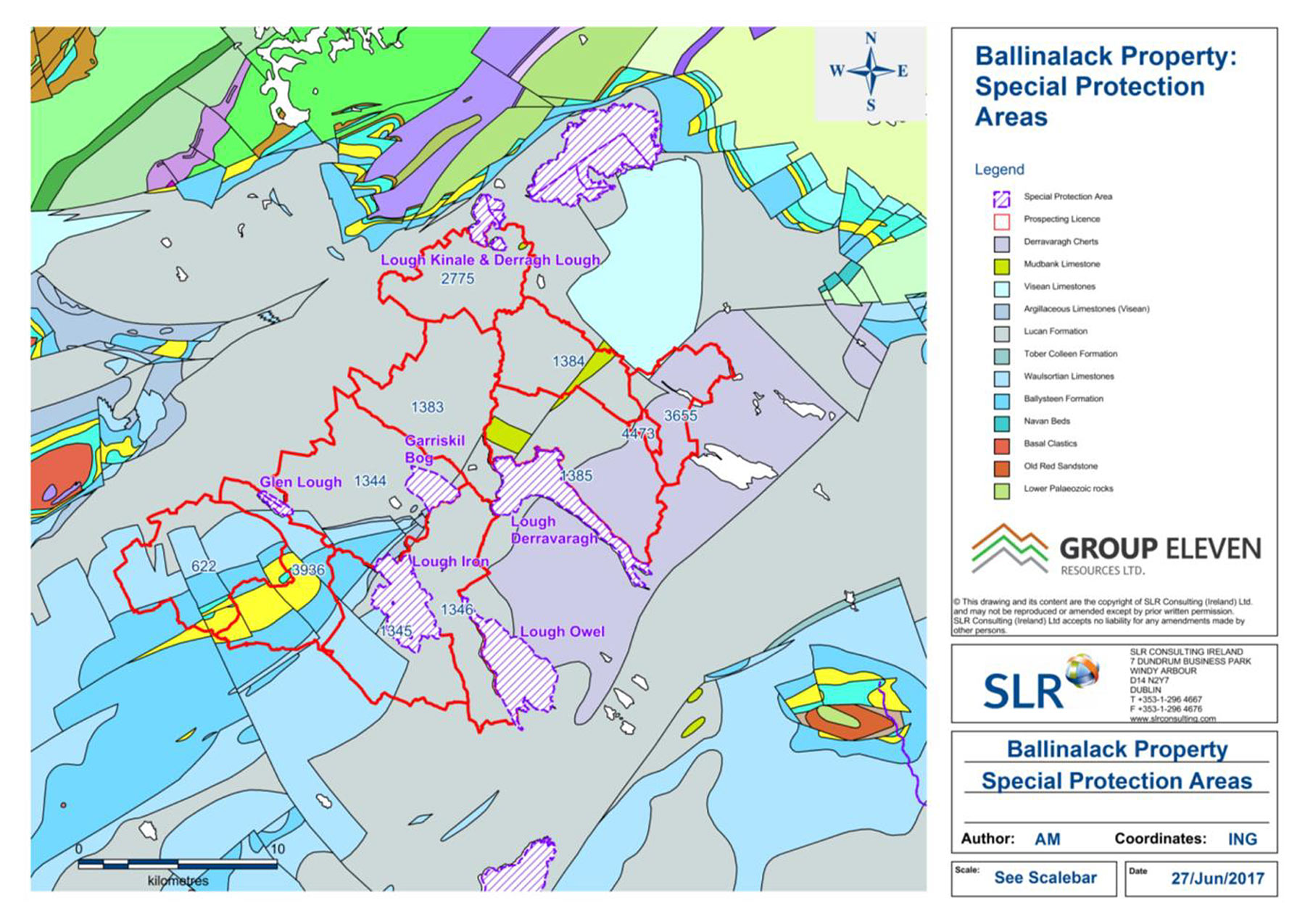

Our first stop after leaving Dublin was the 314 square kilometer Ballinalack project, which is located in the Irish Midlands, just 90 kilometres Northwest of Dublin. There are paved roads going straight onto the project, and from an infrastructure-focused point of view, the location of Ballinalack is probably as good as it gets: paved roads all over the place, an existing 110 kilovolt powerline is running straight through the property to Mullingar, a town with approximately 20,000 inhabitants. Sure, there is some farmland (although the yields aren’t great as the hotspot for farming in Ireland is further south), and there are some areas where Group Eleven will have to be careful:

But this is pretty standard for any first world country, and shouldn’t be a huge issue considering all potential mining operations will happen underground anyway.

There’s an existing (historical) resource estimate on the property, which contained 7.7 million tonnes at an average grade of 6.33% zinc and 0.95% lead within the first 260 meters from surface. This resource was just updated by Group Eleven, and the current NI 43-101 compliant resource hosts 5.4 million tonnes at an average grade of 7.6% zinc and 1.1% lead. So the tonnage decreased, but the average grade increased by almost exactly 20%. The technical report will be filed on SEDAR within the next six weeks, and we expect the report to contain additional valuable information on the property.

It’s also important to note the average grade of the mineralization appears to be increasing at depth. The historical resource estimate mentioned a grade of 5.1% zinc and 0.5% lead in the upper horizons while this increases to 11.2% zinc and 2.3% lead in the lower horizons of the mineralized structure. Expanding the mineralization in the lower zones could help to lift the overall grade, so the current ZnPb grade of 8.7% could still be improved.

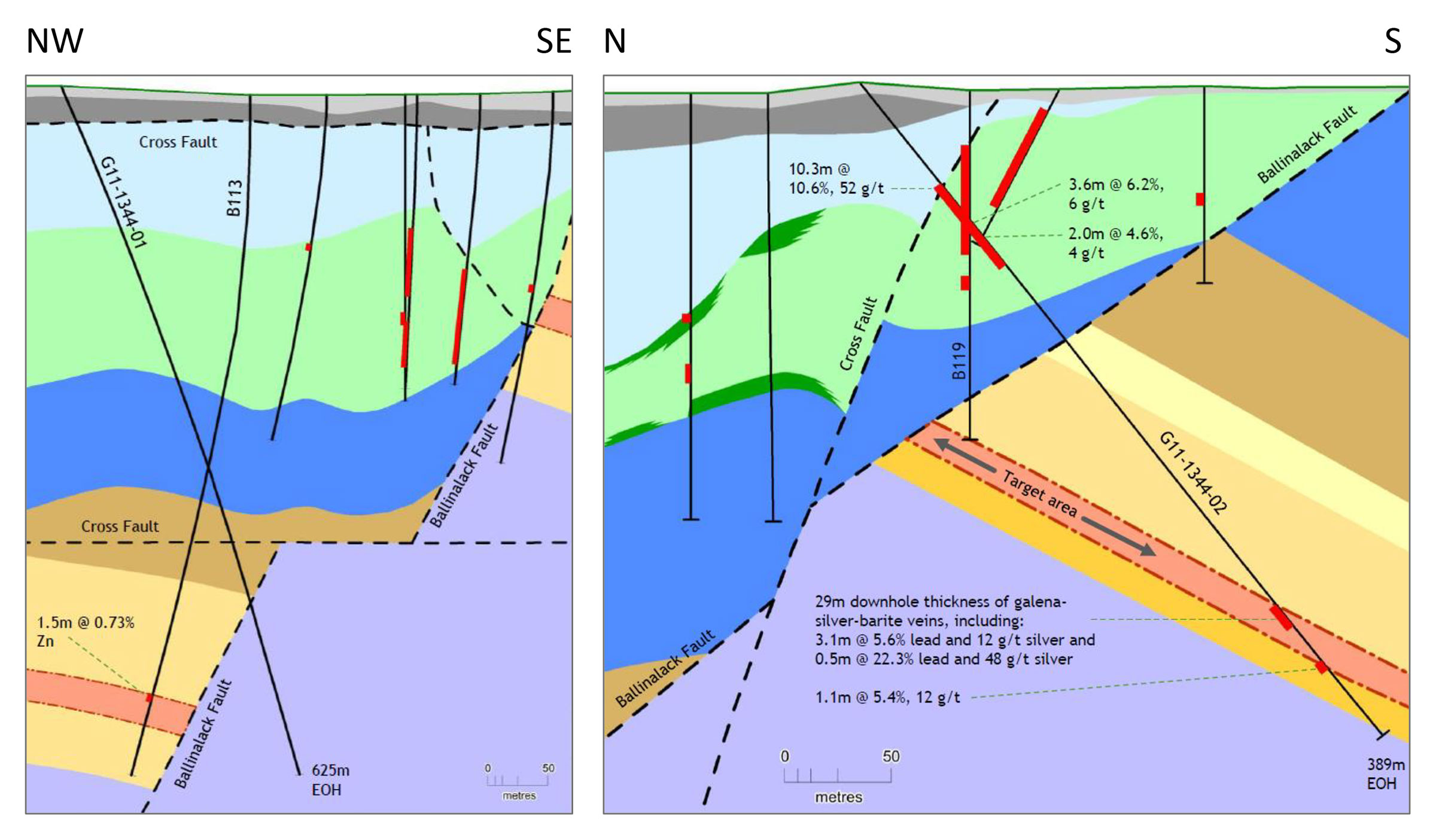

Group Eleven completed a drill program on the property in the first half of this year, but rather than cherry-picking the low-hanging fruit, it kicked off the exploration program on the property with two technical drill holes to follow up on the main exploration theory: the two beds (Waulsortian and Navan) may both be mineralized and it’s generally seen as a good idea to first figure out what the potential is at depth before focusing too much on the near-surface Waulsortian rocks. After all, you can’t put a mine plan together before having a very good idea of the total potential of the property, which means the deep holes drilling the Navan beds could be seen as some sort of ‘condemnation drilling’. If there’s nothing (viable) down there, G11 will focus on the Waulsortian resource, but if there’s a large and high-grade zinc zone underneath the Waulsortian rocks in the Navan beds, the company has to make sure it’s able to put a comprehensive mine plan in place to maximize the efficiency of a mining operation on two levels.

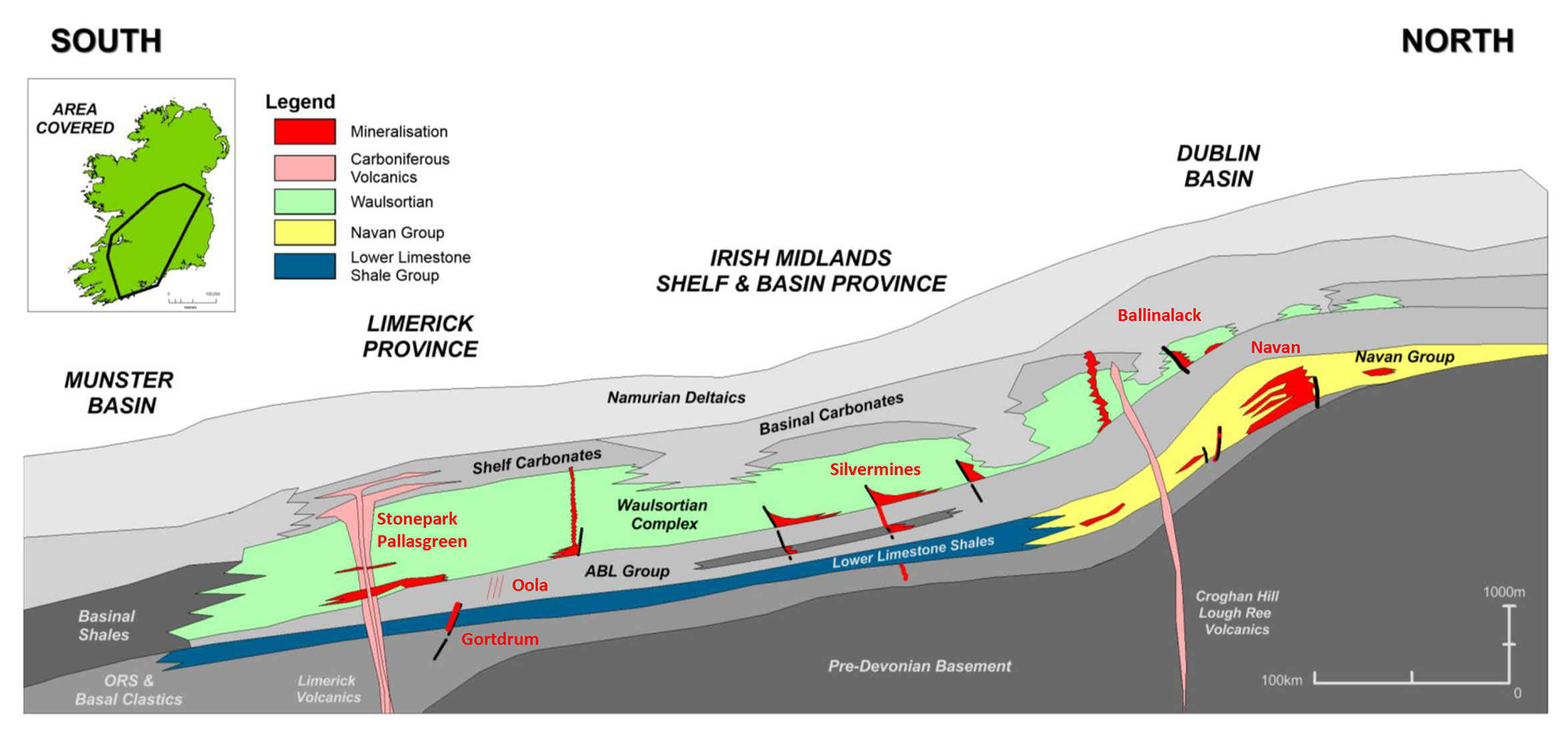

G11 released the results of two drill holes at Ballinalack before the summer. One hole was meant to gather more data and gain more insight of the structural controls of the mineralization and was the first ever hole to drill-test the Ballinalack fault below the historical resource estimate. The technical approach is very important as this project is – as far as we know – the only major zinc occurrence in Ireland with two underlying prospective horizons: the Waulsortian horizon and the Navan beds. Irish zinc deposits are usually only found in either the Waulsortian rock or the Navan Beds which host the giant Navan zinc mine owned and operated by Boliden just 50 kilometres towards the east.

The technical hole discovered that cross-faults are present across the historic estimate (7.7mt @ 6.3% Zn and 1.0% Pb – not compliant with NI 43-101) and that these faults may be significant in controlling mineralization (an important development as historic drill programs weren’t considering the existence of these cross-faults). Realizing the presence of cross-faults as well as re-analysing the historic zinc intercepts allowed Group Eleven to identify four high-priority Navan Beds targets at Ballinalack.

According to Group Eleven, the technical hole confirms historical drilling on the property to test the hanging wall of the Navan Beds was going too far down dip. This means the ‘real’ target area remains untested.

The second hole successfully intersected a known area of zinc-lead-silver mineralization with an interval of 10.3 meters containing 10.58% ZnPb at a depth of just 60 metres down-hole.

That’s a great result on the zinc-lead front as the grade of this interval is approximately 50% higher than the average grade in the historical resource estimate but on top of that, the silver grade came in pretty high as well, at 51.8 g/t (1.67 ounces per ton). That’s an important achievement as the historical drill programs at Ballinalack often didn’t assay the core for silver… It’s not unreasonable to expect Ballinalack getting a zinc-equivalent grade boost thanks to the silver, putting it closer to the ‘magical’ 10 million tonnes at 10% mark.

Importantly, the second hole also intersected three new distinct zones of mineralization in the Navan Beds (3.1 metres of 5.6% lead and 12 g/t silver, 0.5 metres of 22.3% lead and 48 g/t silver and 1.1m of 4.6% zinc and 0.8% lead (5.4% combined) and 12 g/t silver (true widths estimated at Approximately 30%, respectively). These intercepts are new pierce points within Navan Bed ‘Target 2’ which is already drilled by five significantly mineralized historic holes widely-spaced over a length of approximately one kilometre.

Stonepark (76.56% interest)

Group Eleven Resources acquired the majority stake in the Stonepark project from Teck Resources in 2017 for a total cash compensation of C$2.15M which is just a fraction of the sunk cost on the property. Teck Resources and its predecessors (including Connemara Mining (CON.L), the 23.44% minority owner of the project) spent in excess of C$9M on Stonepark, which includes completing a 133 hole diamond drill program.

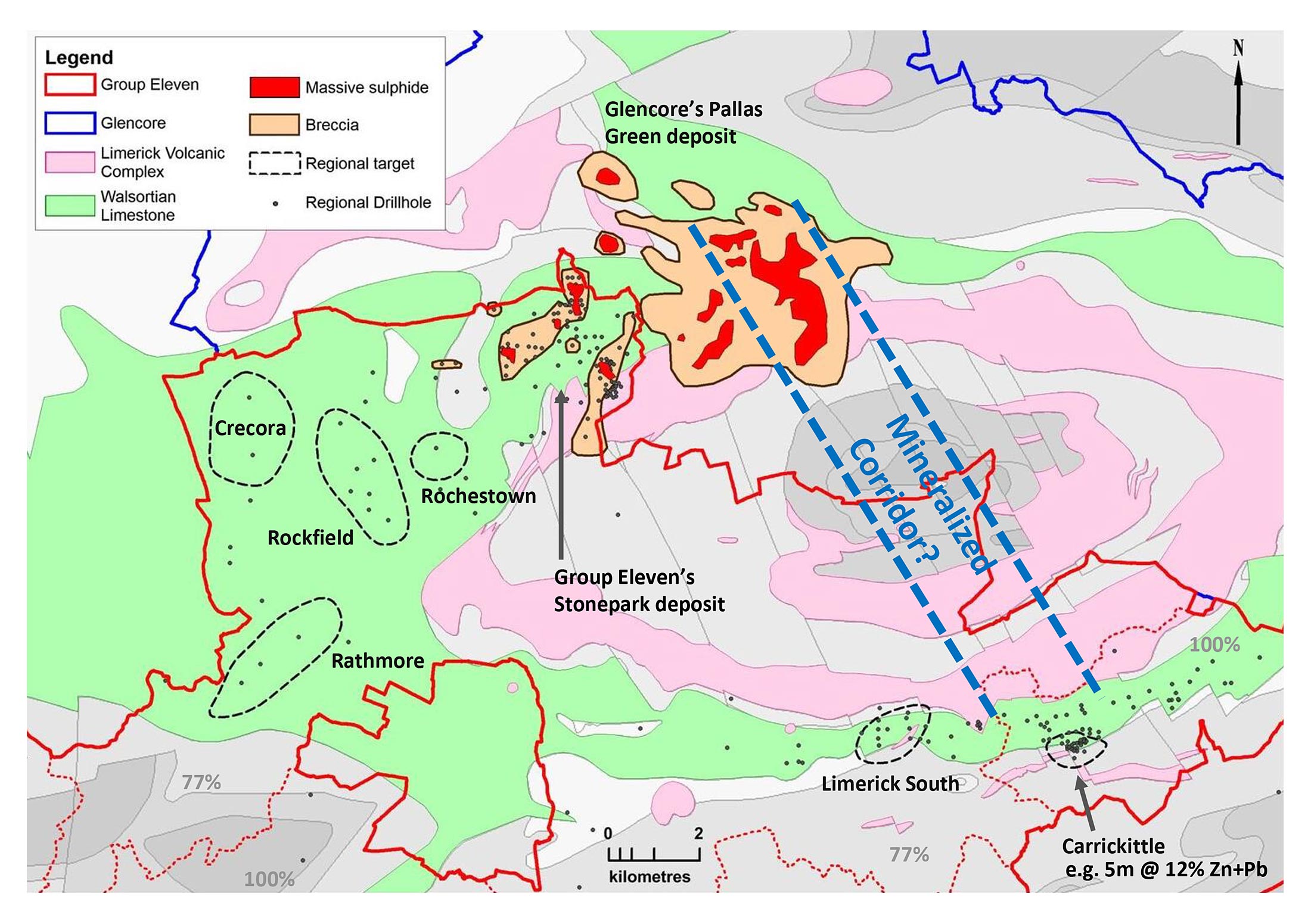

This definitely isn’t a greenfields exploration project as the Stonepark resource estimate already contains 5.1 million tonnes at an average grade of 8.7% zinc and 2.6% lead. Although the tonnage is just halfway the 10 million tonnes in the rule of thumb, the combined grade of 11.3% is absolutely excellent, and Group Eleven should now just focus on increasing the size of the deposit.

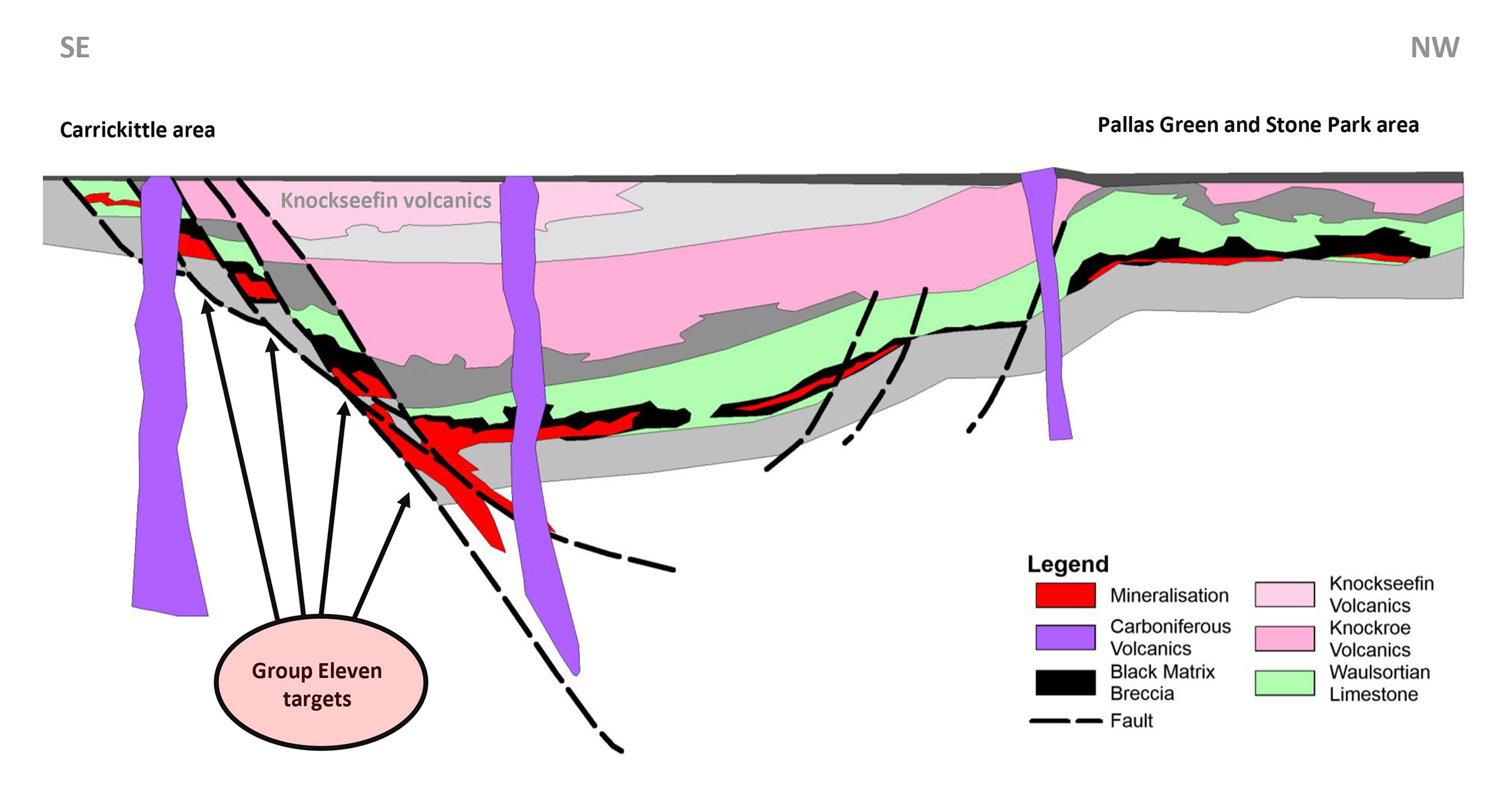

And the company has a special theory it’s trying to confirm. As you can see on the previous image, there’s known zinc-lead mineralization on both sides of the volcanic complex. And that’s interesting. Group Eleven has recently figured out that the volcanics in this area were a big factor in driving the zinc mineralization. Previously, it was believed these volcanics had nothing to do with the zinc and in fact were just messing up the story.

If this theory is correct and the Waulsortian zinc zones are indeed connected, there should be high-grade zinc and lead mineralization below the volcanic cover:

This is a very interesting theory and the proof will be in the pudding as the only way to find out if this theory is correct, is through drilling the edges of the volcanic system (before drilling a few deep holes right in the middle of the volcanics).

But that’s not the only way to prove up the value of Stonepark. As you noticed on the map, the Stonepark deposit is literally adjacent to Glencore’s (GLEN.L) Pallas Green deposit, one of the largest undeveloped zinc-lead projects in Europe, and per definition Ireland’s best shot at getting a new zinc mine developed. Despite its size (44 million tonnes), the average grade falls short of the 10% rule; the combined zinc-lead grade is just 8%. Which means it could work, but Glencore probably wouldn’t make much money on it.

Allow us to paint a hypothetical picture here. One way for Glencore to make the development of Pallas Green more interesting would be to combine Group Eleven’s current resource with its own Pallas Green activities. This makes sense on a lot of levels as A) the Stonepark resource is closer to surface which means the paydirt will be reached pretty fast and B) this will allow Glencore to fund the development of the ‘real’ Pallas Green deposit using the cash flow from Stonepark.

Ballinalack property, Ireland

The Big Think

Late September, Group Eleven announced its ‘Big Think’ plan. Although it does sound like a cheap marketing stunt, G11 is very serious about finding more large zinc deposits in Ireland, and is deploying a road map to get there.

The kick-off was given by the recent announcement of the Irish Geological Survey which started the Tellus Survey, an airborne geophysical survey over Ireland. Group Eleven has elected to participate in this country-wide survey and although this will cost the company some money (C$180,000), it will receive the geophysical data over 2,500 square kilometres in return, which means the participation in the Tellus survey could be very cost-effective.

The Big Think is actually based on the re-interpretation of historic exploration data, combined with the use of new exploration techniques (like geophysical and geochemical surveys). And that’s why the Tellus survey is so important for Group Eleven: the airborne survey might be able to pick up certain signatures of large zinc deposits without any indications at surface.

Group Eleven has published an excellent Q&A session on The Big Think: read it here.

The current small drill program at Stonepark will help to define the high-priority drill targets

Group Eleven has now started drilling at Stonepark to further define the geological structures that control the zinc mineralization. Although this drill program is a bit larger than the theory-focused drill program at Ballinalack earlier this year, it’s merely meant to gain a better understanding of what’s hiding beneath the surface. This will help Group Eleven to design additional drill programs which will then focus on trying to make a new discovery.

The entire 1,500-2,000 metre drill program will be focusing on zones outside of the existing resource at Stonepark, and will try to establish a connection between the volcanic complex and the ‘pods’ of zinc mineralization that appear to be located in a concentric circle around these volcanics. This drill program could go a long way to further fine-tune the exploration theory based on the zinc zones dipping under the volcanics zone.

Management

Bart Jaworski – Chief Executive Officer

- Geologist / ex Mining Equity Analyst

- 24 yrs experience (co-founder of Group Eleven)

- Including 12 yrs with Raymond James and Davy

- Regional identification of Coffee Creek anomaly

David Furlong – Chief Operating Officer

- Geologist with 24 yrs industry experience

- Co-Founder of Group Eleven

- Previously, GM at Rathdowney Resources

John Barry – VP, Exploration Strategy

- Geologist with 30 yrs experience

- Co-Founder of Group Eleven

- Previously, founder & CEO of Rathdowney Resources

Dr. Mark Holdstock – Project Manager

- Geologist with over 30 yrs experience

- Led team which discovered >20Mt ‘SWEX extension’ at Navan mine in Ireland

- Previously, MD at Aurum Exploration Services

Share structure and ownership

Group Eleven currently has 59.8 million shares outstanding and although the fully diluted share count of 81.2 million shares sounds more impressive, we would like to emphasize every option and warrant is currently out of the money. The C$0.60 warrants that were issued as part of the IPO will expire in December, and unless Group Eleven extends the expiration date of these warrants, the fully diluted share count will decrease to less than 69 million shares. On top of that, an additional 5.5 million warrants will expire throughout 2019 and with an average exercise price of C$0.40 (for 2.1M warrants) and C$0.21 (for the remaining 3.4 million warrants), these warrants are currently out of the money.

A large part of the shares are in strong hands: the management and insiders own about 15% of the stock, while MAG Silver (MAG, MAG.TO) and Teck Resources (TECK) own a combined 22% as well. Retail is good for just 54% of the shares and considering Group Eleven went public at C$0.40 per share, it’s safe to say pretty much everyone is sitting at a loss. And that includes the management team.

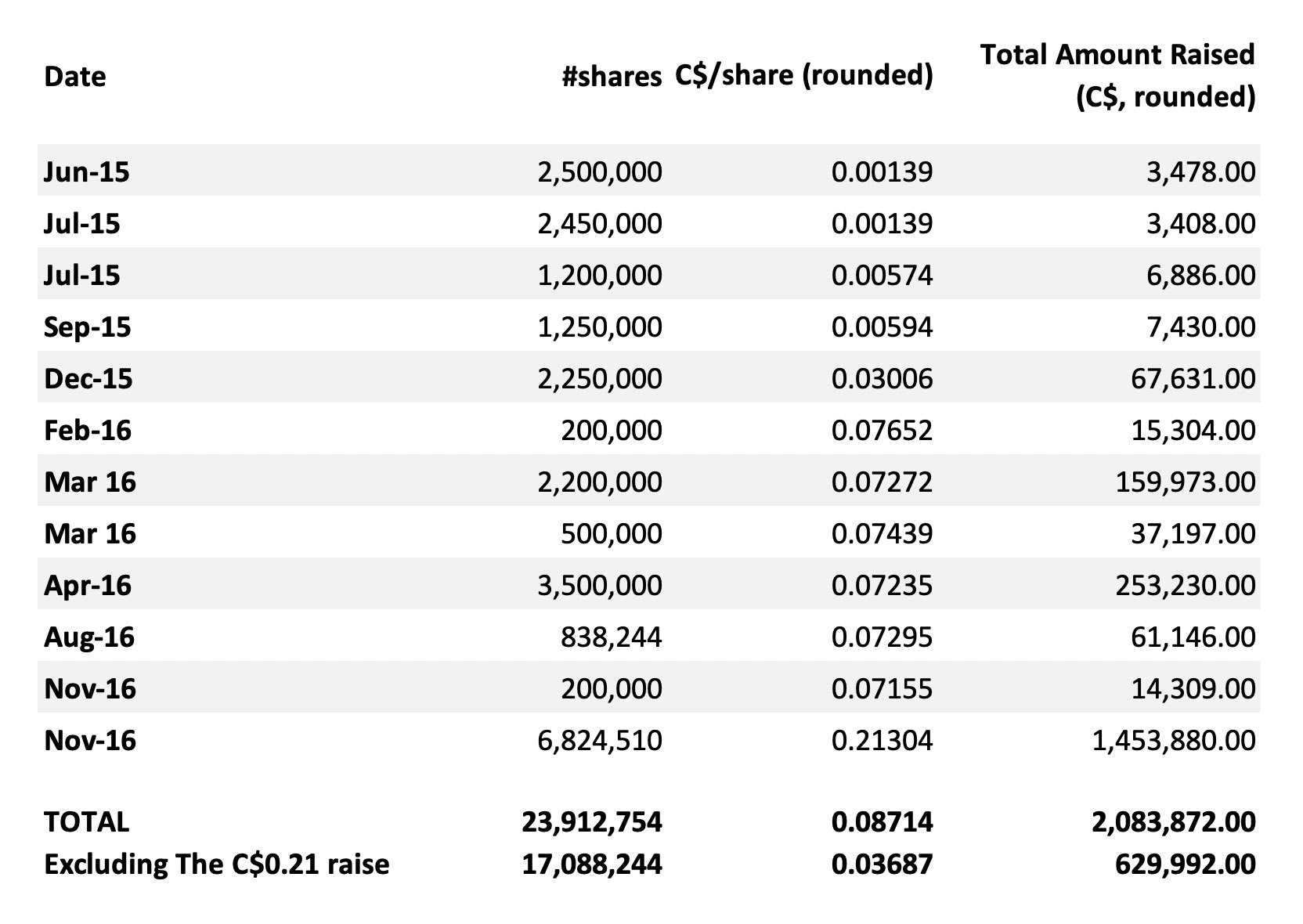

When the private company was vended into Group Eleven Resources in 2016, this happened at a pro-forma valuation of 3.6M EUR as Group Eleven issued 24 million shares valued at 0.15 EUR (C$0.225) each. In fact, every subsequent placement and option issue happened at a much higher price than where Group Eleven is trading at.

We also checked the last year’s prospectus to figure out how much money was raised in Group Eleven Mineral Exploration (‘GEME’, the company acquired for the 24.01 million shares). Including the C$0.21 raise (spearheaded by MAG Silver), the average price of the issued shares was C$0.087. Excluding the C$0.21 funding, the founders and early investors have purchased stock at an average of C$0.037/share, with 7.4 million shares outstanding (held by the three founders) at less than 1 cent per share. Note that the founders have bought shares subsequently, so their cost base is higher than implied above; for example, CEO Jaworski told us his cost base is approximately C$0.03/share. Cheap? Somewhat – but not egregious. Plus, it definitely helps to keep the management team incentivized to do a good job. And keep in mind management definitely isn’t selling any stock as there have been no filings of insider sales. In fact, CFO Shaun Heinrichs and CEO Bart Jaworski have been buying stock on the open market.

When you pay peanuts, you get monkeys, and the technical team running Group Eleven Resources deserves to be rewarded based on a stronger share price. Additionally, they decided to forego normal salaries for the first few years while setting up the company as well.

Of the 17.1 million shares, only 2.5 million shares were sold to people that aren’t insiders (under SEDI) and those would be the only shareholders that would have any real incentive to sell right now (considering their average cost base of approximately C$0.03 per share). However, as the total trading volume (on the TSX Venture, Frankfurt and OTC listings) since the IPO in Dec 2017 has been about 11.5M shares, this potential overhang is likely long gone by now.

Therefore, most people that are selling now very likely aren’t taking profits off the table, but are probably creating a tax loss (perhaps to offset the gains on marijuana deals earlier this year).

Long story short, cheap stock for the management was fairly earned and doesn’t worry us too much as it keeps their interests aligned with smaller shareholders. It’s also interesting to see how the incentive options were priced at C$0.20, a 43% premium compared to the share price of C$0.14 the day they were issued. As long as we don’t see any insider sales, we’re perfectly fine with the situation as is.

Conclusion

At a current market capitalization of C$6.7M and an enterprise value of just over half the market cap, Group Eleven Resources is an interesting option on the zinc sector. The company is deploying original exploration theories in a mature mining jurisdiction with a lot of experience in zinc, and if either just one of the Ballinalack and/or Stonepark exploration theories works out, the upside potential is sky-high.

Is there any guarantee on a successful outcome? Absolutely not. But the risk/reward ratio is very interesting given Group Eleven’s strong cash position, knowledgeable team on the ground and Ireland’s need to keep the zinc sector alive.

Disclosure: the author has a long position in Group Eleven Resources. We paid for our flights to Ireland, Group Eleven covered the local expenses. Group Eleven is not a sponsor of the website. Please read the disclaimer

One Comment