Reyna Silver (RSLV.V) is just one of the very few silver exploration companies out there as most explorers have been wiped out in the last downturn which lasted almost an entire decade. Reyna’s timing is actually impeccable. It started to put its properties together last year so the company clearly had no intention to ride on the coattails of the resurrected silver price. That makes the company even more interesting as the main assets were acquired during a period of $15 silver which means the company’s principals had to make sure they were picking up robust projects that could handle a sub-$20 silver price.

Fast forward to the summer of 2020. The silver price is trading at around $28 per ounce and pretty much every company that has ‘Silver’ in its company name is enjoying renewed attention from the market. Reyna’s share price has now quadrupled in the past few months and with in excess of C$10M in working capital and C$12.5M worth of warrants that are currently in the money, Reyna has the power to fire on all cylinders as it will hit the ground running at its Guigui and Batopilas projects in Mexico.

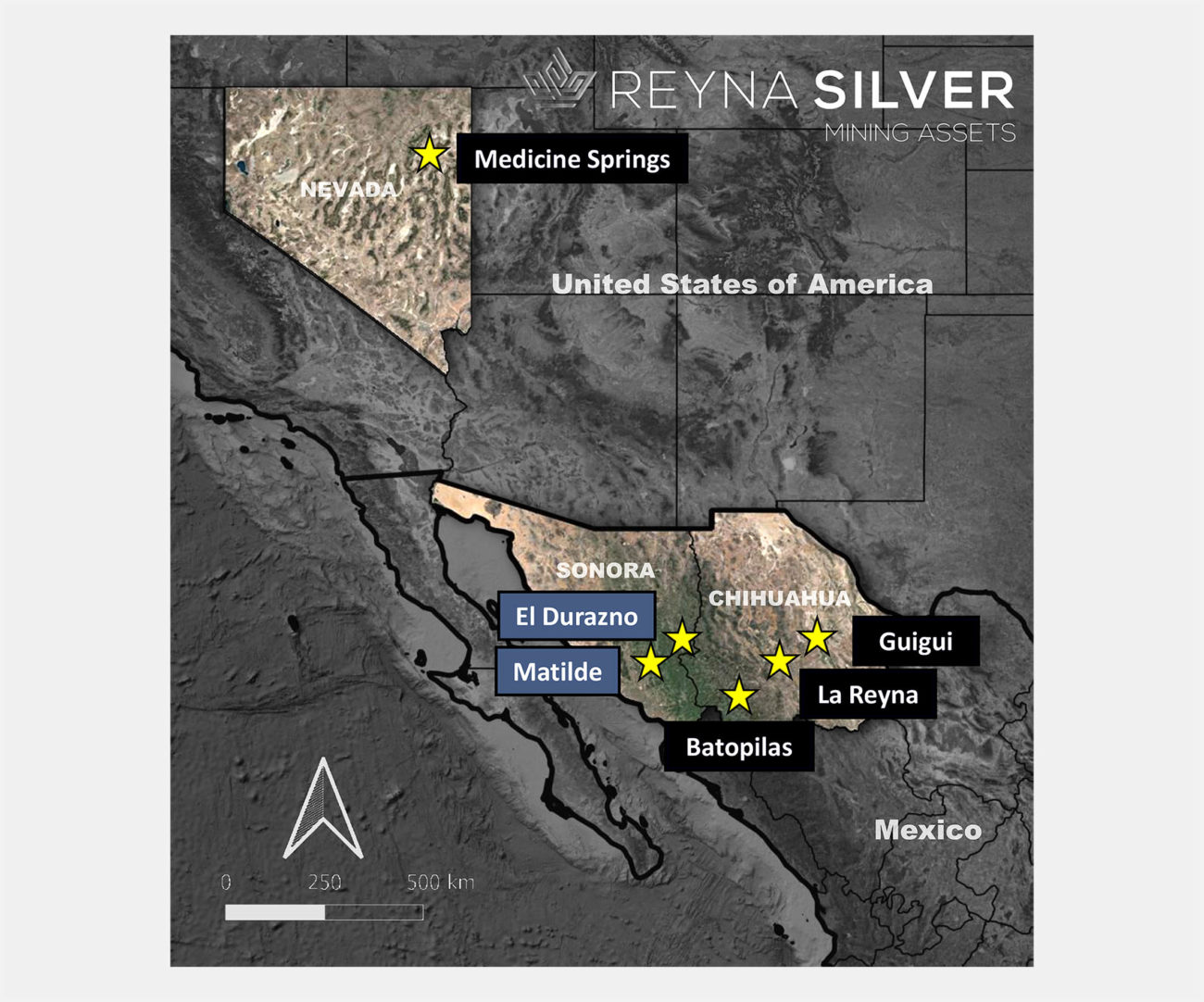

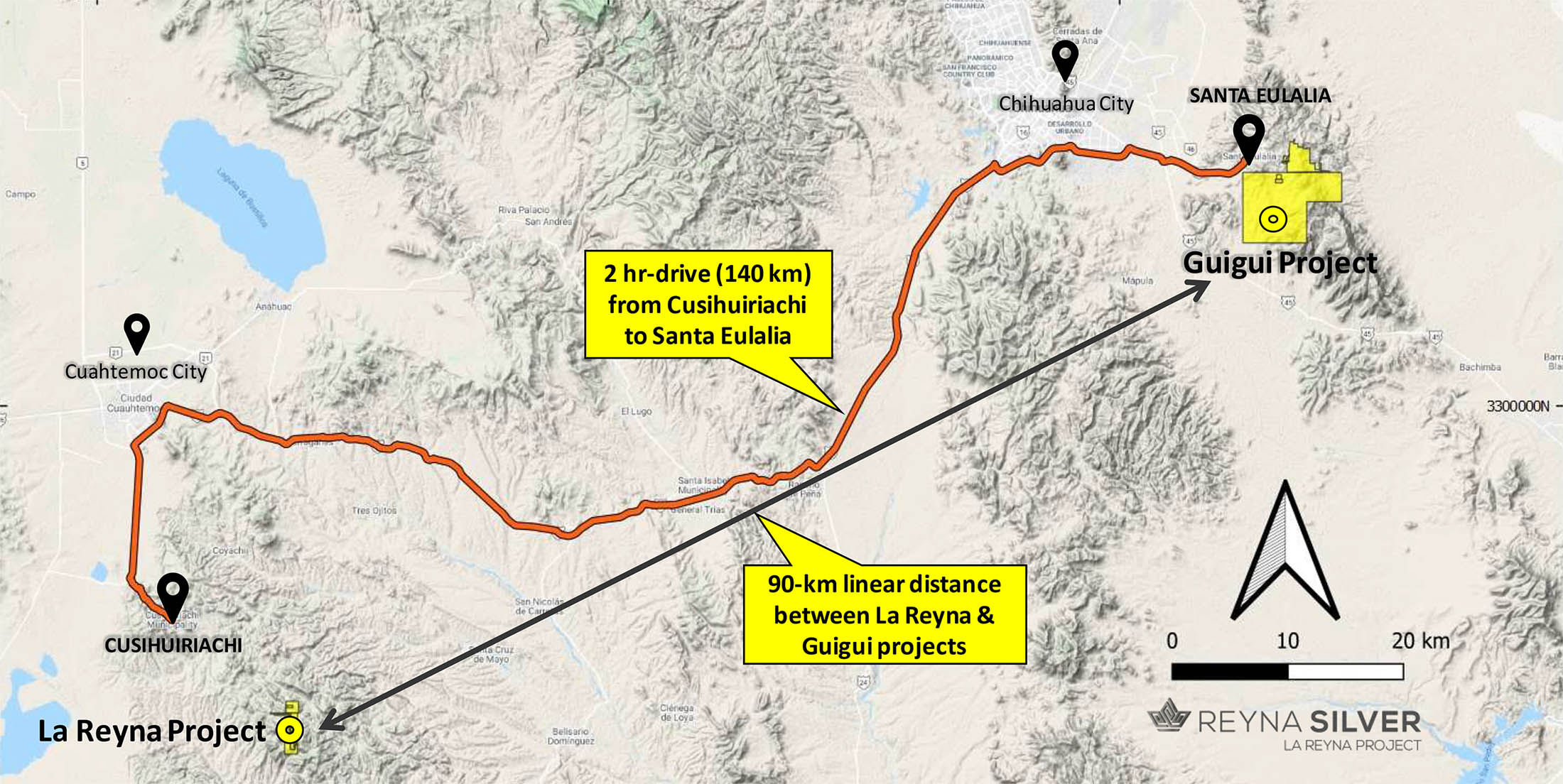

In the past few weeks, Reyna Silver also acquired two new projects, the La Reyna project in Mexico and Medicine Springs project in Nevada.

Highlighting four projects

The Guigui project

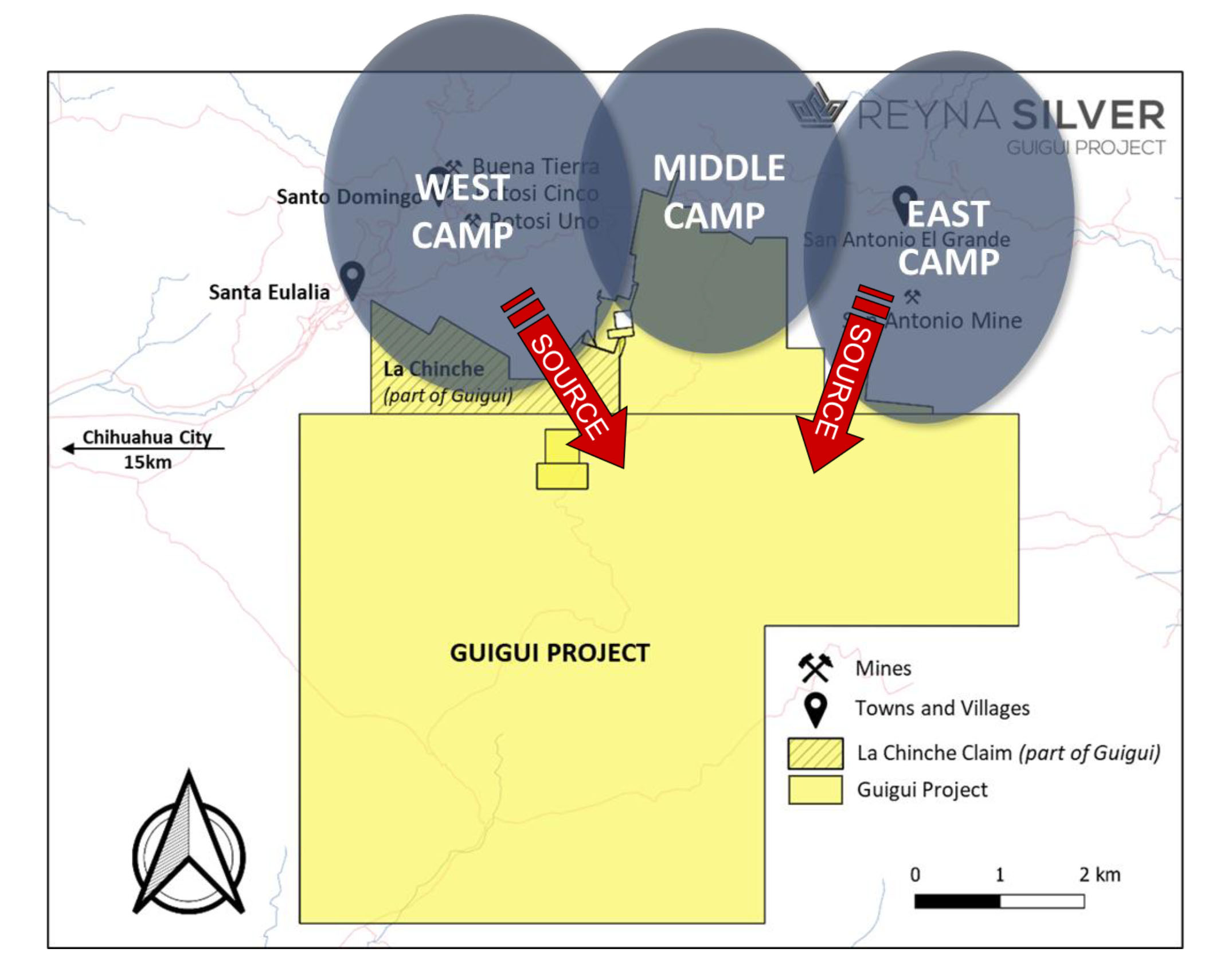

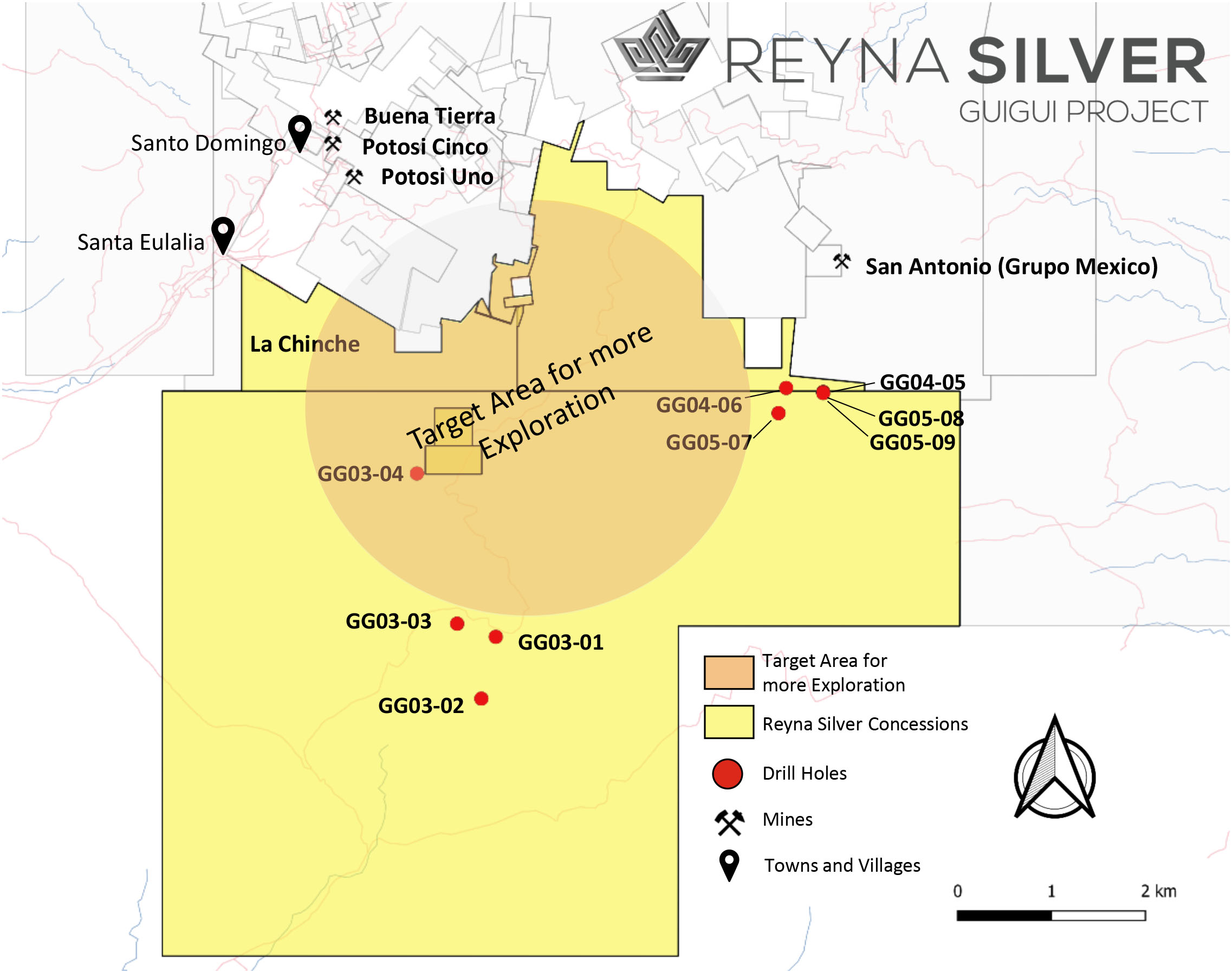

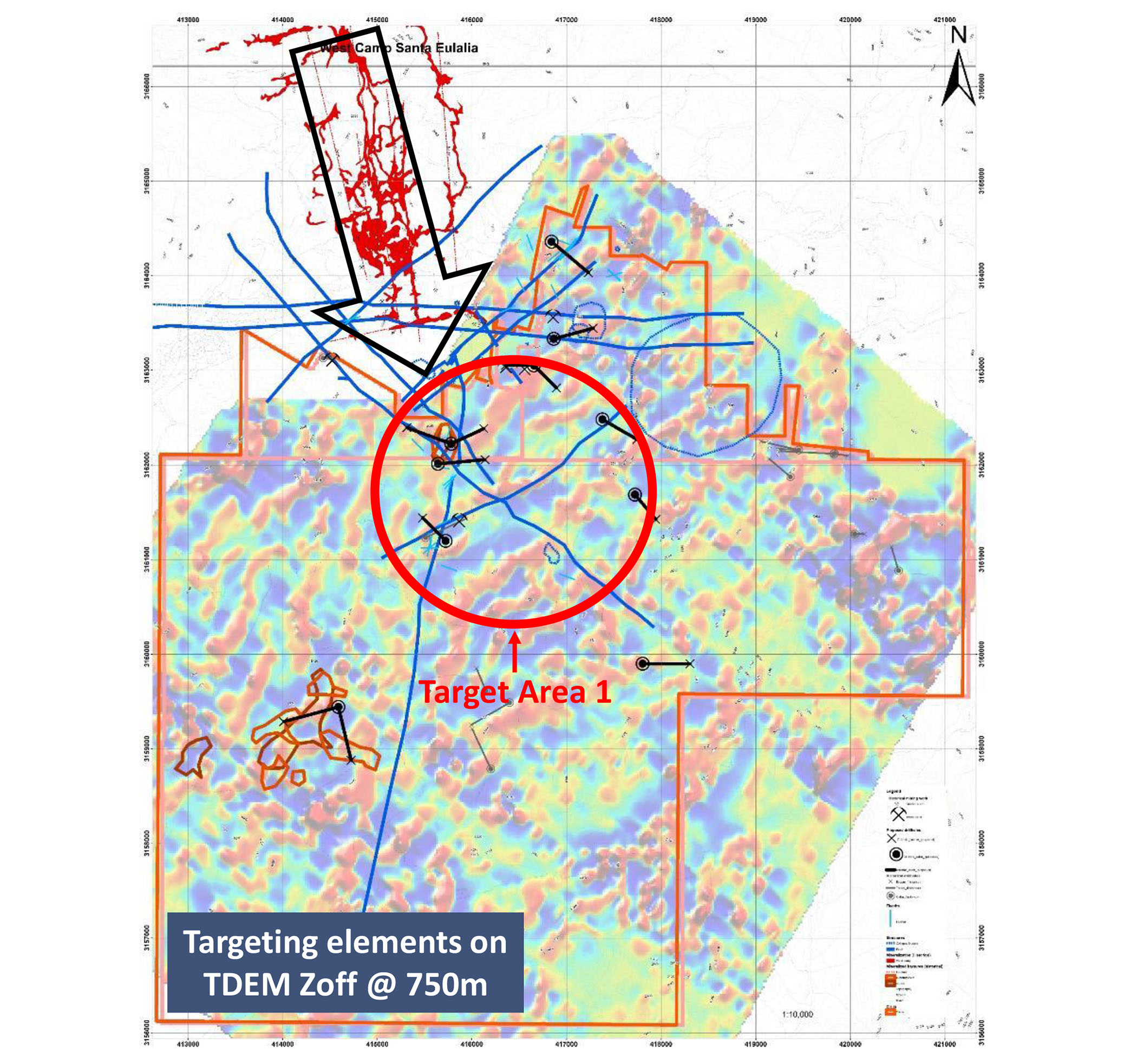

The Guigui property is Reyna Silver’s flagship project and originally consisted of just over 4,500 hectares of land (the property has since been expanded, see later). The location couldn’t have been more convenient: in the middle of the Santa Eulalia Mining district, the project is surrounded by known mineral occurrences and mines and having the city of Chihuahua in close proximity will keep exploration (and potential exploitation) expenses down as it will be easy enough to attract local labor while the mobilization expenses will remain low as well.

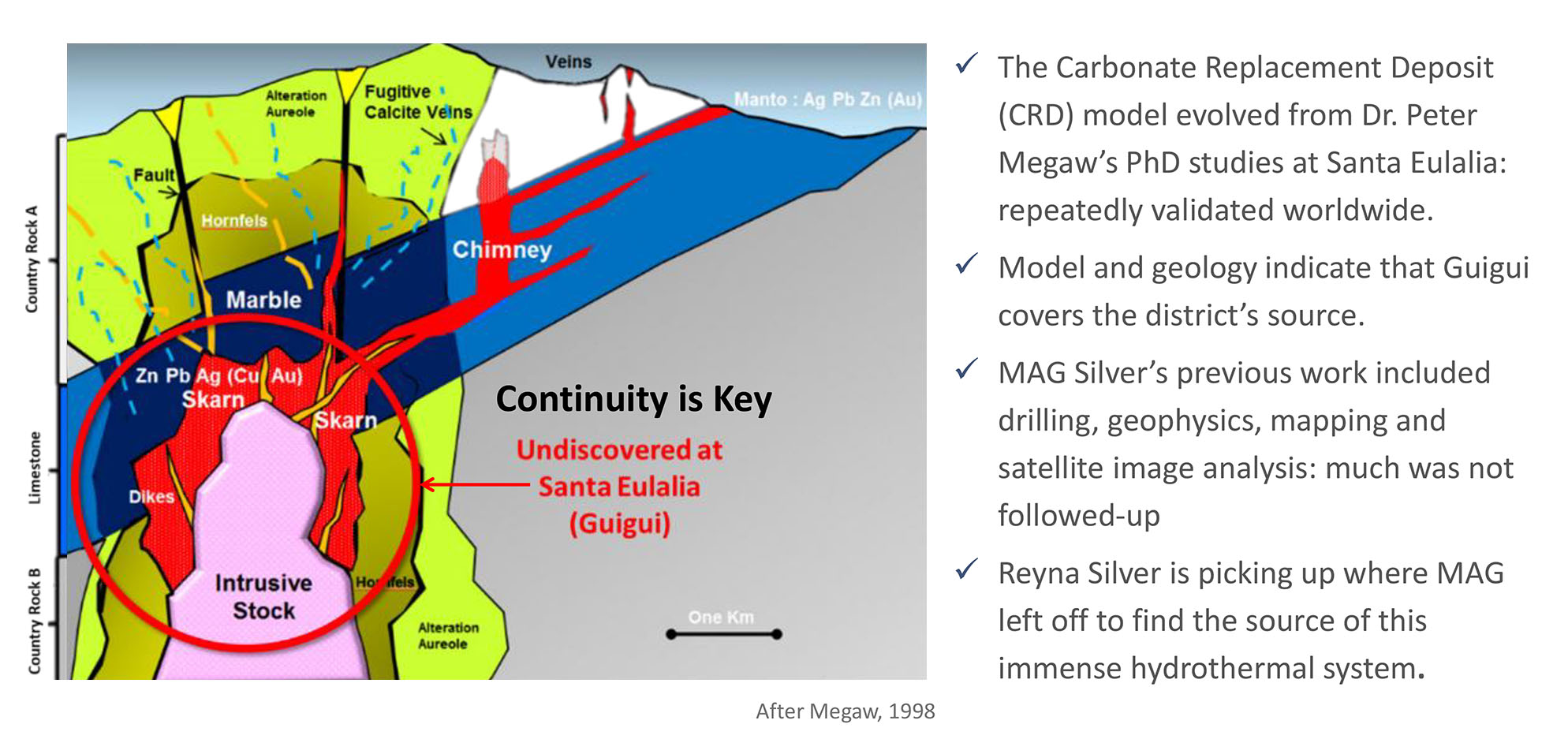

The location in the Santa Eulalia district is important, as this is one of the premier CRD (Carbonate Replacement Deposit) structures in the world that traditionally contain very high-grade mineralization. Peter Megaw, co-founder of MAG Silver (MAG.TO, MAG) is one of the world’s most renowned specialists on these types of deposits and Reyna Silver will be happy to rely on his technical expertise further down the road as Megaw accepted a position as Chief Technical Advisor at Reyna, determined to put his mark on this district.

The first occurrences of mineralization in the region were confirmed in the first few years of the 1900s and the area, including zones on the Guigui licenses have been subject to limited exploration to test some theses. However, this is the first time a company will apply a dedicated exploration approach as Reyna has signed an agreement to acquire 100% of the Guigui project.

So why is Reyna (and by extension, MAG Silver as it still owns a 19.9% stake in Reyna) so interested in Guigui? After all, the district has seen 51 million tonnes being pulled out of the ground for close to half a billion ounces of silver, wouldn’t the hills be mined out by now?

No. As you can see in one of the previous images, the source of the hydrothermal system that mineralized the areas that have been mined now remains undiscovered and it is Reyna’s belief the source of this system may actually be hiding underneath the Guigui land package. And that’s not just Reyna’s interpretation of the system, Megaw has been studying these CRD systems for the better part of the last half-century and all data appears to be pointing to the Guigui area as host of the source.

The prolific areas for historical production were the West Cap, Middle Camp and East Camp zones, and according to the geological interpretation of Megaw & team, the logical location of the source would be on the Guigui land package.

And Reyna isn’t just going on a wild goose chase. The project has been subject to a few drill programs and MAG Silver encountered the typical silver-lead-zinc mineralization on the northern edge of the license boundaries. These intervals were quite narrow but did encounter the right grades, so if anything, it does improve the odds of finding the source. The historical drill holes also helped to narrow down the specific areas that need to be drill-tested.

As Reyna will zoom in on the northern portion of the license, it also entered into an agreement to acquire the La Chinche project directly bordering the Guigui license to cover even more bases.

La Chinche is being purchased from two separate groups. Reyna has committed to making a combination of cash and warrant payments as well as making certain exploration commitments. Reyna will have to make a US$42,000 cash payment, issue 500,000 shares and 11.5 million warrants which will have to be issued every six months at exercise prices of C$0.74 (1M warrants), C$0.75 (3M warrants), C$1.00 (3.5M warrants) and 4M warrants at C$1.25.

This actually is a brilliant structure; it limits the cash outflow upfront and technically the vendors of the property will be making cash payments to Reyna Silver if the company is successful. All four warrant tranches would be in the money (assuming the share price remains above C$1.25 during the next two years) and if all warrants would be exercised, Reyna Silver will receive approximately C$11.5M from the vendors, which will actually make their money on share price appreciation rather than being paid upfront. Brilliant.

The Batopilas project

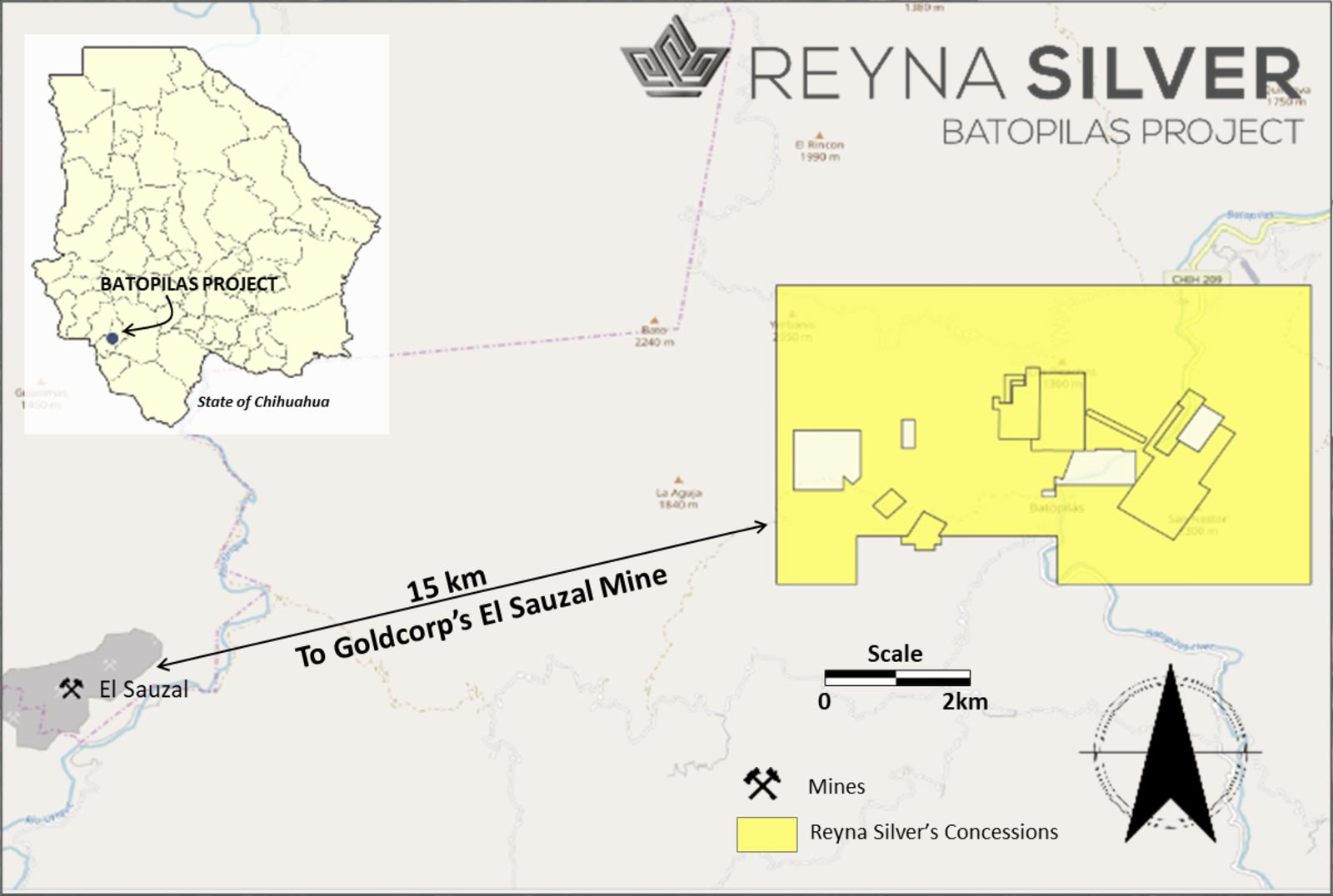

The Batopilas silver project is also located in the province of Chihuahua and currently covers almost 1,200 hectares with 30 known high-grade silver veins on them. Historical production records indicate in excess of 300 million ounces have been pulled out of the ground from high-grade vein systems with grades of up to 50 ounces of silver per tonne of rock. High-grade silver was first discovered in the 1600s and mining has occurred on an off-and-on basis in the past 300 years.

This project has been gathering dust on the shelf of MAG Silver in the past, even after a 2005 drill program encountered some ultra high-grade intervals. The eye-catcher is a 20-centimeter interval of almost 20,000 g/t silver. Granted, 20 centimeters is very narrow and this 2005 interval should mainly be seen as an indication there appears to be much more to be discovered in this past-producing silver district. The concessions owned by Reyna Silver are surrounding the town of Batopilas which really is just a decent hike away from the El Sauzal mine which was shut down in 2014 after producing about 2 million ounces of gold. Needless to say, Reyna’s claims are in an excellent location with historic production at Batopilas and a multi-million ounce precious metals mine just a stone’s throw away.

Reyna’s exploration focus at Batopilas will be zooming in on trying to follow up on the high-grade veins with native silver where the vast majority of the historical production was sourced from. But even more interesting is the idea to start targeting the mineralization styles that hadn’t been considered in the past. Historical activities were focused on the native silver veins and pretty much ignored the traditional silver-lead-zinc mineralization you would expect to be present as well. Miners in the 1600s couldn’t care less about these two base metals but with zinc at $1.15/pound and lead at $1/pound, lead and zinc are two very useful by-products.

Although trying to find the veins with native silver and the potential silver-lead-zinc structures is interesting, there’s one big prize Reyna Silver will be chasing as well. Substantial mapping programs have shown that several of the vein systems are diverging from one common point, now called the ‘Asterisk’ by Reyna Silver. The exploration theory is that this Asterisk zone may very well contain a the feeder structure that actually mineralized the vein systems.

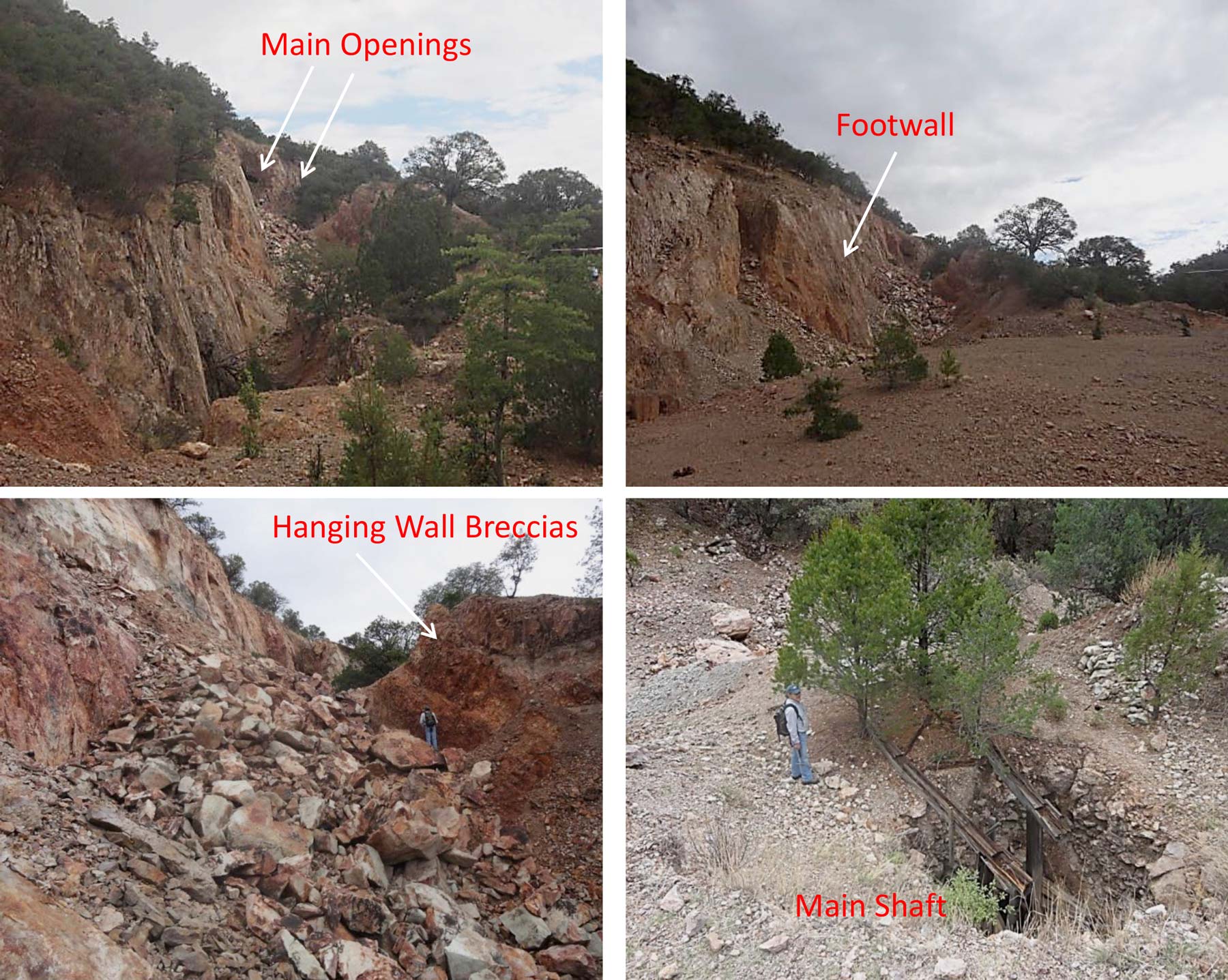

Of course, it is what it is, an exploration theory. But with an excellent theorist like Peter Megaw who has decades of experience under his belt and has been keeping close tabs on the Batopilas district for the past two decades, the credibility of this exploration theory is quite strong. Of course, there’s only one way to find out and that will be by drilling this zone and that’s something Reyna Silver will very likely get to in the not so distant future but the near-term focus will be on the vein systems and the rehabilitation of the old Porfirio Diaz tunnel. Once the rehabilitation is complete, Reyna’s technical team will be able to go underground to have a closer look at the old mining works.

La Reyna – a new acquisition in Chihuahua, Mexico

On October 1st, Reyna announced it had entered into an agreement to acquire Exploradora La Reyna which owns the 300 hectare La Reyna silver project in Chihuahua. La Reyna is located less than 150 kilometers by road from the Guigui project and includes two past-producing high-grade silver mines (La Princesa and La Reyna) which have never been drilled. Despite the lack of any modern exploration activities the Mexican Geological Survey estimates the historical production in the Seventies and Eighties to have been roughly 30,000 tonnes at an average grade of 300 g/t silver (for about 300,000 ounces of silver) with grades up to several kilos per tonne of rock.

Although the production indicates the total output was limited (mainly due to the lack of records from the period 1890-1970 during which two shafts were completed), it’s intriguing to see the miners were actually able to pull the rock out of the high-grade areas and we’d like to think that a dedicated exploration program using modern techniques will go a long way to figure out if there are larger quantities of silver-bearing rock at La Reyna.

Despite these indications of the presence of high-grade silver the total price tag to acquire the project seems low and it looks like Reyna Silver was able to negotiate a very good deal. The total cash payments are just US$1.3M payable over a 4 year period with approximately 2/3rd of the cash payments due on the third and fourth anniversary of the agreement. So basically Reyna is buying an option to explore the asset for the next three years for less than half a million US Dollar. Does the La Reyna property meet the company’s minimum criteria? Great, then it can continue to make the payments. Does the project not meet the expectations? Reyna Silver can walk away with minimal financial damage. A 2.5% NSR will also be issued, but the entire NSR can be repurchased for US$2.5M (US$0.5M per tranche of US$0.5M the company would like to repurchase).

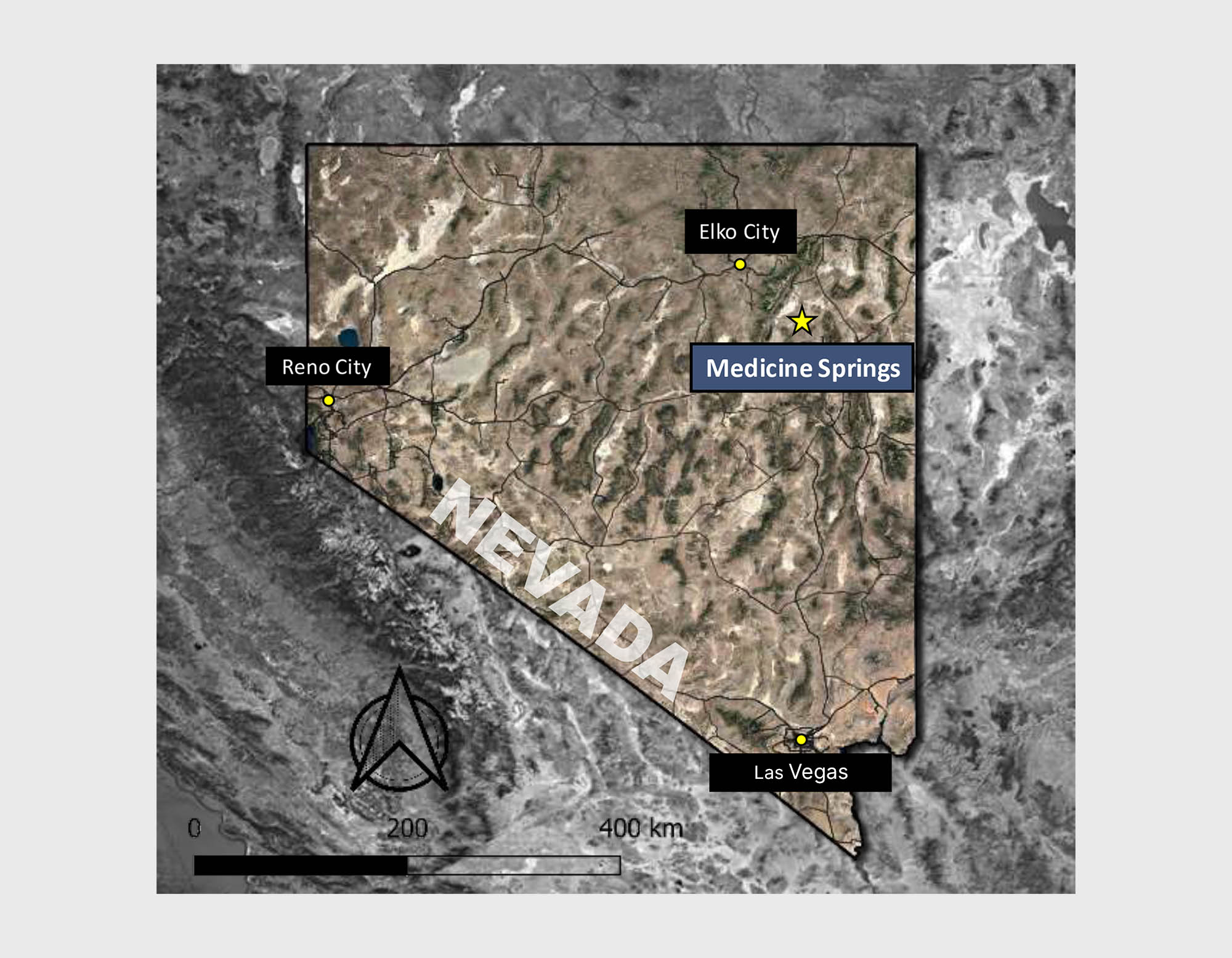

Medicine Springs – venturing into Nevada

Just a few days after the La Reyna announcement, Reyna Silver also announced a surprising deal outside of Mexico as it entered into an agreement to acquire majority ownership of the Medicine Springs project in Nevada in Nevada.

Although Nevada is predominantly known for its gold production these days, there’s a reason why this state is called the Silver State. So it hardly is a surprise Reyna Silver is effectively targeting a silver system as previous exploration activities at Medicine Springs indicate it potentially hosts a CRD target and this quote from Peter Megaw sums up why this project was appealing to Reyna Silver:

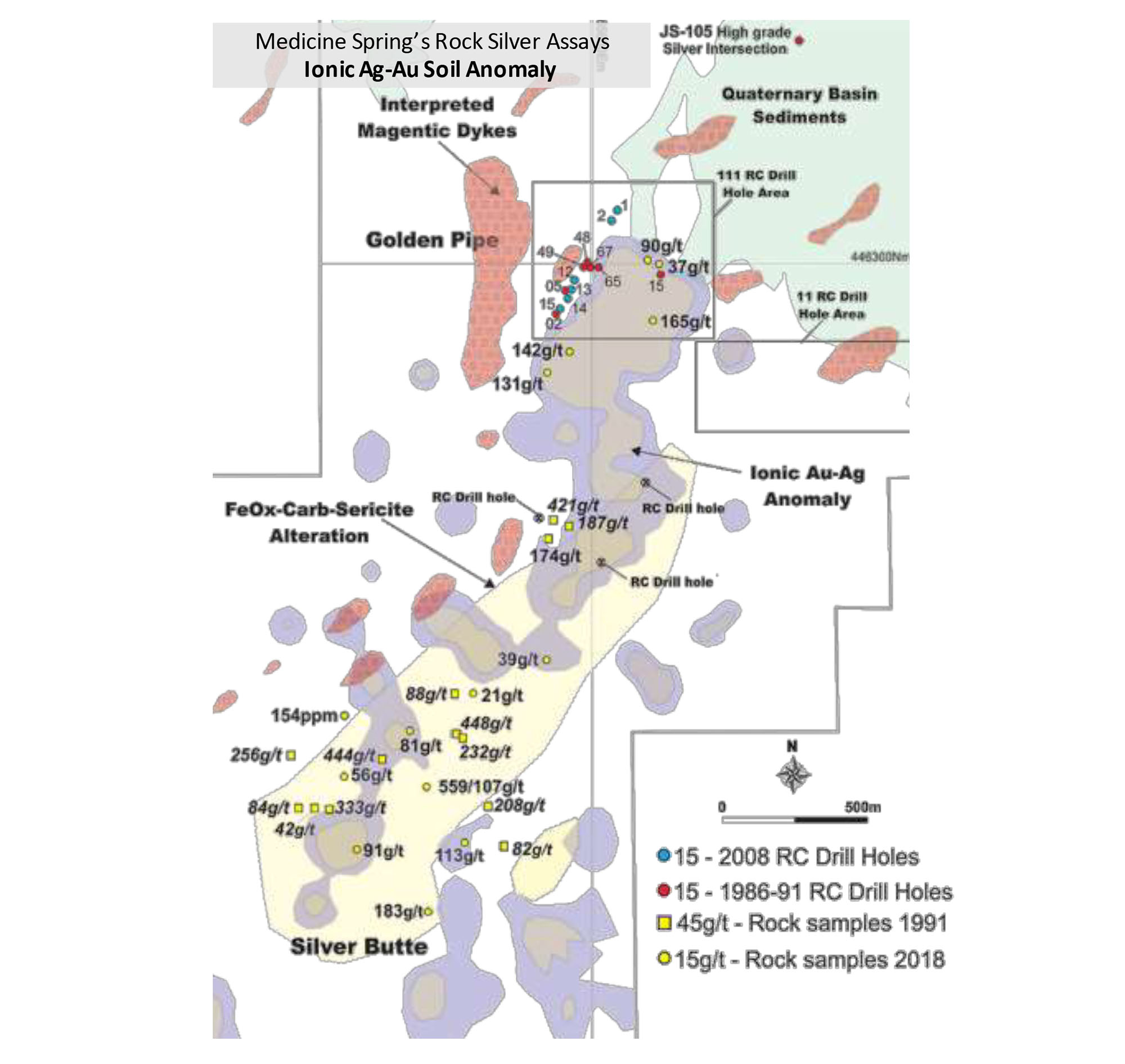

“Medicine Springs ticks the most important boxes we look for in CRD exploration including location on a large regional structure that hosts significant CRDs, situated at the top or a thick section of potentially favorable carbonate host rocks and evidence of high silver grades. Some of the dump and rock chip samples run well over our 400 g/t (12 oz/t) silver threshold and it is quite likely that similar grades were diluted by the Reverse Circulation drilling used historically in the district. We will be drilling core to get a true picture of the clearly structurally-controlled mineralization as we trace it towards its source.”

Indeed, the Medicine Springs project has been subject of an RC drill campaign that focused on drilling pretty shallow holes (according to Reyna’s presentation, a total of 125 reverse circulation holes were drilled to an average depth of 43 meters), barely scratching the surface.

Despite this relatively low-key approach, the drill bit interested some very interesting silver values with 33 meters of 90 g/t silver, and 6 meters containing 225 g/t silver. Plenty of data to make Reyna Silver very interested in the asset, and Megaw will design a drill program to get a better idea of what’s controlling the mineralization.

And just like the La Reyna acquisition, the purchase of a majority stake in Medicine springs by assuming the commitments to the underlying property vendor where after a 75/25 joint venture will be established. Reyna Silver will subsequently be able to buy an additional 5% stake for US$1M in cash where after Northern Lights and Reyna will form a 20/80 joint venture whereby Northern Lights’s ownership will be diluted if it doesn’t contribute its fair share.

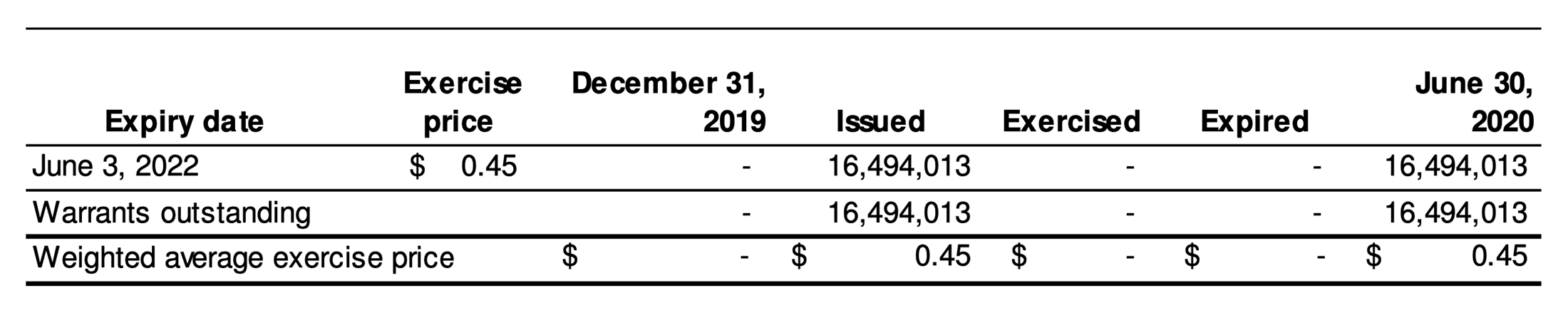

Reyna Silver and the cap table

Right before Reyna started to trade, the company issued raised C$6.6M by issuing almost 33 million units at C$0.20 with each unit consisting of one common share and half a warrant allowing the warrant holder to purchase an additional share of Reyna at C$0.45 within 24 months from closing the RTO (June 4, 2022). Raising almost C$7M was a great achievement as you need to keep in mind the majority of the cash was raised in the first few months of the year, way before the silver price started to move again.

As of the end of June, Reyna Silver had a working capital position of approximately C$5.5M which puts the company in excellent shape but as the share price started to move along with the silver price, Reyna decided to make hay while the sun shines and closed a new C$7M placement consisting of 11.3M units at C$0.62 per unit (more than three times higher than the C$0.20 initial capital round). The new units consisted of one share and half a warrant with each full warrant entitling the warrant holder to acquire an additional share for C$0.90 until August 19th, 2022.

This means we can now reasonably estimate Reyna’s working capital position to be around C$10-11M. Although this is a very healthy cash position, we think it would make a lot of sense for the company to raise even more money at a higher price than the previous two rounds – if the cash would be available..

But even if Reyna doesn’t raise any cash in the next few weeks and months, the current C$12M working capital position in combination with the warrants that are in the money are basically securing the company’s financial future.

The 16.5M warrants at C$0.45 are very deeply in the money now and if/when they are exercised, approximately C$7.5M will hit Reyna’s treasury. Additionally, the 5.65M warrants issued in August with an exercise price of C$0.90 also have the potential to add an additional C$5M in cash.

So assuming Reyna’s share price remains in a C$0.90-1.10 range, the current working capital position and the expected incoming C$12.5M from warrant exercises (+ the C$11.5M that could be expected from exercising the La Chinche warrants) should cover the exploration and overhead budgets for years to come.

Management

Jorge Ramiro Monroy, Chief Executive Officer

Founder and Managing Director of Emerging Markets, a mining-focused investment company based in Hong Kong and which has participated in the financing of numerous TSX Junior and Mid-tier exploration and mining companies.

He is a director of Prime Mining TSX.PRYM and Arabian Shield Resources.

Jorge holds a Bachelor’s degree from the State University of New York, an MBA in Finance from the Hong Kong University of Science and Technology and currently doing a Certificate in Mining Studies from the University of British Columbia.

Ariel G. Navarro Herrera, MSc Geology, VP Exploration

Mr. Navarro is a geologist with 25 years of experience in mineral exploration mainly in Mexico.

He started his career with Phelps Dodge Newmont Gold in the exploration of epithermal deposits in the Sierra Madre Occidental, Sierra Madre Oriental, Potosino Altiplano, and Trans-Mexican Volcanic Belt (TMVB). For 4 years, he became the Chief Exploration Geologist (NW Region) of GoldGroup Mining.

Most recently, he was an exploration geologist for Pan American Silver with focus on precious metals in epithermal and porphyry deposits, and mineralized structures such as breccia pipes and diatremes in the Mexican states of Sonora, Sinaloa, and Chihuahua.

Rene Ramirez, BS Geology, Senior Exploration Manager

Rene Ramirez is one of Mexico’s most well regarded silver exploration geologists.

He was part of the team that made the Junicipio discovery and which is one of the highest-grade silver deposits in the world.

He was also part of the team that discovered La Platosa’s CRD deposit for Excellon Resources.

He has been exploring Reyna Silver’s asset Guigui since the late 90’s.

Advisory board

Peter K.M. Megaw, Chief Technical Advisor

Consulting Geologist and President of IMDEX/Cascabel and co-founder of Minera Cascabel and MAG Silver, has 40 years involvement in Mexican geology and is well-known in the Mexican mining industry. He has been a frequent speaker at international academic and technical symposia.

His Ph.D. work at the University of Arizona was an exploration-focused geological/ geochemical study of the Santa Eulalia Ag-Pb-Zn District, Chihuahua and Carbonate Replacement Deposits (CRDs) in general. He has published extensively on CRDs in both geological and mineralogical journals and books.

Dr. Megaw and his team are credited with the significant discoveries at Platosa, Durango (Excellon Resources), Juanicipio-Fresnillo, Zacatecas (JV between Fresnillo & MAG Silver), Pozo-Seco/Cinco de Mayo, Chihuahua (MAG Silver).

Peter Jones, Chairman of the Board

Peter was instrumental in development and transformation of HudBay Minerals Inc. (“HudBay”) and its predecessor, Hudson Bay Mining and Smelting Company, Ltd. (“HBMS”).

As the CEO of HudBay, in 2004 he orchestrated the company’s initial public offering and acquisition of HBMS from Anglo American. Peter oversaw HudBay’s emergence until 2008, and its turnaround after re-joining in 2009. Previously, he was CEO of HBMS (2002-2004).

Peter currently, serves on the boards of Mandalay Resources Corporation, Victory Nickel Inc. and Rubicon Minerals Inc.

Conclusion

There’s only a handful of silver exploration companies out there and that has caused the valuations to reach levels we would have laughed you out of the room with during the summer if you would have told us just six months ago. Fortunately, the share prices and market capitalizations have now come back down to more reasonable levels and at the current share price of C$1.1, Reyna Silver currently has a market capitalization of C95.9M which appears to be very reasonable for a company that still has to put a resource estimate together. Sure, investors are anticipating future exploration successes, and given the strong team involved with Reyna Silver and the implied backing of MAG Silver a certain premium is certainly justified and warranted.

Interested parties should realize the four-month lock-up period of the C$0.20 round expired in early October and it’s just common sense (and basic capitalism) to expect a portion of the 33M shares to hit the market in the next few days and weeks. It will be up to Reyna Silver’s exploration team to deliver on the expectations in a way the market can absorb the shares that will come out of lock-up as there’s only one recipe that could help investors refrain from selling: keeping the hope and anticipation of even better results and higher share prices alive. With an anticipated initial drill program at Guigui in Q4 and getting Batopilas drill-ready by the end of this year, Reyna should be in a position to deliver a continuous news flow as it re-enters two exciting past-producing silver districts.

One very important factor that Reyna Silver has got going for itself is the strong treasury. We expect a net working capital north of C$10M as of the end of the third quarter (and perhaps even closer to C$12M depending on how many warrants have been exercised) and this, combined with the C$12.5M in proceeds should the existing warrants be exercised means there’s no need for Reyna Silver to go back to the market anytime soon. And if it does raise more money, it would be a sign of strength.

Reyna Silver has the right team, the right projects and the money to complete a substantial exploration program. Now it will be up to the company to make sure its exploration results justify the current C$95M valuation and become a platform to build the company out to an established multi-project silver company with projects that could and should be viable at $20 silver.

Disclosure: The author has a long position in Reyna Silver. Reyna Silver is a sponsor of the website.