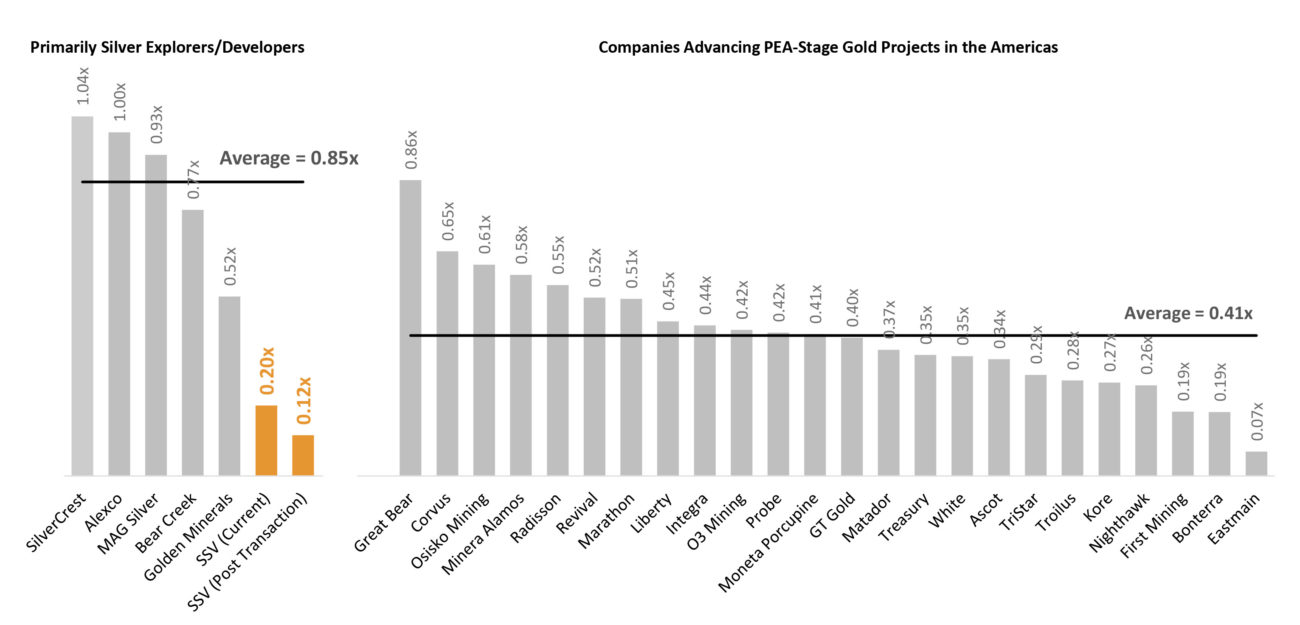

Companies owning a minority interest in their flagship project generally don’t enjoy a good valuation by the market as they basically remain at the mercy of their majority partner. This has been the case for Southern Silver Exploration (SSV.V) the past few years. Electrum (private) earned a 60% stake in the Cerro Las Minitas polymetallic project and although our preliminary calculations (which you can find here) indicated an after-tax NPV7% of around US$295M (of which 40% was attributable to Southern Silver), the company continued to trade at a large discount to this presumed value (which makes sense as there is no official PEA yet).

Southern Silver has now entered into an agreement with Electrum to acquire the 60% stake the latter owns. This will allow Southern Silver to consolidate the ownership of the project again and although there will be substantial cash payments required, it is a good (and probably the only acceptable) move for Southern Silver to advance the project and hopefully see a re-rating further down the road.

The deal terms

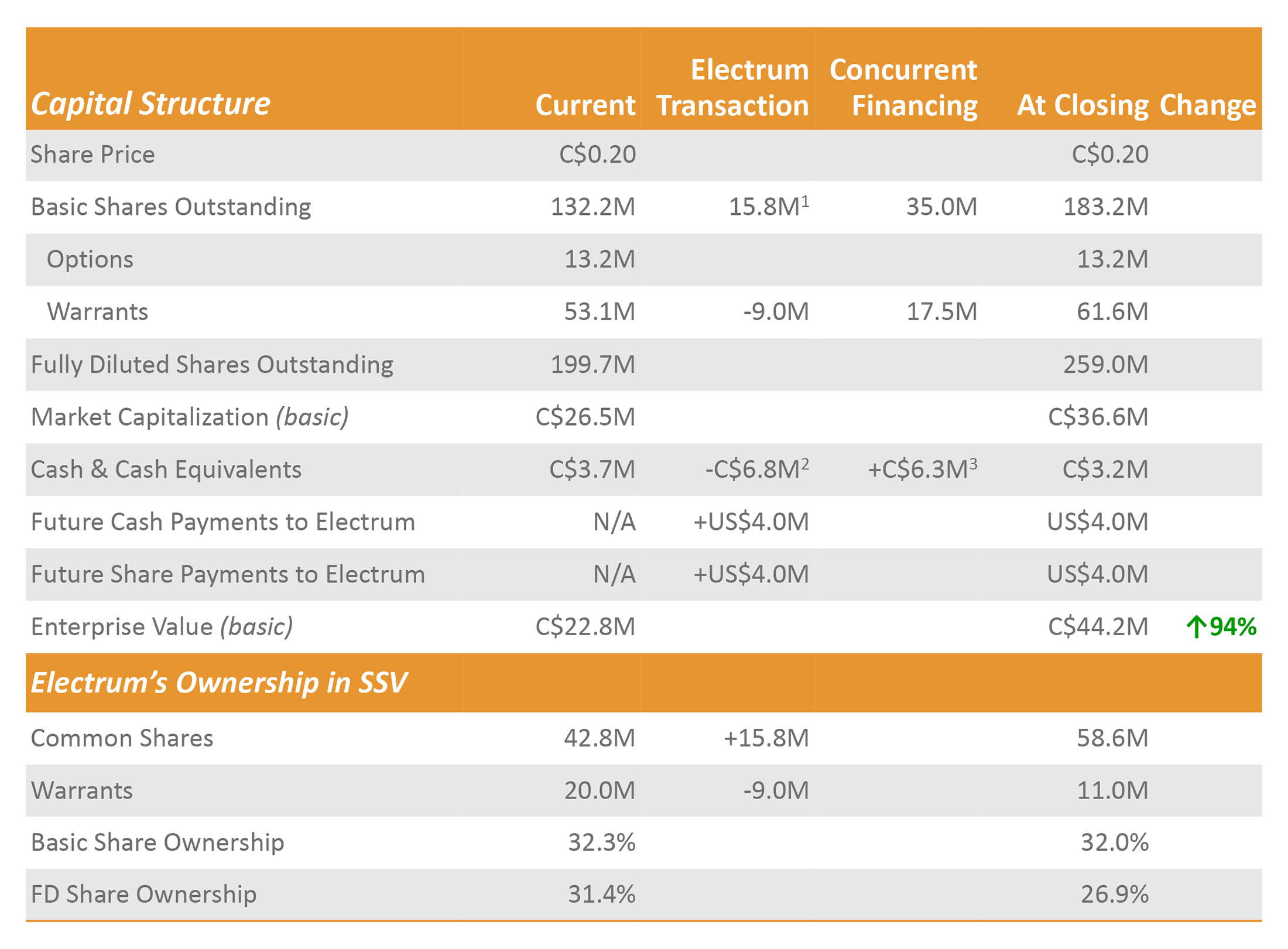

Fortunately, the acquisition terms to purchase Electrum’s 60% stake in Cerro Las Minitas are straightforward as Southern Silver needs to make straight cash and stock payments.

At closing (September 2020 is the anticipated closing date), Southern Silver needs to make a US$5M cash payment and issue US$2M worth in stock. As Southern Silver has made a cash deposit upon signing the initial agreement, the remaining stock payment will be roughly C$1.35M (depending on the USD/CAD exchange rate). At the current share price, this would result in an additional 6.5M shares that will have to be issued to Electrum.

Six months after closing (March 2021), Southern Silver will have to make an additional US$2M cash and US$2M stock payment to Electrum.

Twelve months after closing (September 2021), SSV will have to make a final cash payment of US$2M and a final stock payment valued at US$2M as well.

The company also described how the issue price of the share payment will be determined and to make it easier and more comprehensible, we have outlined a few scenarios here below. The deemed issue price will be the greater (‘higher’) of either the 20-day VWAP before the payment date or the Discounted Market Price as explained in the TSX Venture Exchange policy. We checked the policy (here) and the discount for companies trading below C$0.50 (which is the case for Southern Silver) is 25%.

So if the 20-day VWAP is C$0.20, but on the final day the share price of Southern Silver closes at C$0.30, US$2M of stock will be issued at C$0.225 as the 25% discount to C$0.30 is higher than the 20-day VWAP.

This also works the other way around. If the 20-day VWAP is C$0.20 but Southern Silver closes at C$0.15, the company will still be able to issue the shares at a deemed price of C$0.20.

The share component is an important part of the purchase price and it’s positive to see the terms to establish the deemed issue price appear to be fair and reasonable, and Electrum hasn’t forced suffocating terms on Southern Silver.

Why this deal makes sense from Southern Silver’s perspective

Cerro Las Minitas clearly is Southern Silver’s flagship as it continues to grow and expand the mineral resources from the earlier reported 2018 estimate of 209 million ounces silver-equivalent. Cerro Las Minitas (hereafter sometimes called ‘CLM’ for simplicity sake) is Southern Silver’s 34,500-hectare property located towards the northeast of the city of Durango, in Mexico’s Durango state which is just a short drive away.

Southern Silver started the earn-in procedure to acquire a 100% ownership in these claims in 2010, and in 2014 it completed the requirements of this earn-in agreement. Once it owned the entire project, SSV was able to attract the Electrum Group as a joint venture partner with Electrum earning up to a stake of 60% in the property through a US$5 million earn-in (it’s this 60% stake Southern Silver is now repurchasing). The injection of cash was just what the project needed and resulted in 24,500m of additional core drilling, allowing Southern Silver to publish an initial mineral resource estimate in 2016.

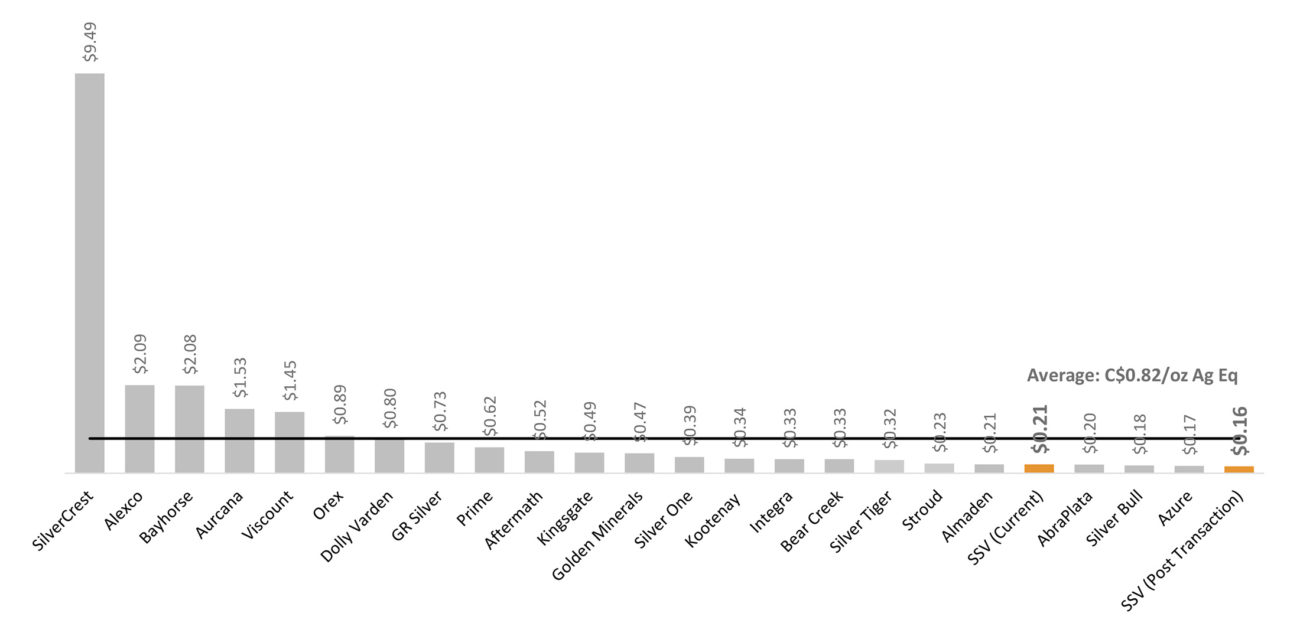

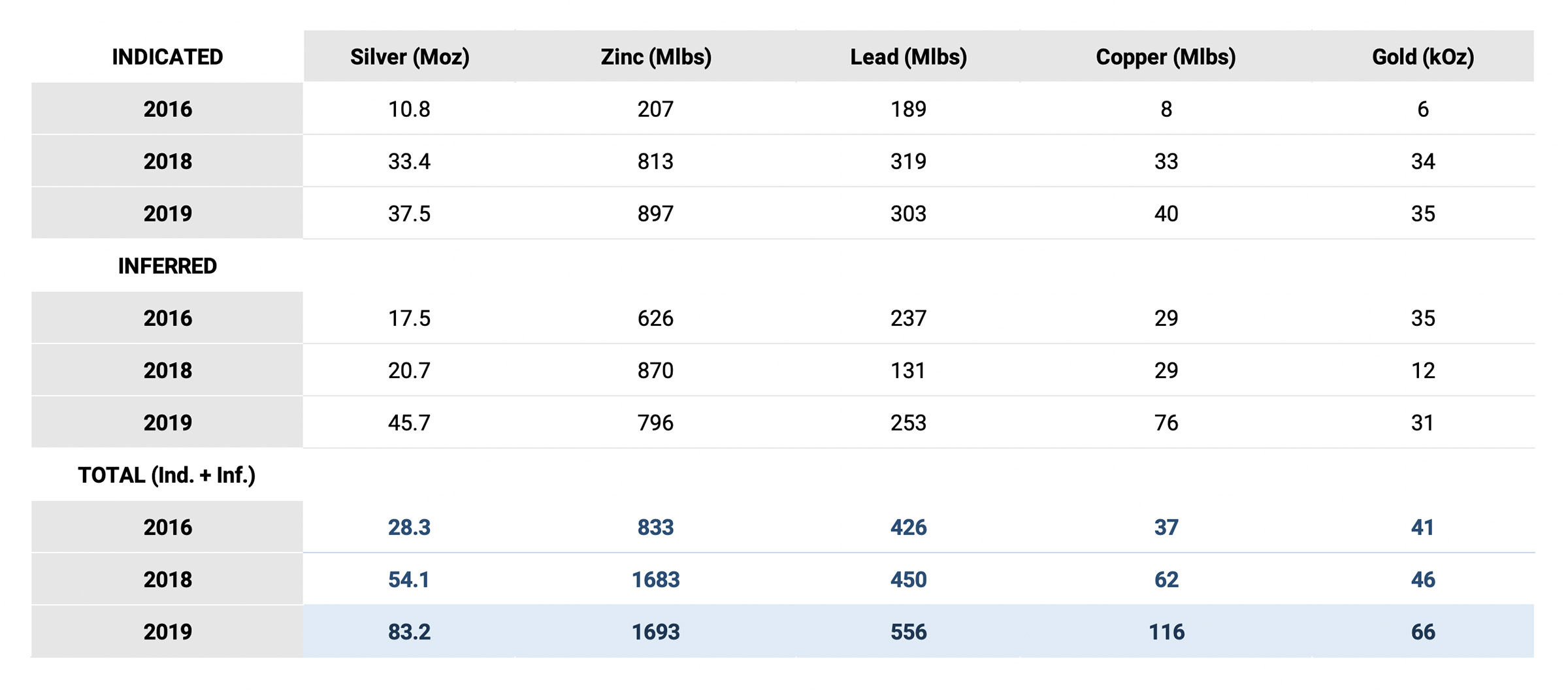

The company has come a long way since then, and the current resource stands at 134 million ounces silver-equivalent in the indicated category and 138 million ounces equivalent in the inferred resource category. In the next table, we are combining the indicated and inferred resources into a global resource (which obviously is not NI43-101 compliant, but we just want to highlight the resource increases over the past few years).

As you notice, just under 1/3rd of the silver-equivalent resource is actually silver and the base metals play a very important role at Cerro Las Minitas. There also is some gold, but even at the current gold price, the gold won’t make a huge difference and perhaps selling off a gold stream could be something for Southern Silver to look into once it needs to determine a financing mix if a positive feasibility study is followed by a construction decision (we are still a few years away from that point).

You can re-read our back of the envelope NPV calculation here (and we will soon provide an updated calculation), but keep in mind Southern Silver has not completed a Preliminary Economic Assessment yet, so you should take our calculations for what they are: a basic back of the envelope calculation based on assumptions we think are reasonable.

The concurrent financing

As of the end of January, Southern Silver had a working capital position of C$3.7M which was rather comfortable, but the company obviously needed more cash to make the first US$5M cash payment. Electrum seems to be flexible as they have exercised 9M warrants at C$0.15 for total proceeds of C$1.35M which was subsequently paid to Electrum as a deposit and will be deducted from the first US$2M share payment (which means approximately C$1.35M will have to be made in stock payments based on either the VWAP or Discounted Market Price). The current share count is approximately 141.3M shares before the announced C$7M raise.

Southern Silver has engaged Red Cloud Securities to market a C$7M placement with 35 million subscription receipts priced at C$0.20. The subscription receipts will be converted into units (with one share and ½ warrant) upon completing the transaction with Electrum (sometime in September). The half warrants will be valid for three years and will see their strike prices increase every year. The first year, the warrants can be exercised at C$0.25, followed by C$0.30 in Y2 and C$0.35 in Y3. Southern Silver is initially targeting a C$7M raise but has granted the agents the option to add an additional C$3M of subscription rights to the offering if the demand outsizes the size of the initial C$7M placement.

Keeping the exercise price low in the first year very likely is a strategy of Southern Silver to get some warrants exercised in the first 12 months as that could help to cover the two US$2M cash payments 6 and 12 months after the closing date.

Conclusion

The purchase of the 60% of Cerro Las Minitas it doesn’t own makes a lot of sense for Southern Silver. This also means the next 2-3 years will be the ‘years of the truth’ as Southern Silver can no longer make excuses for underperforming, and securing full ownership of Cerro Las Minitas should help the company to bring the message across in a clear way. By having full ownership, Southern Silver calls the shots and can advance the project as it desires, and in a way the management expects to unlock full value.

Owning 100% of Cerro Las Minitas will make a lot of lives easier, and assuming the capital raise remains limited to C$7M, the company will have less than 177 million shares outstanding for a market capitalization of around C$35M.

Disclosure: The author holds a long position in Southern Silver. Southern Silver is a sponsor of the website.