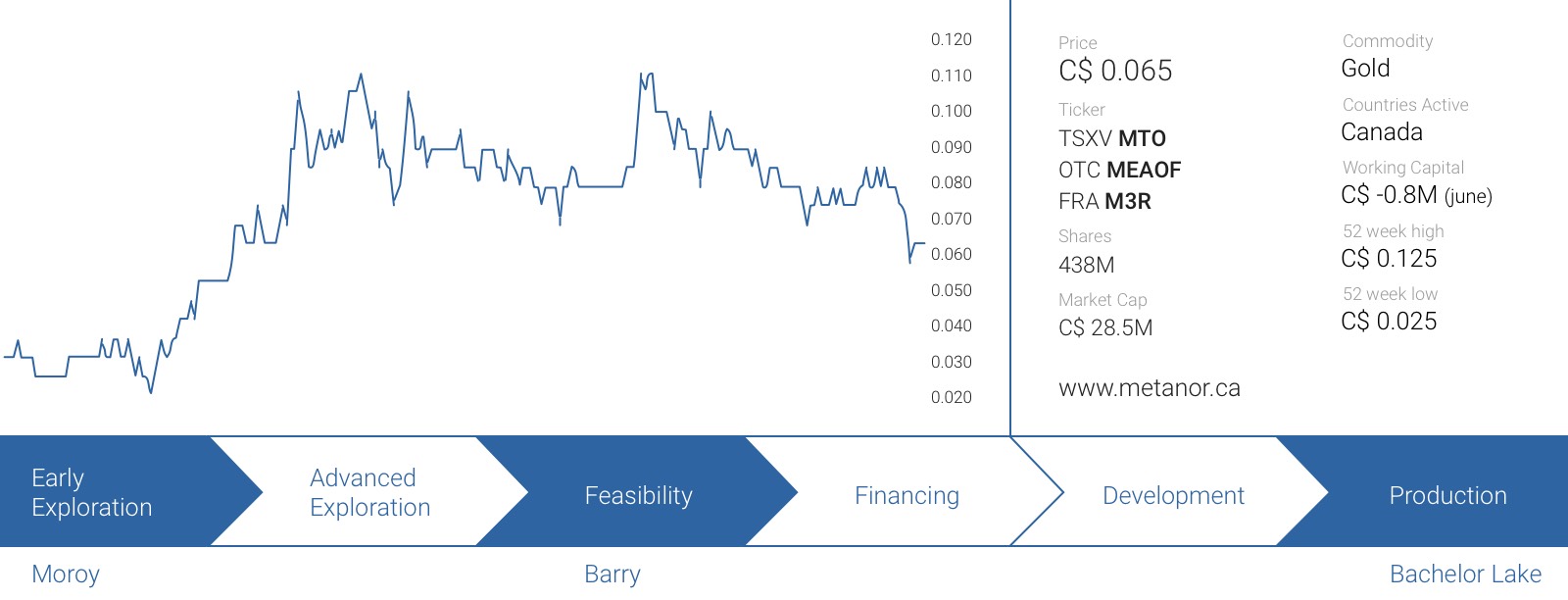

The higher gold price is a blessing for Metanor Resources (MTO.V) as not only does it help the company to generate a positive operating cash flow at Bachelor Lake (which helps to cover the capital expenditures and exploration expenditures), it also provides a welcome boost for the lower-grade Barry project.

Metanor has commissioned an updated technical report to determine how viable the Barry project would be as a standalone open pit mine, with the ore being trucked to the Bachelor Lake mill.

A brief recap of the Barry project

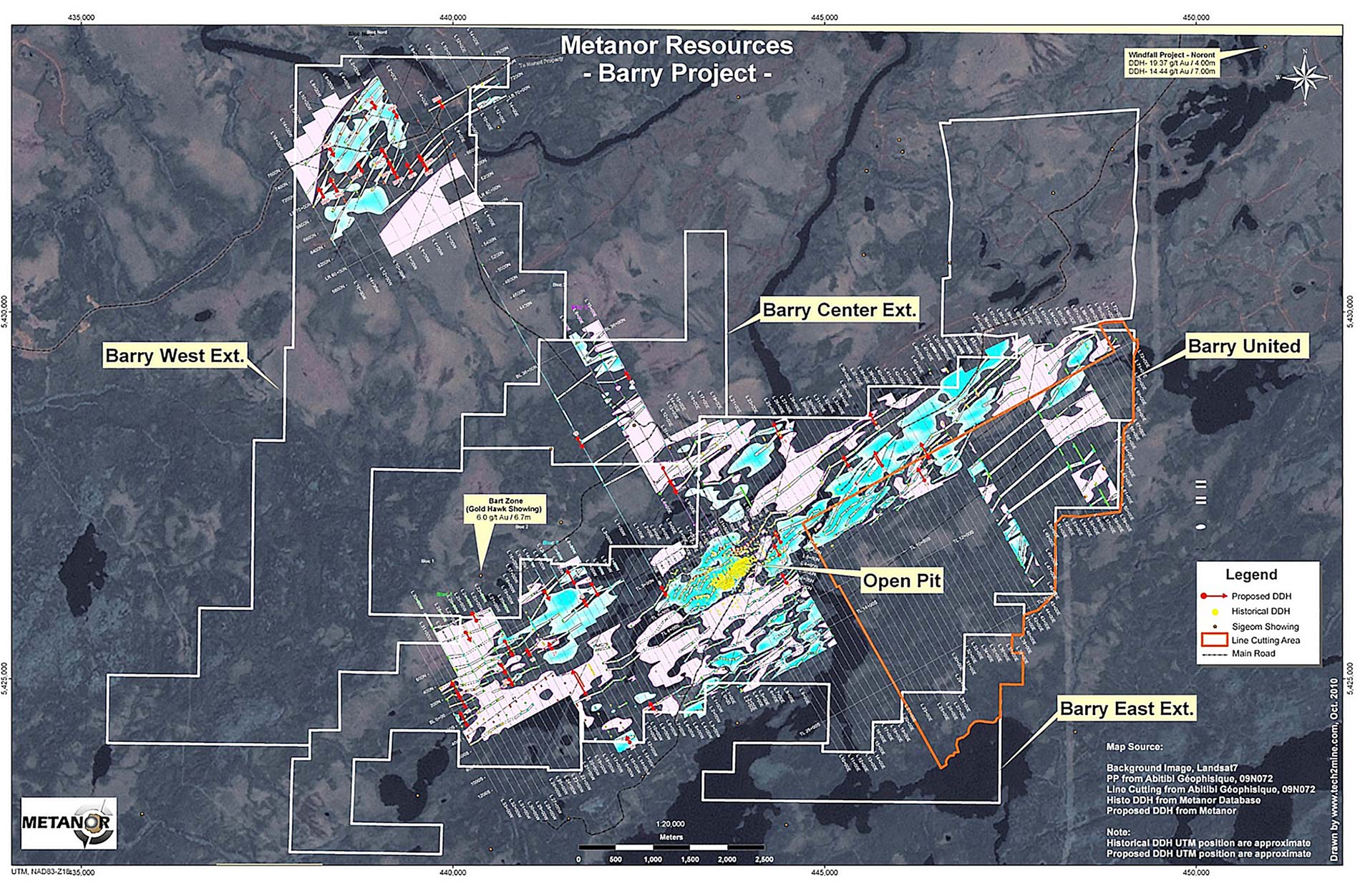

Barry is located approximately 100 kilometers towards the east of Lebel-sur-Quévillon, a small town in Québec that has a small airfield which can be used by small turboprop aircrafts. The total project consists of almost 8,200 hectares of which one area is covered by a mining lease (112 hectares), which simplified the process for the company to get permitted for a 500,000 tonne and subsequently 1.2 million tonne bulk sample.

As the project is linked with Lebel-sur-Quévillon with an all-weather gravel road, Metanor doesn’t have to construct a new road, and it will very likely use the existing road infrastructure to truck the ore from the Barry open pit to the Bachelor Lake mill.

The Barry deposit was identified in the first half of the previous century, but it was only when Teck Resources (TCK) started to do some work in the nineties when the potential size of the mineralized envelope became clear. Several additional drill campaigns were executed by later operators, and Metanor has completed hundreds of drill holes of which the most recent drill campaign was completed earlier this year.

In the 15-hole 2016 exploration program, Metanor Resources wanted to drill-test a new mineralization model at the southern part of the existing open pit, where higher grade zones could be expected. This resulted in an updated resource estimate containing a total of 1.35 million ounces of gold, with the majority (1.05Moz) in the inferred resource category.

This resource update also contained a higher-grade in-pit resource of approximately 350,000 ounces (at an average grade of 2.07 g/t), and this was the basis for an official Preliminary Economic Assessment to determine the viability of Barry.

The PEA confirms a positive NPV

The mine plan is using this higher grade in-pit resource, and Metanor has outlined a mine plan based on a total resource of almost 4 million tonnes. This should be sufficient for a 9-year mine life, using the entire 1,200 tonnes per day capacity of the Bachelor Lake mill, located 115 kilometers towards the north.

As the mill already exists and as the overburden of a part of the planned Barry open pit has already been removed, the initial capex is just C$8.5M, which includes a C$1.5M budget to repurchase a part of the existing royalty on the project (which could be seen as an investment cash flow rather than a capital expenditure). That’s really low, but in Y2, an additional C$6.4M will be needed, predominantly for working capital purposes to bridge the gap between the start of the mining activities at Barry, and selling the gold coming out of the Bachelor Lake mill.

From Year 3 on, the capital expenditures are dropping dramatically to C$3.7M (or just C$100/oz) even though this does include a C$2.5M diamond drill program. Over the entire 9-year mine life, the total sustaining capex is estimated at C$12M, of which in excess of C$5M consists of diamond drilling (very likely associated with a grade control drill program) and an additional C$0.5M has been budgeted to buy back another portion of the Net Smelter Royalty.

The total amount of gold that will be sold (using a 95% recovery rate at Bachelor Lake) is 193,500 ounces, of which 87,000 ounces will be produced in the first 2.5 years of the mine life, as Metanor will start digging up the higher grade ore with an average grade of 3.13 g/t in the first 7 months, followed by 2.93 g/t in the second year of its operations.

That’s the main reason why the IRR is sky-high at 198% (pre-tax), as 45% of the total amount of gold will be produced in the first 30% of the total mine life. This also emphasizes the importance of grade controls, as the entire mine plan stands or falls with effectively being able to mine and process above-average grade material. Should the average grade in Y1 be 10% lower than expected in the mine plan, the pre-tax revenue will fall by almost C$4M and have a huge impact on the bottom line.

The initial capex is low, but external financing will be needed

Even though the initial capital expenditures are estimated to be just C$8.5M (which includes a C$1.5M royalty buyback which isn’t absolutely necessary to start the mine), funding the Barry mine will be one of the main hurdles Metanor will have to clear.

As of at the end of June, Metanor had a slightly negative working capital position, and a cash position of approximately C$1.9M. We think the company will have benefited from the strong gold price in the third quarter of this calendar year (which is the first quarter of Metanor’s financial year), so let’s see what the balance sheet situation will be at the end of September (and we expect those numbers to be released shortly).

But it’s pretty clear that unless the gold price jumps to US$1500+ (which is very unlikely), Metanor will have to source additional funding which could be either debt or equity. A third way might be to sign another streaming deal with one of the streamers. This could work because the net operating cash flow in the first year of operations is expected to be C$14.8M, but even though Metanor Resources already has a working relationship with Sandstorm Gold (SSL.TO, SAND), entering in another streaming deal might not be the company’s preferred way to finance the Barry operations.

Conclusion

Metanor’s PEA on the Barry project is positive thanks to the very low initial capex and the extraordinarily high production rate in the first 3 years of the mine life, recovering 87,000 ounces gold in the first 2.5 years of the mine life. That’s due to the high average grade of 2.6 g/t in those first 31 months which increases the cash flows, accelerates the returns on the original investment and is the basis for the high Initial Rate of Return. The lower grade ore at Barry could be mined and processed when the gold price moves higher, but is excluded from this PEA.

With the technical report in its hands, Metanor can now continue to work towards reopening the Barry mine, and securing funding will be an important milestone to complete.

The author has a long position in Metanor Resources. The company isa sponsor of the website. Please read the disclaimer