Maverix Metals (MMX.V) reported its financial results of the first quarter of this year last week, and as expected, the company continued to increase its attributable production and revenue as Maverix is still expanding its asset portfolio.

The company reported a revenue of C$7.5M which is just 10% higher than the same period last year, but that’s mainly due to a delay of the effective sale of some of the ounces: of the 5,264 attributable gold-equivalent ounces, only 4,358 ounces were sold. The shortfall will very likely be sold during the current quarter which should result in an higher-than-expected Q2 revenue and cash flow which should mitigate the impact of the relatively soft first quarter.

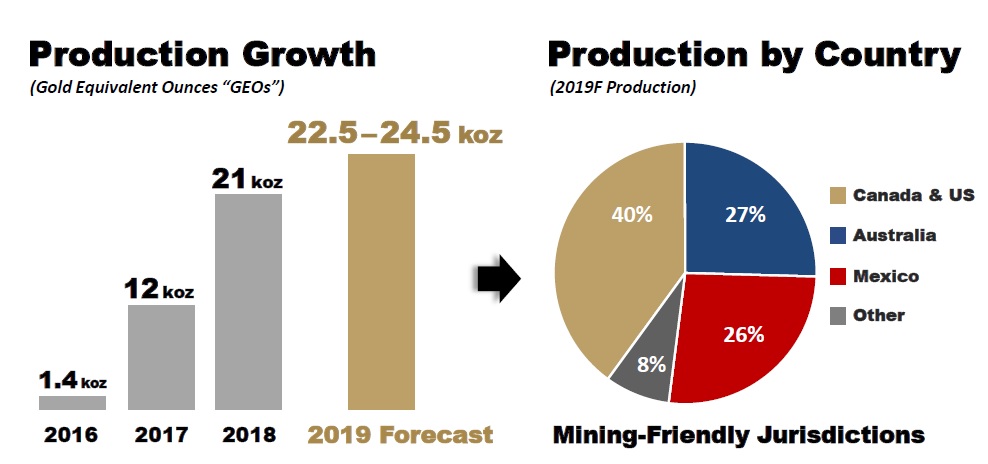

Excluding the changes in the working capital position (where the account receivables increased by in excess of C$2M), Maverix’ operating cash flow would have been C$5.2M and after deducting the interest expenses paid on the net amount that has been drawn down from the credit facility, Maverix’ adjusted operating cash flow in the first quarter would have been C$4.9M. An excellent result considering the attributable production will increase throughout the year as some of the assets Maverix has a royalty or streaming deal on are still ramping up. This results in Maverix maintaining its full-year production guidance of 22,500-24,500 gold-equivalent ounces, and the midpoint of this guidance (23,500 ounces) indicates Maverix will (on average) generate in excess of 6,000 gold-equivalent ounces as attributable production in the next three quarters.

We have completed a full report on Maverix Metals, and expect to publish it shortly. Maverix will also be presenting at the upcoming Metals Investors Forum in Vancouver (Friday May 24-Saturday May 25) on Friday, May 24th at 4PM sharp.

Go to Maverix’ website

The author has a long position in Maverix. Maverix is a sponsor of the website. Please read the disclaimer