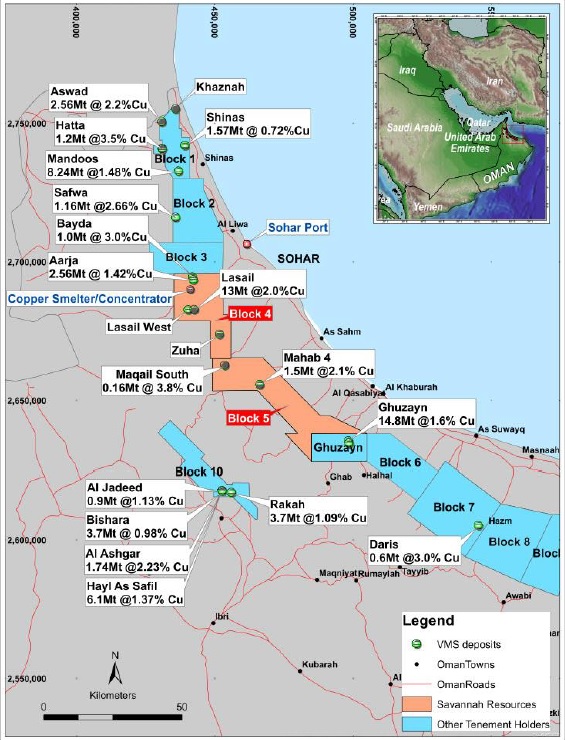

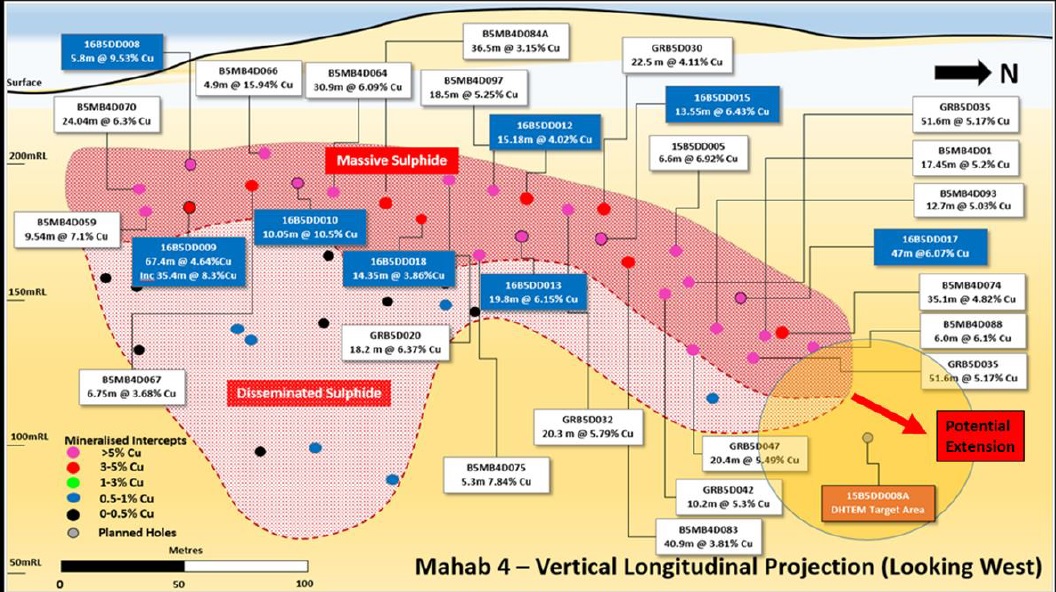

Savannah Resources (SAV.L) has completed its drill program on the Mahab 4 prospect located on the tenements of its Block 5 in Oman, whilst a new four-hole drill program started at Block 4 (and this program should be completed by now).

Drilling at Mahab 4 continued to yield high-grade copper assays, with for instance 14.3 meters at 3.86% copper, 0.62% zinc and 0.22 g/t gold from a depth of 109 meters, but perhaps even more interesting are the shallower copper zones with 67.4 meters at 4.64% copper, 1.13% zinc and 0.3 g/t from a depth of less than 20 meters! Hole 8 at Mahab 4 encountered 5.8 meters of 9.53% copper and just over 15% zinc, including 1.8 meters of almost 30% copper!

Very impressive results, and it will be interesting to see where Savannah’s resource estimate will come in. The official exploration target is 10.7-29.3 million tonnes at an average grade of 1.4% and 2.4% copper. Expressed in pounds of copper, that’s an exploration target of anywhere in between 330 million pounds of copper and 1.55 billion pounds. As Savannah specifically mentions a copper exploration target, we would assume the gold and zinc grades are NOT included in the targeted average copper grade. Recovering both metals as a by-product credit could be very helpful to reduce the production cost per pound of copper. At 1% zinc and 0.25 g/t gold and a recovery rate of 75% for both metals, the current value of the by-product credit is approximately US$25/t.

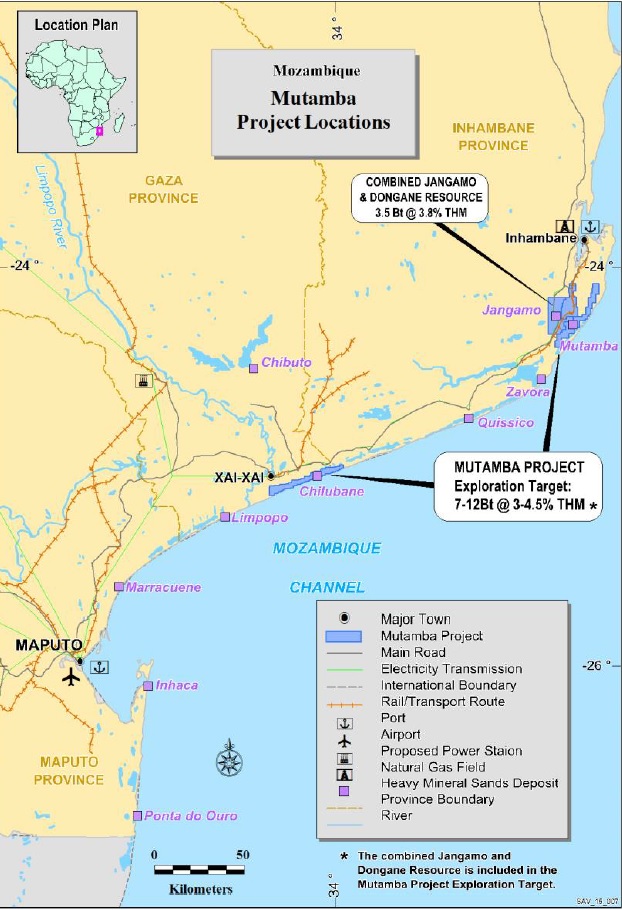

In Mozambique, Savannah has now outlined a 3.5 billion tonnes resource of heavy mineral sands with a total heavy mineral content of 3.8%. The resource contains 81 million tonnes of ilmenite, 2.2 million tonnes of rutile and 3.8 million tonnes of zircon, which makes this an extremely exciting heavy minerals project. Yes, the project is still smaller than Kenmare Resources’ (KMR.L) mineral sands project (although there’s 7-12 billion tonne exploration target), but the average grade is substantially higher (and even higher than Kenmare’s reserve estimate). As the ilmenite prices are increasing again, Savannah’s scoping study (which is expected late Q1 2017, early Q2 2017) will be right in time, and it will be very interesting to see if the company’s plans to define a 200 million tonne low capex resource could be outlined. The slimes level of 7% is in line with Kenmare’s resource, and substantially lower than Base Resources (ASX:BSE) levels.

You should never base any investment decision on an in situ value of a deposit (as we will need to wait for the scoping study to find out if the deposit is economical), but just to give you an idea of the size of the Mutamba project; at an ilmenite price of $125/t, a rutile price of $800/t and a zircon price of $900/t, the total in situ value is $15.3B. Again, keep in mind the scoping study will be based on a smaller but higher grade portion of this total resource estimate, so you shouldn’t expect a huge operation.

Savannah Resources will be the operator of the project and will be able to own a stake of 51% upon meeting certain milestones. After completing the scoping study, Savannah will already own 20% of the property, for which Rio Tinto (RIO) has committed to a 100% offtake agreement.

Go to Savannah’s website

The author has no position in Savannah Resources. Please read the disclaimer